Adjust Payroll Liabilities In Quickbooks Desktop

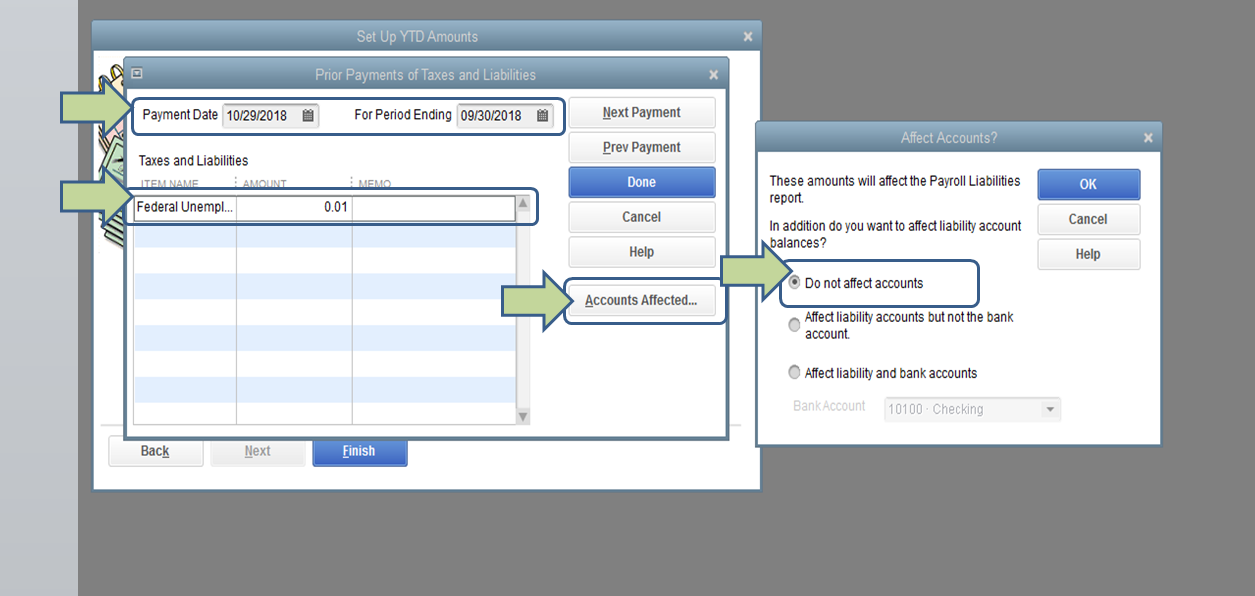

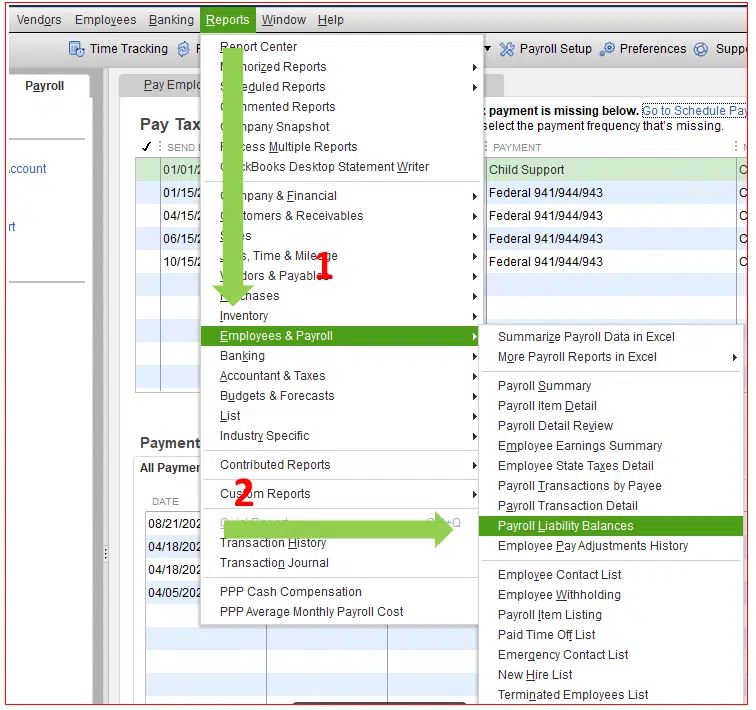

Adjust Payroll Liabilities In Quickbooks Desktop - When your payroll liabilities are incorrect, you can do a liability adjustment to fix purchases journal: Choose adjust payroll liabilities and pick the last paycheck date of. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Head to employees, then payroll taxes and liabilities.

Head to employees, then payroll taxes and liabilities. Choose adjust payroll liabilities and pick the last paycheck date of. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. When your payroll liabilities are incorrect, you can do a liability adjustment to fix purchases journal:

When your payroll liabilities are incorrect, you can do a liability adjustment to fix purchases journal: Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Head to employees, then payroll taxes and liabilities. Choose adjust payroll liabilities and pick the last paycheck date of.

How to Adjust Payroll Liabilities in QuickBooks Desktop

Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Choose adjust payroll liabilities and pick the last paycheck date of. Head to employees, then payroll taxes and liabilities. When your payroll liabilities are incorrect, you can do a liability adjustment to fix purchases journal:

How To Adjust Payroll Liabilities In Quickbooks Online

Head to employees, then payroll taxes and liabilities. Choose adjust payroll liabilities and pick the last paycheck date of. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. When your payroll liabilities are incorrect, you can do a liability adjustment to fix purchases journal:

How to pay payroll taxes and liabilities in QuickBooks Desktop Payroll

When your payroll liabilities are incorrect, you can do a liability adjustment to fix purchases journal: Head to employees, then payroll taxes and liabilities. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Choose adjust payroll liabilities and pick the last paycheck date of.

Solved Payroll liabilities

Head to employees, then payroll taxes and liabilities. Choose adjust payroll liabilities and pick the last paycheck date of. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. When your payroll liabilities are incorrect, you can do a liability adjustment to fix purchases journal:

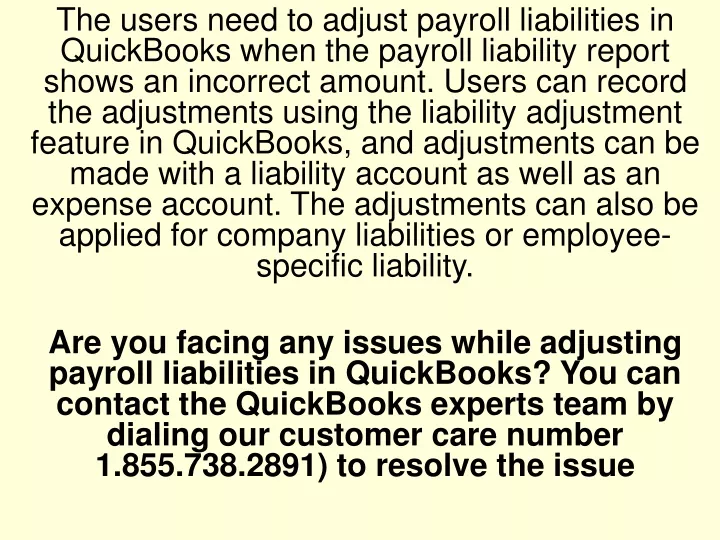

PPT Adjust payroll liabilities in QuickBooks PowerPoint Presentation

When your payroll liabilities are incorrect, you can do a liability adjustment to fix purchases journal: Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Head to employees, then payroll taxes and liabilities. Choose adjust payroll liabilities and pick the last paycheck date of.

Zero Out Payroll Liabilities in QuickBooks (2 DIY Steps )

Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Choose adjust payroll liabilities and pick the last paycheck date of. When your payroll liabilities are incorrect, you can do a liability adjustment to fix purchases journal: Head to employees, then payroll taxes and liabilities.

Adjust Payroll Liabilities in QuickBooks How Does it Help? by Account

Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Head to employees, then payroll taxes and liabilities. When your payroll liabilities are incorrect, you can do a liability adjustment to fix purchases journal: Choose adjust payroll liabilities and pick the last paycheck date of.

How to Adjust Payroll Liabilities in QuickBooks [Explained]

Choose adjust payroll liabilities and pick the last paycheck date of. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Head to employees, then payroll taxes and liabilities. When your payroll liabilities are incorrect, you can do a liability adjustment to fix purchases journal:

Learn how to Adjust Payroll Liabilities in Intuit QuickBooks Desktop

Choose adjust payroll liabilities and pick the last paycheck date of. Head to employees, then payroll taxes and liabilities. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. When your payroll liabilities are incorrect, you can do a liability adjustment to fix purchases journal:

Quickbooks desktop payroll liabilities locatormusli

Head to employees, then payroll taxes and liabilities. When your payroll liabilities are incorrect, you can do a liability adjustment to fix purchases journal: Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. Choose adjust payroll liabilities and pick the last paycheck date of.

Head To Employees, Then Payroll Taxes And Liabilities.

Choose adjust payroll liabilities and pick the last paycheck date of. Changing the payroll liabilities schedule in quickbooks desktop entails reviewing and adjusting the payment dates, frequency, and. When your payroll liabilities are incorrect, you can do a liability adjustment to fix purchases journal:

![How to Adjust Payroll Liabilities in QuickBooks [Explained]](https://blog.accountinghelpline.com/wp-content/uploads/2018/12/QuickBooks-Liability-Adjustment.png)