Debt Discharged Meaning

Debt Discharged Meaning - The court will issue a. Discharge (of debts) means the debtor is no longer liable for their debts, and the lender is no longer allowed to collect them. In other words, when a debt is discharged, the. Debt discharge is the cancellation of a debtor’s liability, often associated with bankruptcy. To discharge a debt means to eliminate the debtor’s legal obligation to repay it.

In other words, when a debt is discharged, the. Discharge (of debts) means the debtor is no longer liable for their debts, and the lender is no longer allowed to collect them. To discharge a debt means to eliminate the debtor’s legal obligation to repay it. The court will issue a. Debt discharge is the cancellation of a debtor’s liability, often associated with bankruptcy.

The court will issue a. To discharge a debt means to eliminate the debtor’s legal obligation to repay it. In other words, when a debt is discharged, the. Debt discharge is the cancellation of a debtor’s liability, often associated with bankruptcy. Discharge (of debts) means the debtor is no longer liable for their debts, and the lender is no longer allowed to collect them.

Debt Discharge What it is, How it Works

In other words, when a debt is discharged, the. To discharge a debt means to eliminate the debtor’s legal obligation to repay it. The court will issue a. Discharge (of debts) means the debtor is no longer liable for their debts, and the lender is no longer allowed to collect them. Debt discharge is the cancellation of a debtor’s liability,.

Chapter 7 Bankruptcy 24 Hour Legal Advice Ask A Lawyer Live Chat

Discharge (of debts) means the debtor is no longer liable for their debts, and the lender is no longer allowed to collect them. The court will issue a. Debt discharge is the cancellation of a debtor’s liability, often associated with bankruptcy. To discharge a debt means to eliminate the debtor’s legal obligation to repay it. In other words, when a.

Bankruptcy Discharge What Is It And Why It's A Vital Step? Debt.ca

The court will issue a. Debt discharge is the cancellation of a debtor’s liability, often associated with bankruptcy. Discharge (of debts) means the debtor is no longer liable for their debts, and the lender is no longer allowed to collect them. In other words, when a debt is discharged, the. To discharge a debt means to eliminate the debtor’s legal.

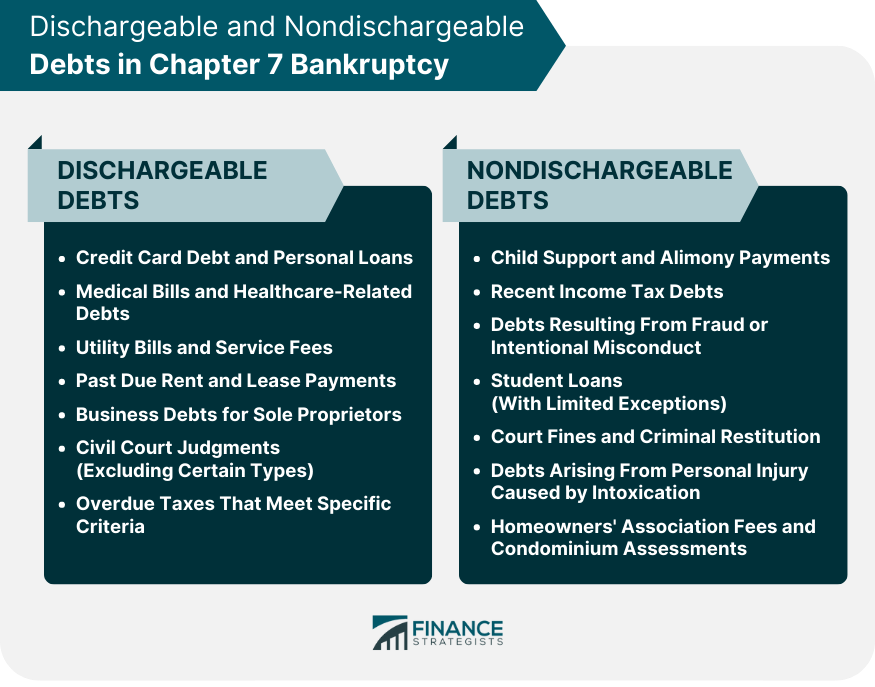

Which Debts Are Discharged in Chapter 7 Bankruptcy? Best Bankruptcy

In other words, when a debt is discharged, the. Discharge (of debts) means the debtor is no longer liable for their debts, and the lender is no longer allowed to collect them. To discharge a debt means to eliminate the debtor’s legal obligation to repay it. Debt discharge is the cancellation of a debtor’s liability, often associated with bankruptcy. The.

What does debt is discharged?

In other words, when a debt is discharged, the. The court will issue a. Debt discharge is the cancellation of a debtor’s liability, often associated with bankruptcy. Discharge (of debts) means the debtor is no longer liable for their debts, and the lender is no longer allowed to collect them. To discharge a debt means to eliminate the debtor’s legal.

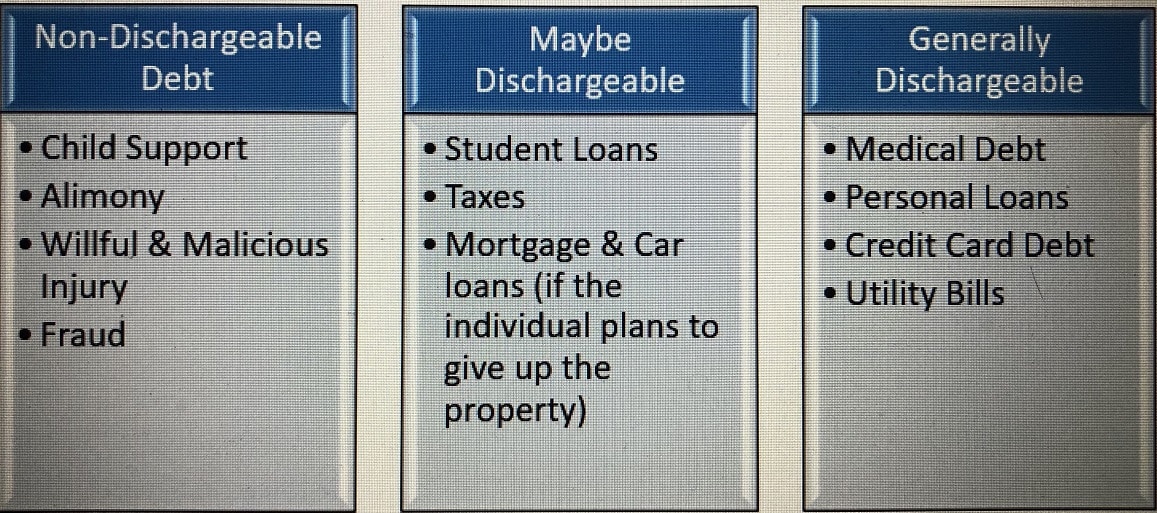

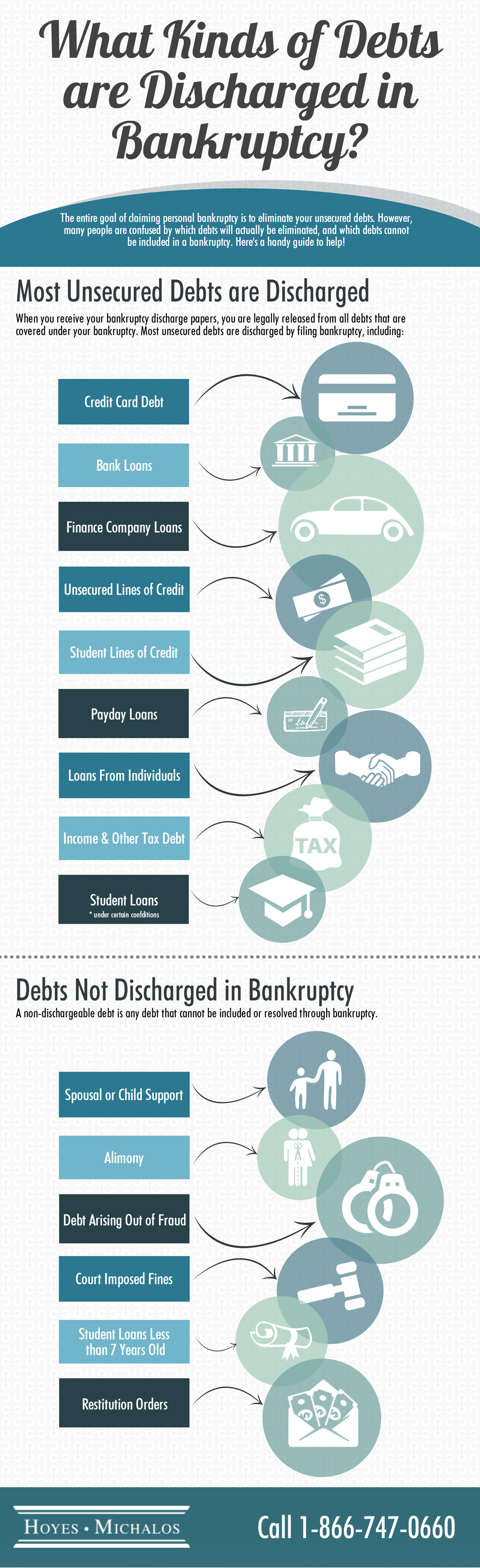

What Types of Debt are Discharged in Bankruptcy

Debt discharge is the cancellation of a debtor’s liability, often associated with bankruptcy. To discharge a debt means to eliminate the debtor’s legal obligation to repay it. The court will issue a. In other words, when a debt is discharged, the. Discharge (of debts) means the debtor is no longer liable for their debts, and the lender is no longer.

Debts Discharged in Bankruptcy Infographic

Debt discharge is the cancellation of a debtor’s liability, often associated with bankruptcy. Discharge (of debts) means the debtor is no longer liable for their debts, and the lender is no longer allowed to collect them. In other words, when a debt is discharged, the. To discharge a debt means to eliminate the debtor’s legal obligation to repay it. The.

What Debts Are Discharged in Chapter 7 Bankruptcy?

Debt discharge is the cancellation of a debtor’s liability, often associated with bankruptcy. To discharge a debt means to eliminate the debtor’s legal obligation to repay it. The court will issue a. Discharge (of debts) means the debtor is no longer liable for their debts, and the lender is no longer allowed to collect them. In other words, when a.

Debt Discharge Definition

Debt discharge is the cancellation of a debtor’s liability, often associated with bankruptcy. Discharge (of debts) means the debtor is no longer liable for their debts, and the lender is no longer allowed to collect them. In other words, when a debt is discharged, the. The court will issue a. To discharge a debt means to eliminate the debtor’s legal.

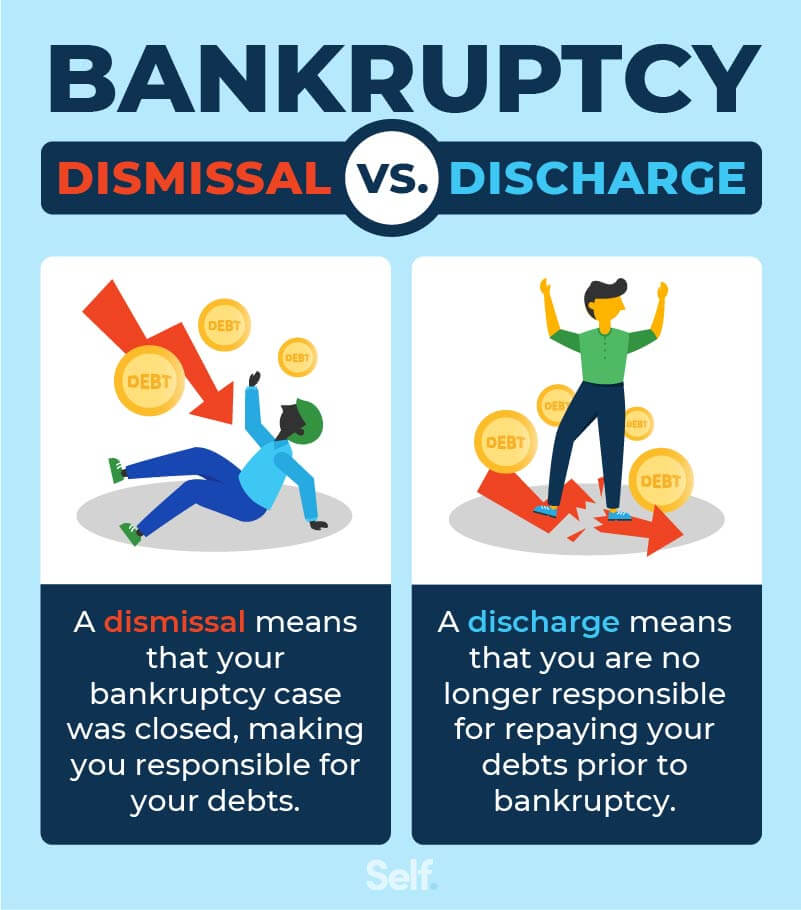

Bankruptcy Dismissal vs. Discharge What's the Difference and How They

Discharge (of debts) means the debtor is no longer liable for their debts, and the lender is no longer allowed to collect them. In other words, when a debt is discharged, the. Debt discharge is the cancellation of a debtor’s liability, often associated with bankruptcy. To discharge a debt means to eliminate the debtor’s legal obligation to repay it. The.

To Discharge A Debt Means To Eliminate The Debtor’s Legal Obligation To Repay It.

In other words, when a debt is discharged, the. Discharge (of debts) means the debtor is no longer liable for their debts, and the lender is no longer allowed to collect them. The court will issue a. Debt discharge is the cancellation of a debtor’s liability, often associated with bankruptcy.

:max_bytes(150000):strip_icc()/finalnew-cd2c2367ef8f4fcdaa1e9218acf86c9d.jpg)

:max_bytes(150000):strip_icc()/payment-due-1036864802-6b1c2ed3cbe2484db04b9409d49382de.jpg)