Balance Sheet Prepaid Rent

Balance Sheet Prepaid Rent - These are both asset accounts and do not increase or. Prepaid rent is classified as a current asset on the balance. Prepaid rent is a payment made in advance for goods or services. Prepaid expenses appear on the balance sheet as current assets, indicating future economic benefits expected within a year. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. Prepaid rent is a balance sheet account, and rent expense is an income statement account.

Prepaid rent is a balance sheet account, and rent expense is an income statement account. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. Prepaid rent is classified as a current asset on the balance. Prepaid rent is a payment made in advance for goods or services. These are both asset accounts and do not increase or. Prepaid expenses appear on the balance sheet as current assets, indicating future economic benefits expected within a year.

There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Prepaid rent is a payment made in advance for goods or services. Prepaid expenses appear on the balance sheet as current assets, indicating future economic benefits expected within a year. Prepaid rent is classified as a current asset on the balance. Prepaid rent is a balance sheet account, and rent expense is an income statement account. These are both asset accounts and do not increase or.

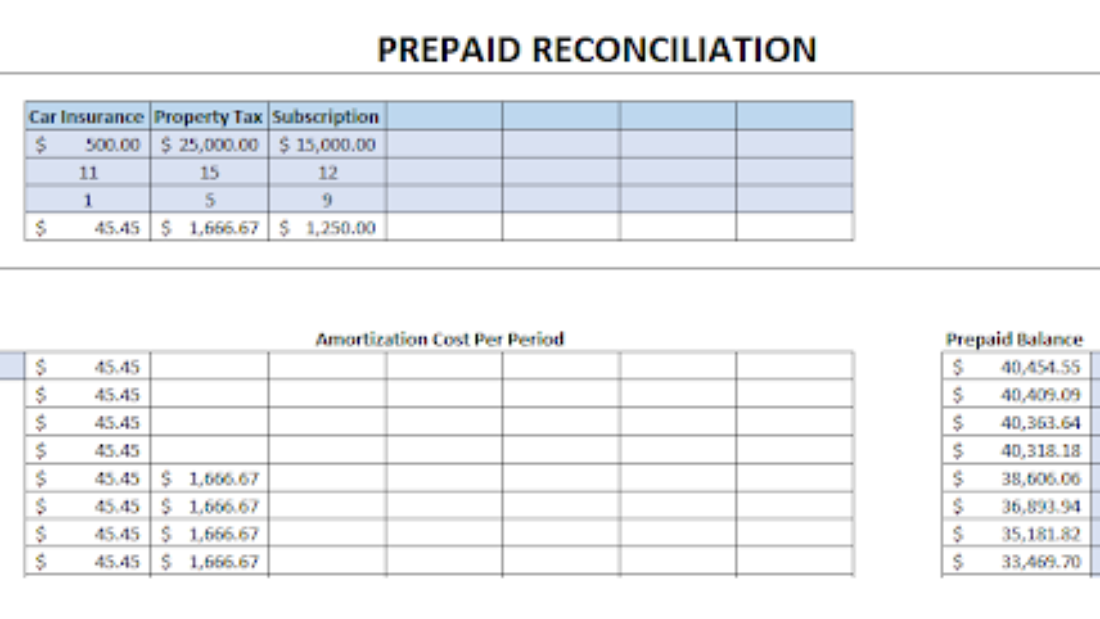

Prepaid Expense Schedule Template Printable Word Searches

Prepaid rent is classified as a current asset on the balance. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Prepaid rent is a payment made in advance for goods or services. Prepaid expenses appear on the balance sheet as current assets, indicating future economic benefits expected within a year. Prepaid.

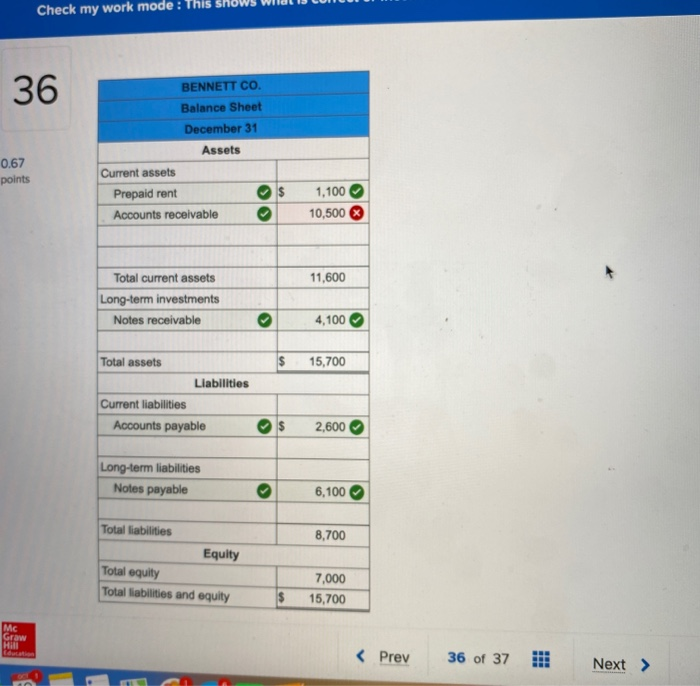

[Solved] Adams Company reports the following balance sheet accounts as

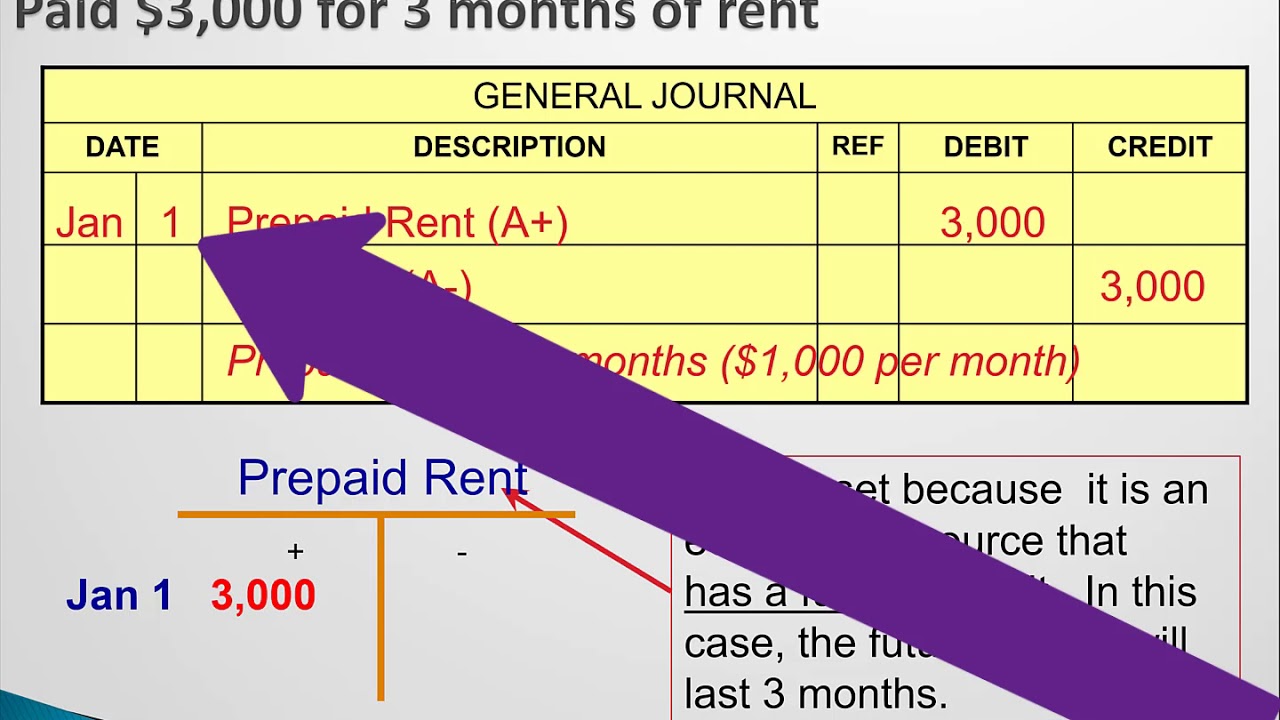

The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Prepaid rent is a balance sheet account, and rent expense is an income statement account. Prepaid rent is classified as a current asset on the balance. These are both asset accounts and do not increase or. Prepaid rent is a payment made.

Solved The balance sheet for Plasma Screens Corporation,

These are both asset accounts and do not increase or. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Prepaid rent is a balance sheet account, and rent expense is an income statement account. Prepaid rent is classified as a current asset on the balance. Prepaid expenses appear on the balance.

Solved 5 QS 716 Preparing a balance sheet LO P2, P4, C3

These are both asset accounts and do not increase or. Prepaid rent is a balance sheet account, and rent expense is an income statement account. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Prepaid expenses appear on the balance sheet as current assets, indicating future economic benefits expected within a.

Where Is Prepaid Rent On The Balance Sheet LiveWell

These are both asset accounts and do not increase or. Prepaid expenses appear on the balance sheet as current assets, indicating future economic benefits expected within a year. Prepaid rent is a balance sheet account, and rent expense is an income statement account. Prepaid rent is classified as a current asset on the balance. There can be several different examples.

What type of account is prepaid rent? Financial

There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Prepaid expenses appear on the balance sheet as current assets, indicating future economic benefits expected within a year. Prepaid rent is classified as a current asset.

Solved Indianapolis Machinery, Balance Sheet accounts at

Prepaid rent is classified as a current asset on the balance. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Prepaid rent is a balance sheet account, and rent expense is an income statement account. Prepaid expenses appear on the balance sheet as current assets, indicating future economic benefits.

Prepaid Expense Reconciliation Template Excel

Prepaid rent is a balance sheet account, and rent expense is an income statement account. Prepaid expenses appear on the balance sheet as current assets, indicating future economic benefits expected within a year. Prepaid rent is a payment made in advance for goods or services. Prepaid rent is classified as a current asset on the balance. Prepaid rent, often classified.

Prepaid Expenses In Statement And Balance Sheet Template South

Prepaid expenses appear on the balance sheet as current assets, indicating future economic benefits expected within a year. These are both asset accounts and do not increase or. Prepaid rent is a balance sheet account, and rent expense is an income statement account. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to.

Is rent expense a debit? Leia aqui Is rent expense a debit account

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet. Prepaid rent is classified as a current asset on the balance. The initial journal entry for prepaid rent is a debit to prepaid rent.

These Are Both Asset Accounts And Do Not Increase Or.

Prepaid rent is classified as a current asset on the balance. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. Prepaid rent is a balance sheet account, and rent expense is an income statement account. Prepaid expenses appear on the balance sheet as current assets, indicating future economic benefits expected within a year.

Prepaid Rent, Often Classified As A Current Asset On The Balance Sheet, Represents A Future Economic Benefit For A Company.

Prepaid rent is a payment made in advance for goods or services. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet.