1099 Shopify

1099 Shopify - For calendar years prior to (and including) 2023: You receive more than 20,000 usd in gross. Irs form 1099 is a tax form that businesses, financial institutions, and other entities use to report payments to nonemployees.

You receive more than 20,000 usd in gross. Irs form 1099 is a tax form that businesses, financial institutions, and other entities use to report payments to nonemployees. For calendar years prior to (and including) 2023:

You receive more than 20,000 usd in gross. Irs form 1099 is a tax form that businesses, financial institutions, and other entities use to report payments to nonemployees. For calendar years prior to (and including) 2023:

Form 1099DIV, Dividends and Distributions How to File

Irs form 1099 is a tax form that businesses, financial institutions, and other entities use to report payments to nonemployees. For calendar years prior to (and including) 2023: You receive more than 20,000 usd in gross.

How to Get a 1099 From Shopify A StepbyStep Guide ThoughtMetric

Irs form 1099 is a tax form that businesses, financial institutions, and other entities use to report payments to nonemployees. For calendar years prior to (and including) 2023: You receive more than 20,000 usd in gross.

What Is an IRS 1099 Form? Purpose and How To File (2024) Shopify

For calendar years prior to (and including) 2023: You receive more than 20,000 usd in gross. Irs form 1099 is a tax form that businesses, financial institutions, and other entities use to report payments to nonemployees.

Shopify 1099 Tax Form Filing Requirements and Steps (2023)

For calendar years prior to (and including) 2023: You receive more than 20,000 usd in gross. Irs form 1099 is a tax form that businesses, financial institutions, and other entities use to report payments to nonemployees.

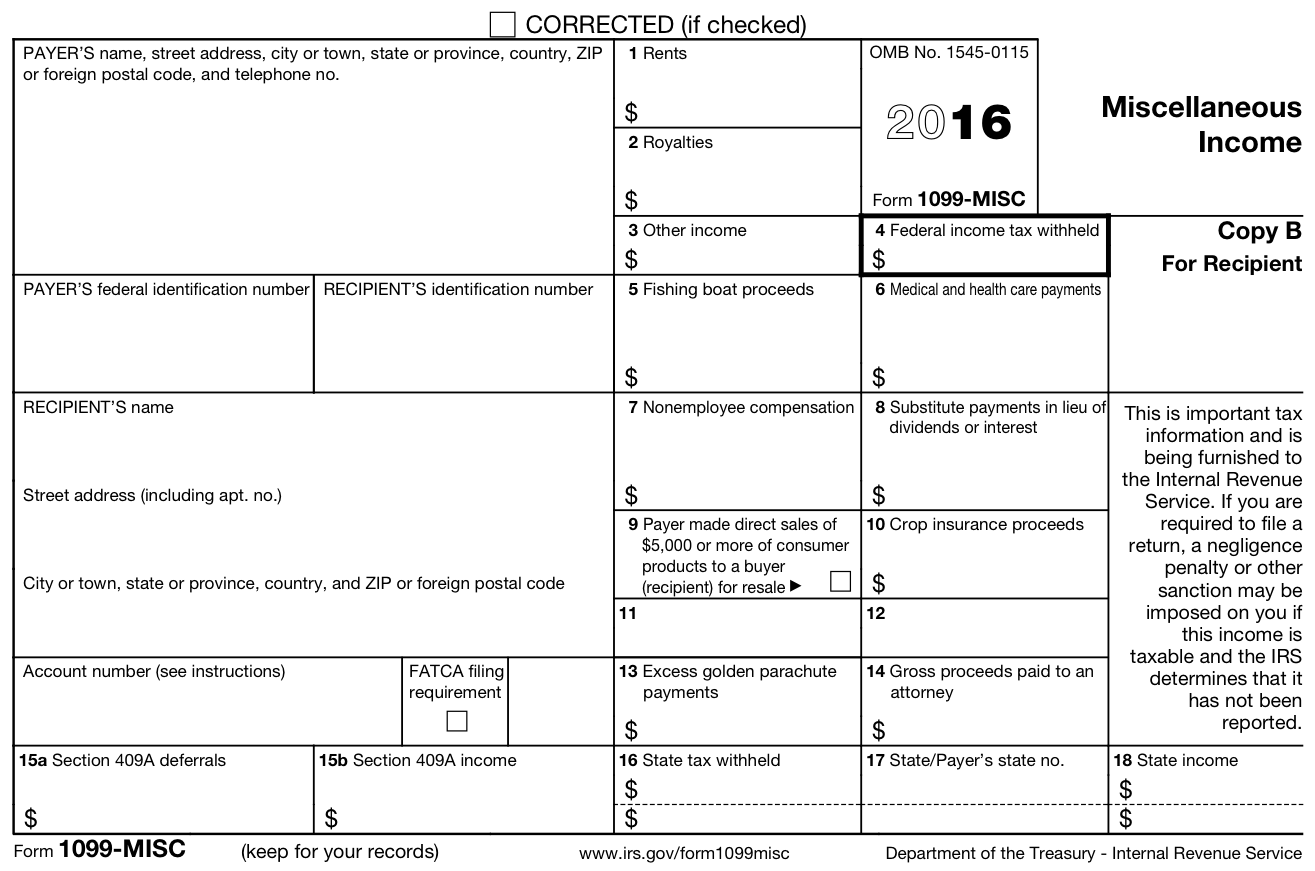

Free 1099 Tax Forms Printable

For calendar years prior to (and including) 2023: You receive more than 20,000 usd in gross. Irs form 1099 is a tax form that businesses, financial institutions, and other entities use to report payments to nonemployees.

FPPA 1099R Forms

You receive more than 20,000 usd in gross. For calendar years prior to (and including) 2023: Irs form 1099 is a tax form that businesses, financial institutions, and other entities use to report payments to nonemployees.

What Is a 1099MISC? Personal Finance for PhDs

You receive more than 20,000 usd in gross. Irs form 1099 is a tax form that businesses, financial institutions, and other entities use to report payments to nonemployees. For calendar years prior to (and including) 2023:

What Is an IRS 1099 Form? Purpose and How To File (2024) Shopify

Irs form 1099 is a tax form that businesses, financial institutions, and other entities use to report payments to nonemployees. You receive more than 20,000 usd in gross. For calendar years prior to (and including) 2023:

IRS Form 1099DIV Guide for 2024 (TY2023) The Boom Post

Irs form 1099 is a tax form that businesses, financial institutions, and other entities use to report payments to nonemployees. For calendar years prior to (and including) 2023: You receive more than 20,000 usd in gross.

You Receive More Than 20,000 Usd In Gross.

Irs form 1099 is a tax form that businesses, financial institutions, and other entities use to report payments to nonemployees. For calendar years prior to (and including) 2023:

:max_bytes(150000):strip_icc()/1099-DIV-ffc2266fbad34acd9de5359089733572.jpg)