Austin Texas Local Tax Rate

Austin Texas Local Tax Rate - The current total local sales tax rate in austin, tx is 8.250%. This is the total of state, county, and city sales tax rates. The minimum combined 2025 sales tax rate for austin, texas is 8.25%. In the tabs below, discover new map and latitude/longitude search options alongside the familiar single. If you have questions about local sales and use tax rate information,. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. Welcome to the new sales tax rate locator. The december 2020 total local sales tax rate was also 8.250%. View the printable version of city rates (pdf).

The current total local sales tax rate in austin, tx is 8.250%. The december 2020 total local sales tax rate was also 8.250%. In the tabs below, discover new map and latitude/longitude search options alongside the familiar single. View the printable version of city rates (pdf). This is the total of state, county, and city sales tax rates. If you have questions about local sales and use tax rate information,. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. Welcome to the new sales tax rate locator. The minimum combined 2025 sales tax rate for austin, texas is 8.25%.

The december 2020 total local sales tax rate was also 8.250%. In the tabs below, discover new map and latitude/longitude search options alongside the familiar single. Welcome to the new sales tax rate locator. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. This is the total of state, county, and city sales tax rates. The current total local sales tax rate in austin, tx is 8.250%. If you have questions about local sales and use tax rate information,. The minimum combined 2025 sales tax rate for austin, texas is 8.25%. View the printable version of city rates (pdf).

Loxley Al Sales Tax Rate at Gary Saldana blog

Welcome to the new sales tax rate locator. This is the total of state, county, and city sales tax rates. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. View the printable version of city rates (pdf). In the tabs below, discover new map and latitude/longitude search options alongside the familiar.

Lowest Property Taxes in Texas 5 Counties with Low Tax Rates

View the printable version of city rates (pdf). The december 2020 total local sales tax rate was also 8.250%. If you have questions about local sales and use tax rate information,. This is the total of state, county, and city sales tax rates. In the tabs below, discover new map and latitude/longitude search options alongside the familiar single.

2023 State Corporate Tax Rates & Brackets Tax Foundation

Welcome to the new sales tax rate locator. The current total local sales tax rate in austin, tx is 8.250%. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. The minimum combined 2025 sales tax rate for austin, texas is 8.25%. This is the total of state, county, and city sales.

What are commercial property tax rates in Austin, Texas? AQUILA Blog

If you have questions about local sales and use tax rate information,. The december 2020 total local sales tax rate was also 8.250%. This is the total of state, county, and city sales tax rates. In the tabs below, discover new map and latitude/longitude search options alongside the familiar single. View the printable version of city rates (pdf).

Does Your State Have a Gross Receipts Tax? State Gross Receipts Taxes

In the tabs below, discover new map and latitude/longitude search options alongside the familiar single. This is the total of state, county, and city sales tax rates. View the printable version of city rates (pdf). Welcome to the new sales tax rate locator. If you have questions about local sales and use tax rate information,.

How Do Property Taxes Work in Texas? Texas Property Tax Guide

If you have questions about local sales and use tax rate information,. The current total local sales tax rate in austin, tx is 8.250%. Welcome to the new sales tax rate locator. The minimum combined 2025 sales tax rate for austin, texas is 8.25%. In the tabs below, discover new map and latitude/longitude search options alongside the familiar single.

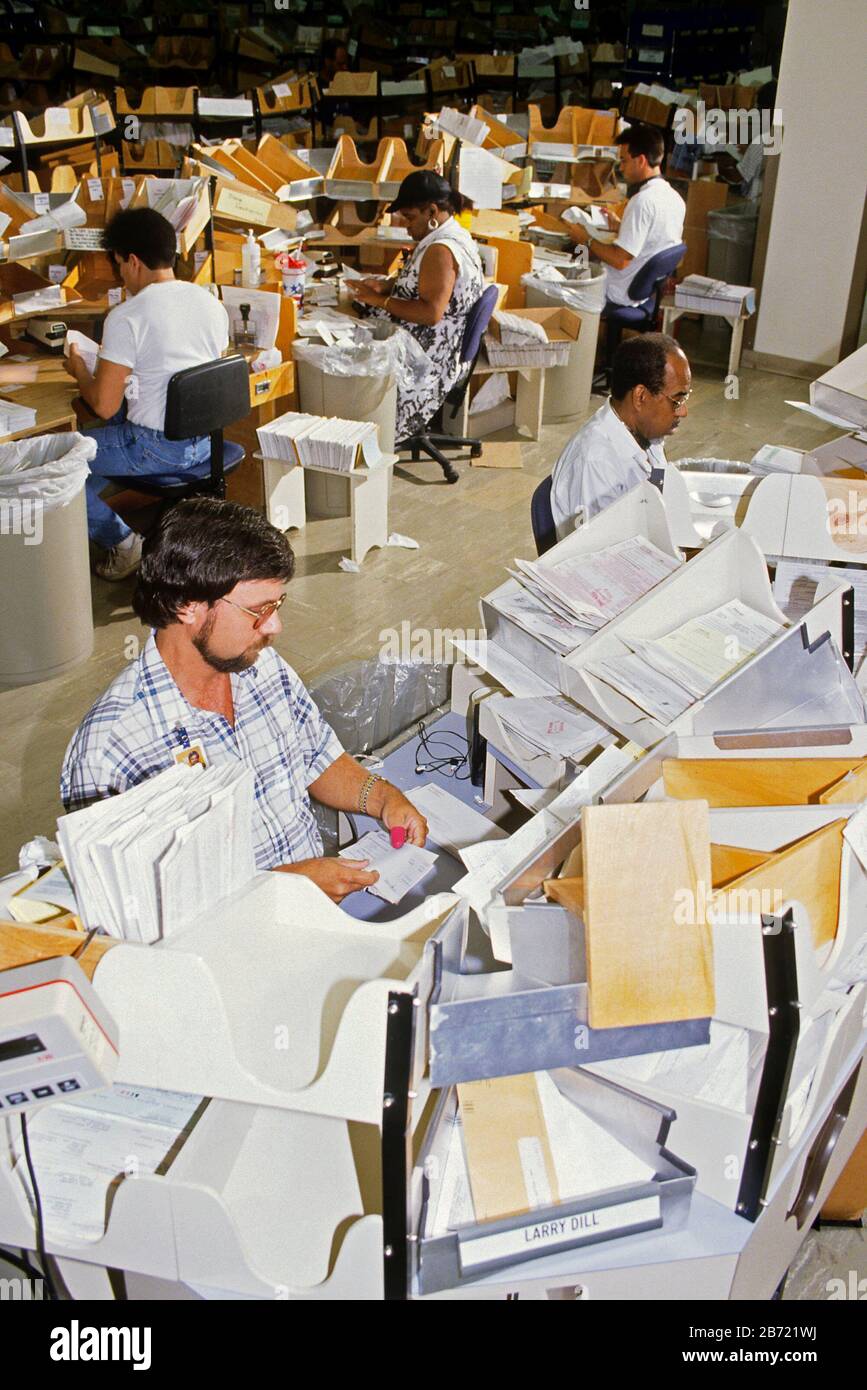

Austin, Texas USA, 1987 Internal Revenue Service (IRS) employees open

The december 2020 total local sales tax rate was also 8.250%. Welcome to the new sales tax rate locator. This is the total of state, county, and city sales tax rates. The minimum combined 2025 sales tax rate for austin, texas is 8.25%. In the tabs below, discover new map and latitude/longitude search options alongside the familiar single.

Most Texans Pay More In Taxes Than Californians Reform Austin

Welcome to the new sales tax rate locator. The december 2020 total local sales tax rate was also 8.250%. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. If you have questions about local sales and use tax rate information,. View the printable version of city rates (pdf).

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

This is the total of state, county, and city sales tax rates. View the printable version of city rates (pdf). The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. The december 2020 total local sales tax rate was also 8.250%. Welcome to the new sales tax rate locator.

a map shows the percentage of texas's tax burden by county, fy 2013

The current total local sales tax rate in austin, tx is 8.250%. In the tabs below, discover new map and latitude/longitude search options alongside the familiar single. The december 2020 total local sales tax rate was also 8.250%. Welcome to the new sales tax rate locator. This is the total of state, county, and city sales tax rates.

If You Have Questions About Local Sales And Use Tax Rate Information,.

This is the total of state, county, and city sales tax rates. The december 2020 total local sales tax rate was also 8.250%. The state of texas assesses a 6.7% gross receipts tax and an 8.25% sales tax on mixed beverages. View the printable version of city rates (pdf).

Welcome To The New Sales Tax Rate Locator.

The minimum combined 2025 sales tax rate for austin, texas is 8.25%. In the tabs below, discover new map and latitude/longitude search options alongside the familiar single. The current total local sales tax rate in austin, tx is 8.250%.

.png)