Cash Vs Accrual Quickbooks

Cash Vs Accrual Quickbooks - The accrual method is when you. Cash accounting records income and expenses as. Learn the difference between cash and accrual basis and how to set them as preferences in quickbooks desktop for. Let me share with you the difference between cash and accrual basis of accounting in quickbooks desktop. What is the difference between cash and accrual accounting? Cash method is when you delay your gratification when you have received the payment from your customer.

What is the difference between cash and accrual accounting? Cash accounting records income and expenses as. Cash method is when you delay your gratification when you have received the payment from your customer. Learn the difference between cash and accrual basis and how to set them as preferences in quickbooks desktop for. The accrual method is when you. Let me share with you the difference between cash and accrual basis of accounting in quickbooks desktop.

Cash method is when you delay your gratification when you have received the payment from your customer. Let me share with you the difference between cash and accrual basis of accounting in quickbooks desktop. The accrual method is when you. What is the difference between cash and accrual accounting? Learn the difference between cash and accrual basis and how to set them as preferences in quickbooks desktop for. Cash accounting records income and expenses as.

Ini dia Pengertian dan perbedaan Accrual Basis dengan Cash basis (2/3

Let me share with you the difference between cash and accrual basis of accounting in quickbooks desktop. Learn the difference between cash and accrual basis and how to set them as preferences in quickbooks desktop for. Cash accounting records income and expenses as. What is the difference between cash and accrual accounting? The accrual method is when you.

14 1 Cash Vs Accrual Accounting Free Download Nude Photo Gallery

Cash method is when you delay your gratification when you have received the payment from your customer. Learn the difference between cash and accrual basis and how to set them as preferences in quickbooks desktop for. Cash accounting records income and expenses as. What is the difference between cash and accrual accounting? Let me share with you the difference between.

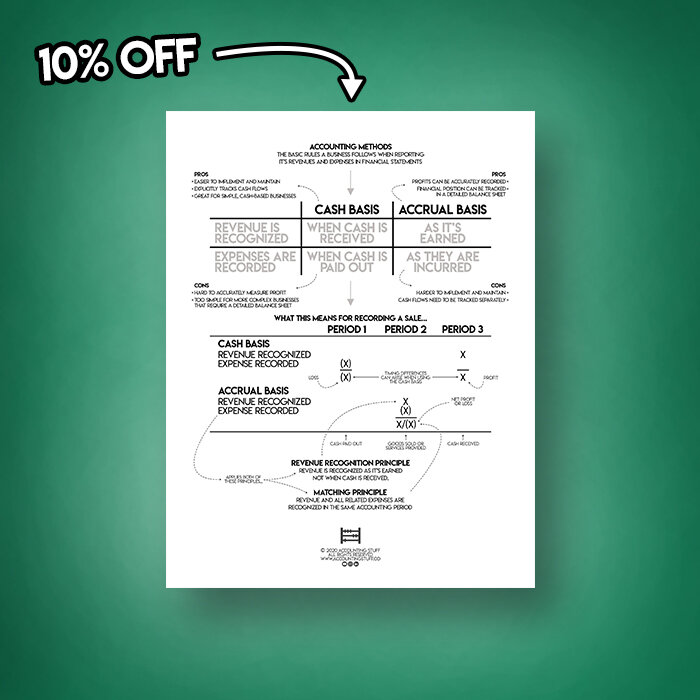

Cash vs Accrual Accounting Cheat Sheet — Accounting Stuff

Cash method is when you delay your gratification when you have received the payment from your customer. Learn the difference between cash and accrual basis and how to set them as preferences in quickbooks desktop for. Cash accounting records income and expenses as. The accrual method is when you. What is the difference between cash and accrual accounting?

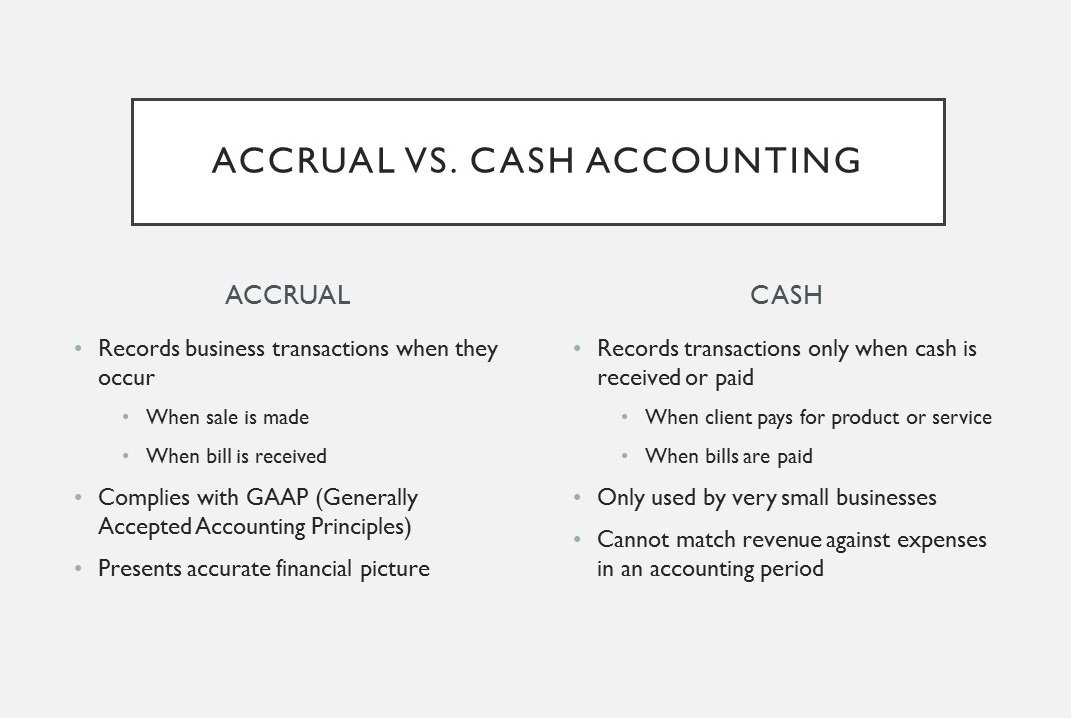

Cash versus accrual basis of Accounting Accrual Accounting and

Let me share with you the difference between cash and accrual basis of accounting in quickbooks desktop. Learn the difference between cash and accrual basis and how to set them as preferences in quickbooks desktop for. The accrual method is when you. What is the difference between cash and accrual accounting? Cash method is when you delay your gratification when.

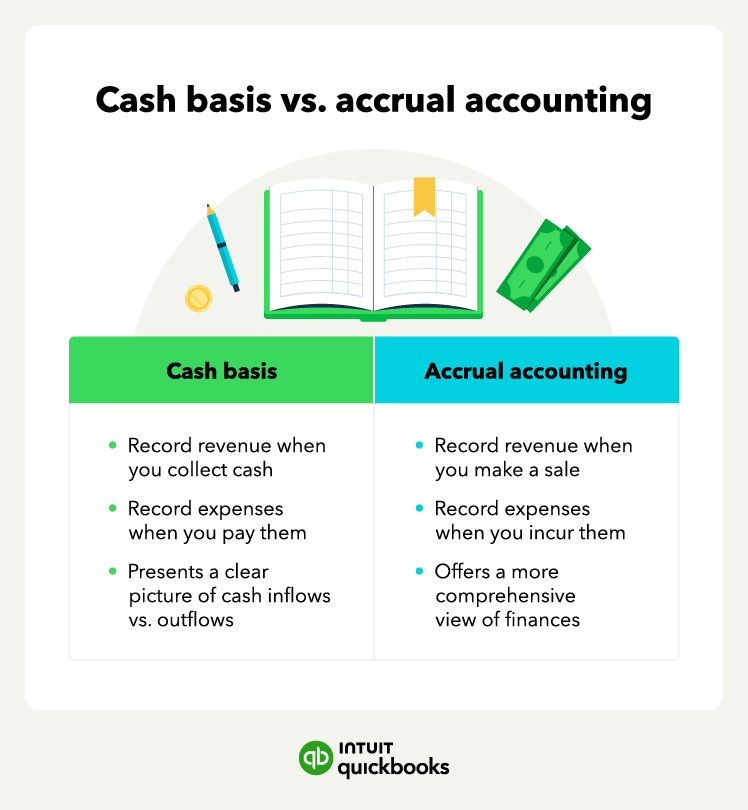

Cash vs. Accrual Accounting Which is Best? QuickBooks

Cash accounting records income and expenses as. Learn the difference between cash and accrual basis and how to set them as preferences in quickbooks desktop for. Cash method is when you delay your gratification when you have received the payment from your customer. The accrual method is when you. What is the difference between cash and accrual accounting?

19.1 Cash vs accrual accounting

Cash method is when you delay your gratification when you have received the payment from your customer. Let me share with you the difference between cash and accrual basis of accounting in quickbooks desktop. Learn the difference between cash and accrual basis and how to set them as preferences in quickbooks desktop for. The accrual method is when you. Cash.

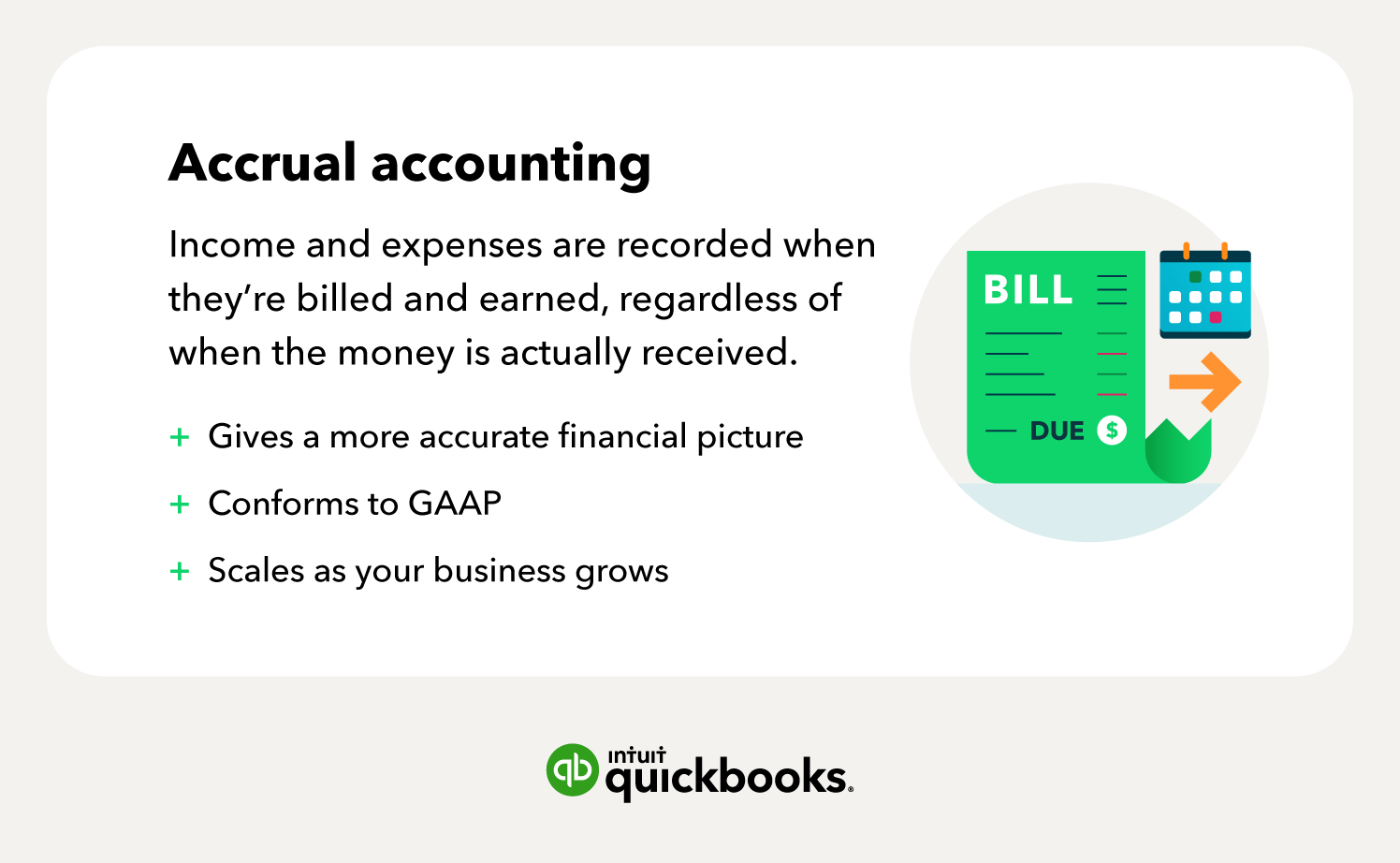

What Is Accrual Accounting? How It Works, Pros, and Cons

Let me share with you the difference between cash and accrual basis of accounting in quickbooks desktop. Learn the difference between cash and accrual basis and how to set them as preferences in quickbooks desktop for. The accrual method is when you. What is the difference between cash and accrual accounting? Cash method is when you delay your gratification when.

19.1 Cash vs accrual accounting

Cash method is when you delay your gratification when you have received the payment from your customer. Learn the difference between cash and accrual basis and how to set them as preferences in quickbooks desktop for. Let me share with you the difference between cash and accrual basis of accounting in quickbooks desktop. What is the difference between cash and.

What is cash basis accounting QuickBooks

Learn the difference between cash and accrual basis and how to set them as preferences in quickbooks desktop for. Let me share with you the difference between cash and accrual basis of accounting in quickbooks desktop. Cash accounting records income and expenses as. The accrual method is when you. Cash method is when you delay your gratification when you have.

Cash vs. Accrual Accounting Which is Best for Your Business?

Cash method is when you delay your gratification when you have received the payment from your customer. What is the difference between cash and accrual accounting? The accrual method is when you. Let me share with you the difference between cash and accrual basis of accounting in quickbooks desktop. Cash accounting records income and expenses as.

Learn The Difference Between Cash And Accrual Basis And How To Set Them As Preferences In Quickbooks Desktop For.

What is the difference between cash and accrual accounting? The accrual method is when you. Cash accounting records income and expenses as. Cash method is when you delay your gratification when you have received the payment from your customer.