Does Paying Property Tax Give Ownership In Michigan

Does Paying Property Tax Give Ownership In Michigan - The owner pays property taxes in 2021 based on $80,000.00 multiplied by the local millage rate. The sale “uncaps” the taxable value. So, to answer the initial question, paying property tax in michigan does not automatically confer ownership. In michigan, the taxable value can only increase by. The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. Michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property, including the beneficial use of. In michigan, property taxes are handled by each town or city. In accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value of the. Individual properties will have their property taxes evaluated by the municipality. Property tax uncapping occurs as a result of a change in ownership of a property.

The sale “uncaps” the taxable value. The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. The owner pays property taxes in 2021 based on $80,000.00 multiplied by the local millage rate. Property tax uncapping occurs as a result of a change in ownership of a property. In accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value of the. In michigan, the taxable value can only increase by. So, to answer the initial question, paying property tax in michigan does not automatically confer ownership. In michigan, property taxes are handled by each town or city. Individual properties will have their property taxes evaluated by the municipality. Michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property, including the beneficial use of.

So, to answer the initial question, paying property tax in michigan does not automatically confer ownership. Michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property, including the beneficial use of. The sale “uncaps” the taxable value. The owner pays property taxes in 2021 based on $80,000.00 multiplied by the local millage rate. Property tax uncapping occurs as a result of a change in ownership of a property. In michigan, property taxes are handled by each town or city. The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. In michigan, the taxable value can only increase by. Individual properties will have their property taxes evaluated by the municipality. In accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value of the.

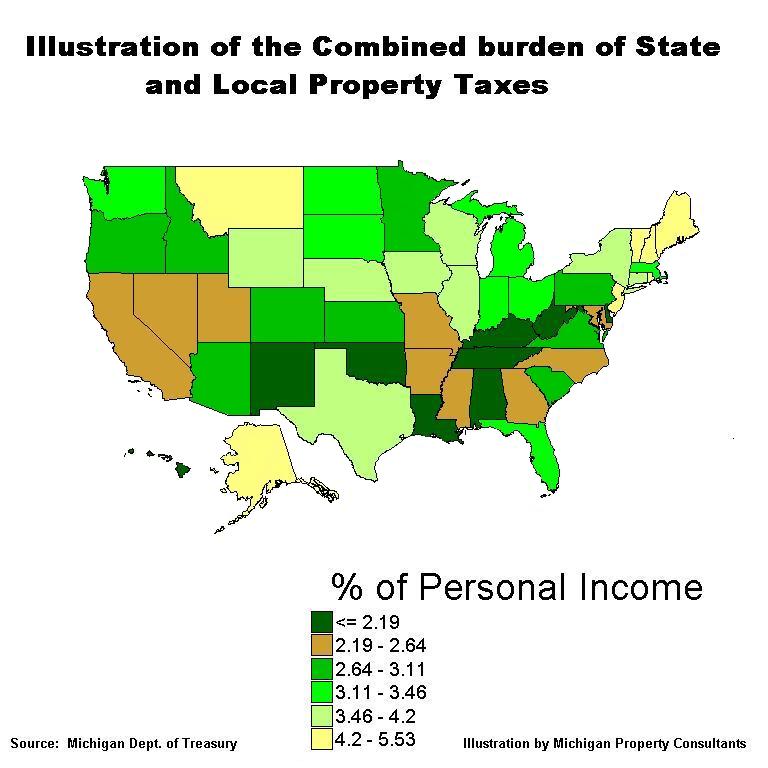

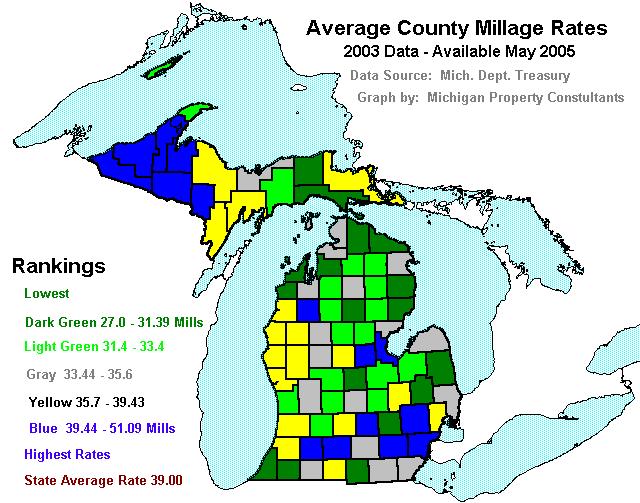

Michigan SEV Values, Tax Burdens and other Charts, Maps and Statistics

Individual properties will have their property taxes evaluated by the municipality. In michigan, property taxes are handled by each town or city. The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. In michigan, the taxable value can only increase by. In accordance with the michigan constitution as amended by proposal a.

Michigan Property Tax

The sale “uncaps” the taxable value. Property tax uncapping occurs as a result of a change in ownership of a property. The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. In michigan, the taxable value can only increase by. So, to answer the initial question, paying property tax in michigan does.

Does Paying Property Tax Give Ownership In Florida? Eye And Pen

Property tax uncapping occurs as a result of a change in ownership of a property. Michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property, including the beneficial use of. In accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable.

17++ Does paying property tax give ownership in india information

In michigan, property taxes are handled by each town or city. In accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value of the. The owner pays property taxes in 2021 based on $80,000.00 multiplied by the local millage rate. Michigan statute defines “transfer of ownership” generally as the.

Does Paying Property Tax Give Ownership? ThinkGlink

In michigan, the taxable value can only increase by. Individual properties will have their property taxes evaluated by the municipality. The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. In accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value.

Does Paying Property Tax Give Ownership? ThinkGlink

Individual properties will have their property taxes evaluated by the municipality. The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. In accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value of the. The sale “uncaps” the taxable value. Michigan.

Michigan SEV Values, Tax Burdens and other Charts, Maps and Statistics

Michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property, including the beneficial use of. Individual properties will have their property taxes evaluated by the municipality. So, to answer the initial question, paying property tax in michigan does not automatically confer ownership. The straightforward answer to whether paying someone else's property.

Does Paying Property Tax Give Ownership? ThinkGlink

In michigan, the taxable value can only increase by. The sale “uncaps” the taxable value. Michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property, including the beneficial use of. Property tax uncapping occurs as a result of a change in ownership of a property. The straightforward answer to whether paying.

Does Paying Property Tax Give Ownership? ThinkGlink

In michigan, property taxes are handled by each town or city. The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. In michigan, the taxable value can only increase by. The owner pays property taxes in 2021 based on $80,000.00 multiplied by the local millage rate. Michigan statute defines “transfer of ownership”.

Does Paying Property Tax Give Ownership? ThinkGlink

The owner pays property taxes in 2021 based on $80,000.00 multiplied by the local millage rate. The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. Property tax uncapping occurs as a result of a change in ownership of a property. Michigan statute defines “transfer of ownership” generally as the conveyance of.

In Michigan, Property Taxes Are Handled By Each Town Or City.

The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. Property tax uncapping occurs as a result of a change in ownership of a property. The owner pays property taxes in 2021 based on $80,000.00 multiplied by the local millage rate. In michigan, the taxable value can only increase by.

Individual Properties Will Have Their Property Taxes Evaluated By The Municipality.

The sale “uncaps” the taxable value. In accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value of the. So, to answer the initial question, paying property tax in michigan does not automatically confer ownership. Michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property, including the beneficial use of.