Change Business Name Irs

Change Business Name Irs - You have two primary options for reporting your business name change to the irs: If you are a sole proprietor,. Here are the irs name change requirements for different business entity types: If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Business owners and other authorized individuals can submit a name change for their business. The specific action required may vary depending on. Include the information when you file your annual taxes.

Business owners and other authorized individuals can submit a name change for their business. You have two primary options for reporting your business name change to the irs: Here are the irs name change requirements for different business entity types: The specific action required may vary depending on. If you are a sole proprietor,. Include the information when you file your annual taxes. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your.

Include the information when you file your annual taxes. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. The specific action required may vary depending on. If you are a sole proprietor,. Here are the irs name change requirements for different business entity types: You have two primary options for reporting your business name change to the irs: Business owners and other authorized individuals can submit a name change for their business.

How to Change your LLC Name with the IRS? LLC University®

Include the information when you file your annual taxes. The specific action required may vary depending on. If you are a sole proprietor,. Here are the irs name change requirements for different business entity types: You have two primary options for reporting your business name change to the irs:

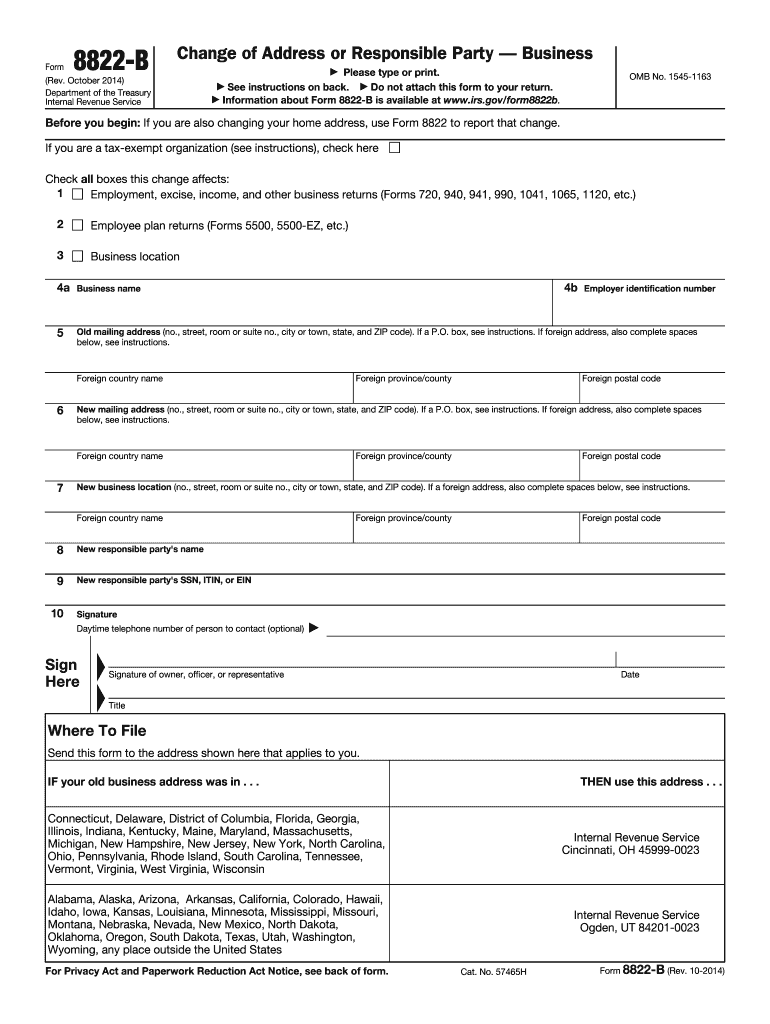

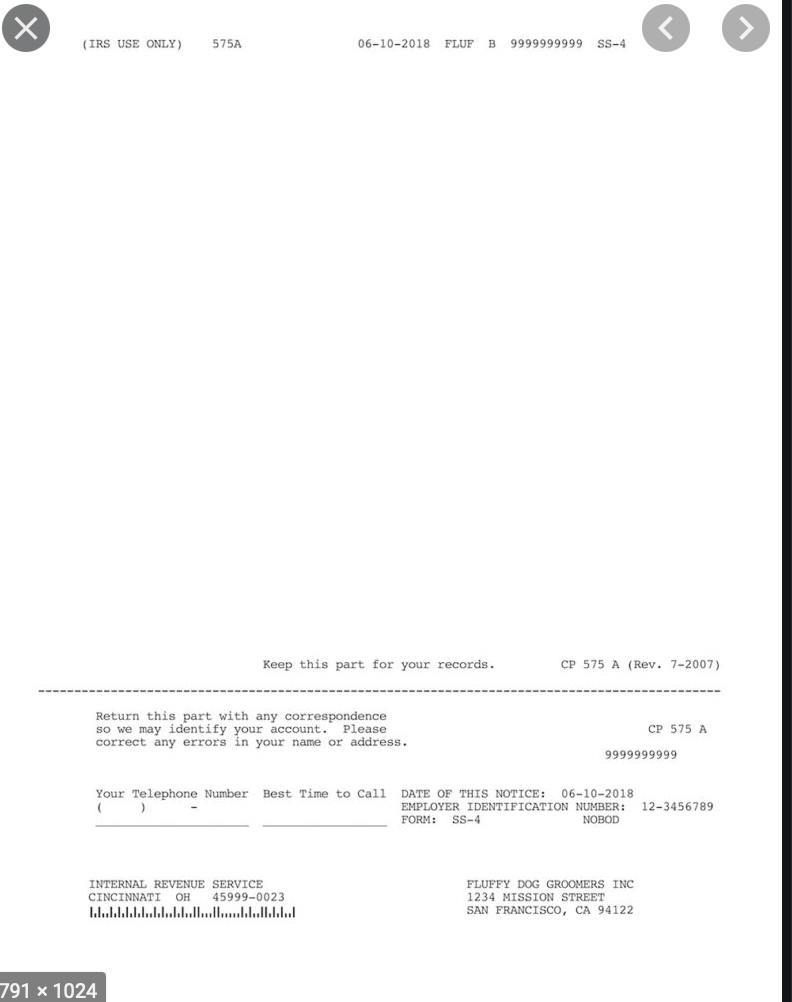

Irs business name change form 8822 Fill out & sign online DocHub

The specific action required may vary depending on. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Include the information when you file your annual taxes. If you are a sole proprietor,. Business owners and other authorized individuals can submit a name change for their business.

How to change your Business Name with the IRS YouTube

You have two primary options for reporting your business name change to the irs: Business owners and other authorized individuals can submit a name change for their business. Include the information when you file your annual taxes. If you are a sole proprietor,. The specific action required may vary depending on.

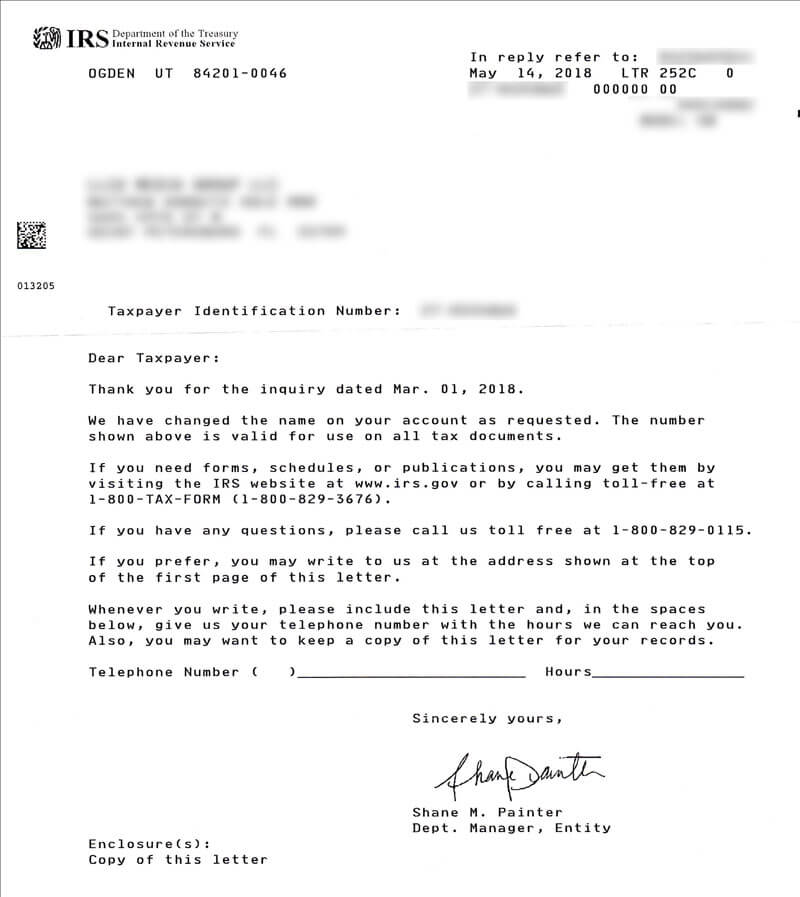

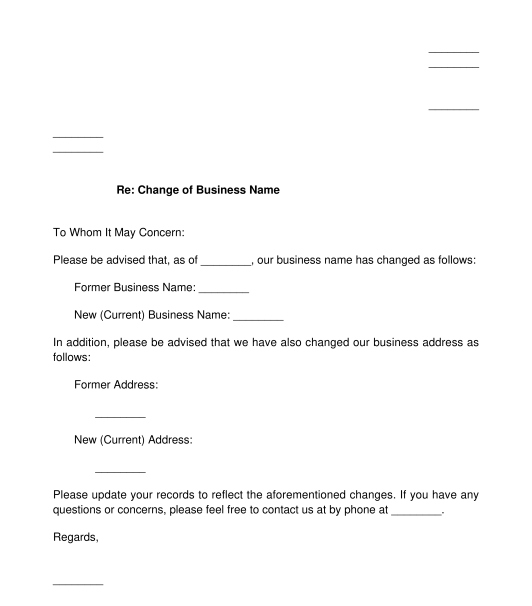

Business Name Change Letter Template To Irs

If you are a sole proprietor,. The specific action required may vary depending on. You have two primary options for reporting your business name change to the irs: Here are the irs name change requirements for different business entity types: Business owners and other authorized individuals can submit a name change for their business.

Irs Business Name Change Letter Template

Business owners and other authorized individuals can submit a name change for their business. Here are the irs name change requirements for different business entity types: You have two primary options for reporting your business name change to the irs: If you’re considering changing your name or the name of your business, you have to follow the correct procedure to.

Irs Business Name Change Letter Template

Here are the irs name change requirements for different business entity types: The specific action required may vary depending on. If you are a sole proprietor,. You have two primary options for reporting your business name change to the irs: If you’re considering changing your name or the name of your business, you have to follow the correct procedure to.

Business Name Change Letter Template To Irs

The specific action required may vary depending on. If you are a sole proprietor,. Business owners and other authorized individuals can submit a name change for their business. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Include the information when you file your annual taxes.

How Do You Change Your Business Name with the IRS? Form Fill Out and

Here are the irs name change requirements for different business entity types: If you are a sole proprietor,. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Include the information when you file your annual taxes. The specific action required may vary depending on.

Irs business name change letter template Fill out & sign online DocHub

Here are the irs name change requirements for different business entity types: You have two primary options for reporting your business name change to the irs: Business owners and other authorized individuals can submit a name change for their business. If you are a sole proprietor,. If you’re considering changing your name or the name of your business, you have.

How to Change Your Business Name A Complete Guide

If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. The specific action required may vary depending on. Business owners and other authorized individuals can submit a name change for their business. Here are the irs name change requirements for different business entity types: Include the information when.

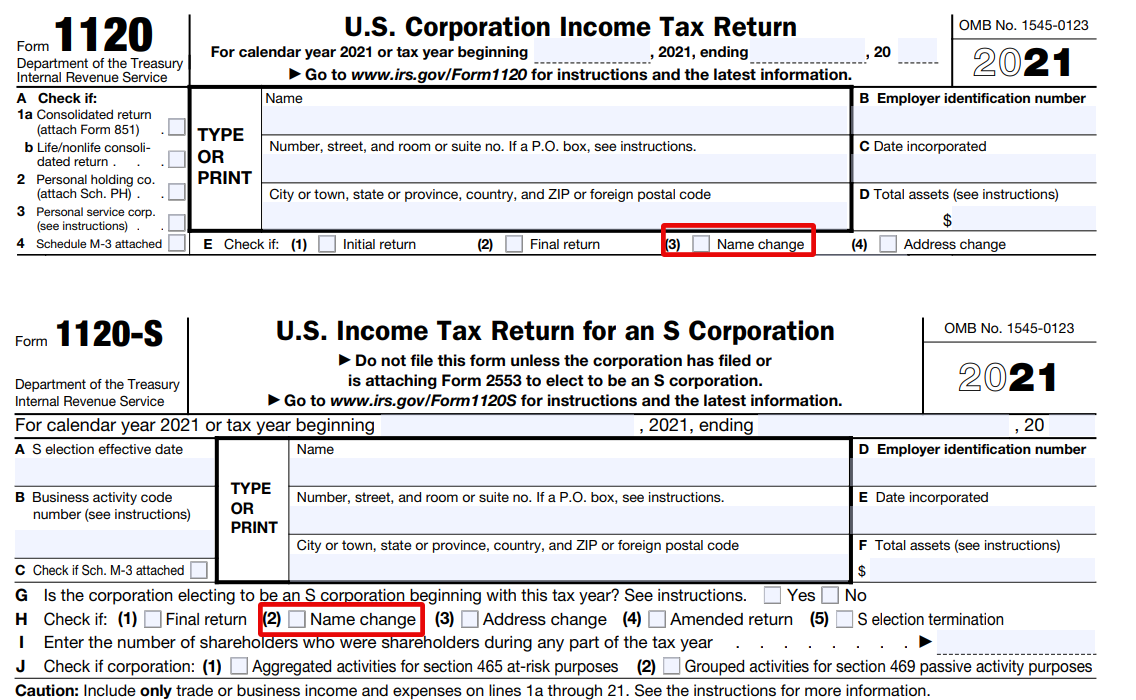

Here Are The Irs Name Change Requirements For Different Business Entity Types:

Include the information when you file your annual taxes. The specific action required may vary depending on. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Business owners and other authorized individuals can submit a name change for their business.

You Have Two Primary Options For Reporting Your Business Name Change To The Irs:

If you are a sole proprietor,.