Child Support Lien On Jointly Owned Property

Child Support Lien On Jointly Owned Property - When someone refuses or fails to pay child support, unless the state has stepped into to help try to collect it, you need to do. To check the lien requirements in your state, go to the office of child support enforcement website at. Child support liens cannot be put on. It's called tenancy by the entirety. Most states have a law that protects jointly owned property. You need to check your deed to. Regarding your question about the child support lien, it is possible for a lien to be placed on your property if your husband owes. The short answer is yes. A lien on property itself, however, does not result in the immediate collection of the support amount. In the case of unpaid child support, the state can place a lien on the delinquent parent’s property as a way to secure the owed.

Most states have a law that protects jointly owned property. It's called tenancy by the entirety. To check the lien requirements in your state, go to the office of child support enforcement website at. Child support liens cannot be put on. A lien on property itself, however, does not result in the immediate collection of the support amount. Enter your zip code to see attorneys available in your area. Yes, the lien will be on his interest in the property. Regarding your question about the child support lien, it is possible for a lien to be placed on your property if your husband owes. The short answer is yes. In the case of unpaid child support, the state can place a lien on the delinquent parent’s property as a way to secure the owed.

When someone refuses or fails to pay child support, unless the state has stepped into to help try to collect it, you need to do. Enter your zip code to see attorneys available in your area. Most states have a law that protects jointly owned property. The short answer is yes. You need to check your deed to. To check the lien requirements in your state, go to the office of child support enforcement website at. In the case of unpaid child support, the state can place a lien on the delinquent parent’s property as a way to secure the owed. Yes, the lien will be on his interest in the property. A lien on property itself, however, does not result in the immediate collection of the support amount. Regarding your question about the child support lien, it is possible for a lien to be placed on your property if your husband owes.

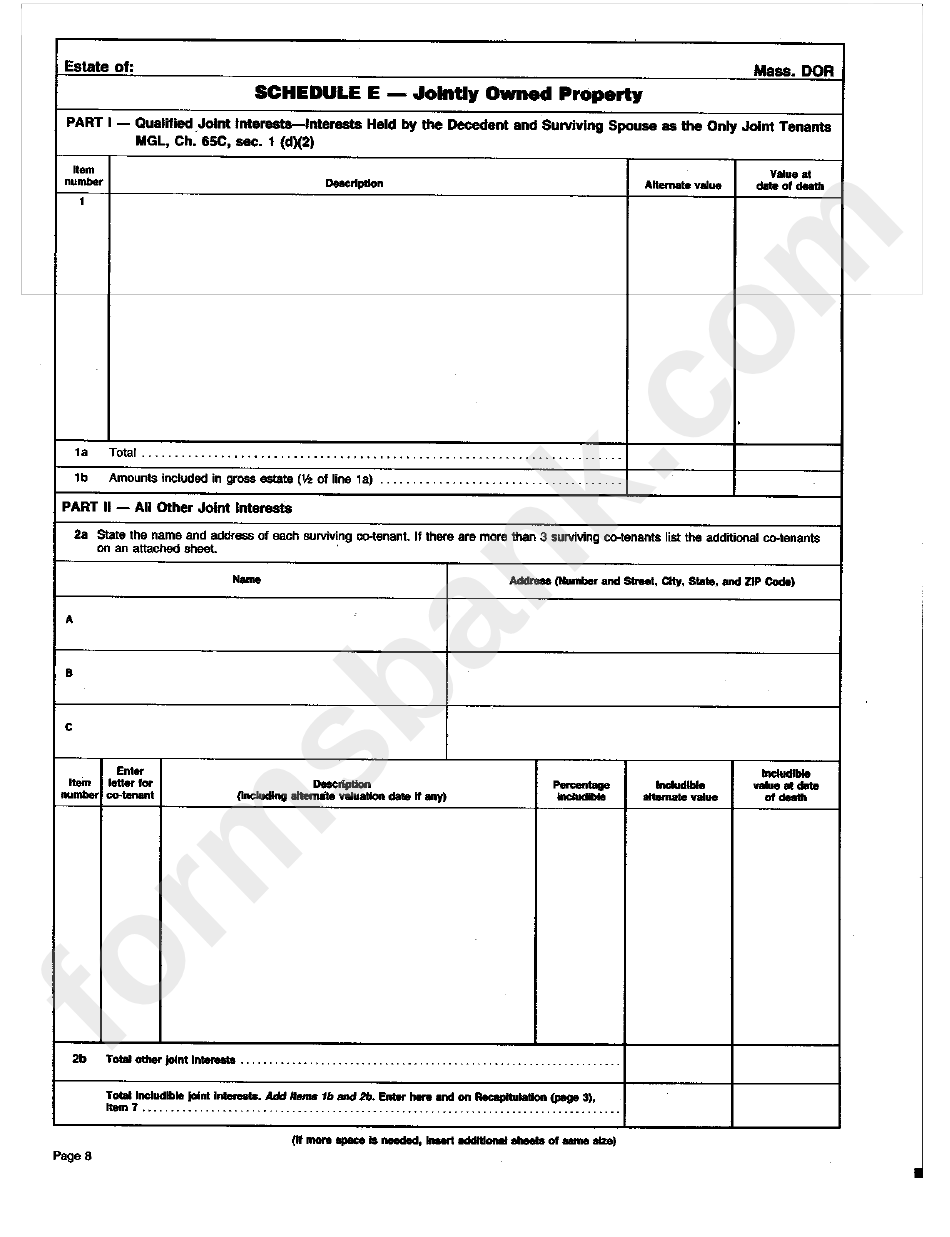

Schedule E (Form 706) Jointly Owned Property printable pdf download

It's called tenancy by the entirety. When someone refuses or fails to pay child support, unless the state has stepped into to help try to collect it, you need to do. Yes, the lien will be on his interest in the property. A lien on property itself, however, does not result in the immediate collection of the support amount. Regarding.

Orders for Sale of Jointly Owned Property Online Legal Advice

The short answer is yes. A lien on property itself, however, does not result in the immediate collection of the support amount. Child support liens cannot be put on. Most states have a law that protects jointly owned property. To check the lien requirements in your state, go to the office of child support enforcement website at.

Benefits Of Jointly Owned Property RealtyNXT

Enter your zip code to see attorneys available in your area. Regarding your question about the child support lien, it is possible for a lien to be placed on your property if your husband owes. Most states have a law that protects jointly owned property. A lien on property itself, however, does not result in the immediate collection of the.

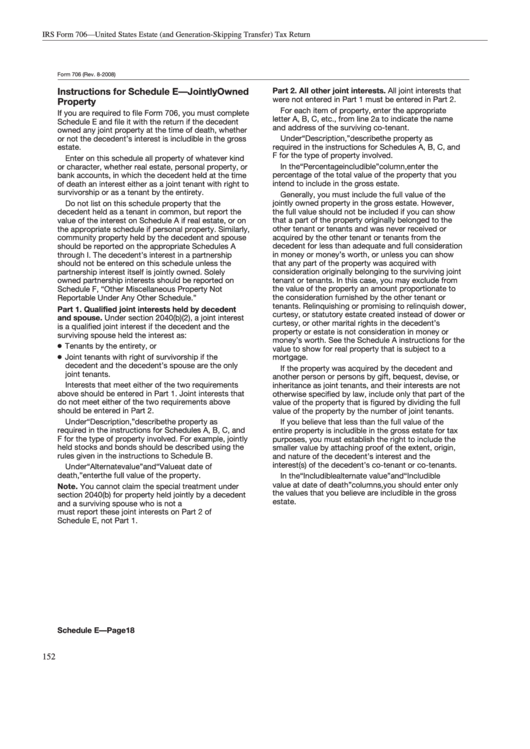

Instructions For Schedule E Jointly Owned Property printable pdf download

A lien on property itself, however, does not result in the immediate collection of the support amount. It's called tenancy by the entirety. Most states have a law that protects jointly owned property. Enter your zip code to see attorneys available in your area. In the case of unpaid child support, the state can place a lien on the delinquent.

Property118 Married Couples Jointly owned property expenses split

The short answer is yes. In the case of unpaid child support, the state can place a lien on the delinquent parent’s property as a way to secure the owed. It's called tenancy by the entirety. You need to check your deed to. Most states have a law that protects jointly owned property.

Forced Sale Of Jointly Owned Property Calgary Real Estate Lawyers

To check the lien requirements in your state, go to the office of child support enforcement website at. Most states have a law that protects jointly owned property. Child support liens cannot be put on. In the case of unpaid child support, the state can place a lien on the delinquent parent’s property as a way to secure the owed..

Jointly Owned Property What Happens When a CoOwner Dies?

To check the lien requirements in your state, go to the office of child support enforcement website at. In the case of unpaid child support, the state can place a lien on the delinquent parent’s property as a way to secure the owed. When someone refuses or fails to pay child support, unless the state has stepped into to help.

Child Support Lien Network

A lien on property itself, however, does not result in the immediate collection of the support amount. It's called tenancy by the entirety. Enter your zip code to see attorneys available in your area. Child support liens cannot be put on. The short answer is yes.

Joint Accounts and Jointly Owned Property and Businesses The Garrett

A lien on property itself, however, does not result in the immediate collection of the support amount. When someone refuses or fails to pay child support, unless the state has stepped into to help try to collect it, you need to do. Yes, the lien will be on his interest in the property. In the case of unpaid child support,.

What are the tax implications of a jointly owned property?

Child support liens cannot be put on. It's called tenancy by the entirety. You need to check your deed to. To check the lien requirements in your state, go to the office of child support enforcement website at. When someone refuses or fails to pay child support, unless the state has stepped into to help try to collect it, you.

Child Support Liens Cannot Be Put On.

When someone refuses or fails to pay child support, unless the state has stepped into to help try to collect it, you need to do. You need to check your deed to. Regarding your question about the child support lien, it is possible for a lien to be placed on your property if your husband owes. Yes, the lien will be on his interest in the property.

It's Called Tenancy By The Entirety.

A lien on property itself, however, does not result in the immediate collection of the support amount. In the case of unpaid child support, the state can place a lien on the delinquent parent’s property as a way to secure the owed. To check the lien requirements in your state, go to the office of child support enforcement website at. The short answer is yes.

Enter Your Zip Code To See Attorneys Available In Your Area.

Most states have a law that protects jointly owned property.