Director Fee Malaysia

Director Fee Malaysia - In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such payment. Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. The level of remuneration for ned. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph 7.24 of the. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank negara. The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances.

If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such payment. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph. Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph 7.24 of the. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank negara. The level of remuneration for ned. The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which.

Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph 7.24 of the. The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such payment. Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. The level of remuneration for ned. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank negara. In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph.

Is the Director Fee In Singapore Taxable? Learn More

Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph 7.24 of the. The level of remuneration for ned. Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. In malaysia, the payment of directors’ fees and.

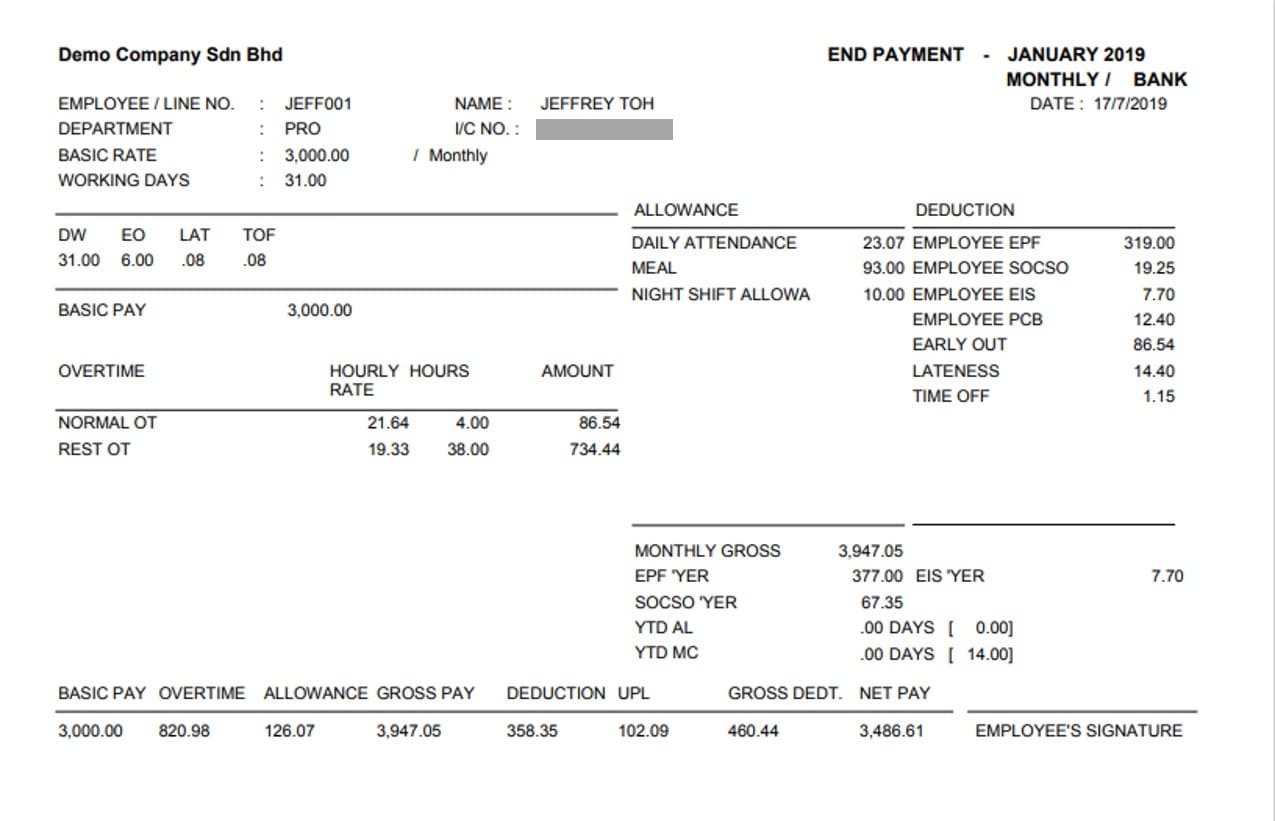

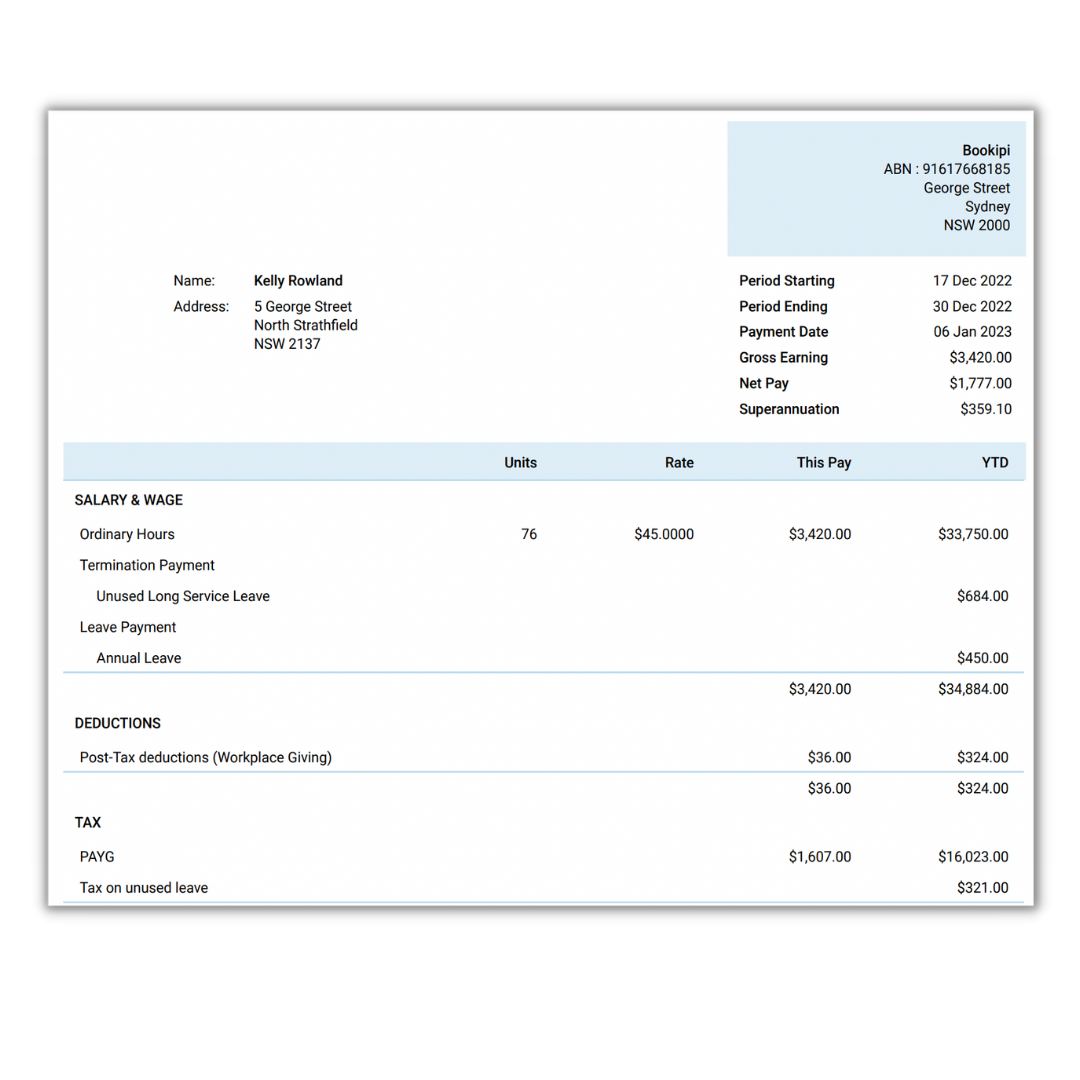

Payslip Template And Employee's Salary Slip In Malaysia, 48 OFF

Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph. The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such.

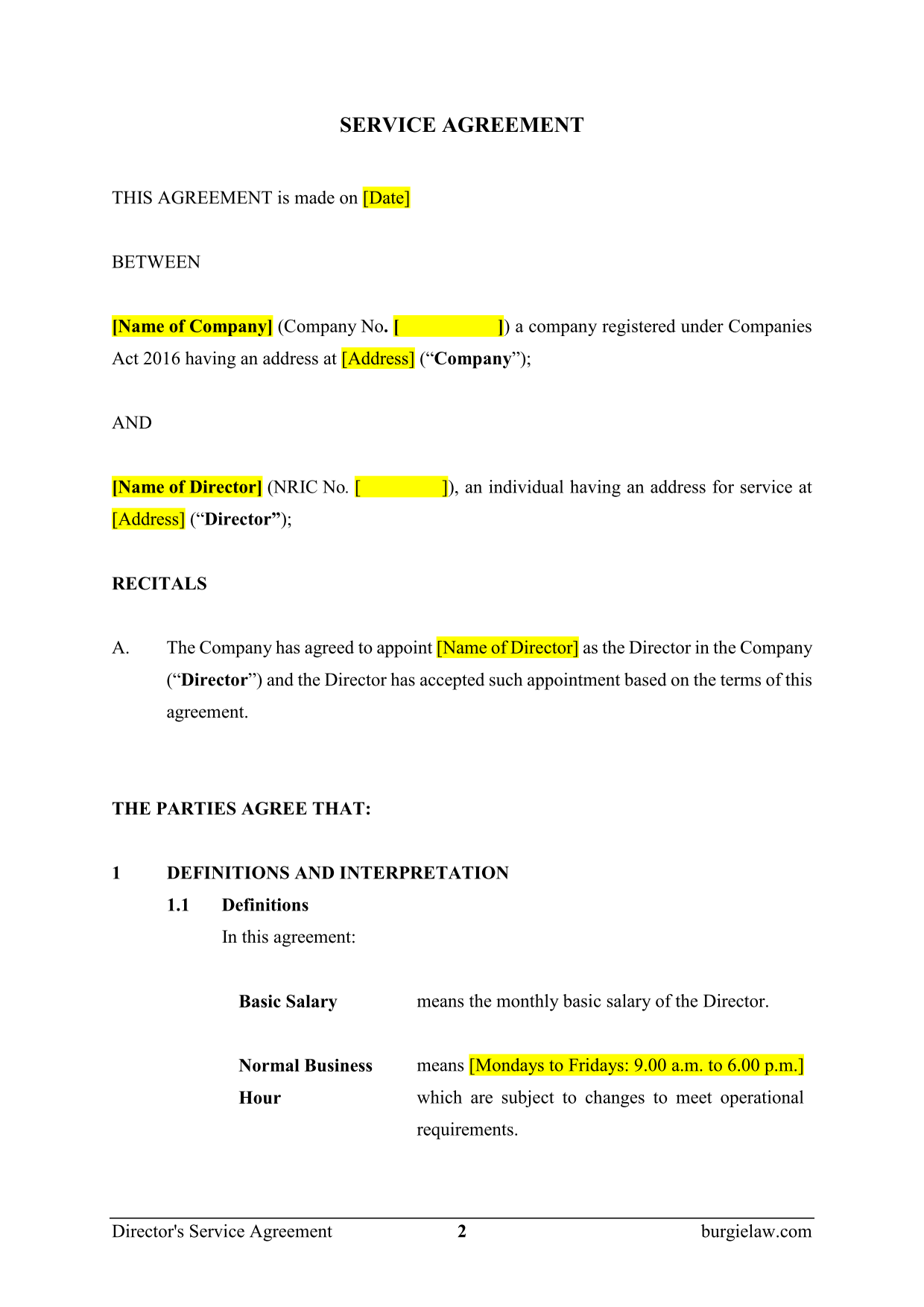

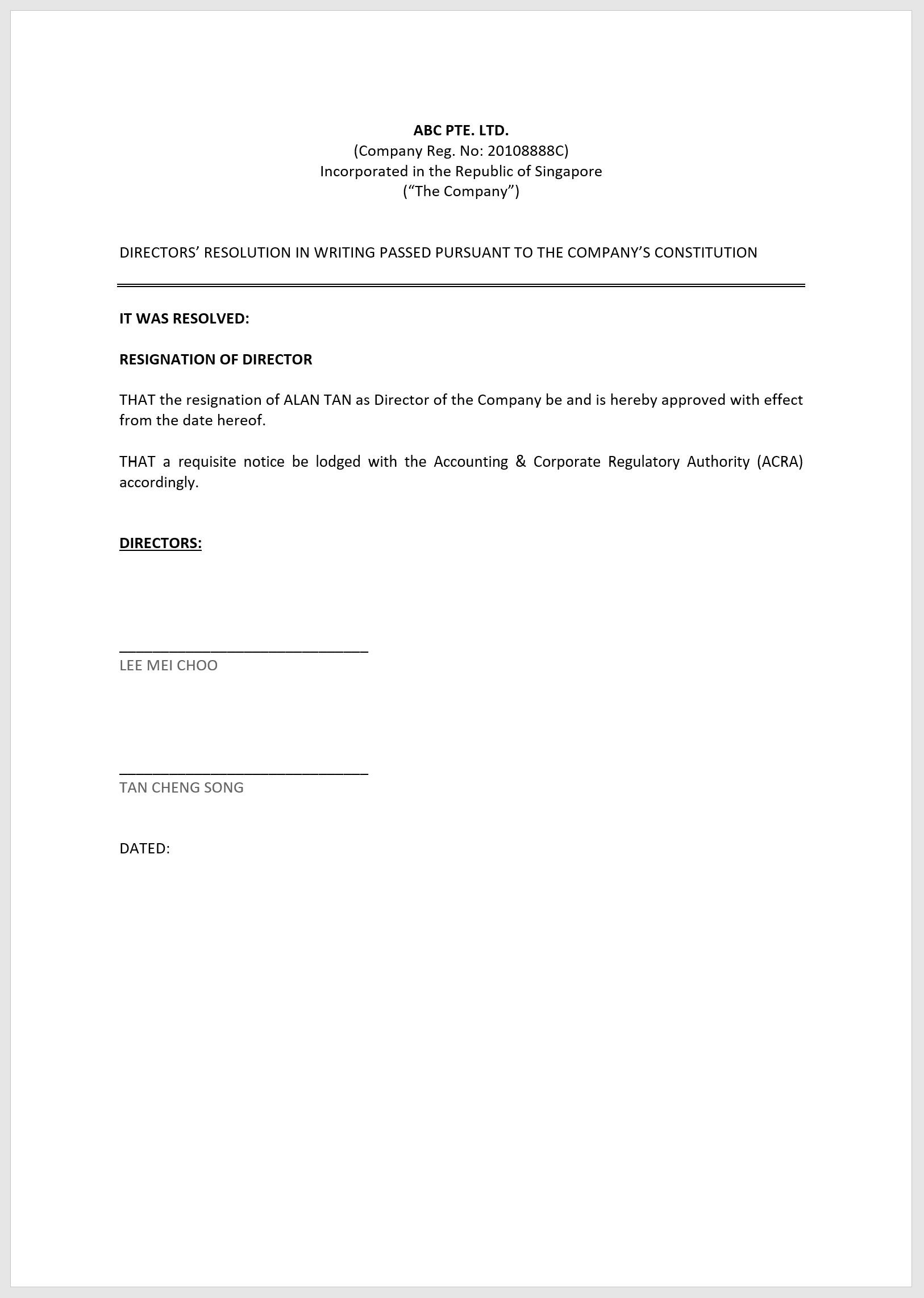

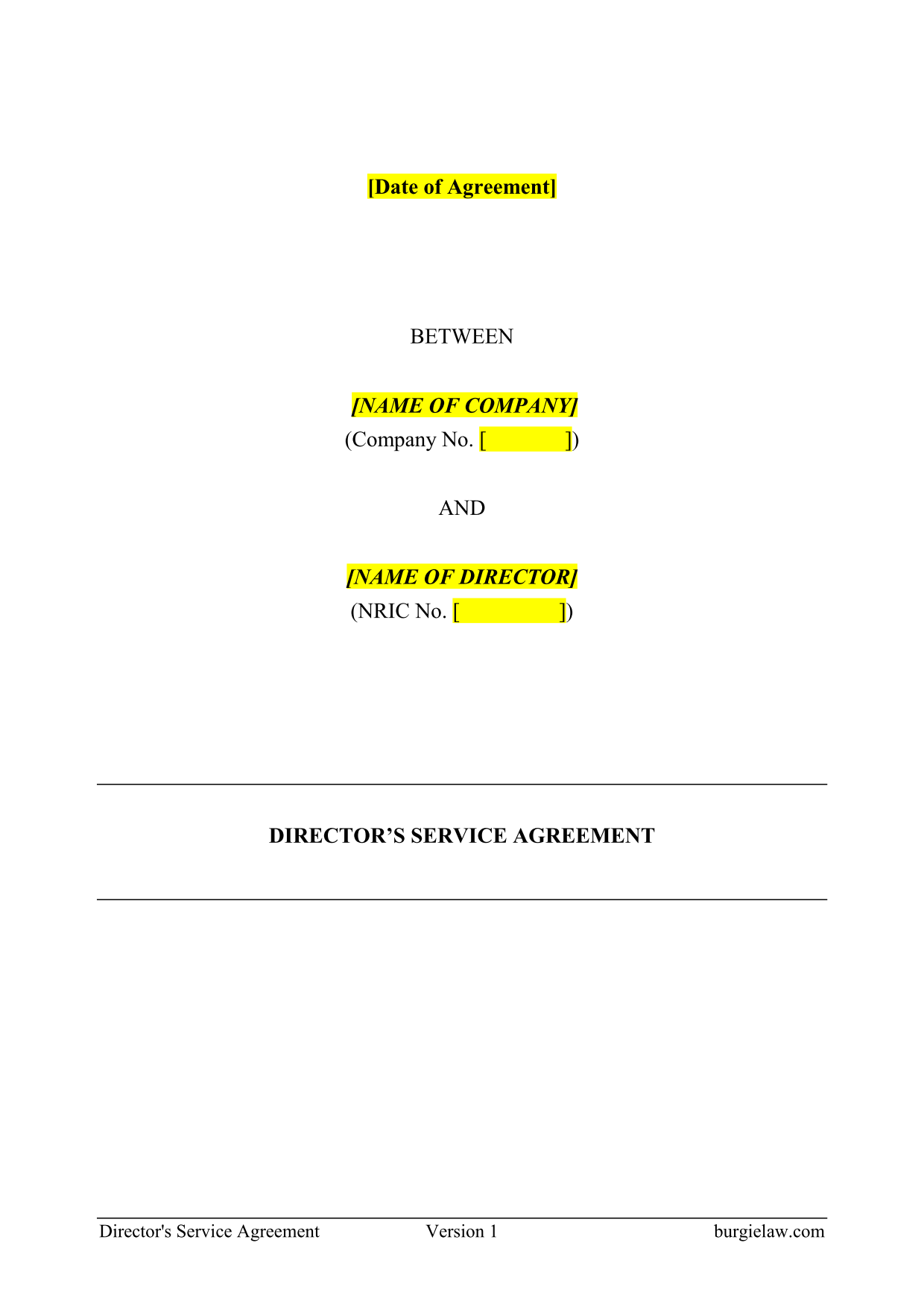

Directors Service Agreement Template

Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. Negara.

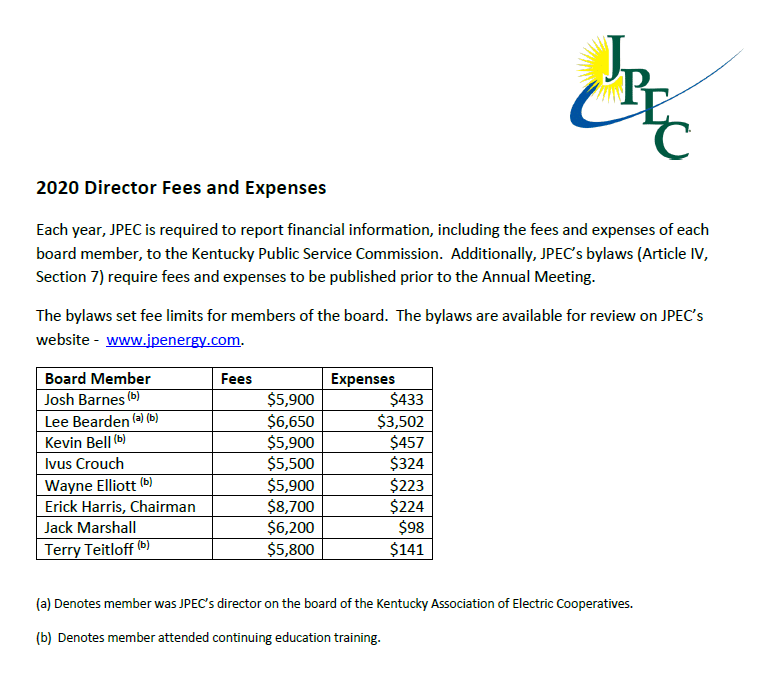

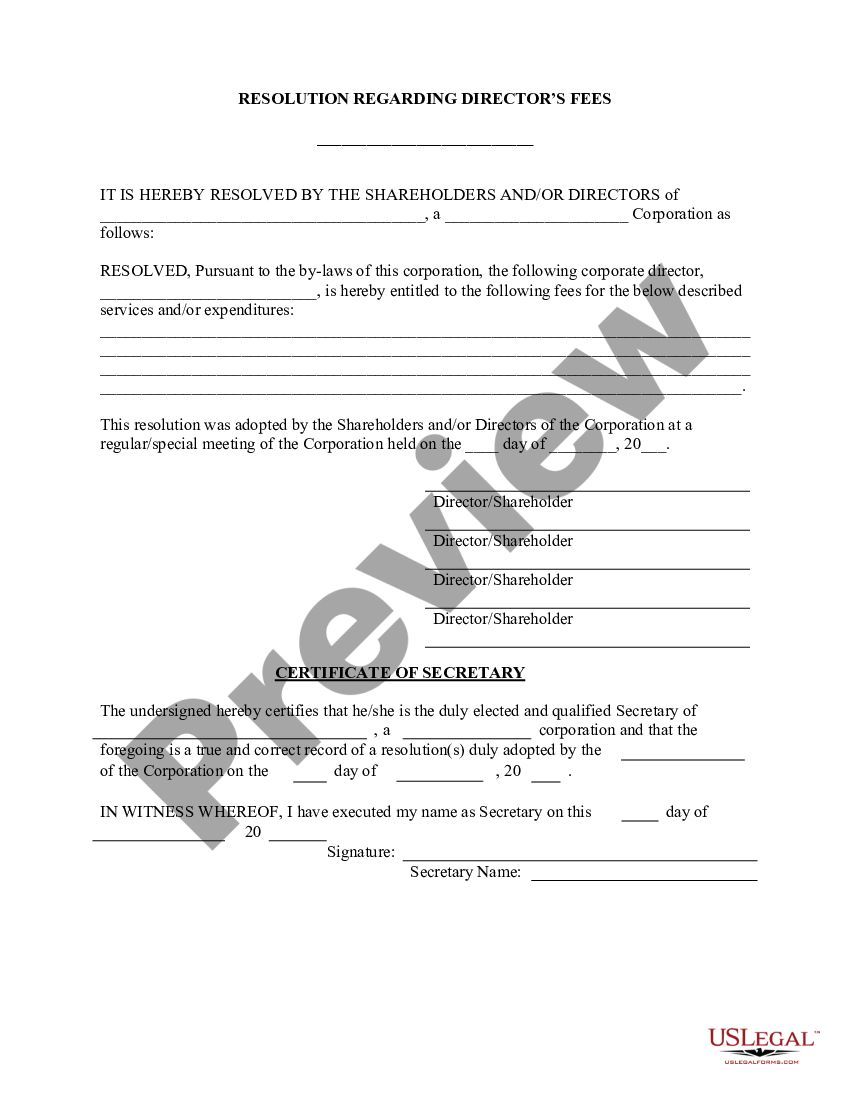

Directors Fees & Expenses Jackson Purchase Energy Cooperative

In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. The level of remuneration for ned. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph 7.24 of the. If a company, whether public or private, intends to pay.

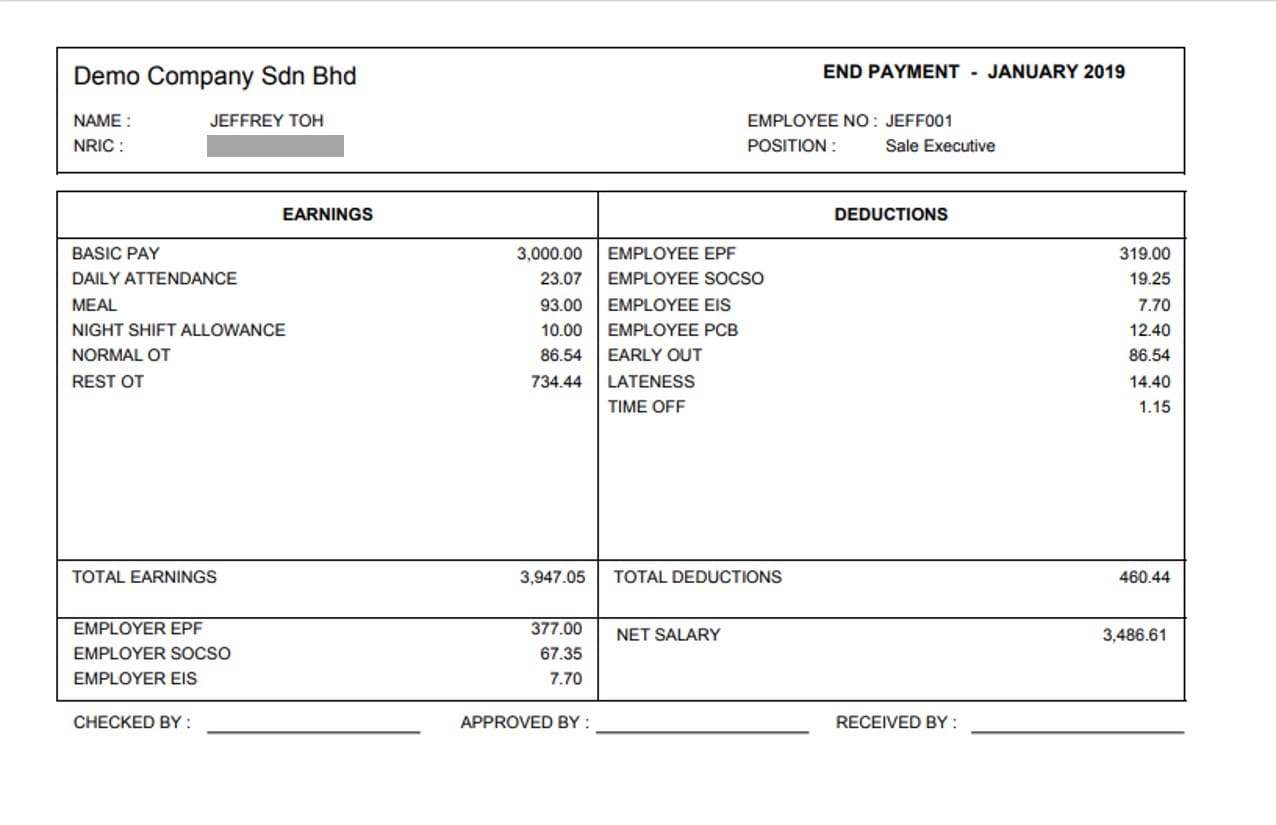

Salary Slip Template Excel Malaysia NBKomputer

Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph 7.24 of the. Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. If a company, whether public or private, intends to pay fees and benefits to.

Payslip Template And Employee's Salary Slip In Malaysia, 59 OFF

In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. The level of remuneration for ned. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank negara. The remuneration of ned is made up of directors’ fees and other.

North Dakota Director's Fees Resolution Form Corporate Resolutions

The level of remuneration for ned. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank negara. Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. Directors’ fees and benefits payable to directors are subject to.

Consultant Fee Schedule Template Fee Structure Bonsai

In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. The level of remuneration for ned. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph. The remuneration of ned is made up of directors’ fees and other benefits.

Resolution Of Board Of Directors Template

Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank negara. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general.

Directors Service Agreement Template

The level of remuneration for ned. In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph 7.24 of the. If a company, whether public or private, intends to pay.

Directors’ Fees And Benefits Payable To Directors Are Subject To Annual Shareholder Approval At A General Meeting, As Provided Under Paragraph.

Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank negara. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph 7.24 of the. The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances.

In Malaysia, The Payment Of Directors’ Fees And Benefits And Directors’ Service Contracts Are Subject To Certain Legal Requirements, Which.

If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such payment. The level of remuneration for ned.