Colorado Senior Property Tax Exemption Form

Colorado Senior Property Tax Exemption Form - Senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and the surviving spouses of. Explore the attached documents for more information regarding the senior property tax exemption! Senior exemption application form for applicants confined to a nursing home, surviving spouses or whose property is owned by a trust or. The senior property tax exemption is available to senior citizens and the surviving. Senior citizens in colorado property tax exemption. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. We recommend you obtain a receipt when delivering the form in person, or mail the. A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. Mail or deliver this form to your county assessor by july 15.

A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. Senior exemption application form for applicants confined to a nursing home, surviving spouses or whose property is owned by a trust or. Senior citizens in colorado property tax exemption. Senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and the surviving spouses of. The senior property tax exemption is available to senior citizens and the surviving. Explore the attached documents for more information regarding the senior property tax exemption! We recommend you obtain a receipt when delivering the form in person, or mail the. Mail or deliver this form to your county assessor by july 15. A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified.

Senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and the surviving spouses of. A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. Senior exemption application form for applicants confined to a nursing home, surviving spouses or whose property is owned by a trust or. The senior property tax exemption is available to senior citizens and the surviving. Senior citizens in colorado property tax exemption. Mail or deliver this form to your county assessor by july 15. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. Explore the attached documents for more information regarding the senior property tax exemption! We recommend you obtain a receipt when delivering the form in person, or mail the.

Tax Exempt Form TAX

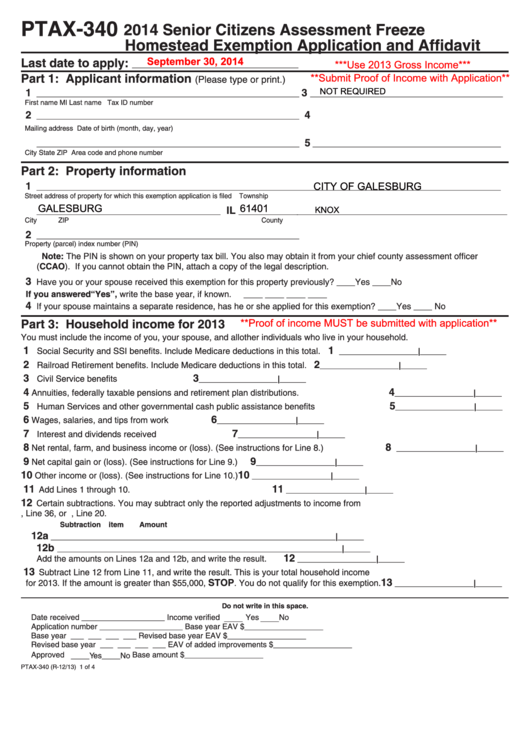

The senior property tax exemption is available to senior citizens and the surviving. Senior citizens in colorado property tax exemption. A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. Senior exemption application form for applicants confined to a nursing home, surviving spouses or whose property is owned by a trust.

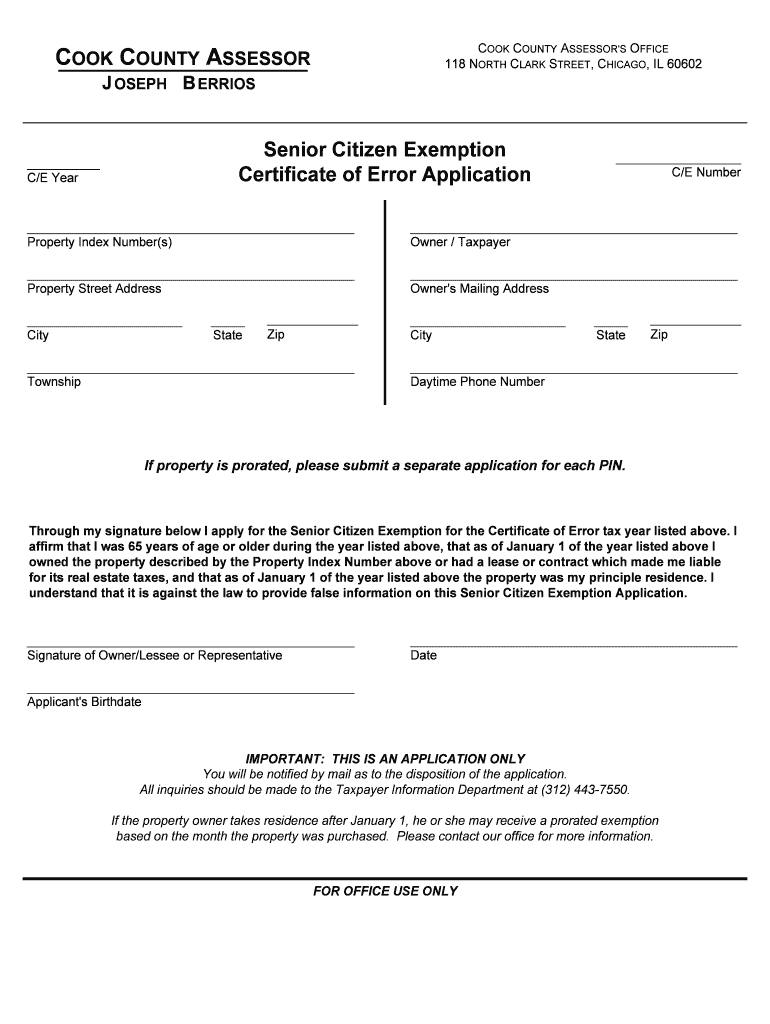

Fillable 201 Taxpayer Exemption Application Cook County Assessor

A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. Senior citizens in colorado property tax exemption. A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. Mail or deliver this form to your county assessor by july 15. The senior property.

Which States Offer Disabled Veteran Property Tax Exemptions?

The senior property tax exemption is available to senior citizens and the surviving. Senior citizens in colorado property tax exemption. Explore the attached documents for more information regarding the senior property tax exemption! Mail or deliver this form to your county assessor by july 15. Senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens.

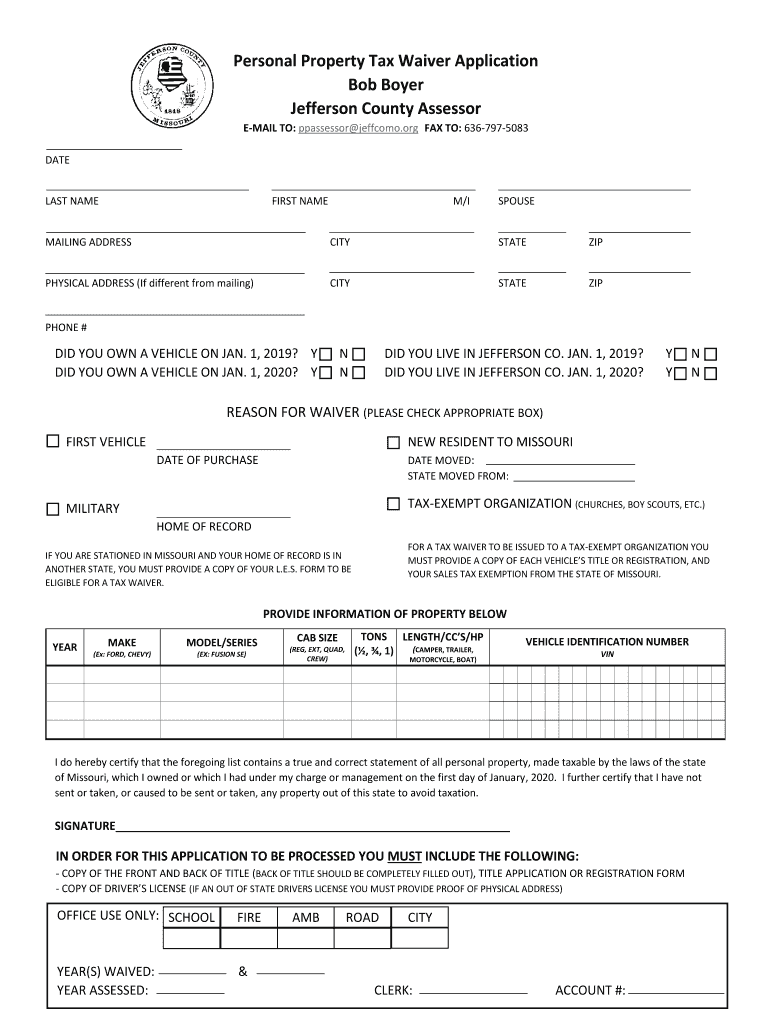

Jefferson county mo real estate taxes Fill out & sign online DocHub

Mail or deliver this form to your county assessor by july 15. Senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and the surviving spouses of. Senior exemption application form for applicants confined to a nursing home, surviving spouses or whose property is owned by a trust or. Explore the attached documents for more.

How Much Is The Tax Exemption For 2024 Alisa Florida

Explore the attached documents for more information regarding the senior property tax exemption! A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. Senior exemption application form for applicants confined to a nursing home, surviving spouses or whose property is owned by a trust or. The senior property tax exemption is.

Colorado Homestead Exemption 2024 Ynes Amelita

Mail or deliver this form to your county assessor by july 15. A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. Explore the attached documents for more information regarding the senior.

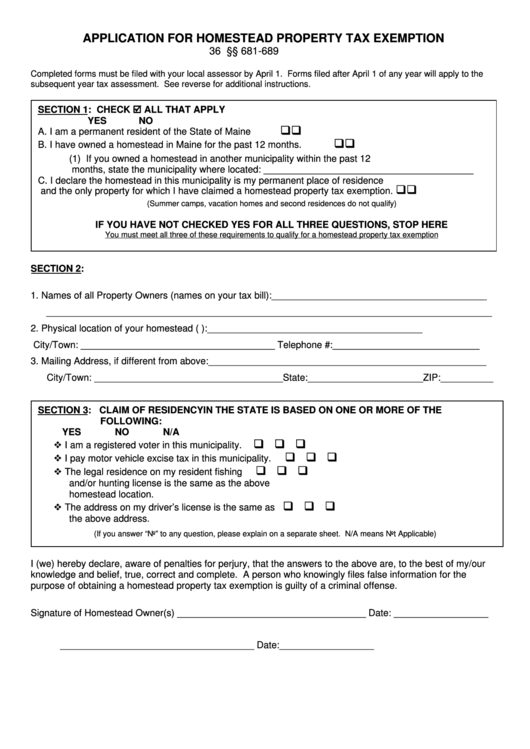

Free Printable Homestead Tax Form Printable Forms Free Online

The senior property tax exemption is available to senior citizens and the surviving. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. Senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and the surviving spouses of. Explore the attached documents for more information regarding.

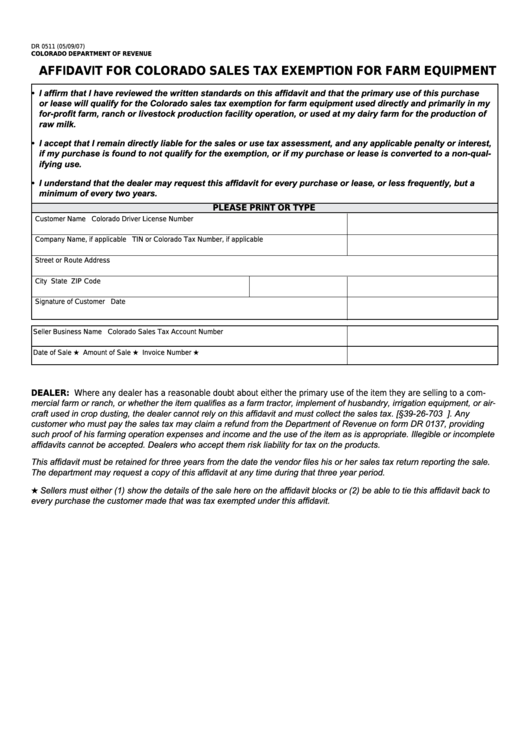

Colorado Sales Tax Exemption Form For Contractors

Senior citizens in colorado property tax exemption. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. Senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and the surviving spouses of. Mail or deliver this form to your county assessor by july 15. We recommend.

2020 Colorado Senior Property Tax Exemption Funded

Senior citizens in colorado property tax exemption. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified. Mail or deliver this form to your county assessor by july 15. Senior exemption application form for applicants confined to a nursing home, surviving spouses or whose property is owned by a trust or..

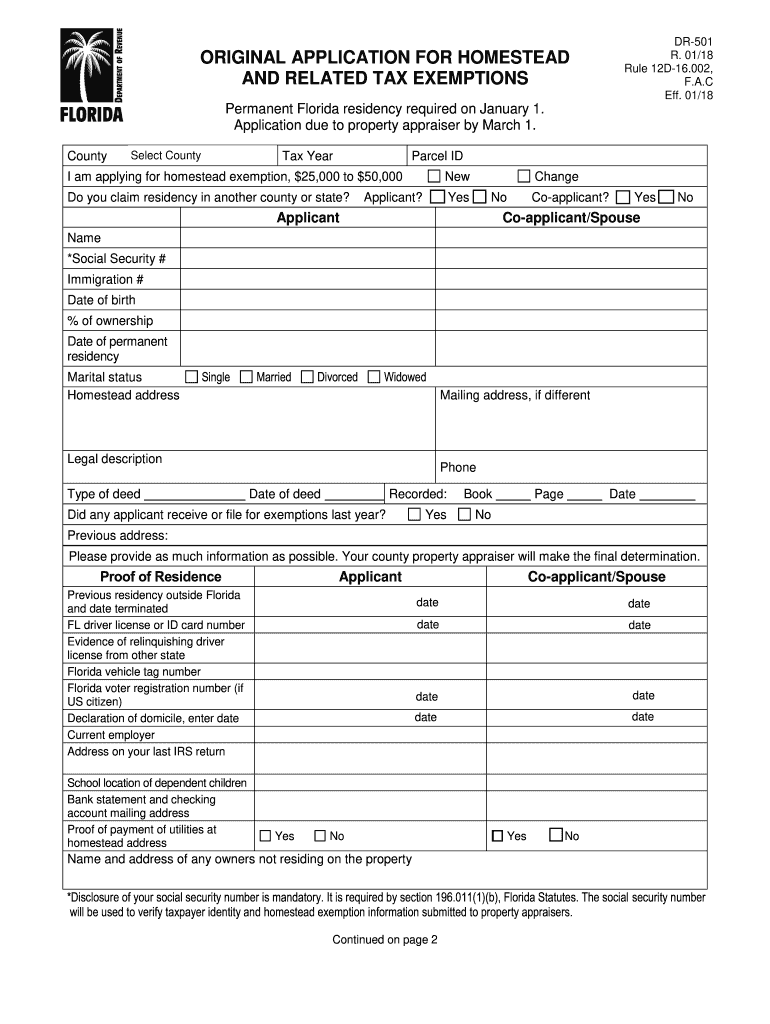

Hillsborough County Homestead Application 20182024 Form Fill Out and

Explore the attached documents for more information regarding the senior property tax exemption! A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. Mail or deliver this form to your county assessor by july 15. The senior property tax exemption is available to senior citizens and the surviving. We recommend you.

We Recommend You Obtain A Receipt When Delivering The Form In Person, Or Mail The.

A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. Senior citizens in colorado property tax exemption. Senior property tax homestead exemption a property tax exemption is available to qualifying senior citizens and the surviving spouses of. A property tax exemption is available to qualifying senior citizens and the surviving spouses of those who previously qualified.

The Senior Property Tax Exemption Is Available To Senior Citizens And The Surviving.

Senior exemption application form for applicants confined to a nursing home, surviving spouses or whose property is owned by a trust or. Mail or deliver this form to your county assessor by july 15. Explore the attached documents for more information regarding the senior property tax exemption!