Does Shopify Report Sales Tax To States

Does Shopify Report Sales Tax To States - Shopify does not charge you, the merchant, for sales tax because we do not remit sales tax on your behalf. After $100,000, a 0.35% calculation fee (0.25% for shopify plus. Does shopify report sales tax to states? Unfortunately, shopify doesn’t report sales tax to states on your behalf. Does shopify report sales tax to states? No, shopify does not report sales tax to states automatically. Shopify tax is free on your first $100,000 of us sales each calendar year. As a merchant, it’s your responsibility to ensure that you’re. Unlike marketplaces such as amazon or etsy, ecommerce platforms including. If you are liable to pay.

No, shopify does not report sales tax to states automatically. Unfortunately, shopify doesn’t report sales tax to states on your behalf. If you are liable to pay. Does shopify report sales tax to states? Does shopify report sales tax to states? After $100,000, a 0.35% calculation fee (0.25% for shopify plus. Unlike marketplaces such as amazon or etsy, ecommerce platforms including. As a merchant, it’s your responsibility to ensure that you’re. Shopify does not charge you, the merchant, for sales tax because we do not remit sales tax on your behalf. Because you've already calculated your county level gross sales (which should be all the sales you did across all the.

As a merchant, it’s your responsibility to ensure that you’re. If you are liable to pay. Does shopify report sales tax to states? Does shopify report sales tax to states? Unlike marketplaces such as amazon or etsy, ecommerce platforms including. No, shopify does not report sales tax to states automatically. Unfortunately, shopify doesn’t report sales tax to states on your behalf. Because you've already calculated your county level gross sales (which should be all the sales you did across all the. Shopify tax is free on your first $100,000 of us sales each calendar year. After $100,000, a 0.35% calculation fee (0.25% for shopify plus.

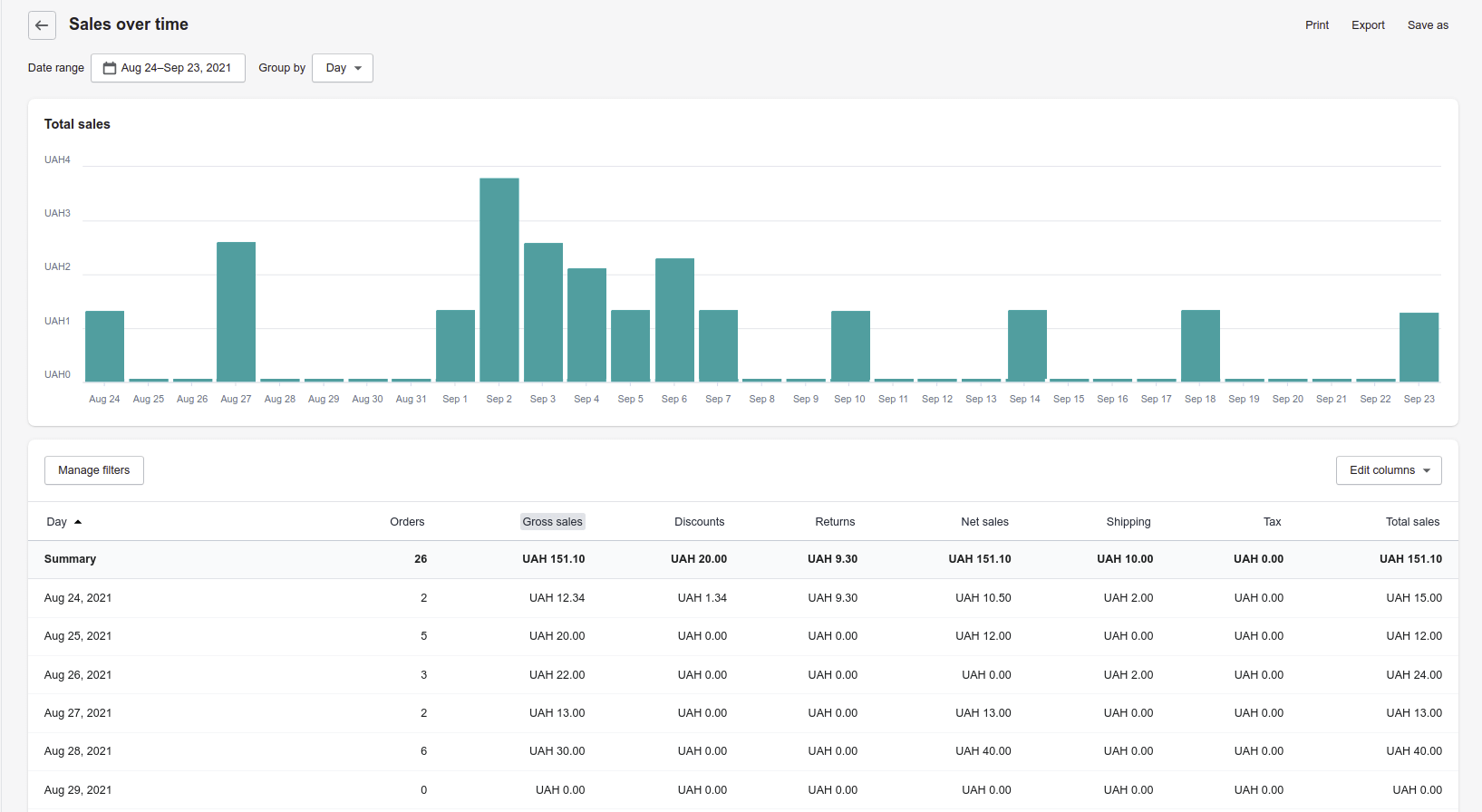

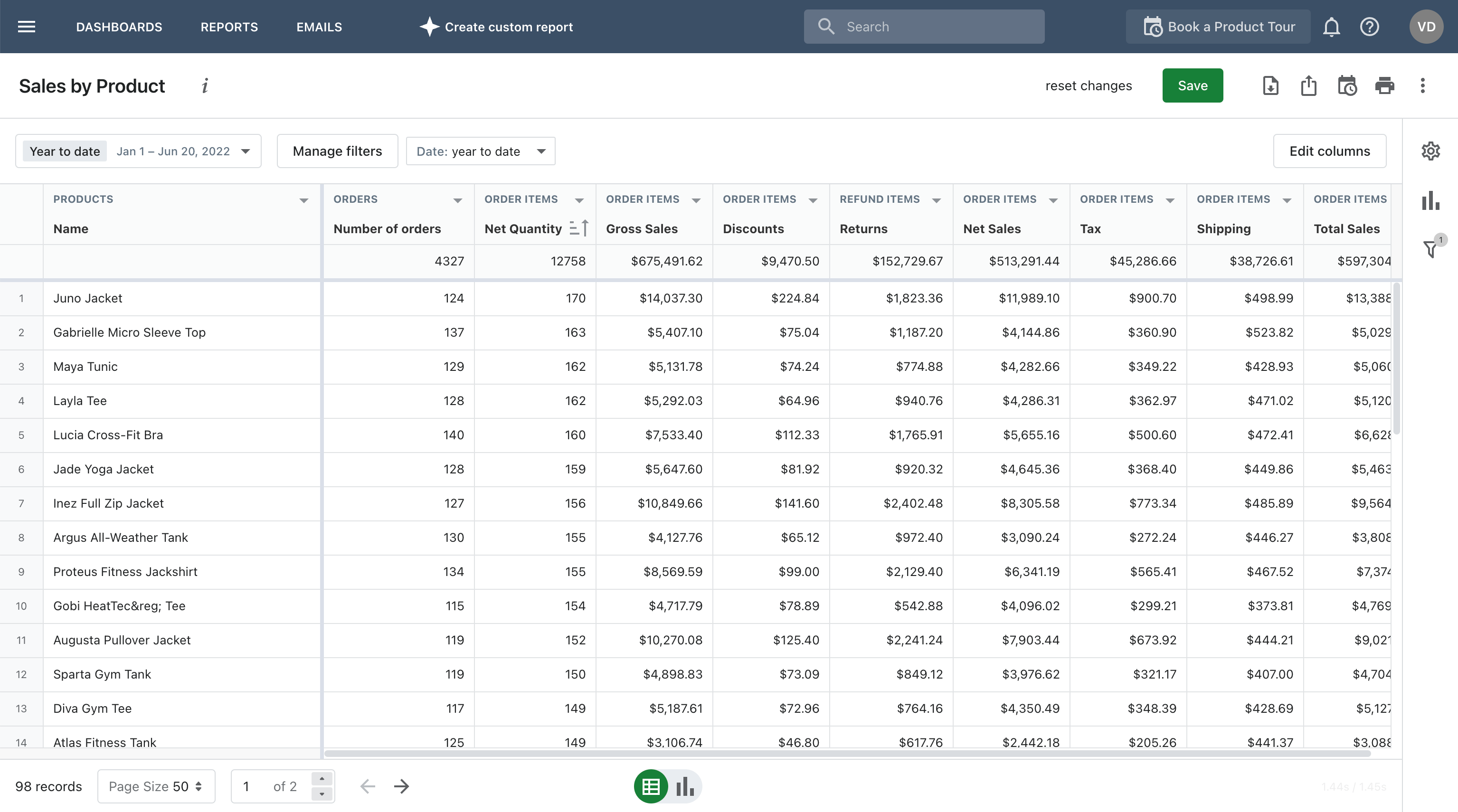

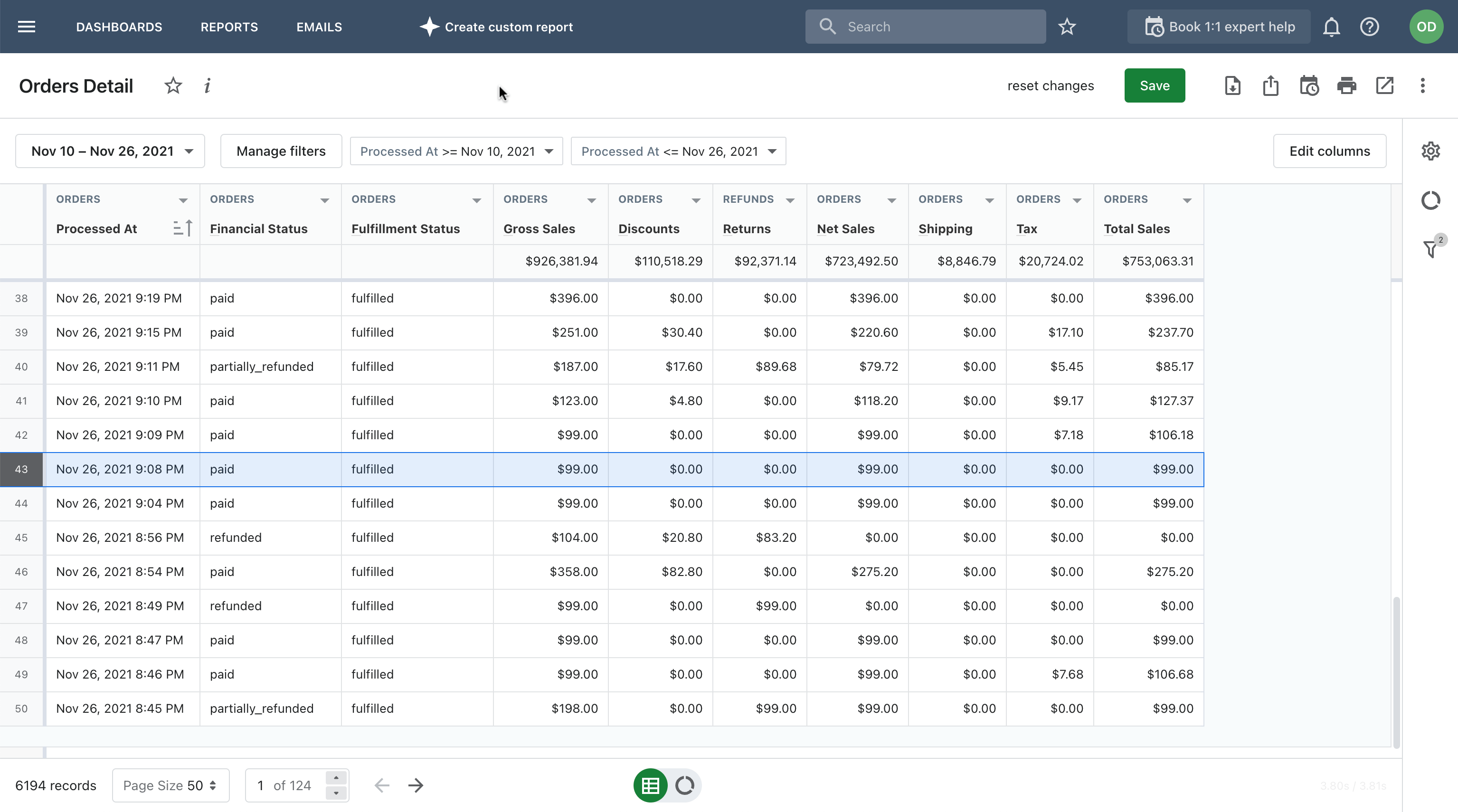

Most powerful sales reports for your Shopify store A brief guide

If you are liable to pay. Shopify tax is free on your first $100,000 of us sales each calendar year. Because you've already calculated your county level gross sales (which should be all the sales you did across all the. Does shopify report sales tax to states? As a merchant, it’s your responsibility to ensure that you’re.

Does Shopify Collect Sales Tax (Guide & How to Collect)

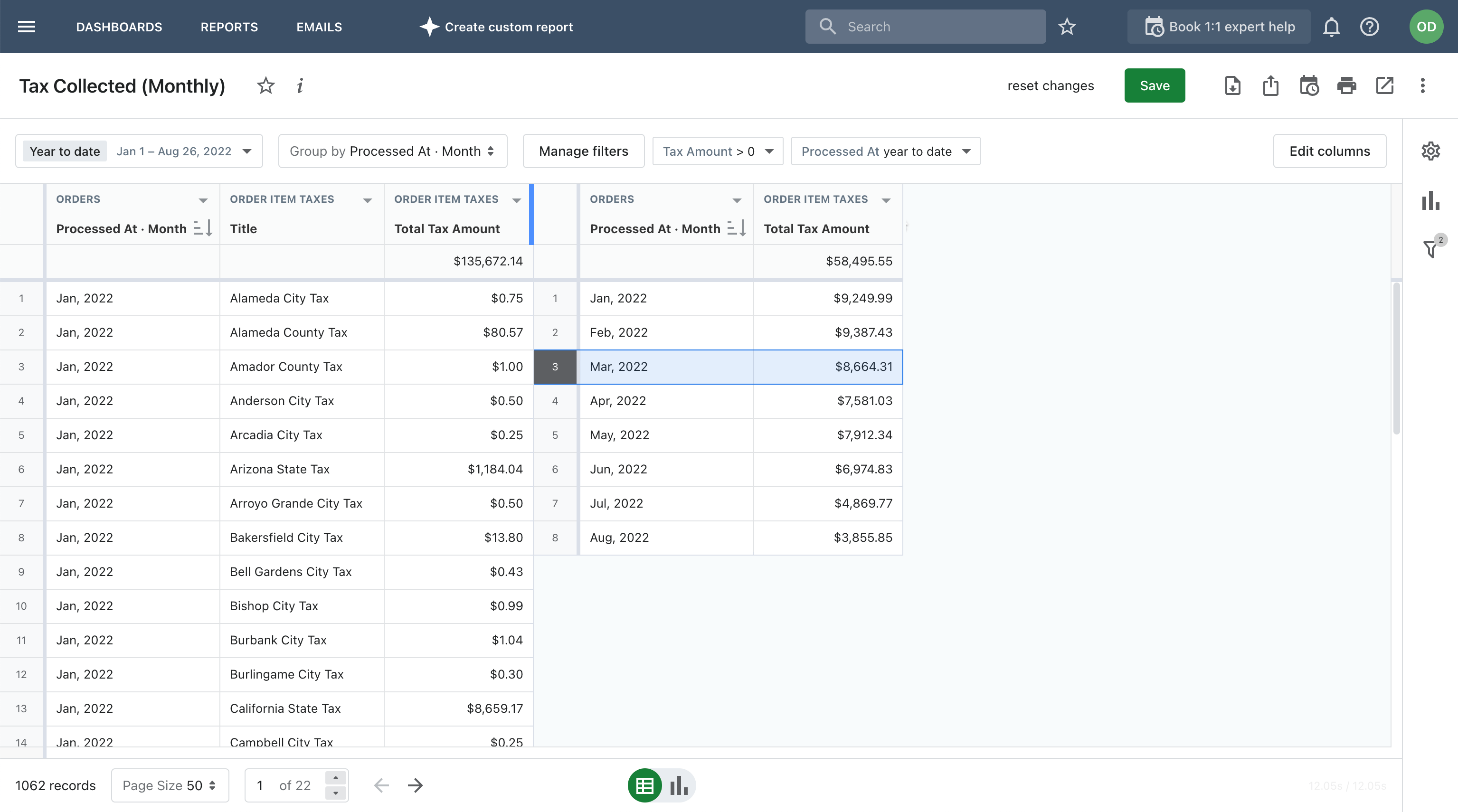

Because you've already calculated your county level gross sales (which should be all the sales you did across all the. Unfortunately, shopify doesn’t report sales tax to states on your behalf. Shopify tax is free on your first $100,000 of us sales each calendar year. After $100,000, a 0.35% calculation fee (0.25% for shopify plus. Does shopify report sales tax.

Does Shopify Collect Sales Tax? What You Need To Know

Shopify does not charge you, the merchant, for sales tax because we do not remit sales tax on your behalf. Does shopify report sales tax to states? No, shopify does not report sales tax to states automatically. After $100,000, a 0.35% calculation fee (0.25% for shopify plus. If you are liable to pay.

Does Shopify Collect Sales Tax (Guide & How to Collect)

As a merchant, it’s your responsibility to ensure that you’re. No, shopify does not report sales tax to states automatically. Because you've already calculated your county level gross sales (which should be all the sales you did across all the. Does shopify report sales tax to states? Unlike marketplaces such as amazon or etsy, ecommerce platforms including.

Analytics and Reporting for Shopify and Magento Mipler Reports

Unlike marketplaces such as amazon or etsy, ecommerce platforms including. Does shopify report sales tax to states? After $100,000, a 0.35% calculation fee (0.25% for shopify plus. Because you've already calculated your county level gross sales (which should be all the sales you did across all the. Shopify tax is free on your first $100,000 of us sales each calendar.

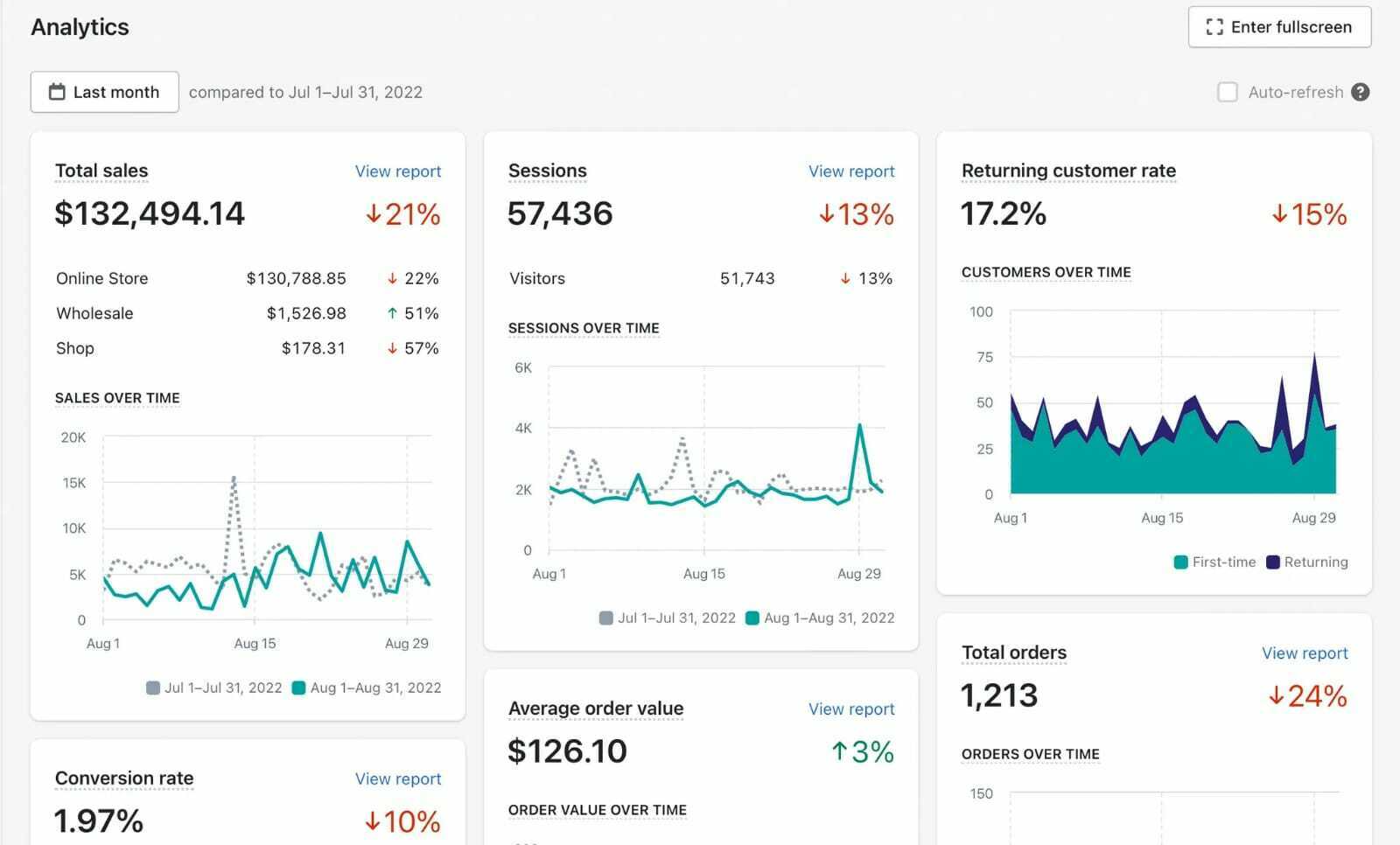

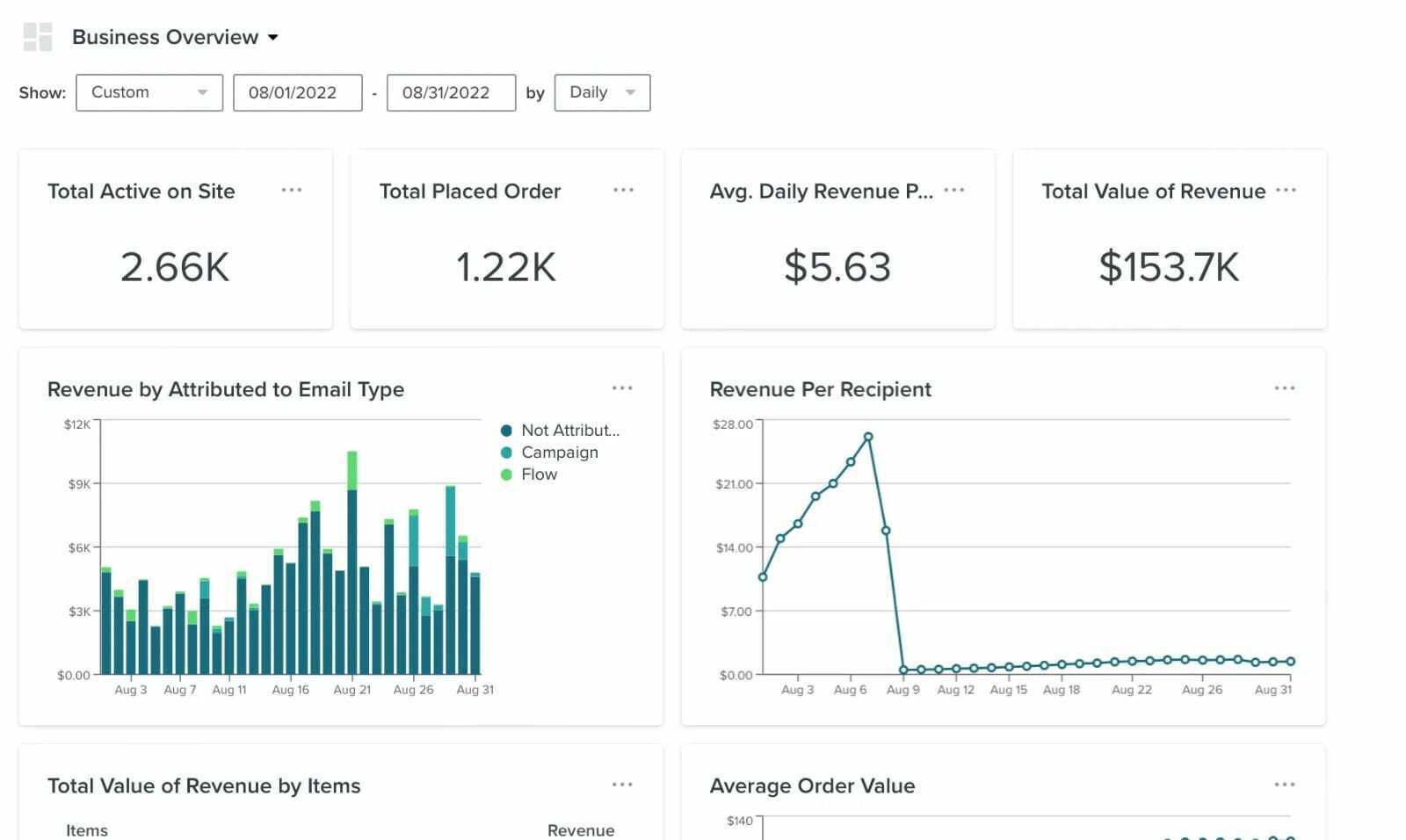

Why does Shopify report less sales than Klaviyo? Klaviyo Community

Unlike marketplaces such as amazon or etsy, ecommerce platforms including. Does shopify report sales tax to states? Does shopify report sales tax to states? Shopify does not charge you, the merchant, for sales tax because we do not remit sales tax on your behalf. Shopify tax is free on your first $100,000 of us sales each calendar year.

Shopify Tax Reports and How to Make Them More Flexible Selfservice

After $100,000, a 0.35% calculation fee (0.25% for shopify plus. Shopify tax is free on your first $100,000 of us sales each calendar year. Does shopify report sales tax to states? Because you've already calculated your county level gross sales (which should be all the sales you did across all the. Unlike marketplaces such as amazon or etsy, ecommerce platforms.

Why does Shopify report less sales than Klaviyo? Klaviyo Community

Does shopify report sales tax to states? Does shopify report sales tax to states? No, shopify does not report sales tax to states automatically. As a merchant, it’s your responsibility to ensure that you’re. Shopify does not charge you, the merchant, for sales tax because we do not remit sales tax on your behalf.

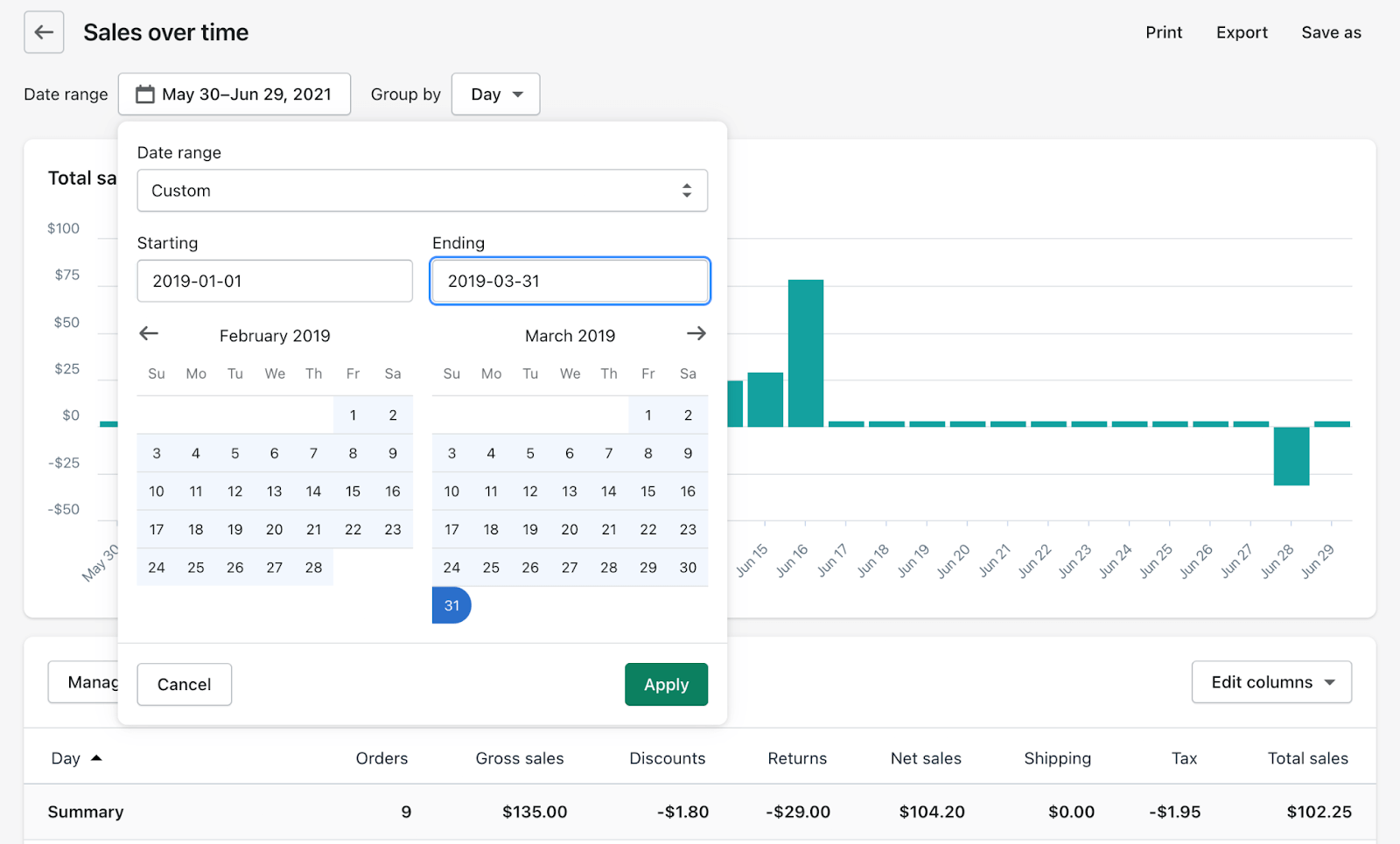

The Ultimate Guide to Shopify Reports Coupler.io Blog

After $100,000, a 0.35% calculation fee (0.25% for shopify plus. Does shopify report sales tax to states? As a merchant, it’s your responsibility to ensure that you’re. No, shopify does not report sales tax to states automatically. Shopify does not charge you, the merchant, for sales tax because we do not remit sales tax on your behalf.

Shopify Tax Reports and How to Make Them More Flexible Selfservice

No, shopify does not report sales tax to states automatically. Because you've already calculated your county level gross sales (which should be all the sales you did across all the. Unlike marketplaces such as amazon or etsy, ecommerce platforms including. Shopify tax is free on your first $100,000 of us sales each calendar year. As a merchant, it’s your responsibility.

As A Merchant, It’s Your Responsibility To Ensure That You’re.

If you are liable to pay. Does shopify report sales tax to states? Because you've already calculated your county level gross sales (which should be all the sales you did across all the. Unfortunately, shopify doesn’t report sales tax to states on your behalf.

Shopify Tax Is Free On Your First $100,000 Of Us Sales Each Calendar Year.

After $100,000, a 0.35% calculation fee (0.25% for shopify plus. Shopify does not charge you, the merchant, for sales tax because we do not remit sales tax on your behalf. No, shopify does not report sales tax to states automatically. Unlike marketplaces such as amazon or etsy, ecommerce platforms including.