Federal Tax Lien Release

Federal Tax Lien Release - When conditions are in the best interest of both the government and the taxpayer, other options for. If the notice of federal tax lien (nftl) included on public record is causing you a problem, you can apply to have. Manually requesting a release is the act of preparing form 13794, request for release or partial release of notice of federal tax lien, and forwarding it to the centralized lien operation (clo) for input to als. The irs releases your lien within 30 days after you have paid your tax debt. The tax can be satisfied by full payment, completion of an offer in compromise, or the irs. The irs has filed a notice of federal tax lien (nftl) for unpaid taxes and the balance has been satisfied or the time the irs can collect has ended. Section 6325(a) of the internal revenue code directs us to release a federal tax lien within 30 days of when the liability is fully paid or becomes legally unenforceable, or the irs accepts a bond for payment of the liability.

If the notice of federal tax lien (nftl) included on public record is causing you a problem, you can apply to have. The irs has filed a notice of federal tax lien (nftl) for unpaid taxes and the balance has been satisfied or the time the irs can collect has ended. When conditions are in the best interest of both the government and the taxpayer, other options for. Manually requesting a release is the act of preparing form 13794, request for release or partial release of notice of federal tax lien, and forwarding it to the centralized lien operation (clo) for input to als. The tax can be satisfied by full payment, completion of an offer in compromise, or the irs. The irs releases your lien within 30 days after you have paid your tax debt. Section 6325(a) of the internal revenue code directs us to release a federal tax lien within 30 days of when the liability is fully paid or becomes legally unenforceable, or the irs accepts a bond for payment of the liability.

Manually requesting a release is the act of preparing form 13794, request for release or partial release of notice of federal tax lien, and forwarding it to the centralized lien operation (clo) for input to als. The tax can be satisfied by full payment, completion of an offer in compromise, or the irs. The irs releases your lien within 30 days after you have paid your tax debt. Section 6325(a) of the internal revenue code directs us to release a federal tax lien within 30 days of when the liability is fully paid or becomes legally unenforceable, or the irs accepts a bond for payment of the liability. The irs has filed a notice of federal tax lien (nftl) for unpaid taxes and the balance has been satisfied or the time the irs can collect has ended. When conditions are in the best interest of both the government and the taxpayer, other options for. If the notice of federal tax lien (nftl) included on public record is causing you a problem, you can apply to have.

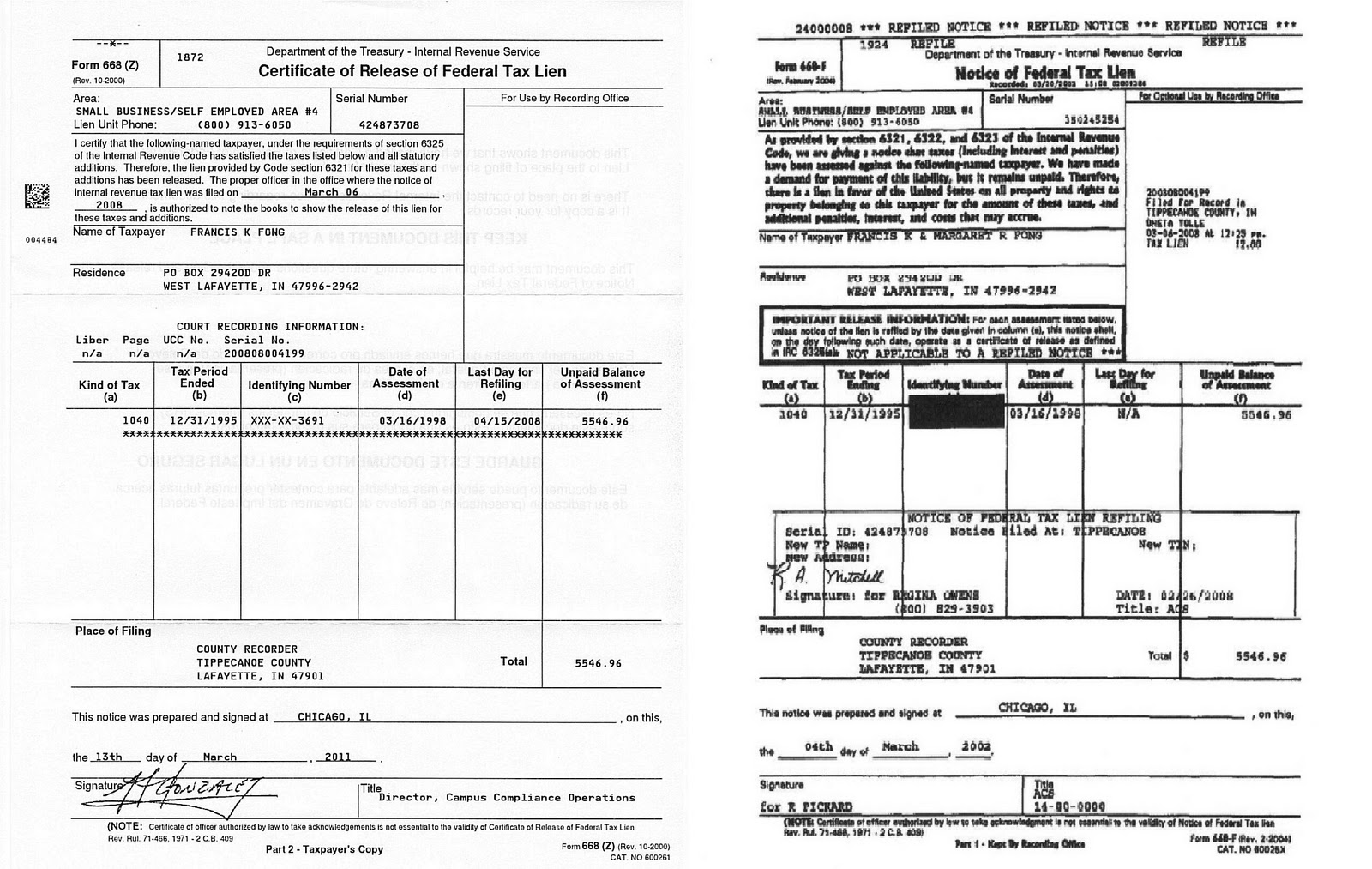

Federal Tax Lien Form 668z Certificate Of Release Of Federal Tax Lien

When conditions are in the best interest of both the government and the taxpayer, other options for. Manually requesting a release is the act of preparing form 13794, request for release or partial release of notice of federal tax lien, and forwarding it to the centralized lien operation (clo) for input to als. The irs has filed a notice of.

Understanding a Federal Tax Lien Release Traxion Tax

When conditions are in the best interest of both the government and the taxpayer, other options for. If the notice of federal tax lien (nftl) included on public record is causing you a problem, you can apply to have. The irs releases your lien within 30 days after you have paid your tax debt. Manually requesting a release is the.

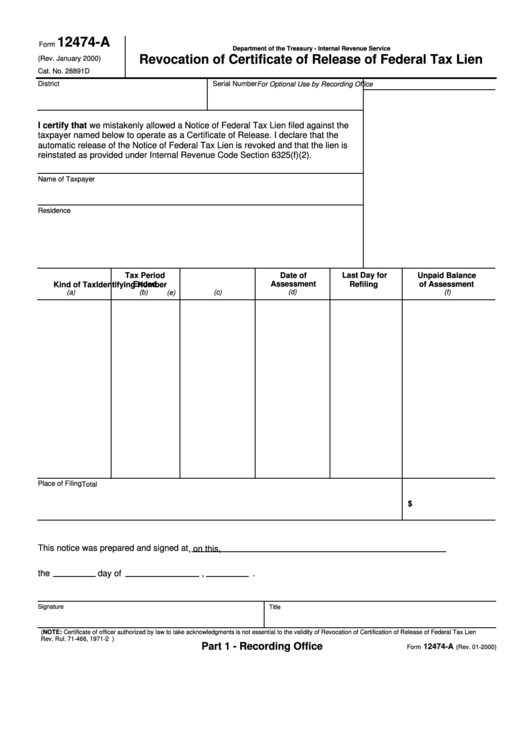

Fillable Form 12474A Revocation Of Certificate Of Release Of Federal

Section 6325(a) of the internal revenue code directs us to release a federal tax lien within 30 days of when the liability is fully paid or becomes legally unenforceable, or the irs accepts a bond for payment of the liability. If the notice of federal tax lien (nftl) included on public record is causing you a problem, you can apply.

Tax lien Finschool By 5paisa

The irs releases your lien within 30 days after you have paid your tax debt. If the notice of federal tax lien (nftl) included on public record is causing you a problem, you can apply to have. The irs has filed a notice of federal tax lien (nftl) for unpaid taxes and the balance has been satisfied or the time.

Federal Tax Lien Release NFTL Release

Section 6325(a) of the internal revenue code directs us to release a federal tax lien within 30 days of when the liability is fully paid or becomes legally unenforceable, or the irs accepts a bond for payment of the liability. When conditions are in the best interest of both the government and the taxpayer, other options for. If the notice.

Federal Tax Lien IRS Lien Call the best tax lawyer!

The tax can be satisfied by full payment, completion of an offer in compromise, or the irs. Section 6325(a) of the internal revenue code directs us to release a federal tax lien within 30 days of when the liability is fully paid or becomes legally unenforceable, or the irs accepts a bond for payment of the liability. The irs has.

Release or Discharge of Property from a Third Party's Federal Tax Lien

Section 6325(a) of the internal revenue code directs us to release a federal tax lien within 30 days of when the liability is fully paid or becomes legally unenforceable, or the irs accepts a bond for payment of the liability. If the notice of federal tax lien (nftl) included on public record is causing you a problem, you can apply.

Certificate Of Release Of Federal Tax Lien Get What You Need For Free

The tax can be satisfied by full payment, completion of an offer in compromise, or the irs. If the notice of federal tax lien (nftl) included on public record is causing you a problem, you can apply to have. Section 6325(a) of the internal revenue code directs us to release a federal tax lien within 30 days of when the.

Federal Tax Lien February 2017

If the notice of federal tax lien (nftl) included on public record is causing you a problem, you can apply to have. Section 6325(a) of the internal revenue code directs us to release a federal tax lien within 30 days of when the liability is fully paid or becomes legally unenforceable, or the irs accepts a bond for payment of.

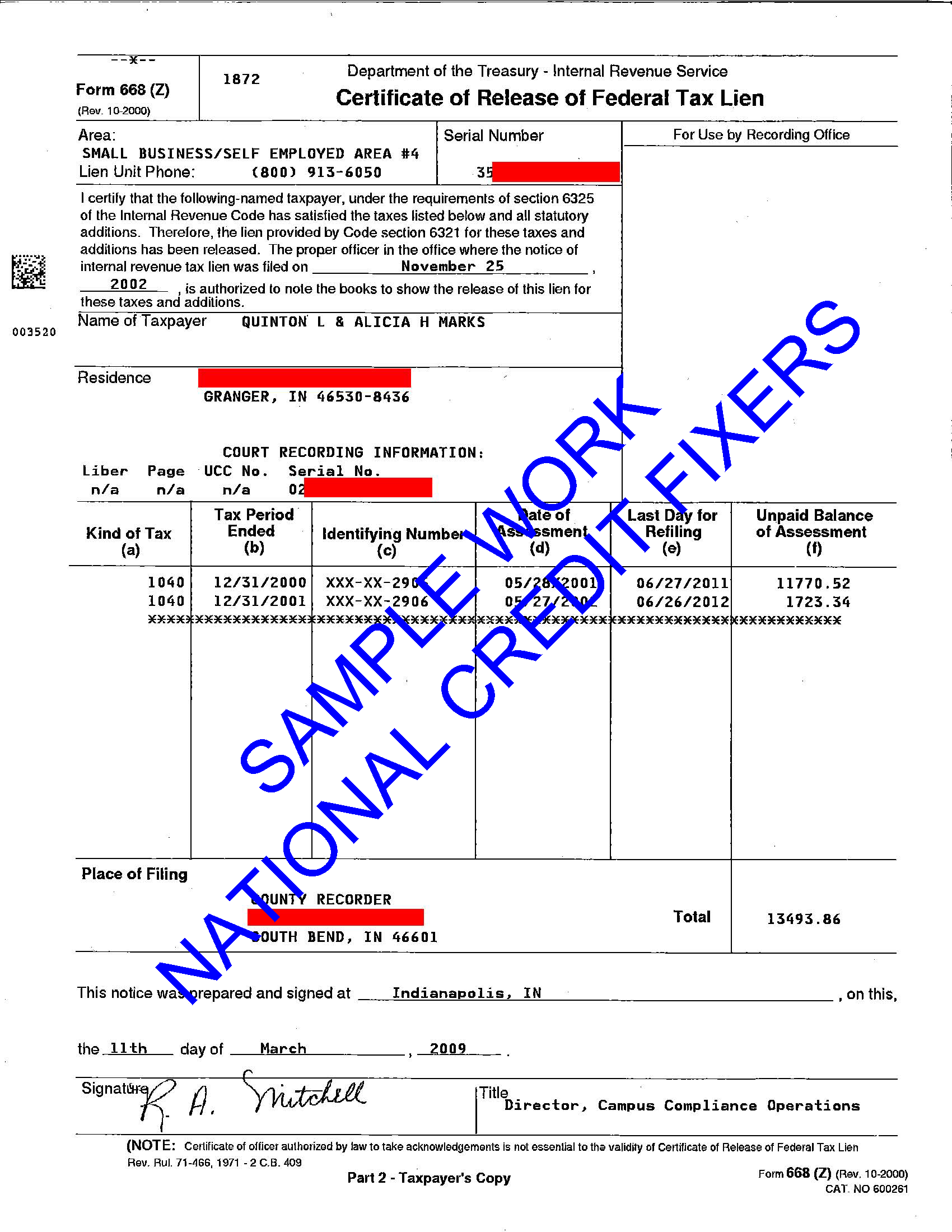

Success Stories Samples Of Our Work Federal Tax Lien Release

The irs has filed a notice of federal tax lien (nftl) for unpaid taxes and the balance has been satisfied or the time the irs can collect has ended. When conditions are in the best interest of both the government and the taxpayer, other options for. The tax can be satisfied by full payment, completion of an offer in compromise,.

Manually Requesting A Release Is The Act Of Preparing Form 13794, Request For Release Or Partial Release Of Notice Of Federal Tax Lien, And Forwarding It To The Centralized Lien Operation (Clo) For Input To Als.

The irs has filed a notice of federal tax lien (nftl) for unpaid taxes and the balance has been satisfied or the time the irs can collect has ended. When conditions are in the best interest of both the government and the taxpayer, other options for. If the notice of federal tax lien (nftl) included on public record is causing you a problem, you can apply to have. The tax can be satisfied by full payment, completion of an offer in compromise, or the irs.

Section 6325(A) Of The Internal Revenue Code Directs Us To Release A Federal Tax Lien Within 30 Days Of When The Liability Is Fully Paid Or Becomes Legally Unenforceable, Or The Irs Accepts A Bond For Payment Of The Liability.

The irs releases your lien within 30 days after you have paid your tax debt.