Change Of Business Name Irs

Change Of Business Name Irs - Business owners and other authorized individuals can submit a name change for their business. Changing a business name with the irs can be done in one of two ways. Here are the key considerations: Corporations and llcs can check the name change box while. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. The specific action required may vary depending on. If your business undergoes a name change, it is essential to notify the internal revenue service (irs).

If your business undergoes a name change, it is essential to notify the internal revenue service (irs). Business owners and other authorized individuals can submit a name change for their business. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Changing a business name with the irs can be done in one of two ways. Corporations and llcs can check the name change box while. The specific action required may vary depending on. Here are the key considerations:

The specific action required may vary depending on. If your business undergoes a name change, it is essential to notify the internal revenue service (irs). If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Changing a business name with the irs can be done in one of two ways. Here are the key considerations: Business owners and other authorized individuals can submit a name change for their business. Corporations and llcs can check the name change box while.

Top Irs Name Change Form Templates free to download in PDF format

Business owners and other authorized individuals can submit a name change for their business. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Changing a business name with the irs can be done in one of two ways. If your business undergoes a name change, it is.

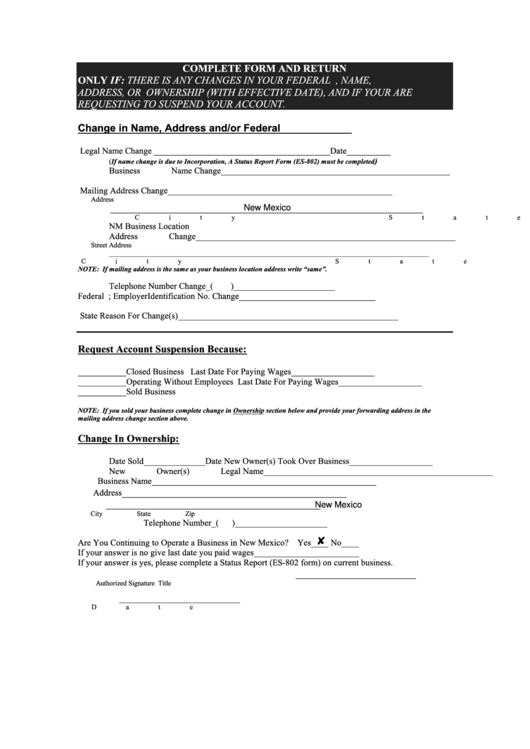

IRS Business Name Change

The specific action required may vary depending on. If your business undergoes a name change, it is essential to notify the internal revenue service (irs). Corporations and llcs can check the name change box while. Business owners and other authorized individuals can submit a name change for their business. If you’re considering changing your name or the name of your.

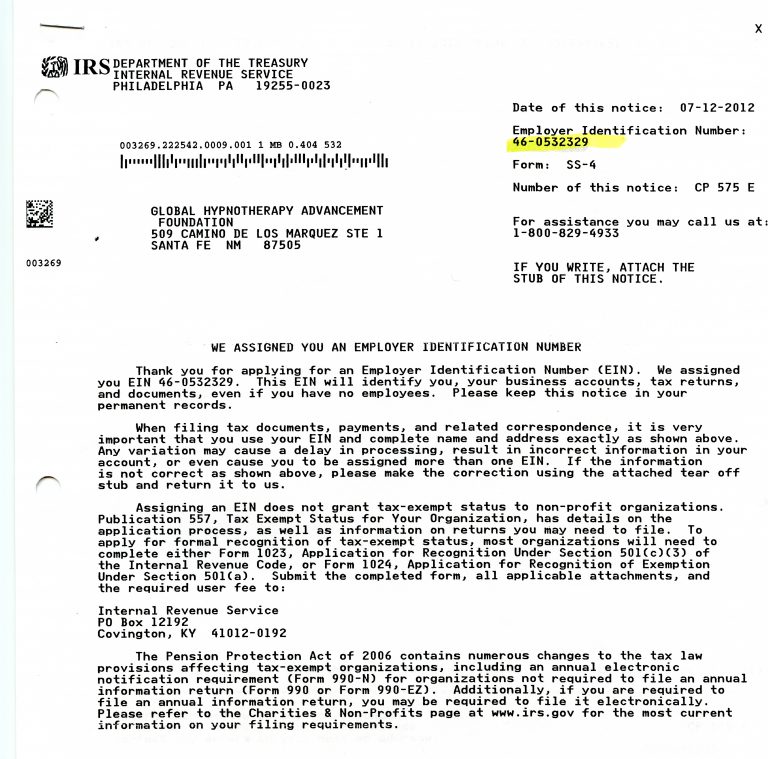

EIN IRS

The specific action required may vary depending on. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. If your business undergoes a name change, it is essential to notify the internal revenue service (irs). Changing a business name with the irs can be done in one of.

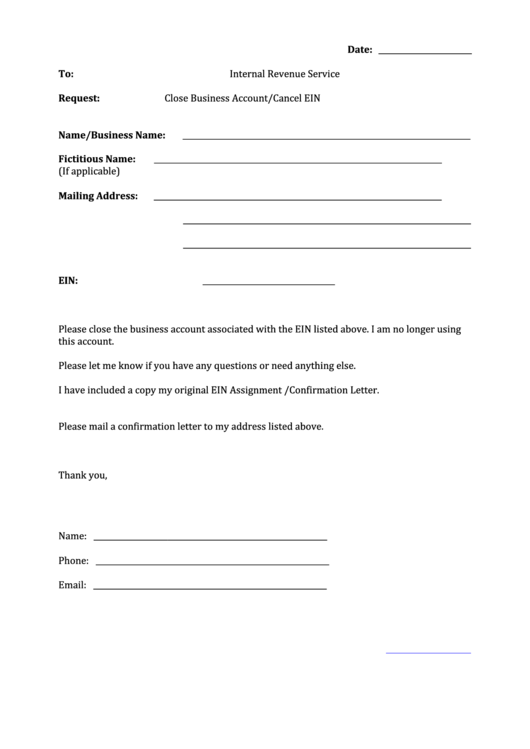

Sample Letter To Irs To Change Business Name

The specific action required may vary depending on. If your business undergoes a name change, it is essential to notify the internal revenue service (irs). If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Corporations and llcs can check the name change box while. Changing a business.

Update Your Business Name with IRS Leweter

If your business undergoes a name change, it is essential to notify the internal revenue service (irs). If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Changing a business name with the irs can be done in one of two ways. Business owners and other authorized individuals.

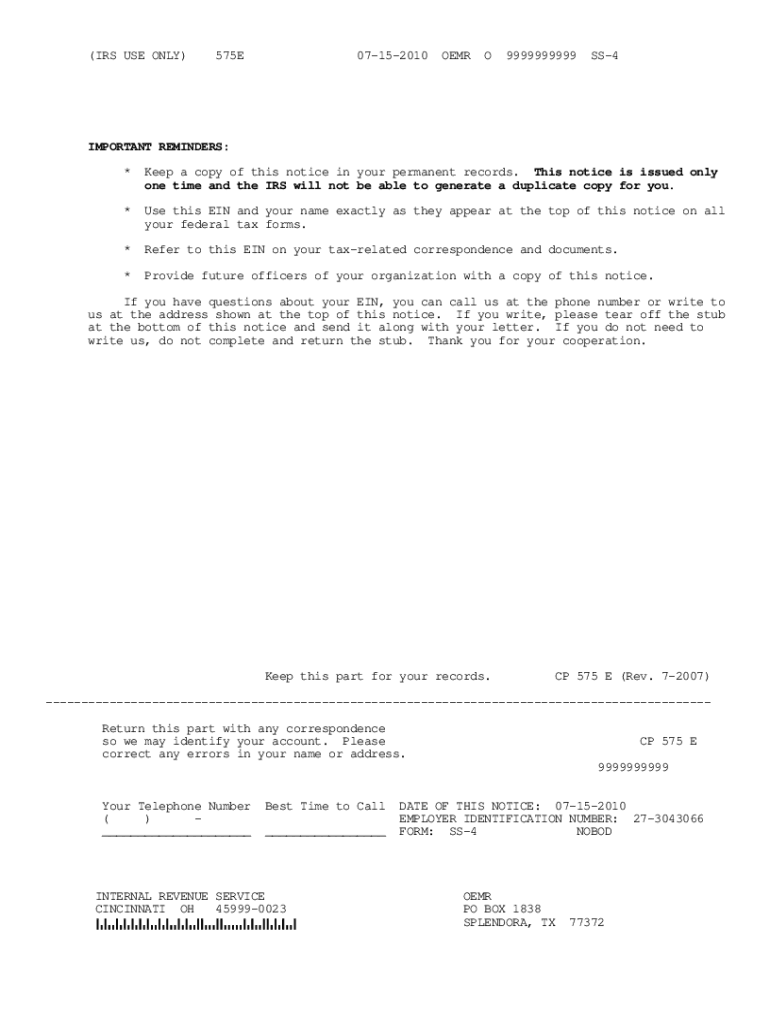

Irs Business Name Change Letter Template

The specific action required may vary depending on. Here are the key considerations: Business owners and other authorized individuals can submit a name change for their business. Corporations and llcs can check the name change box while. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your.

Irs Business Name Change Letter Template

The specific action required may vary depending on. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Changing a business name with the irs can be done in one of two ways. If your business undergoes a name change, it is essential to notify the internal revenue.

Irs Name Change Letter Sample business name change letter template

Changing a business name with the irs can be done in one of two ways. Business owners and other authorized individuals can submit a name change for their business. The specific action required may vary depending on. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Corporations.

Business Name Change Irs Sample Letter / Lovely Irs Ein Name Change

Changing a business name with the irs can be done in one of two ways. Corporations and llcs can check the name change box while. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. The specific action required may vary depending on. Business owners and other authorized.

Irs Business Name Change Letter Template

If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Business owners and other authorized individuals can submit a name change for their business. Here are the key considerations: The specific action required may vary depending on. Corporations and llcs can check the name change box while.

The Specific Action Required May Vary Depending On.

If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. If your business undergoes a name change, it is essential to notify the internal revenue service (irs). Business owners and other authorized individuals can submit a name change for their business. Corporations and llcs can check the name change box while.

Changing A Business Name With The Irs Can Be Done In One Of Two Ways.

Here are the key considerations: