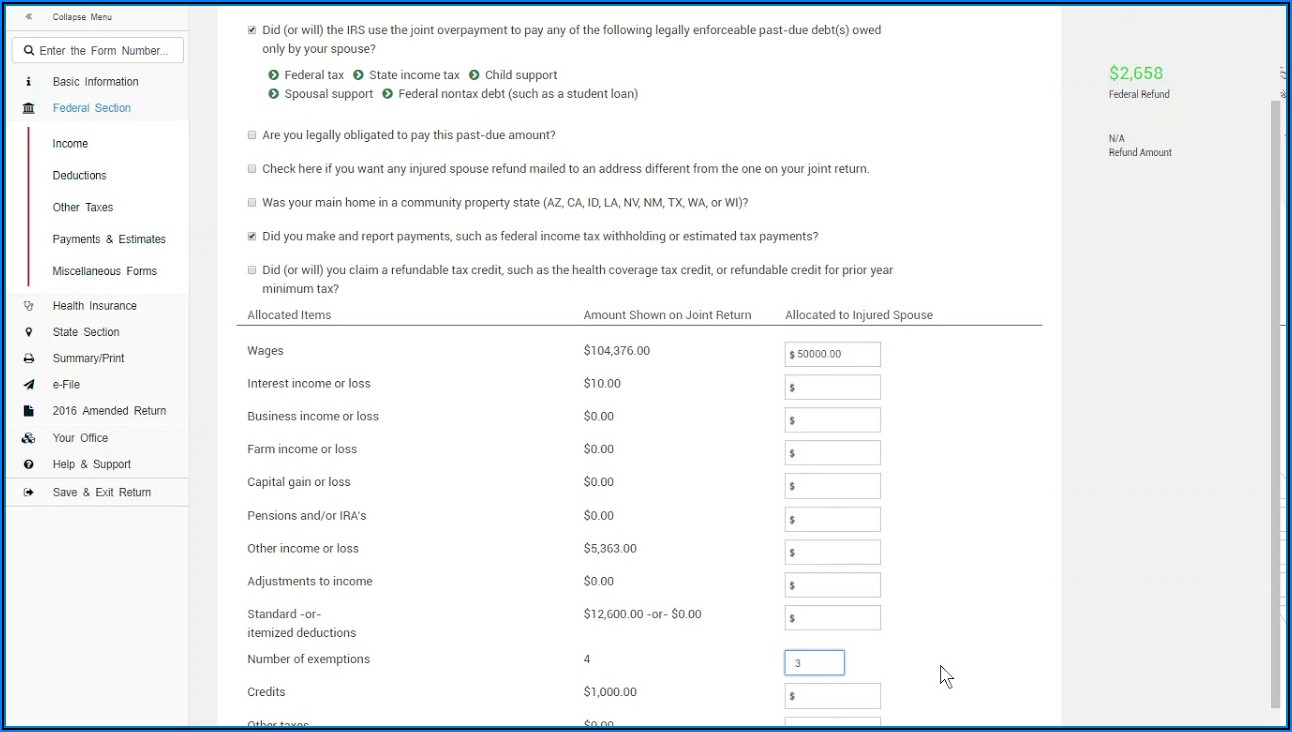

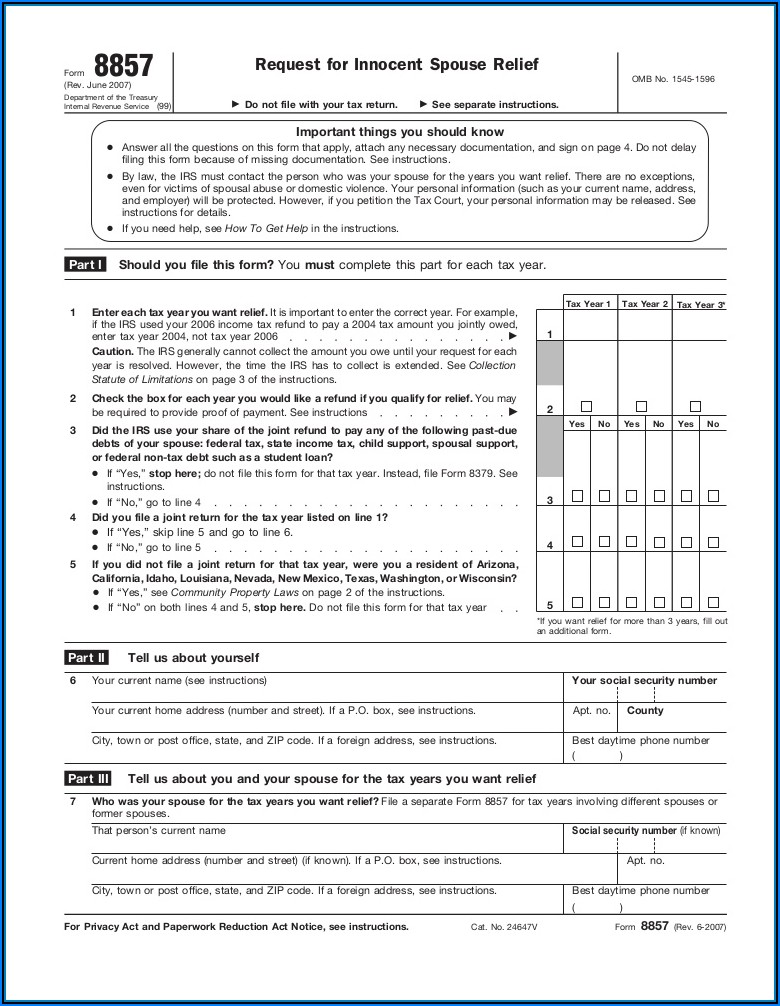

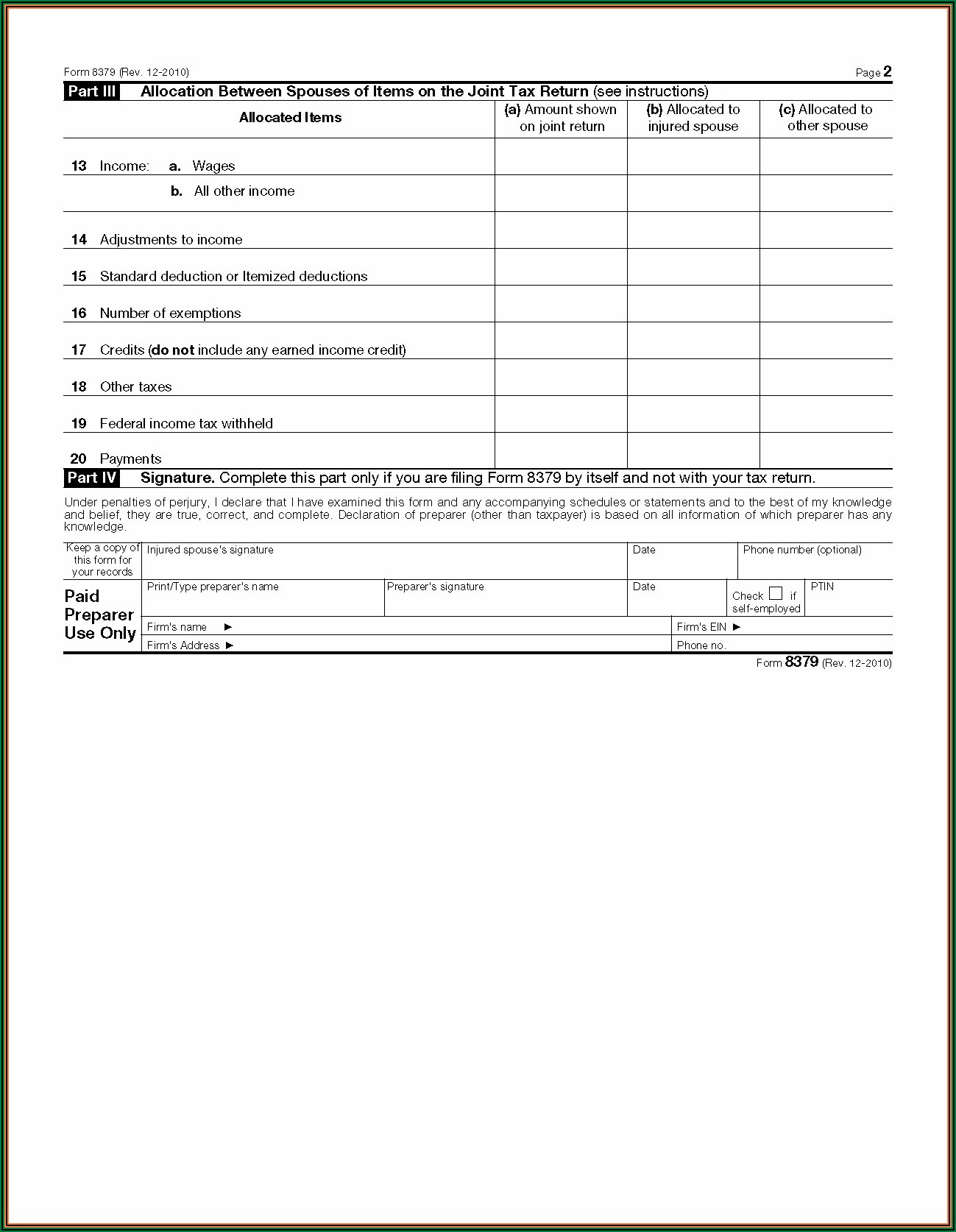

File Form 8379 Electronically

File Form 8379 Electronically - You will see a chart on the first page that says where to file. In the i'm looking for: Can i file my return electronically even though i am filing a form 8379, injured spouse allocation? In the results box, highlight 8379, injured spouse claim and allocation, then click go. File form 8379 when you become aware that all or part of your share of an overpayment was, or is expected to be, applied (offset) against your. It states that if you file form 8379 by itself after you filed your original joint return. Yes, you can file form 8379.

Yes, you can file form 8379. You will see a chart on the first page that says where to file. In the i'm looking for: In the results box, highlight 8379, injured spouse claim and allocation, then click go. File form 8379 when you become aware that all or part of your share of an overpayment was, or is expected to be, applied (offset) against your. It states that if you file form 8379 by itself after you filed your original joint return. Can i file my return electronically even though i am filing a form 8379, injured spouse allocation?

It states that if you file form 8379 by itself after you filed your original joint return. In the i'm looking for: You will see a chart on the first page that says where to file. File form 8379 when you become aware that all or part of your share of an overpayment was, or is expected to be, applied (offset) against your. Can i file my return electronically even though i am filing a form 8379, injured spouse allocation? In the results box, highlight 8379, injured spouse claim and allocation, then click go. Yes, you can file form 8379.

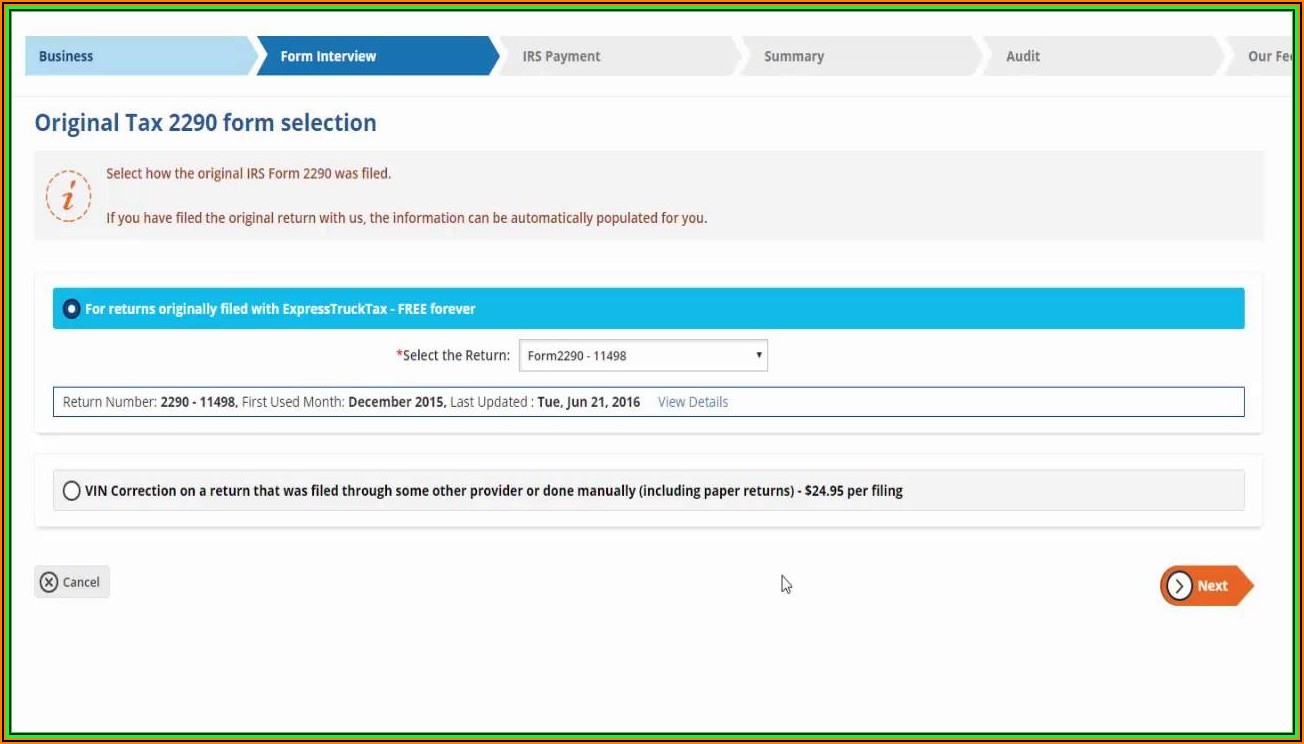

Form 8379 E File Form Resume Examples 1ZV8aBeo23

You will see a chart on the first page that says where to file. It states that if you file form 8379 by itself after you filed your original joint return. In the i'm looking for: In the results box, highlight 8379, injured spouse claim and allocation, then click go. Yes, you can file form 8379.

Irs Forms 8379 Form Resume Examples BpV5WWwX91

It states that if you file form 8379 by itself after you filed your original joint return. Can i file my return electronically even though i am filing a form 8379, injured spouse allocation? File form 8379 when you become aware that all or part of your share of an overpayment was, or is expected to be, applied (offset) against.

Form 8379 E File Form Resume Examples 1ZV8aBeo23

In the i'm looking for: You will see a chart on the first page that says where to file. It states that if you file form 8379 by itself after you filed your original joint return. Yes, you can file form 8379. In the results box, highlight 8379, injured spouse claim and allocation, then click go.

Irs Form 8379 Injured Spouse Allocation Form Resume Examples

You will see a chart on the first page that says where to file. Yes, you can file form 8379. File form 8379 when you become aware that all or part of your share of an overpayment was, or is expected to be, applied (offset) against your. It states that if you file form 8379 by itself after you filed.

Form 8379 E File Form Resume Examples 1ZV8aBeo23

You will see a chart on the first page that says where to file. In the results box, highlight 8379, injured spouse claim and allocation, then click go. Can i file my return electronically even though i am filing a form 8379, injured spouse allocation? Yes, you can file form 8379. In the i'm looking for:

how to file form 8379 electronically Fill Online, Printable, Fillable

Yes, you can file form 8379. You will see a chart on the first page that says where to file. File form 8379 when you become aware that all or part of your share of an overpayment was, or is expected to be, applied (offset) against your. In the i'm looking for: It states that if you file form 8379.

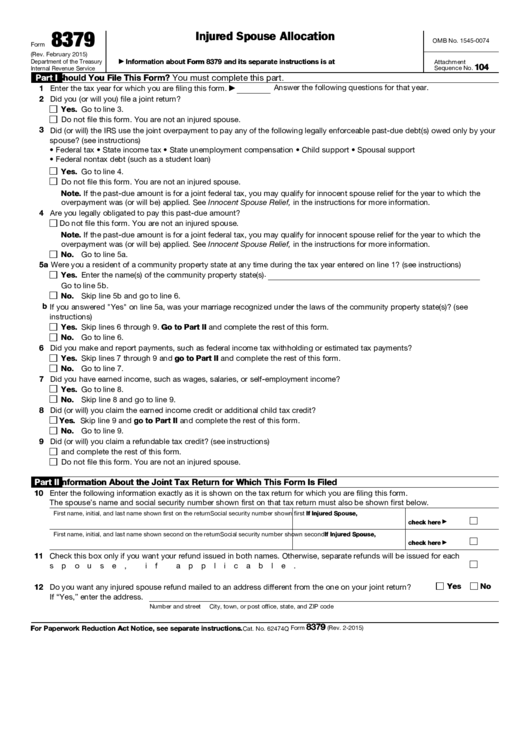

Printable 8379 Tax Form Printable Forms Free Online

It states that if you file form 8379 by itself after you filed your original joint return. Yes, you can file form 8379. File form 8379 when you become aware that all or part of your share of an overpayment was, or is expected to be, applied (offset) against your. Can i file my return electronically even though i am.

Can File Form 8379 Electronically hqfilecloud

It states that if you file form 8379 by itself after you filed your original joint return. Yes, you can file form 8379. Can i file my return electronically even though i am filing a form 8379, injured spouse allocation? File form 8379 when you become aware that all or part of your share of an overpayment was, or is.

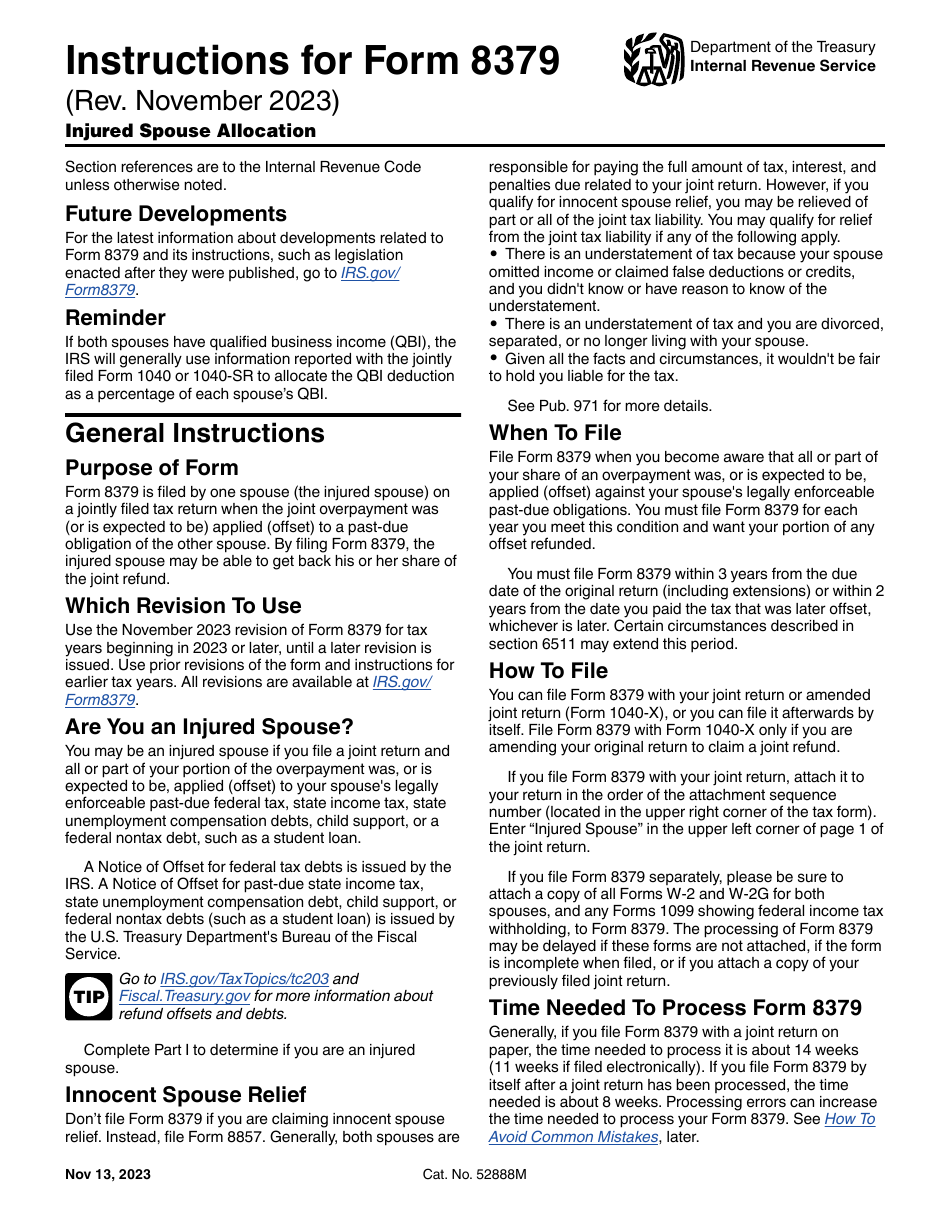

Form 8379 Instructions at tanmosheblog Blog

Yes, you can file form 8379. You will see a chart on the first page that says where to file. In the i'm looking for: In the results box, highlight 8379, injured spouse claim and allocation, then click go. It states that if you file form 8379 by itself after you filed your original joint return.

Irs Form 8379 Fillable Printable Forms Free Online

In the i'm looking for: You will see a chart on the first page that says where to file. File form 8379 when you become aware that all or part of your share of an overpayment was, or is expected to be, applied (offset) against your. Yes, you can file form 8379. In the results box, highlight 8379, injured spouse.

Can I File My Return Electronically Even Though I Am Filing A Form 8379, Injured Spouse Allocation?

It states that if you file form 8379 by itself after you filed your original joint return. In the i'm looking for: File form 8379 when you become aware that all or part of your share of an overpayment was, or is expected to be, applied (offset) against your. In the results box, highlight 8379, injured spouse claim and allocation, then click go.

You Will See A Chart On The First Page That Says Where To File.

Yes, you can file form 8379.