Ca State Tax Lien

Ca State Tax Lien - Find out the collection procedures and options for. Learn how to deal with tax or fee liabilities that are overdue and may result in liens, levies, or offsets. A payoff request allows a third party to receive the current balance due to release a lien or facilitate a business transfer (bulk sale transfer or liquor. Learn how the ca franchise tax board (ftb) can issue a state tax lien against your personal property for unpaid taxes and how to get it released. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date).

Learn how to deal with tax or fee liabilities that are overdue and may result in liens, levies, or offsets. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Find out the collection procedures and options for. Learn how the ca franchise tax board (ftb) can issue a state tax lien against your personal property for unpaid taxes and how to get it released. A payoff request allows a third party to receive the current balance due to release a lien or facilitate a business transfer (bulk sale transfer or liquor.

Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). A payoff request allows a third party to receive the current balance due to release a lien or facilitate a business transfer (bulk sale transfer or liquor. Find out the collection procedures and options for. Learn how to deal with tax or fee liabilities that are overdue and may result in liens, levies, or offsets. Learn how the ca franchise tax board (ftb) can issue a state tax lien against your personal property for unpaid taxes and how to get it released.

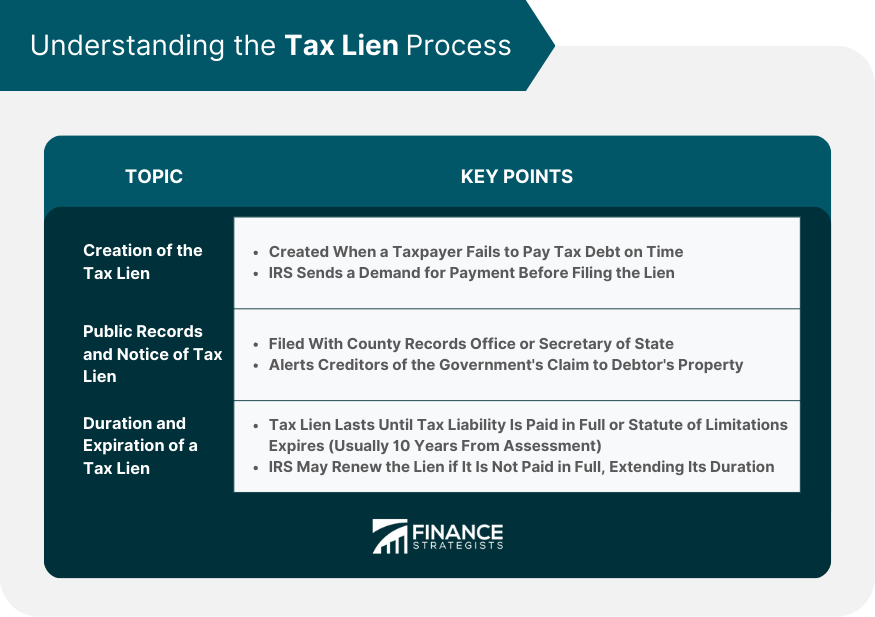

Pursuant to the Tax Lien, Tax May be Collected from Estate Property in

Learn how the ca franchise tax board (ftb) can issue a state tax lien against your personal property for unpaid taxes and how to get it released. Find out the collection procedures and options for. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). A payoff request.

State Tax Lien vs. Federal Tax Lien How to Remove Them

Find out the collection procedures and options for. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Learn how to deal with tax or fee liabilities that are overdue and may result in liens, levies, or offsets. Learn how the ca franchise tax board (ftb) can issue.

Tax Lien Mailing List Spectrum Mailing Lists

Find out the collection procedures and options for. Learn how the ca franchise tax board (ftb) can issue a state tax lien against your personal property for unpaid taxes and how to get it released. Learn how to deal with tax or fee liabilities that are overdue and may result in liens, levies, or offsets. A payoff request allows a.

Tax Lien Sale PDF Tax Lien Taxes

Learn how the ca franchise tax board (ftb) can issue a state tax lien against your personal property for unpaid taxes and how to get it released. A payoff request allows a third party to receive the current balance due to release a lien or facilitate a business transfer (bulk sale transfer or liquor. Learn how to deal with tax.

Tax Lien Definition, Process, Consequences, How to Handle

Learn how the ca franchise tax board (ftb) can issue a state tax lien against your personal property for unpaid taxes and how to get it released. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Find out the collection procedures and options for. A payoff request.

Tax Lien Focus Group Real Estate And Profit Acceleration Enjoy Your

Learn how to deal with tax or fee liabilities that are overdue and may result in liens, levies, or offsets. Learn how the ca franchise tax board (ftb) can issue a state tax lien against your personal property for unpaid taxes and how to get it released. Under california law, priority between state and federal tax liens is determined when.

Tax Lien Foreclosure Update Levitt & Slafkes, P.C.

Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Learn how the ca franchise tax board (ftb) can issue a state tax lien against your personal property for unpaid taxes and how to get it released. Find out the collection procedures and options for. Learn how to.

California Notice of State Tax Lien State Tax Lien California US

Learn how the ca franchise tax board (ftb) can issue a state tax lien against your personal property for unpaid taxes and how to get it released. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). Learn how to deal with tax or fee liabilities that are.

EasytoUnderstand Tax Lien Code Certificates Posteezy

Learn how the ca franchise tax board (ftb) can issue a state tax lien against your personal property for unpaid taxes and how to get it released. Find out the collection procedures and options for. Learn how to deal with tax or fee liabilities that are overdue and may result in liens, levies, or offsets. Under california law, priority between.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

Find out the collection procedures and options for. Learn how the ca franchise tax board (ftb) can issue a state tax lien against your personal property for unpaid taxes and how to get it released. A payoff request allows a third party to receive the current balance due to release a lien or facilitate a business transfer (bulk sale transfer.

Find Out The Collection Procedures And Options For.

Learn how to deal with tax or fee liabilities that are overdue and may result in liens, levies, or offsets. Learn how the ca franchise tax board (ftb) can issue a state tax lien against your personal property for unpaid taxes and how to get it released. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). A payoff request allows a third party to receive the current balance due to release a lien or facilitate a business transfer (bulk sale transfer or liquor.