A Company Owns Equipment For Which It Paid $90 Million

A Company Owns Equipment For Which It Paid $90 Million - A $23 million impairment loss on the equipment. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. B) would record a $3 million. A company owns equipment for which it paid $90 million. At the end of 2025, accumulated depreciation on the equipment was $27 million. A) would record no impairment loss on the equipment. Based on the information provided, the company would report a $23 million impairment loss on the equipment. According to the given case study, fryer co. Owns equipment for which it paid $90 million. At the end of 2024 , it had accumulated depreciation on the equipment of $27 million.

B) would record a $3 million. A company owns equipment for which it paid $90 million. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. A) would record no impairment loss on the equipment. An impairment loss is recognized when the carrying amount of an asset exceeds its. A $23 million impairment loss on the equipment. At the end of 2025, accumulated depreciation on the equipment was $27 million. At the end of 2023, it had accumulated. A company owns equipment for which it paid $90 million.

A company owns equipment for which it paid $90 million. At the end of 2023, it had accumulated. Owns equipment for which it paid $90 million. A $23 million impairment loss on the equipment. At the end of 2024 , it had accumulated depreciation on the equipment of $27 million. At the end of 2025, accumulated depreciation on the equipment was $27 million. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. Based on the information provided, the company would report a $23 million impairment loss on the equipment. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. Owns equipment for which it paid $90 million.

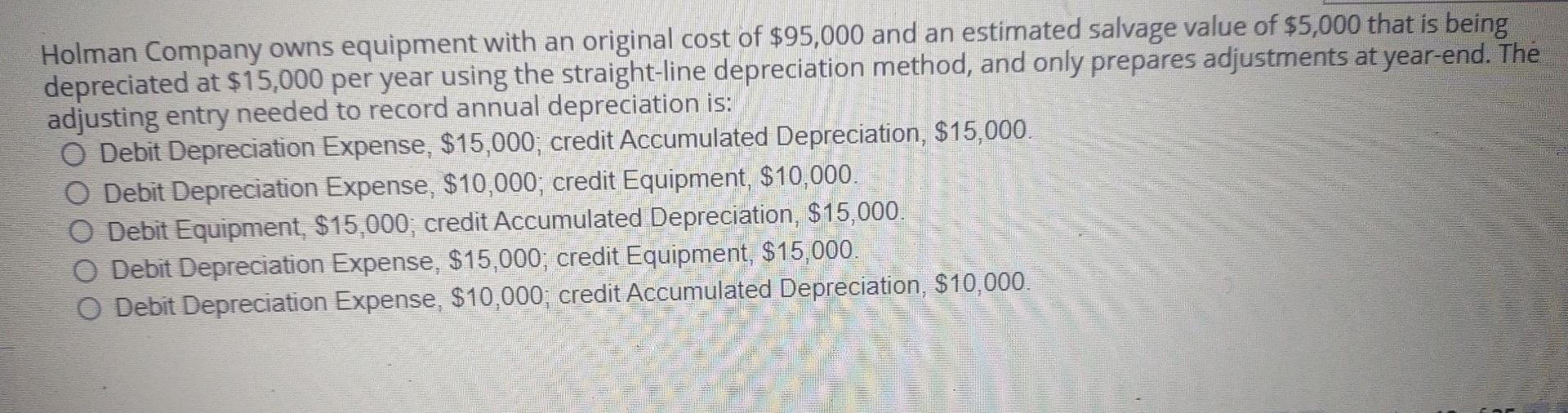

Solved Holman Company owns equipment with an original cost

At the end of 2024, it had accumulated depreciation on the equipment of $27 million. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. A) would record no impairment loss on the equipment. B) would record a $3 million. A $23 million impairment loss on the equipment.

[Solved] Garcia Company owns equipment that cost 84,000, with

A company owns equipment for which it paid $90 million. Based on the information provided, the company would report a $23 million impairment loss on the equipment. At the end of 2023, it had accumulated. An impairment loss is recognized when the carrying amount of an asset exceeds its. A $23 million impairment loss on the equipment.

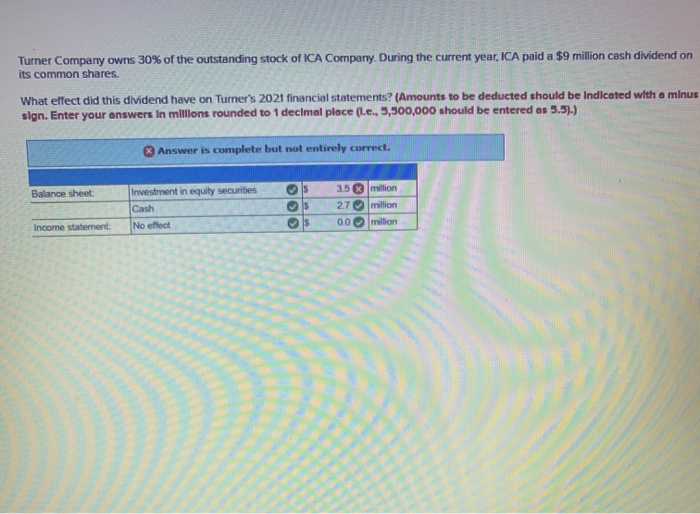

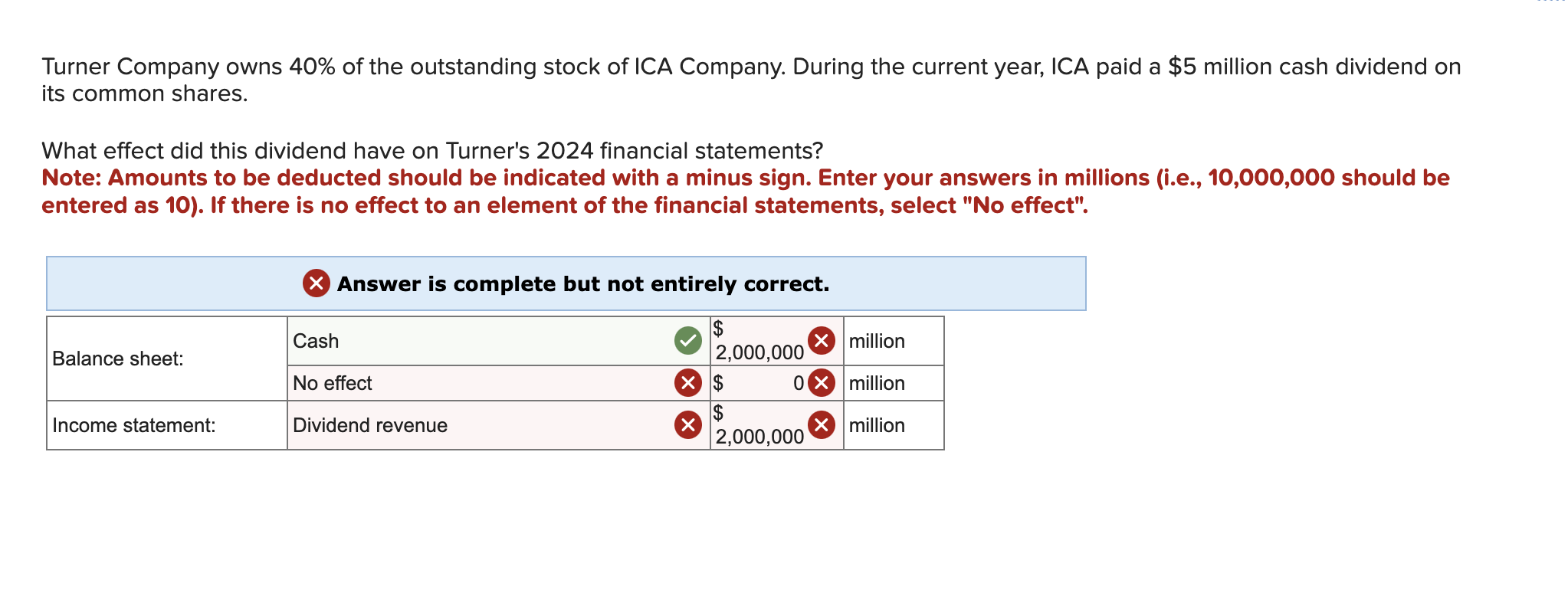

Solved Turner Company owns 30 of the outstanding stock of

At the end of 2025, accumulated depreciation on the equipment was $27 million. At the end of 2023, it had accumulated. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. An impairment loss is recognized when the carrying amount of an asset exceeds its. B) would record a $3 million.

Solved Turner Company owns 40 of the outstanding stock of

B) would record a $3 million. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. A company owns equipment for which it paid $90 million. A) would record no impairment loss on the equipment.

Solved Swifty Company owns specialized equipment that was

A $23 million impairment loss on the equipment. Owns equipment, which it paid $90 million. Owns equipment for which it paid $90 million. Owns equipment for which it paid $90 million. At the end of 2025, accumulated depreciation on the equipment was $27 million.

[Solved] Oriole Company owns equipment that cost 60,900 w

According to the given case study, fryer co. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. At the end of 2025, accumulated depreciation on the equipment was $27 million. Owns equipment, which it paid $90 million. Based on the information provided, the company would report a $23 million impairment loss on the equipment.

[Solved] Help. Sunland Company owns equipment that cost 125,000 when

At the end of 2024, it had accumulated depreciation on the equipment of $27 million. At the end of 2023, it had accumulated. Owns equipment for which it paid $90 million. Owns equipment for which it paid $90 million. A company owns equipment for which it paid $90 million.

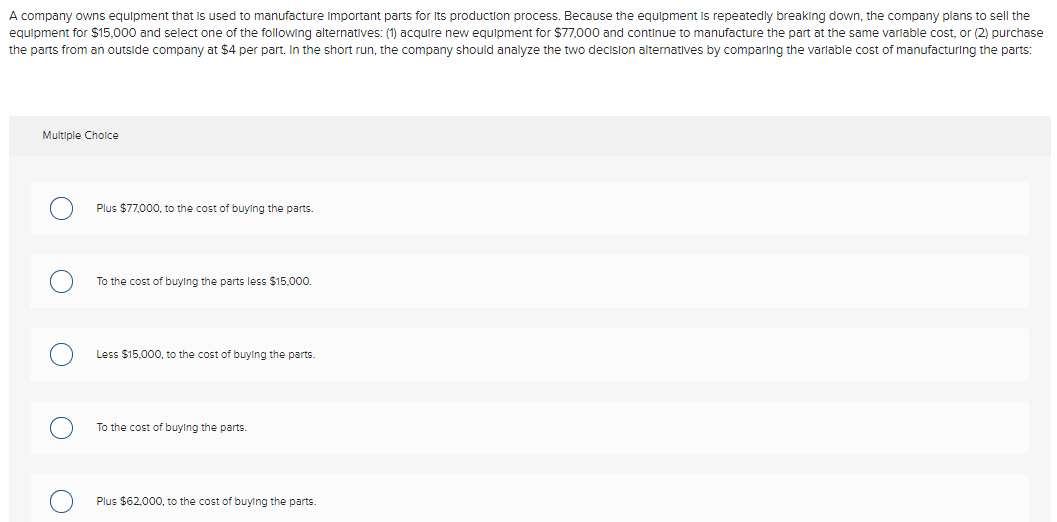

Solved A company owns equipment that is used to manufacture

At the end of 2025, accumulated depreciation on the equipment was $27 million. A company owns equipment for which it paid $90 million. Owns equipment for which it paid $90 million. An impairment loss is recognized when the carrying amount of an asset exceeds its. According to the given case study, fryer co.

[Solved] . 8 Garcia Company owns equipment that cost 81,200, with

Based on the information provided, the company would report a $23 million impairment loss on the equipment. According to the given case study, fryer co. Owns equipment for which it paid $90 million. A $23 million impairment loss on the equipment. At the end of 2024, it had accumulated depreciation on the equipment of $27 million.

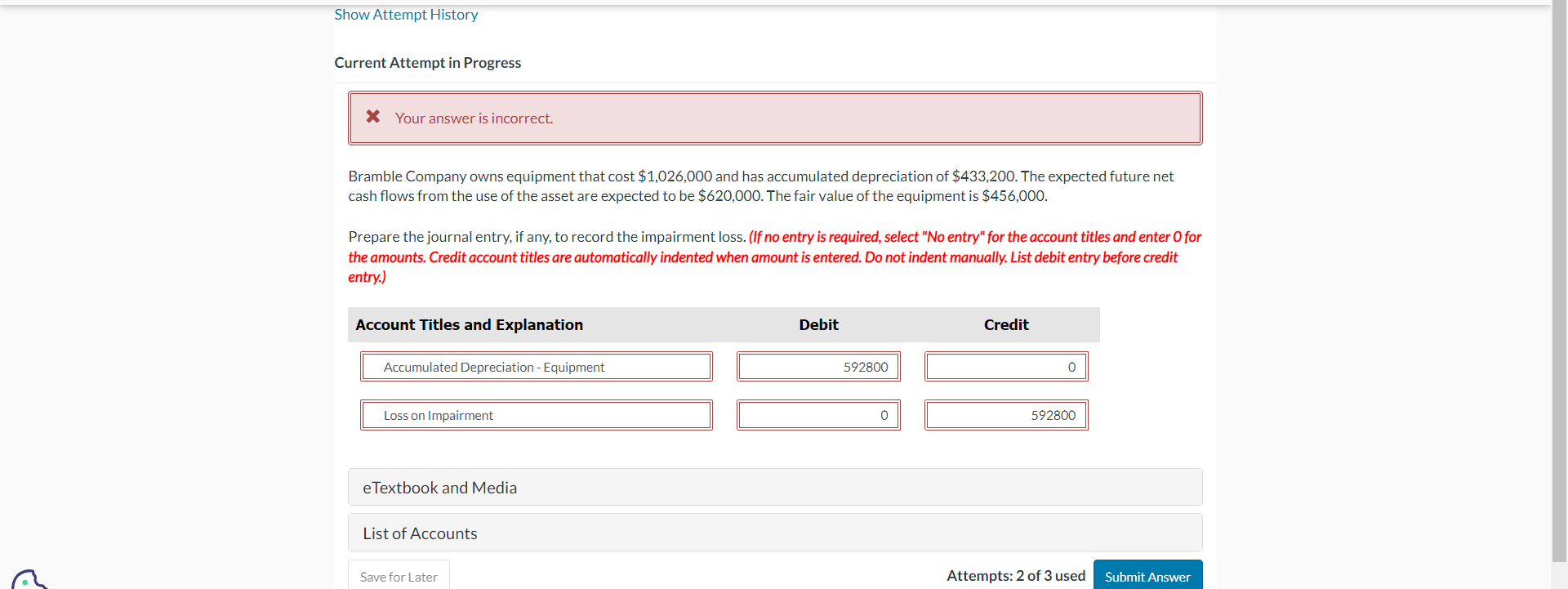

Solved Bramble Company owns equipment that cost 1,026,000

At the end of 2024, it had accumulated depreciation on the equipment of $27 million. B) would record a $3 million. At the end of 2023, it had accumulated. A company owns equipment for which it paid $90 million. Owns equipment for which it paid $90 million.

According To The Given Case Study, Fryer Co.

Based on the information provided, the company would report a $23 million impairment loss on the equipment. At the end of 2025, accumulated depreciation on the equipment was $27 million. Owns equipment, which it paid $90 million. A $23 million impairment loss on the equipment.

An Impairment Loss Is Recognized When The Carrying Amount Of An Asset Exceeds Its.

A) would record no impairment loss on the equipment. A company owns equipment for which it paid $90 million. Owns equipment for which it paid $90 million. At the end of 2023, it had accumulated.

B) Would Record A $3 Million.

Owns equipment for which it paid $90 million. A company owns equipment for which it paid $90 million. At the end of 2024, it had accumulated depreciation on the equipment of $27 million. A company owns equipment for which it paid $90 million.

At The End Of 2024, It Had Accumulated Depreciation On The Equipment Of $27 Million.

At the end of 2024 , it had accumulated depreciation on the equipment of $27 million.

![[Solved] Oriole Company owns equipment that cost 60,900 w](https://media.cheggcdn.com/study/d0d/d0d29f31-cc79-4a62-95cd-3c4a5a40e58b/image)