Federal Tax Lien Expiration

Federal Tax Lien Expiration - How long does an irs tax lien last? A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially.

A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. How long does an irs tax lien last?

A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. How long does an irs tax lien last?

Federal Tax Lien Definition

How long does an irs tax lien last? A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially.

Federal tax lien on foreclosed property laderdriver

A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. How long does an irs tax lien last?

Tax Lien Help Remove IRS (Federal) or State Tax Lien Principal Tax

A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. How long does an irs tax lien last?

Understanding a Federal Tax Lien Release Traxion Tax

A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. How long does an irs tax lien last?

Federal Tax Lien Definition and How to Remove

How long does an irs tax lien last? A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially.

Federal Tax Lien Federal Tax Lien On Foreclosed Property

How long does an irs tax lien last? A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially.

How to Remove a Federal Tax Lien Heartland Tax Solutions

A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. How long does an irs tax lien last?

State Tax Lien vs. Federal Tax Lien How to Remove Them

A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. How long does an irs tax lien last?

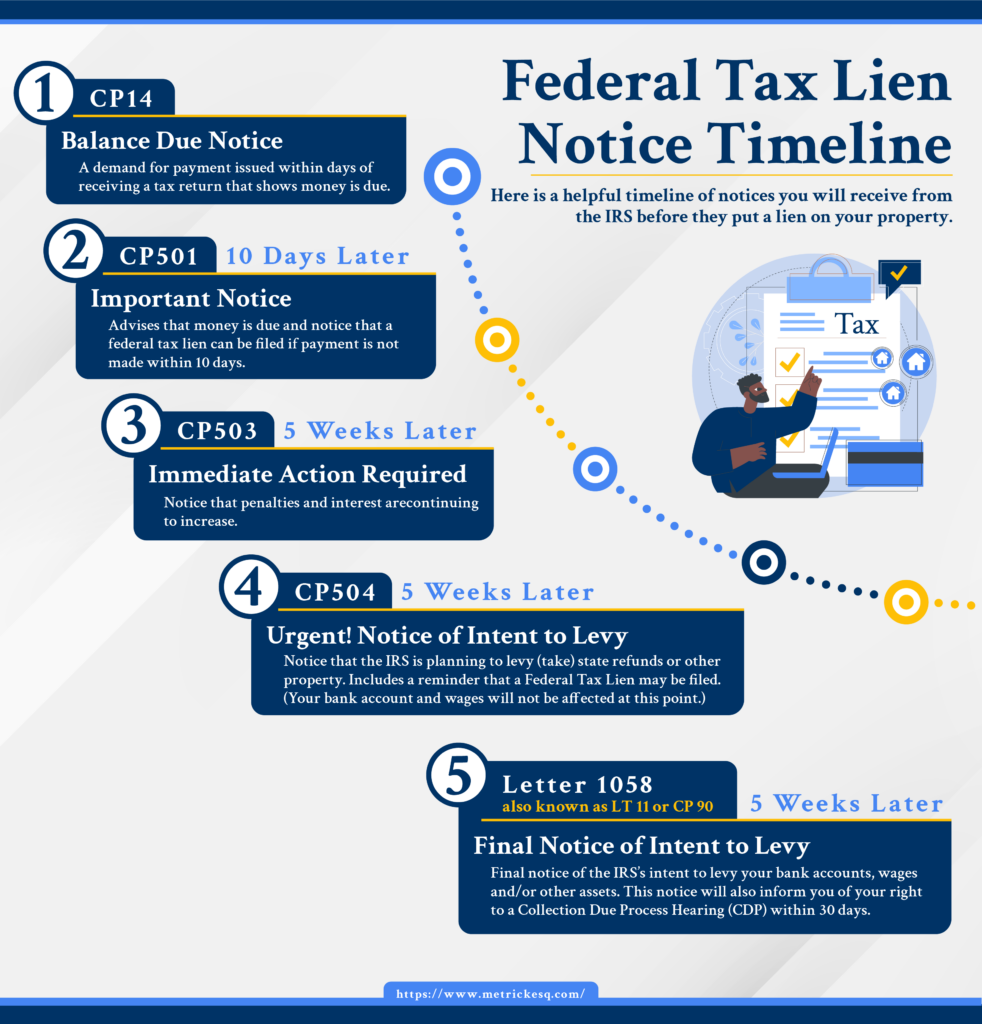

Federal Tax Lien Notice Timeline Ira J. Metrick, Esq.

A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially. How long does an irs tax lien last?

How Long Does An Irs Tax Lien Last?

A tax lien typically lasts 10 years and 30 days from the date of assessment (when the irs officially.

/tax-lien-497446038-d3fe1b94273f4700ad75e4fa45f0fda9.jpg)