Denver County Tax Lien Sale

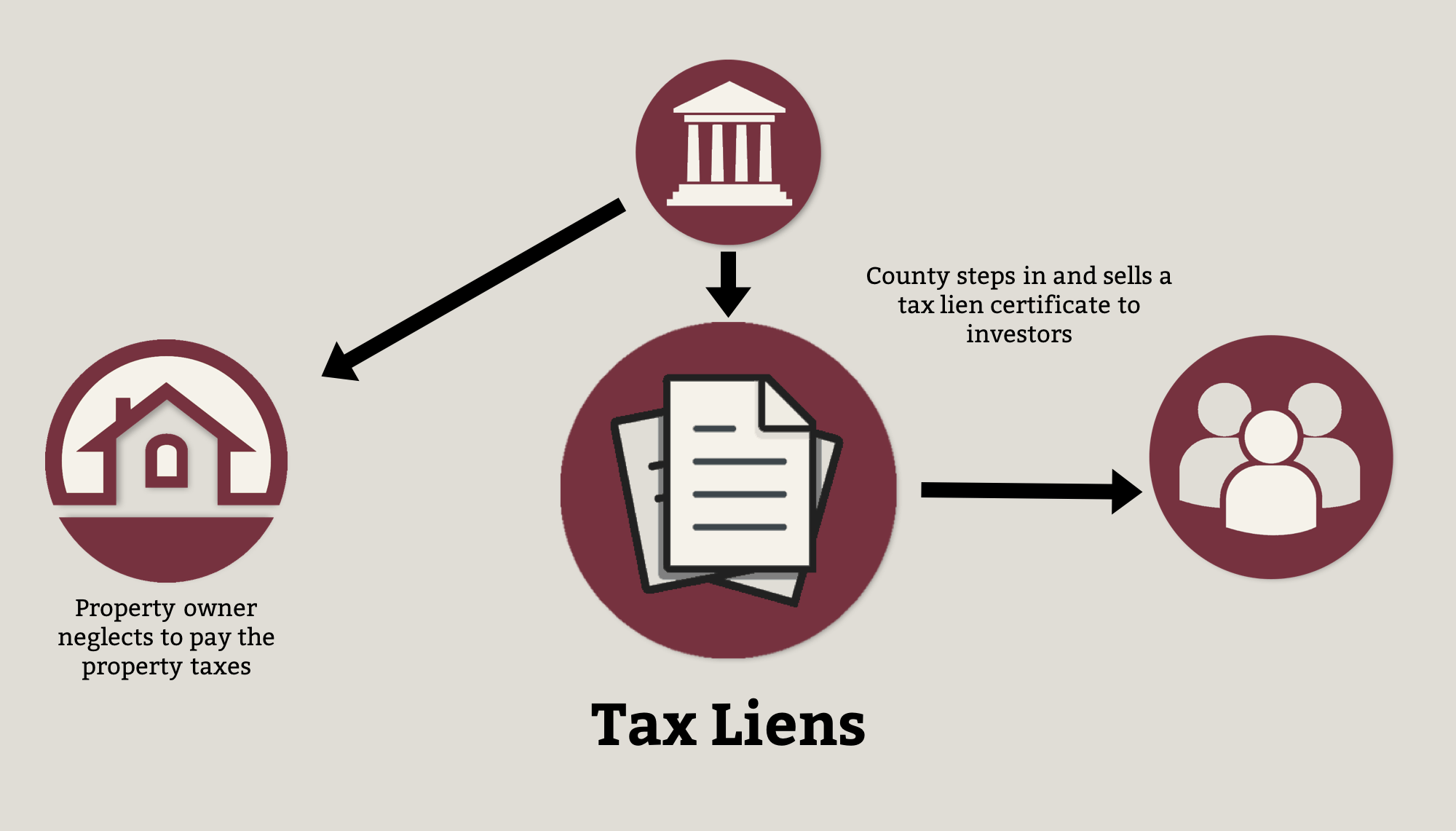

Denver County Tax Lien Sale - Failing to pay your property taxes may ultimately cause you to lose your property. Denver county, co, currently has 3,823 tax liens and 712 other distressed listings available as of january 6. The tax lien public auction is usually held around the first part of november. Focus will then be set to the first menu item. Delinquent taxes are listed and noticed for a. During the month of october or november of each year, the annual tax lien sale is conducted, and additional fees and amounts may be due that. If your taxes are sold at the tax lien sale, you will owe the tax lien face value, redemption interest, redemption fee ($7.00), subsequent year.

During the month of october or november of each year, the annual tax lien sale is conducted, and additional fees and amounts may be due that. Focus will then be set to the first menu item. Delinquent taxes are listed and noticed for a. If your taxes are sold at the tax lien sale, you will owe the tax lien face value, redemption interest, redemption fee ($7.00), subsequent year. Denver county, co, currently has 3,823 tax liens and 712 other distressed listings available as of january 6. The tax lien public auction is usually held around the first part of november. Failing to pay your property taxes may ultimately cause you to lose your property.

Focus will then be set to the first menu item. The tax lien public auction is usually held around the first part of november. If your taxes are sold at the tax lien sale, you will owe the tax lien face value, redemption interest, redemption fee ($7.00), subsequent year. Denver county, co, currently has 3,823 tax liens and 712 other distressed listings available as of january 6. Delinquent taxes are listed and noticed for a. During the month of october or november of each year, the annual tax lien sale is conducted, and additional fees and amounts may be due that. Failing to pay your property taxes may ultimately cause you to lose your property.

Tax Lien Maricopa County Tax Lien Sale

Denver county, co, currently has 3,823 tax liens and 712 other distressed listings available as of january 6. If your taxes are sold at the tax lien sale, you will owe the tax lien face value, redemption interest, redemption fee ($7.00), subsequent year. Delinquent taxes are listed and noticed for a. The tax lien public auction is usually held around.

Mohave County Tax Lien Sale 2024 Dore Nancey

Delinquent taxes are listed and noticed for a. Denver county, co, currently has 3,823 tax liens and 712 other distressed listings available as of january 6. Failing to pay your property taxes may ultimately cause you to lose your property. If your taxes are sold at the tax lien sale, you will owe the tax lien face value, redemption interest,.

Charles County Tax Lien Sale 2024 Bryna Marleah

Denver county, co, currently has 3,823 tax liens and 712 other distressed listings available as of january 6. Delinquent taxes are listed and noticed for a. If your taxes are sold at the tax lien sale, you will owe the tax lien face value, redemption interest, redemption fee ($7.00), subsequent year. The tax lien public auction is usually held around.

Anne Arundel County Tax Lien Certificates prosecution2012

The tax lien public auction is usually held around the first part of november. If your taxes are sold at the tax lien sale, you will owe the tax lien face value, redemption interest, redemption fee ($7.00), subsequent year. Failing to pay your property taxes may ultimately cause you to lose your property. Denver county, co, currently has 3,823 tax.

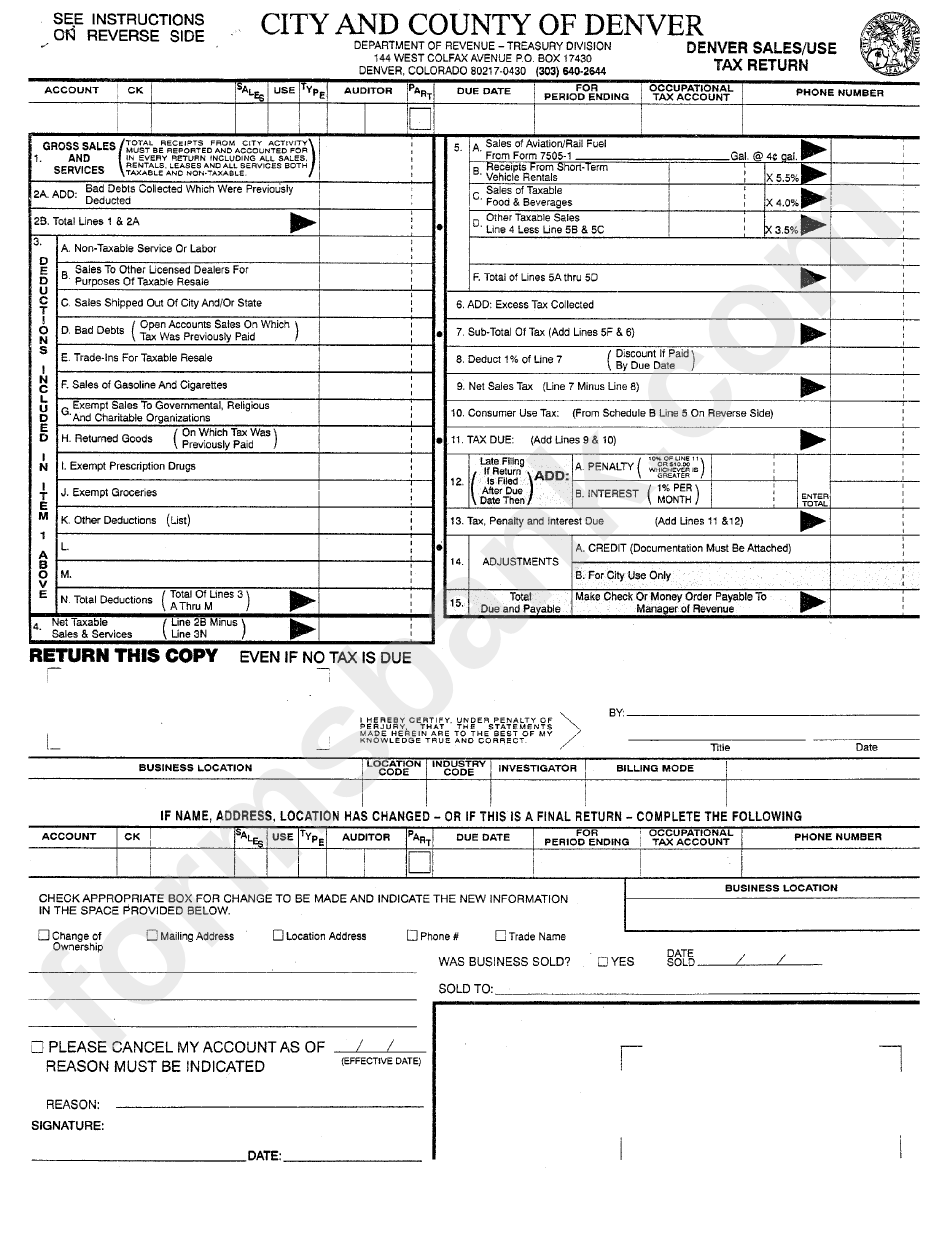

Denver Sales Use Tax Return Form Printable Pdf Download

The tax lien public auction is usually held around the first part of november. Denver county, co, currently has 3,823 tax liens and 712 other distressed listings available as of january 6. Delinquent taxes are listed and noticed for a. During the month of october or november of each year, the annual tax lien sale is conducted, and additional fees.

Suffolk County Tax Lien Sale 2024 Marne Sharona

Denver county, co, currently has 3,823 tax liens and 712 other distressed listings available as of january 6. If your taxes are sold at the tax lien sale, you will owe the tax lien face value, redemption interest, redemption fee ($7.00), subsequent year. Focus will then be set to the first menu item. Delinquent taxes are listed and noticed for.

Mohave County Tax Lien Sale 2024 Dore Nancey

Failing to pay your property taxes may ultimately cause you to lose your property. The tax lien public auction is usually held around the first part of november. If your taxes are sold at the tax lien sale, you will owe the tax lien face value, redemption interest, redemption fee ($7.00), subsequent year. Delinquent taxes are listed and noticed for.

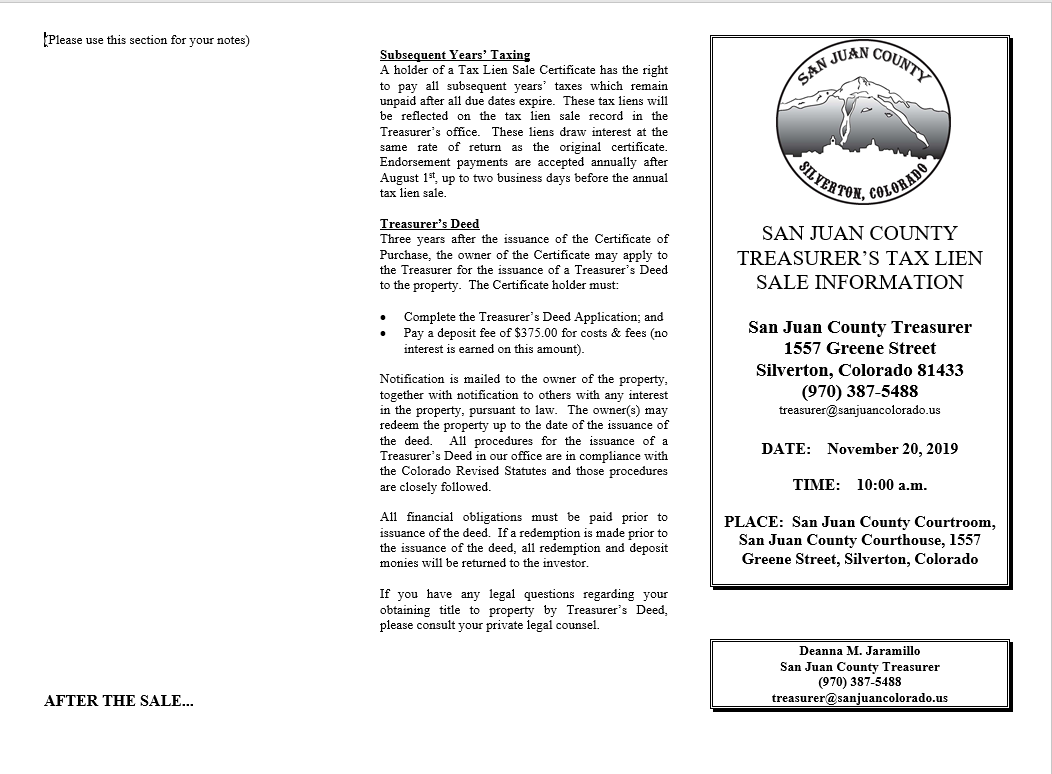

Tax Lien Sale San Juan County

Delinquent taxes are listed and noticed for a. The tax lien public auction is usually held around the first part of november. If your taxes are sold at the tax lien sale, you will owe the tax lien face value, redemption interest, redemption fee ($7.00), subsequent year. Failing to pay your property taxes may ultimately cause you to lose your.

Charles County Tax Lien Sale 2024 Bryna Marleah

If your taxes are sold at the tax lien sale, you will owe the tax lien face value, redemption interest, redemption fee ($7.00), subsequent year. Failing to pay your property taxes may ultimately cause you to lose your property. The tax lien public auction is usually held around the first part of november. During the month of october or november.

Suffolk County Tax Lien Sale 2024 Marne Sharona

The tax lien public auction is usually held around the first part of november. Failing to pay your property taxes may ultimately cause you to lose your property. Focus will then be set to the first menu item. During the month of october or november of each year, the annual tax lien sale is conducted, and additional fees and amounts.

The Tax Lien Public Auction Is Usually Held Around The First Part Of November.

During the month of october or november of each year, the annual tax lien sale is conducted, and additional fees and amounts may be due that. Denver county, co, currently has 3,823 tax liens and 712 other distressed listings available as of january 6. Delinquent taxes are listed and noticed for a. Focus will then be set to the first menu item.

Failing To Pay Your Property Taxes May Ultimately Cause You To Lose Your Property.

If your taxes are sold at the tax lien sale, you will owe the tax lien face value, redemption interest, redemption fee ($7.00), subsequent year.