Delinquent Tax Liens

Delinquent Tax Liens - (1) the full amount of tax finalized by filing a. Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows:

Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows: (1) the full amount of tax finalized by filing a.

(1) the full amount of tax finalized by filing a. Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows:

Delinquent property taxes/vacant residential and nontax liens by

(1) the full amount of tax finalized by filing a. Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows:

How To Find Tax Lien Properties An Investor’s Guide

Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows: (1) the full amount of tax finalized by filing a.

County Corner Delinquent property taxes, Tax Lien Sale Kingman

(1) the full amount of tax finalized by filing a. Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows:

Everything You Need To Know About Getting Your County's "Delinquent Tax

(1) the full amount of tax finalized by filing a. Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows:

How to make money on Delinquent Taxes thru Tax Deeds, Liens & Tax Deed

(1) the full amount of tax finalized by filing a. Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows:

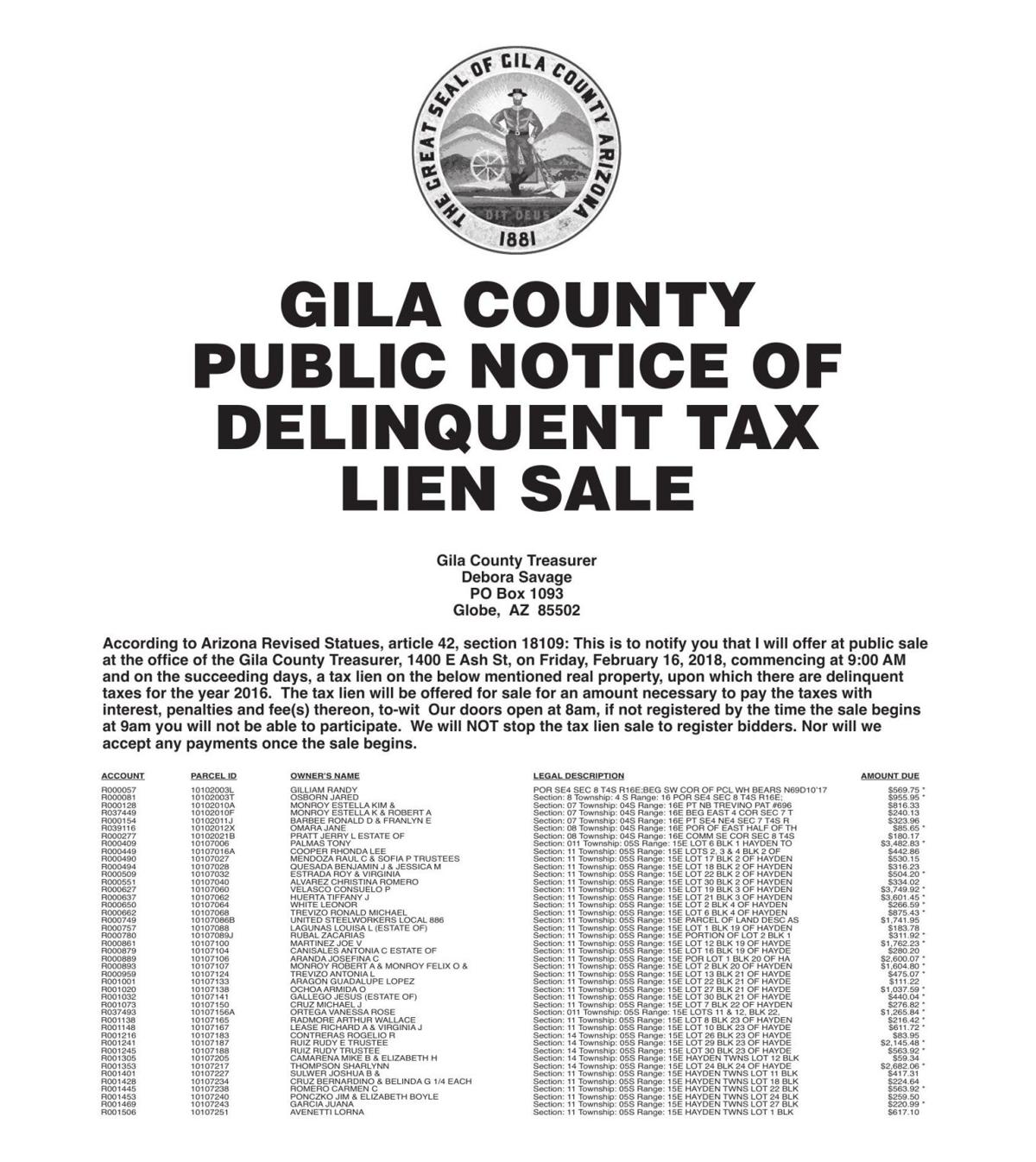

Gila County Public Notice of Delinquent Tax Lien Sale Gila County

(1) the full amount of tax finalized by filing a. Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows:

How She Got A List Of 25,000 Delinquent Tax Liens in Saint Louis

Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows: (1) the full amount of tax finalized by filing a.

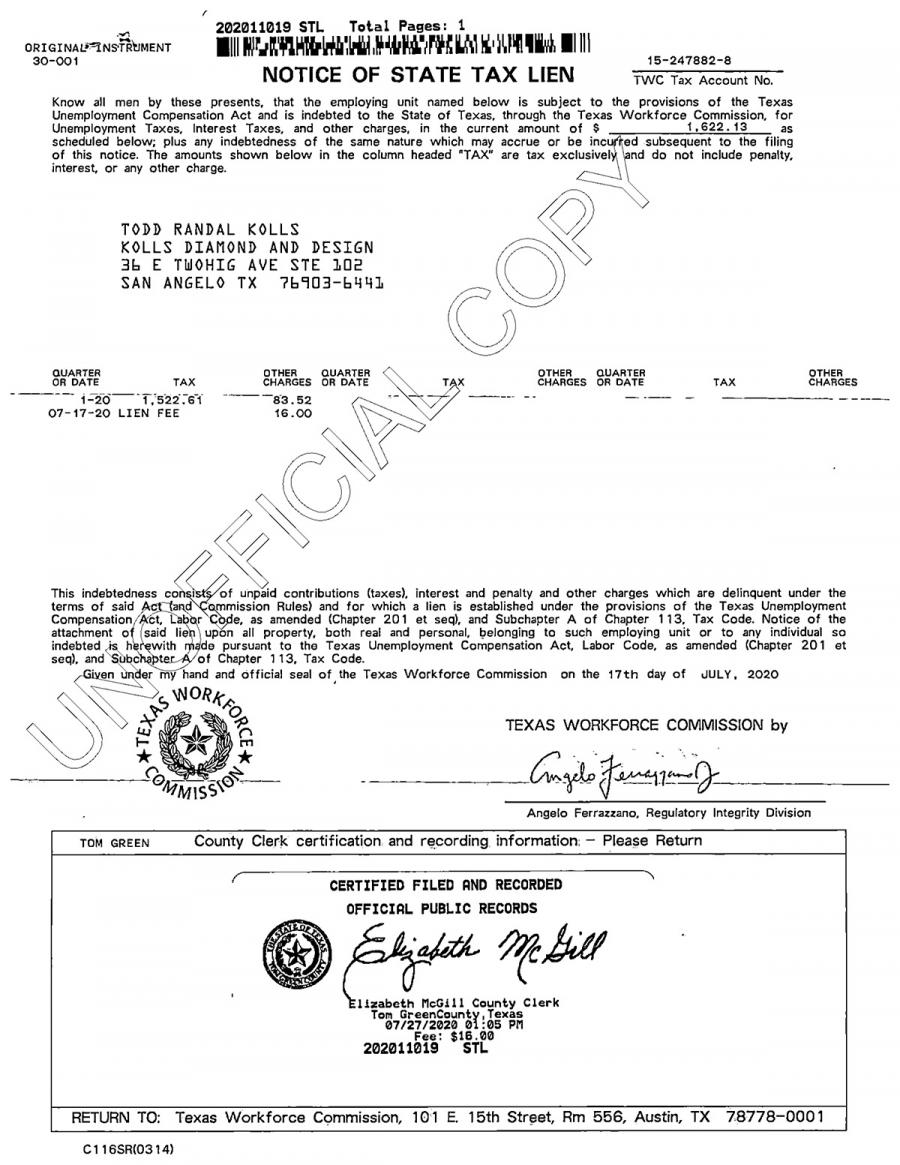

Delinquent Tax Lien Raises Questions About County Judge Candidate

(1) the full amount of tax finalized by filing a. Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows:

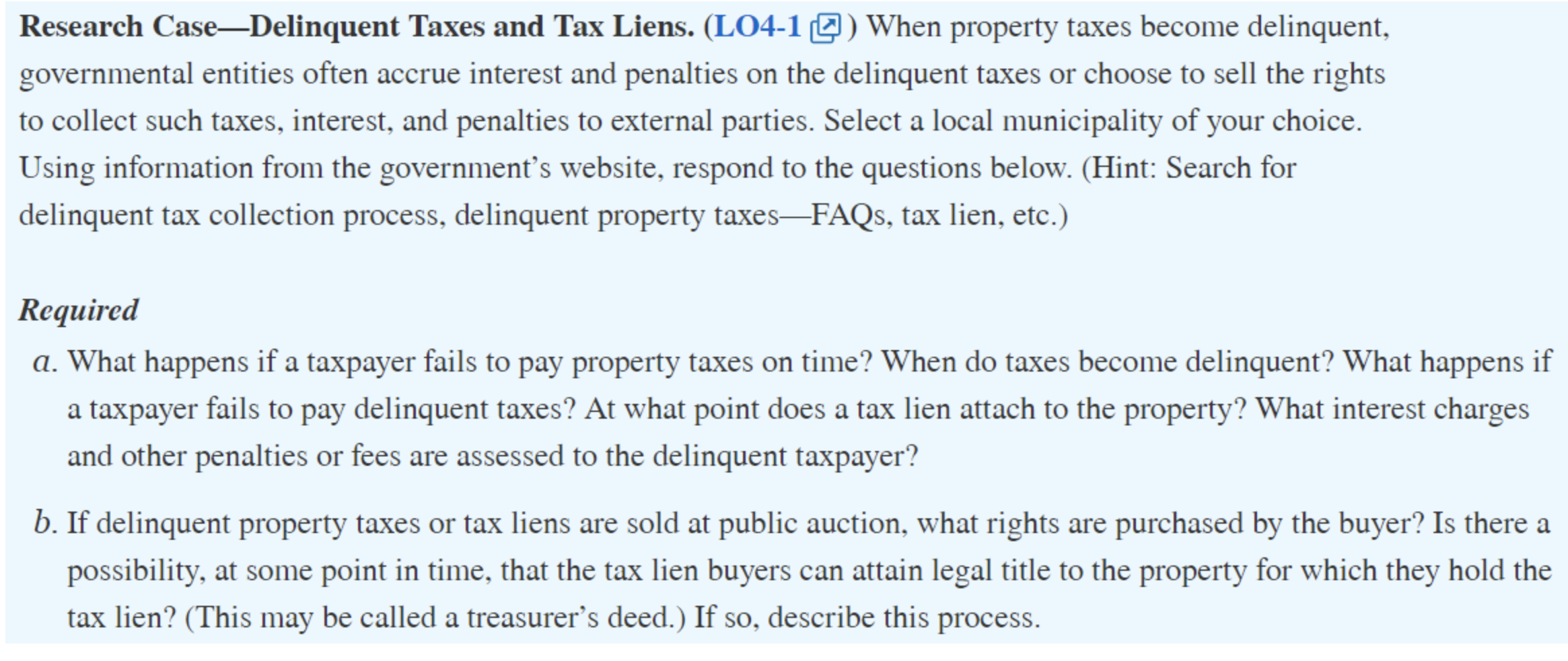

Solved Research Case—Delinquent Taxes and Tax Liens. (L041

Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows: (1) the full amount of tax finalized by filing a.

(1) The Full Amount Of Tax Finalized By Filing A.

Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows: