Does Airbnb Issue 1099

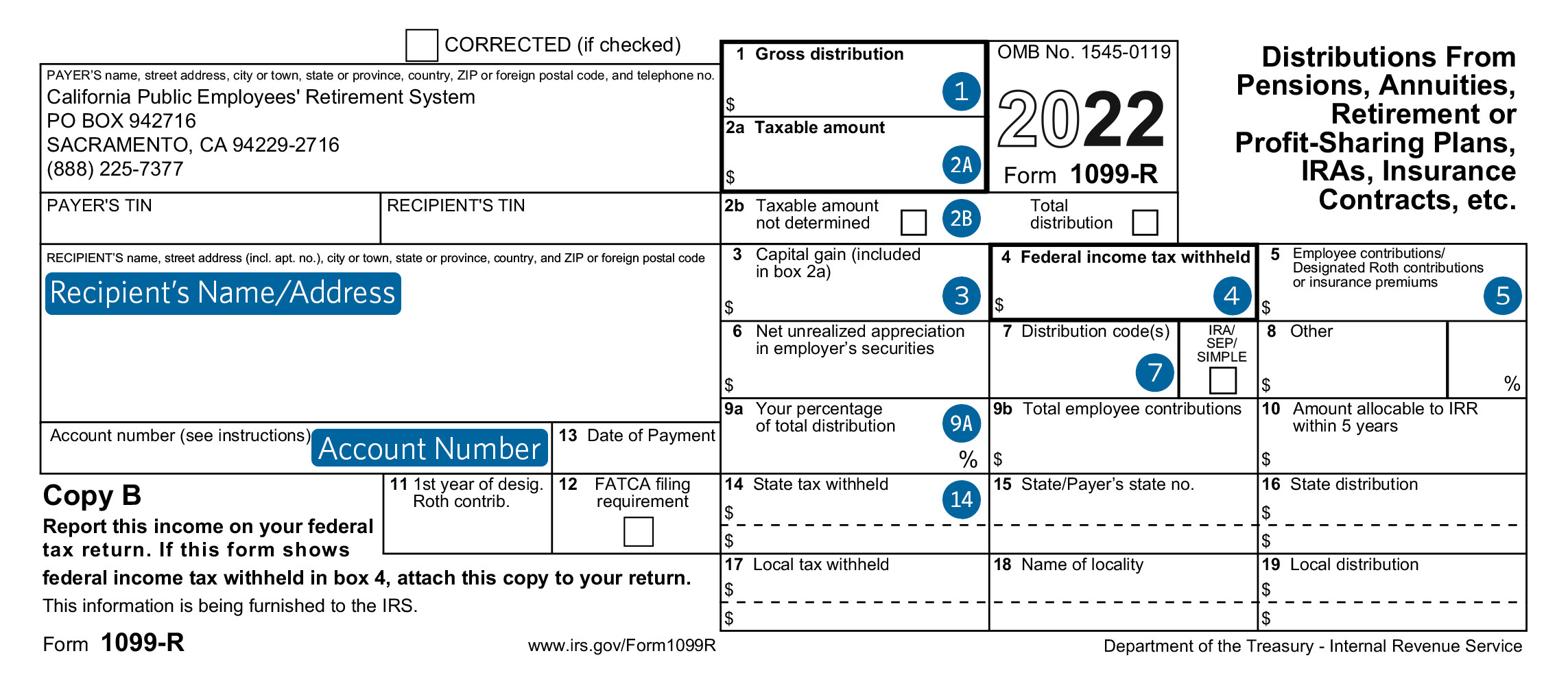

Does Airbnb Issue 1099 - Currently, this threshhold is $20,000 and 200 transactions. Report your income accurately, automate expense. Discover how to report your airbnb 1099 rental business income on your taxes.

Report your income accurately, automate expense. Currently, this threshhold is $20,000 and 200 transactions. Discover how to report your airbnb 1099 rental business income on your taxes.

Discover how to report your airbnb 1099 rental business income on your taxes. Report your income accurately, automate expense. Currently, this threshhold is $20,000 and 200 transactions.

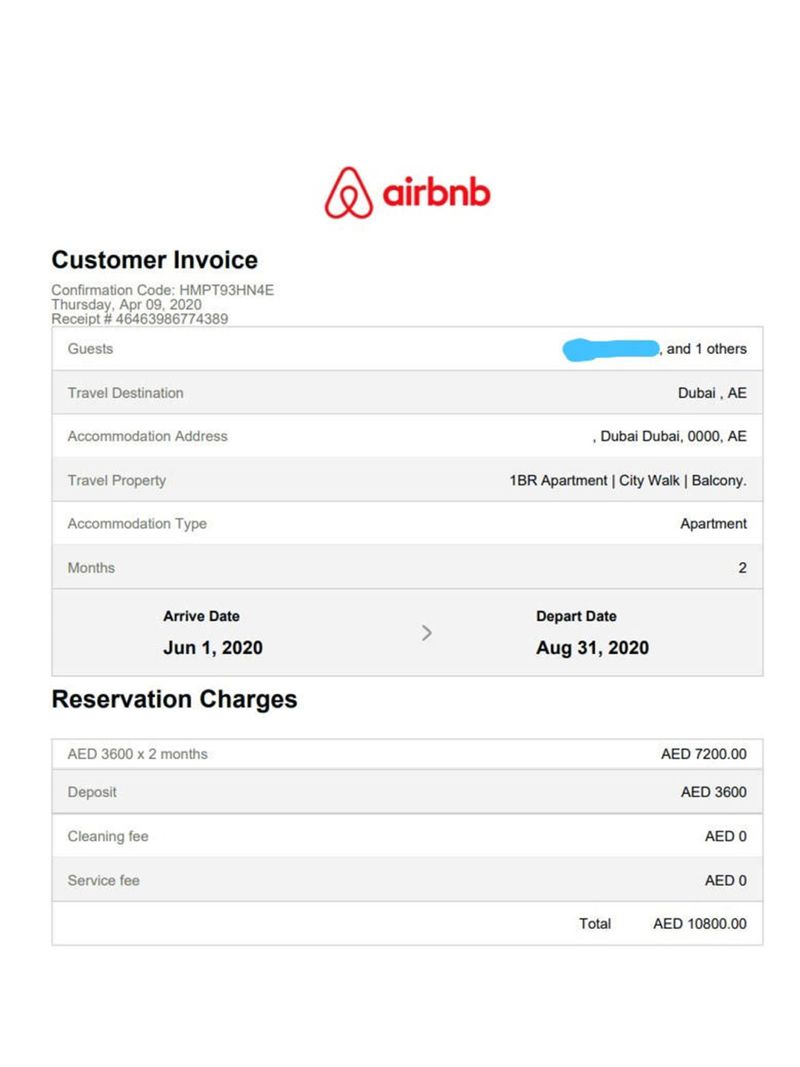

Airbnb Confirmation Email Template

Currently, this threshhold is $20,000 and 200 transactions. Report your income accurately, automate expense. Discover how to report your airbnb 1099 rental business income on your taxes.

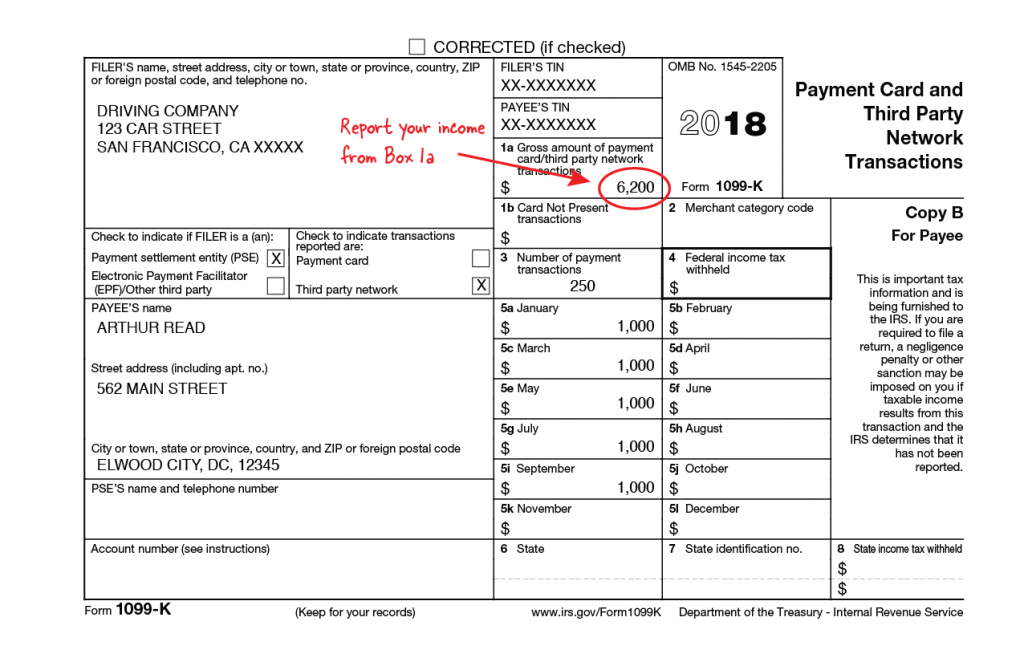

What Is a 1099K? — Stride Blog

Discover how to report your airbnb 1099 rental business income on your taxes. Report your income accurately, automate expense. Currently, this threshhold is $20,000 and 200 transactions.

Airbnb Issues 2024 Megan Sibylle

Currently, this threshhold is $20,000 and 200 transactions. Discover how to report your airbnb 1099 rental business income on your taxes. Report your income accurately, automate expense.

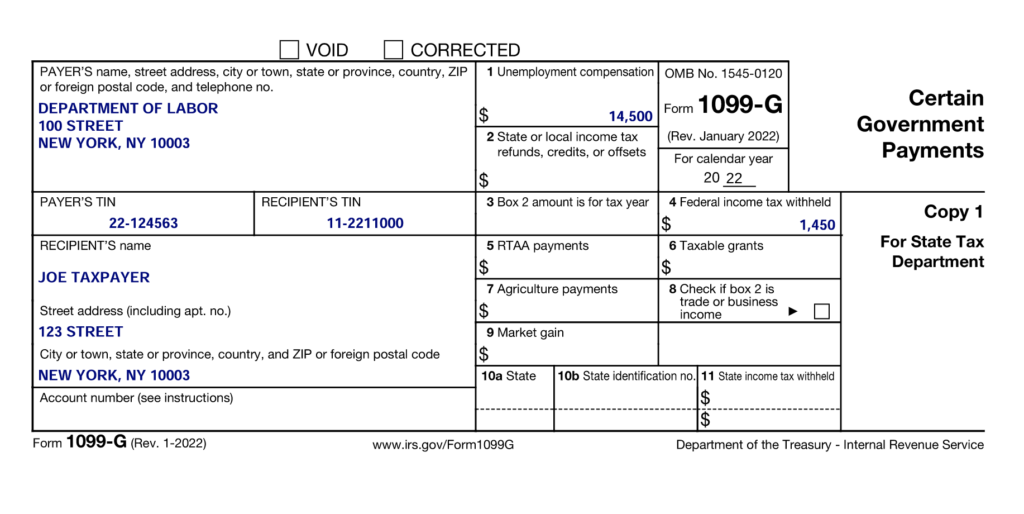

How does a 1099 affect your tax return? Leia aqui How much does a 1099

Discover how to report your airbnb 1099 rental business income on your taxes. Report your income accurately, automate expense. Currently, this threshhold is $20,000 and 200 transactions.

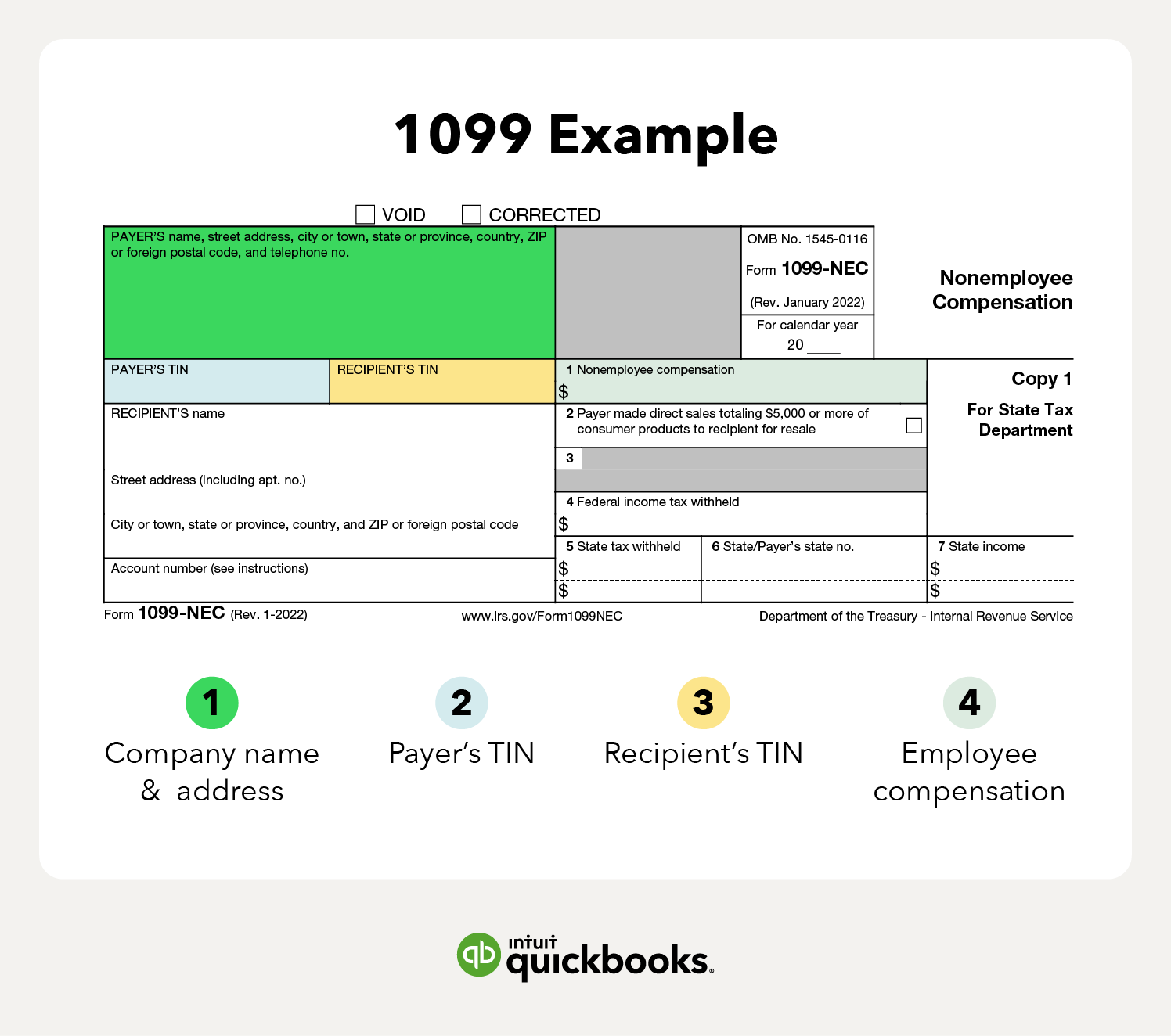

Katie Is Preparing 1099 Tax Forms Which Quickbooks Function Would Be

Currently, this threshhold is $20,000 and 200 transactions. Report your income accurately, automate expense. Discover how to report your airbnb 1099 rental business income on your taxes.

Guide to Working at Airbnb Forage

Discover how to report your airbnb 1099 rental business income on your taxes. Report your income accurately, automate expense. Currently, this threshhold is $20,000 and 200 transactions.

How to file a 1099 form for vendors, contractors, and freelancers

Currently, this threshhold is $20,000 and 200 transactions. Discover how to report your airbnb 1099 rental business income on your taxes. Report your income accurately, automate expense.

How To Get Airbnb Tax 1099 Forms 🔴 YouTube

Currently, this threshhold is $20,000 and 200 transactions. Discover how to report your airbnb 1099 rental business income on your taxes. Report your income accurately, automate expense.

Airbnb’s New Listing Verification Process Favors Pro Hosts

Report your income accurately, automate expense. Currently, this threshhold is $20,000 and 200 transactions. Discover how to report your airbnb 1099 rental business income on your taxes.

Report Your Income Accurately, Automate Expense.

Currently, this threshhold is $20,000 and 200 transactions. Discover how to report your airbnb 1099 rental business income on your taxes.