Does Airbnb Report Income To Irs

Does Airbnb Report Income To Irs - Learn how airbnb collects and reports your tax information to the irs and/or your state if you meet the reporting requirements. Inasmuch as the irs does not show any income or payments by airbnb for your property, air does not report by each owner and.

Inasmuch as the irs does not show any income or payments by airbnb for your property, air does not report by each owner and. Learn how airbnb collects and reports your tax information to the irs and/or your state if you meet the reporting requirements.

Inasmuch as the irs does not show any income or payments by airbnb for your property, air does not report by each owner and. Learn how airbnb collects and reports your tax information to the irs and/or your state if you meet the reporting requirements.

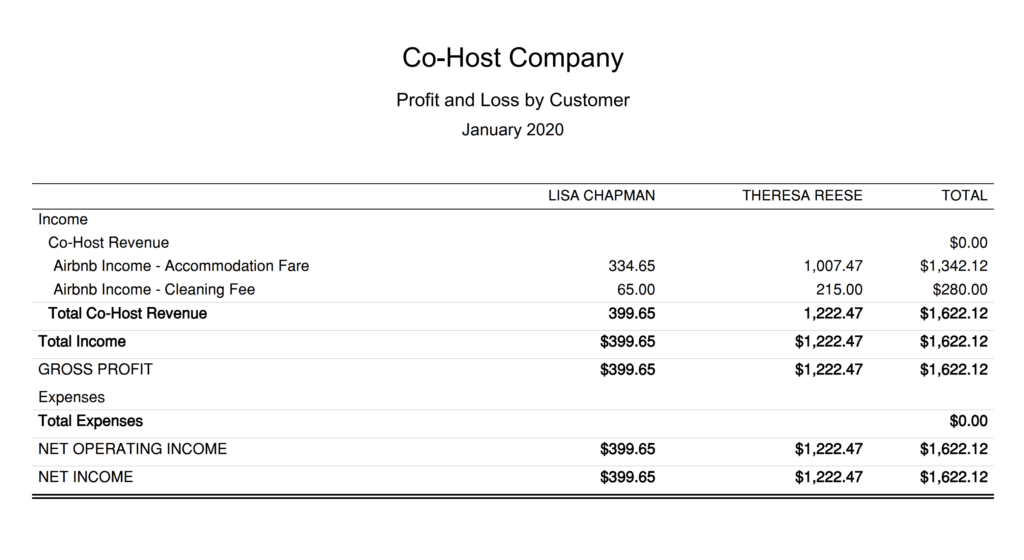

Airbnb CoHost An Accounting Guide for QuickBooks

Learn how airbnb collects and reports your tax information to the irs and/or your state if you meet the reporting requirements. Inasmuch as the irs does not show any income or payments by airbnb for your property, air does not report by each owner and.

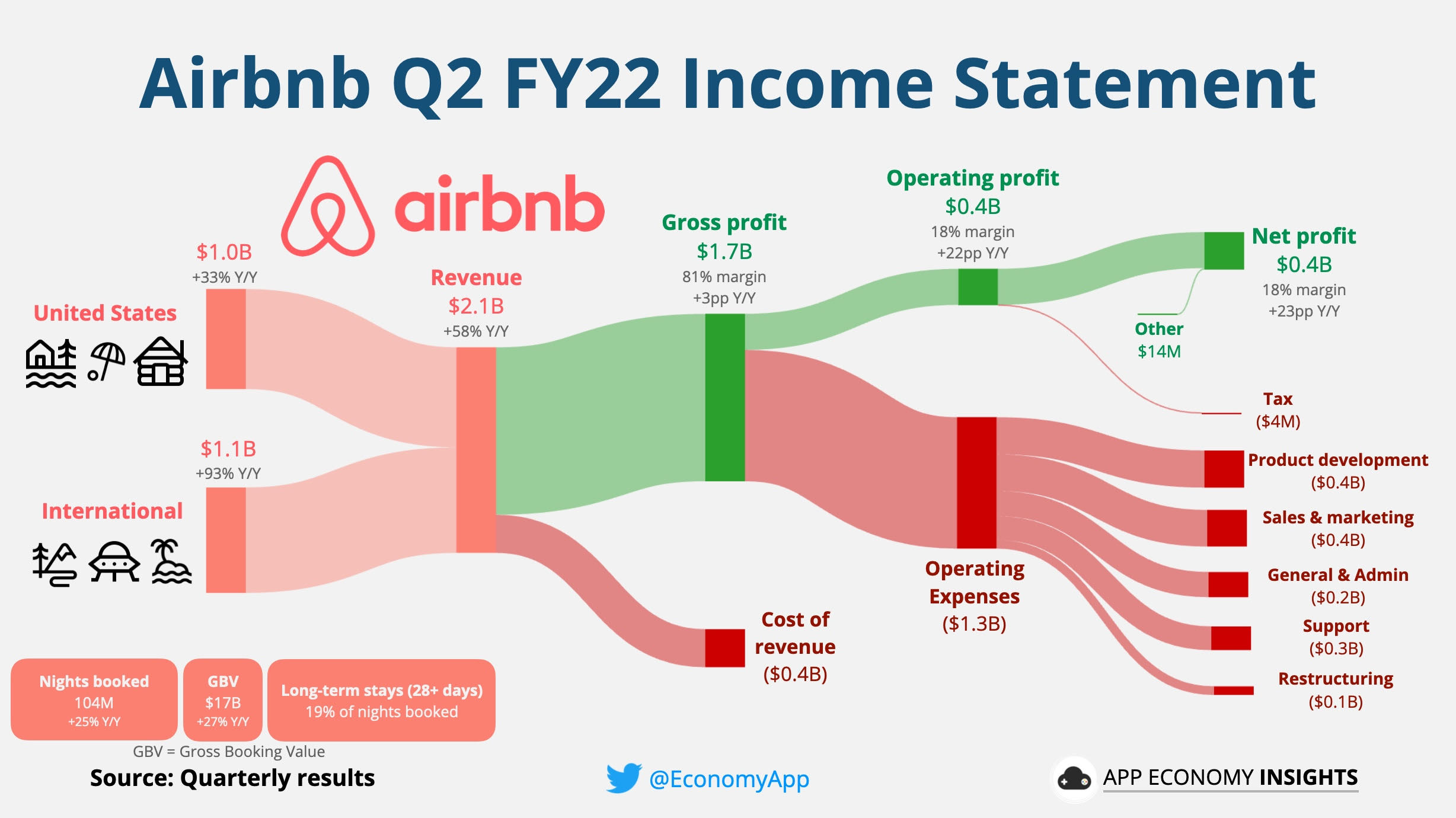

[Technopreneurship] Case Study Airbnb Business Model in 2022

Inasmuch as the irs does not show any income or payments by airbnb for your property, air does not report by each owner and. Learn how airbnb collects and reports your tax information to the irs and/or your state if you meet the reporting requirements.

App Economy Insights on Twitter "BertTravels Yes, this is the

Learn how airbnb collects and reports your tax information to the irs and/or your state if you meet the reporting requirements. Inasmuch as the irs does not show any income or payments by airbnb for your property, air does not report by each owner and.

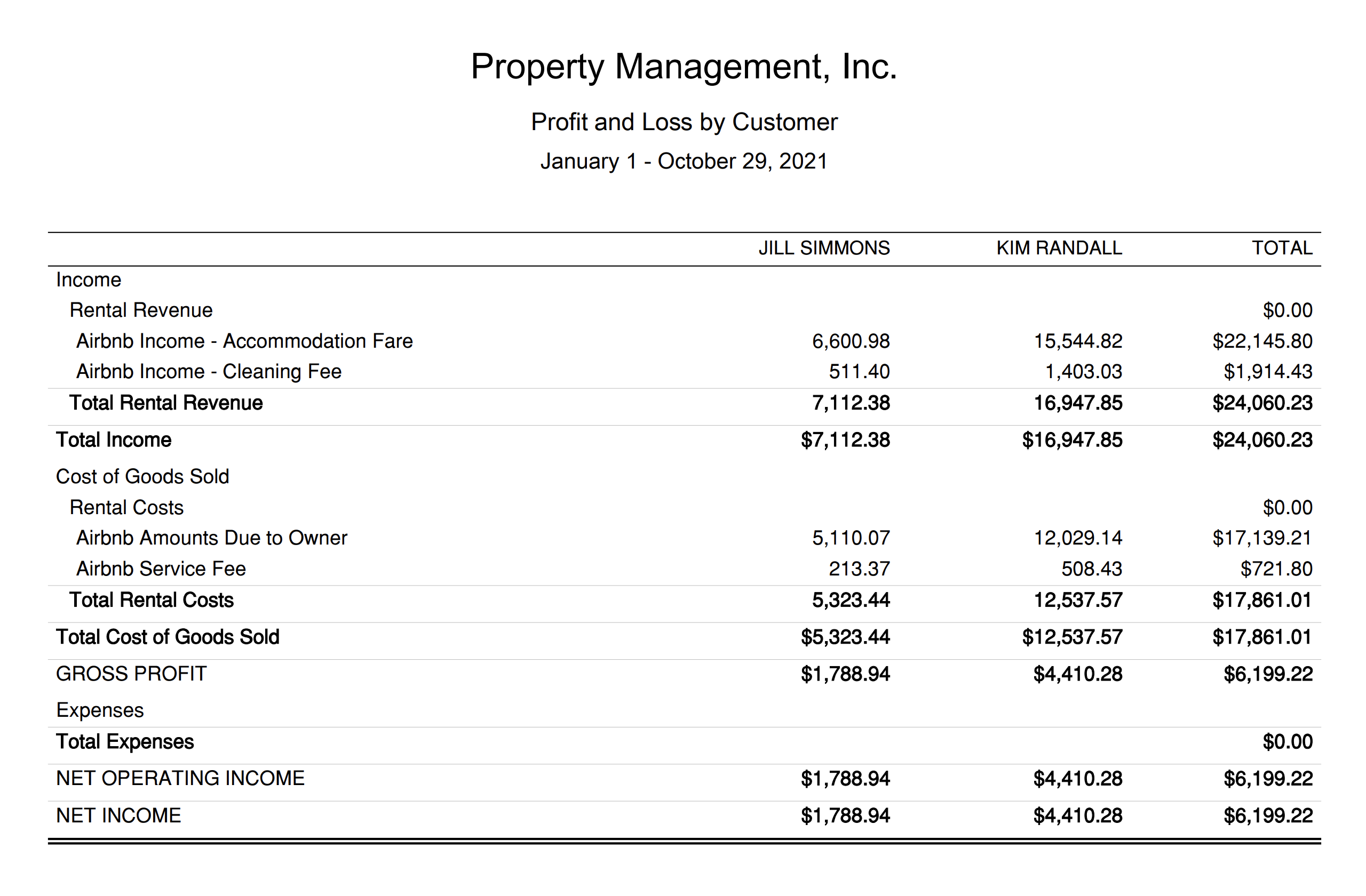

Airbnb Property Management Accounting using QuickBooks

Learn how airbnb collects and reports your tax information to the irs and/or your state if you meet the reporting requirements. Inasmuch as the irs does not show any income or payments by airbnb for your property, air does not report by each owner and.

Vincere Tax Airbnb and IRS Classification Business or Rental?

Inasmuch as the irs does not show any income or payments by airbnb for your property, air does not report by each owner and. Learn how airbnb collects and reports your tax information to the irs and/or your state if you meet the reporting requirements.

Guide to Working at Airbnb Forage

Learn how airbnb collects and reports your tax information to the irs and/or your state if you meet the reporting requirements. Inasmuch as the irs does not show any income or payments by airbnb for your property, air does not report by each owner and.

Airbnb and Rental Statement Tracker Rental Property and

Inasmuch as the irs does not show any income or payments by airbnb for your property, air does not report by each owner and. Learn how airbnb collects and reports your tax information to the irs and/or your state if you meet the reporting requirements.

Report Airbnb Posted A Net Loss In 2019 Amid Rising Costs

Inasmuch as the irs does not show any income or payments by airbnb for your property, air does not report by each owner and. Learn how airbnb collects and reports your tax information to the irs and/or your state if you meet the reporting requirements.

Vincere Tax Airbnb and IRS Classification Business or Rental?

Learn how airbnb collects and reports your tax information to the irs and/or your state if you meet the reporting requirements. Inasmuch as the irs does not show any income or payments by airbnb for your property, air does not report by each owner and.

Vincere Tax How to Report Airbnb on Your Tax Return A Stepby

Inasmuch as the irs does not show any income or payments by airbnb for your property, air does not report by each owner and. Learn how airbnb collects and reports your tax information to the irs and/or your state if you meet the reporting requirements.

Learn How Airbnb Collects And Reports Your Tax Information To The Irs And/Or Your State If You Meet The Reporting Requirements.

Inasmuch as the irs does not show any income or payments by airbnb for your property, air does not report by each owner and.

![[Technopreneurship] Case Study Airbnb Business Model in 2022](https://i.pinimg.com/originals/72/12/34/721234700f481c2ef1b97a83ea9768cb.png)

-p-1080.png)