Airbnb Expenses

Airbnb Expenses - • if a guest pays any of your expenses, for example, utilities expenses, the payments are rental income. What expenses are deductible from my airbnb income as a host of a stay? What expenses are deductible from my airbnb income as a host of a stay? Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. Since you must include this amount in income, you can deduct the. If you’re hosting a stay, it's possible that not all of your airbnb income is taxable. Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. What expenses are deductible from my airbnb income as a host of a stay?

Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. What expenses are deductible from my airbnb income as a host of a stay? Since you must include this amount in income, you can deduct the. • if a guest pays any of your expenses, for example, utilities expenses, the payments are rental income. What expenses are deductible from my airbnb income as a host of a stay? Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. What expenses are deductible from my airbnb income as a host of a stay? If you’re hosting a stay, it's possible that not all of your airbnb income is taxable.

If you’re hosting a stay, it's possible that not all of your airbnb income is taxable. What expenses are deductible from my airbnb income as a host of a stay? Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. What expenses are deductible from my airbnb income as a host of a stay? • if a guest pays any of your expenses, for example, utilities expenses, the payments are rental income. What expenses are deductible from my airbnb income as a host of a stay? Since you must include this amount in income, you can deduct the. Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses.

Airbnb Revenue and Booking Statistics (2023)

Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. • if a guest pays any of your expenses, for example, utilities expenses, the payments are rental income. If you’re hosting a stay, it's possible that not all of your airbnb income is taxable. What expenses are deductible from my airbnb income as a host of.

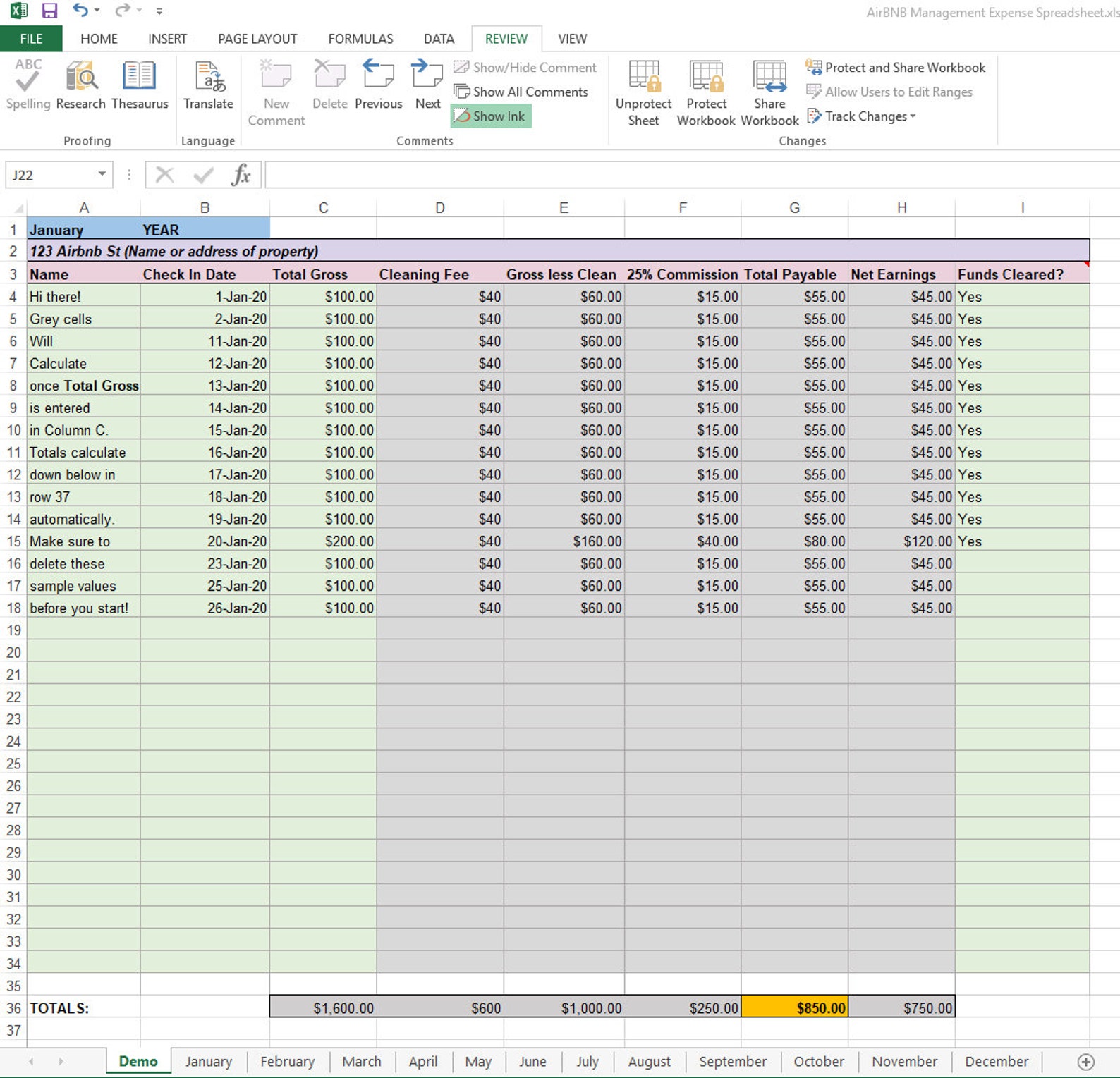

Airbnb Budget Template Free

What expenses are deductible from my airbnb income as a host of a stay? Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. What expenses are deductible from my airbnb income as a host of a stay? If you’re hosting a.

Airbnb Expenses to Keep in Mind

Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. • if a guest pays any of your expenses, for example, utilities expenses, the payments are rental income. If you’re hosting a stay, it's possible that not all of your airbnb income is taxable. What expenses are deductible from my airbnb income as a host of.

Complete List of Airbnb Host Expenses You Must Know! Airbtics

If you’re hosting a stay, it's possible that not all of your airbnb income is taxable. What expenses are deductible from my airbnb income as a host of a stay? • if a guest pays any of your expenses, for example, utilities expenses, the payments are rental income. What expenses are deductible from my airbnb income as a host of.

How to Keep Track of Airbnb Expenses and Top Tracking Apps

What expenses are deductible from my airbnb income as a host of a stay? Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. What expenses are deductible from my airbnb income as a host of a stay? • if a guest pays any of your expenses, for example, utilities expenses, the payments are rental income..

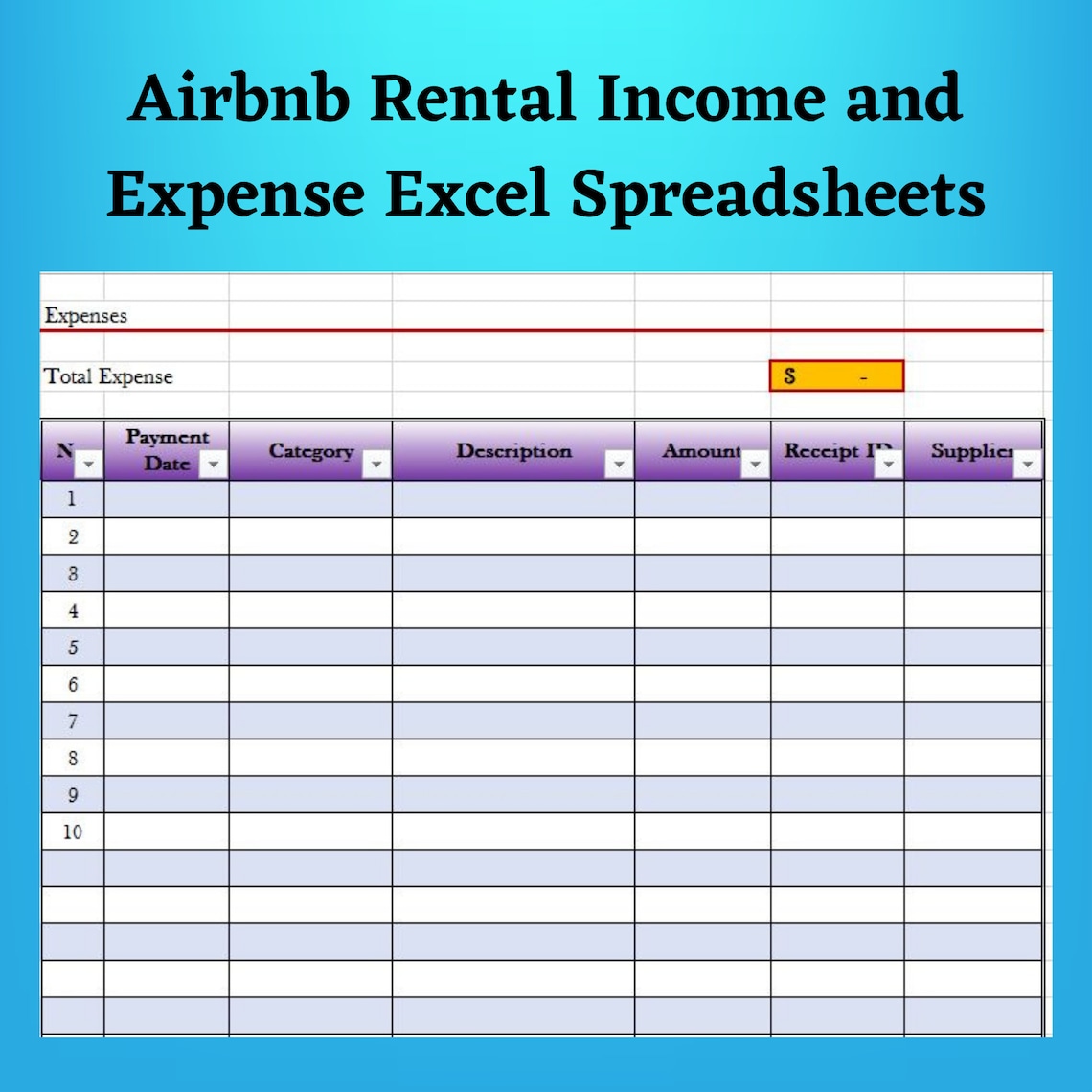

Free Excel Templates For Airbnb Bookkeeping

• if a guest pays any of your expenses, for example, utilities expenses, the payments are rental income. What expenses are deductible from my airbnb income as a host of a stay? Since you must include this amount in income, you can deduct the. What expenses are deductible from my airbnb income as a host of a stay? Deductible items.

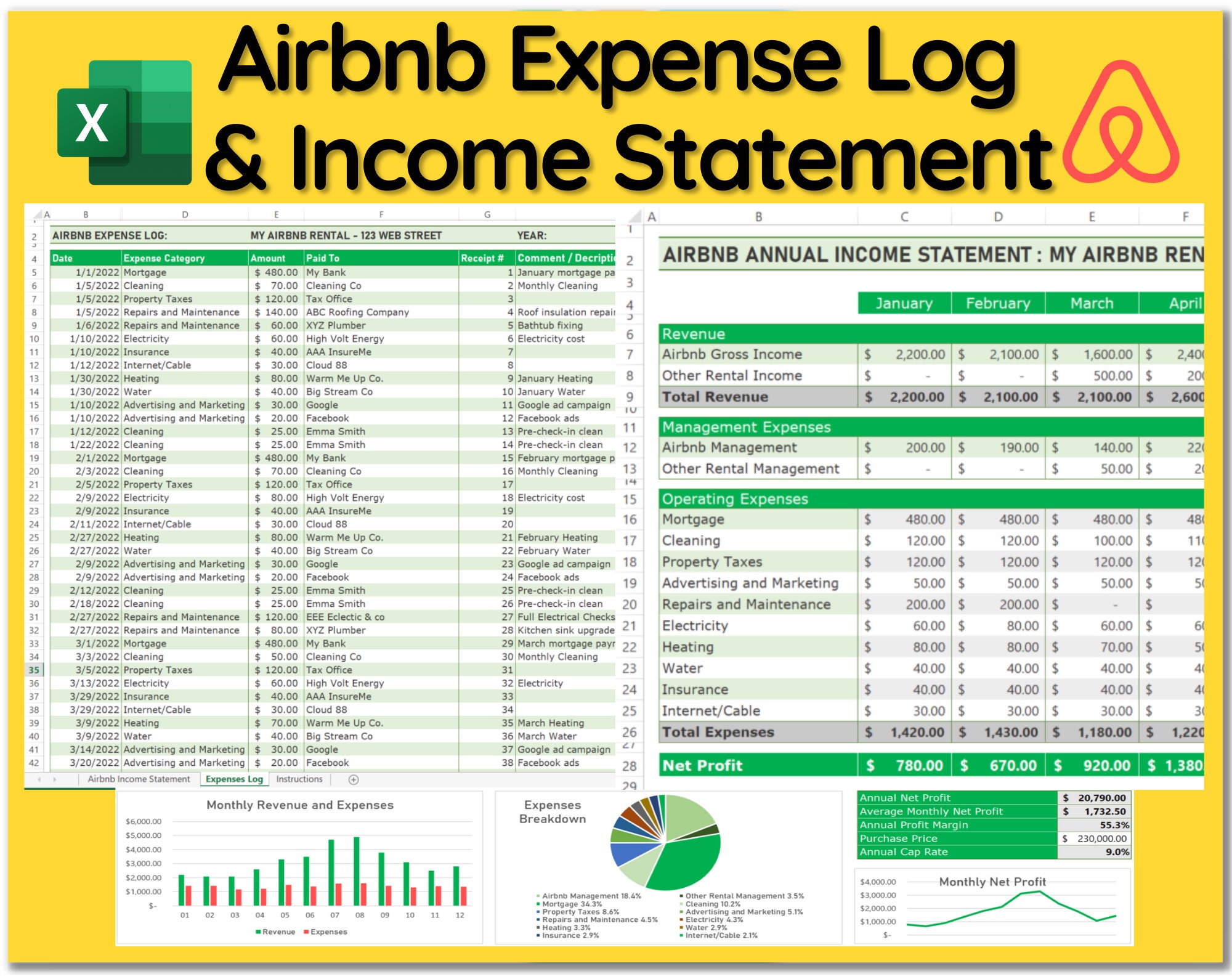

Airbnb Expense Log and Statement / Rental & Etsy Canada

What expenses are deductible from my airbnb income as a host of a stay? • if a guest pays any of your expenses, for example, utilities expenses, the payments are rental income. If you’re hosting a stay, it's possible that not all of your airbnb income is taxable. What expenses are deductible from my airbnb income as a host of.

A Guide to Writing Off Airbnb Expenses Airbtics Airbnb Analytics

Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. What expenses are deductible from my airbnb income as a host of a stay? Since you must include this amount in income, you can deduct the. What expenses are deductible from my.

Expenses Costs Involved Running an Airbnb HelloGuest

What expenses are deductible from my airbnb income as a host of a stay? Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. What expenses are deductible from my airbnb income as a host of a stay? If you’re hosting a.

Airbnb Expense Tracker Template

Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. What expenses are deductible from my airbnb income as a host of a stay? • if a guest pays any of your expenses, for example, utilities expenses, the payments are rental income. Since you must include this amount in income, you can deduct the. What expenses.

Deductible Items May Include Rent, Mortgage, Cleaning Fees, Rental Commissions, Insurance, And Other Expenses.

If you’re hosting a stay, it's possible that not all of your airbnb income is taxable. Since you must include this amount in income, you can deduct the. Deductible items may include rent, mortgage, cleaning fees, rental commissions, insurance, and other expenses. What expenses are deductible from my airbnb income as a host of a stay?

What Expenses Are Deductible From My Airbnb Income As A Host Of A Stay?

What expenses are deductible from my airbnb income as a host of a stay? • if a guest pays any of your expenses, for example, utilities expenses, the payments are rental income.