Filing Bankruptcy For Credit Cards 5K Reddit

Filing Bankruptcy For Credit Cards 5K Reddit - Cut up the cards (you already did one consolidation loan, that didn't take), do a second job for a few months to get out from under the 5k credit card. You could get in serious. Imho, it's probably better to file bankruptcy while your credit is still good than to just let it all go. It's not going to be hard for a court to figure that out. Charging irs debt to credit cards and then filing for bankruptcy is clear fraud. You'll have a quicker recovery that way.

Cut up the cards (you already did one consolidation loan, that didn't take), do a second job for a few months to get out from under the 5k credit card. You could get in serious. You'll have a quicker recovery that way. It's not going to be hard for a court to figure that out. Charging irs debt to credit cards and then filing for bankruptcy is clear fraud. Imho, it's probably better to file bankruptcy while your credit is still good than to just let it all go.

You could get in serious. Charging irs debt to credit cards and then filing for bankruptcy is clear fraud. It's not going to be hard for a court to figure that out. Cut up the cards (you already did one consolidation loan, that didn't take), do a second job for a few months to get out from under the 5k credit card. You'll have a quicker recovery that way. Imho, it's probably better to file bankruptcy while your credit is still good than to just let it all go.

Credit Cards in Chapter 13 Bankruptcy

Imho, it's probably better to file bankruptcy while your credit is still good than to just let it all go. You could get in serious. It's not going to be hard for a court to figure that out. Cut up the cards (you already did one consolidation loan, that didn't take), do a second job for a few months to.

Credit Cards and Bankruptcy

It's not going to be hard for a court to figure that out. Imho, it's probably better to file bankruptcy while your credit is still good than to just let it all go. Cut up the cards (you already did one consolidation loan, that didn't take), do a second job for a few months to get out from under the.

Secured Cards Are The Best Bankruptcy Credit Cards

Cut up the cards (you already did one consolidation loan, that didn't take), do a second job for a few months to get out from under the 5k credit card. It's not going to be hard for a court to figure that out. You could get in serious. Charging irs debt to credit cards and then filing for bankruptcy is.

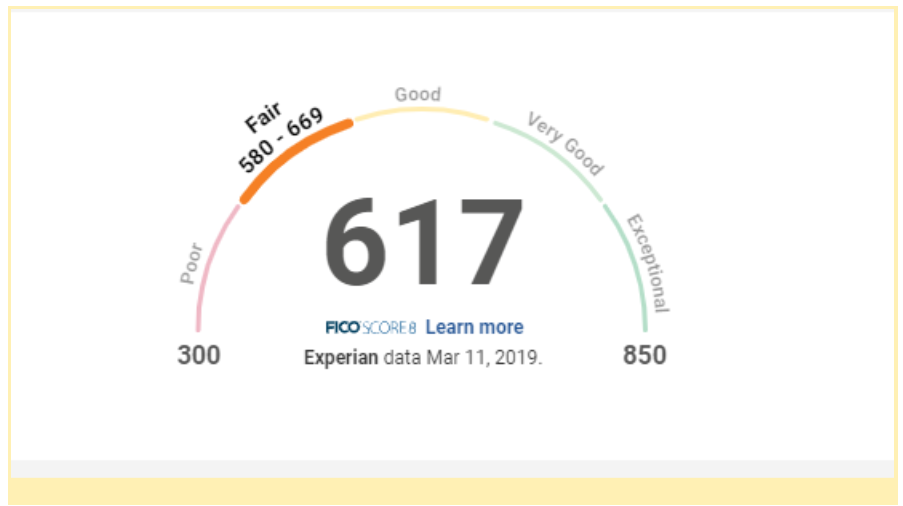

Bankruptcy Credit Cards When to File For Bankruptcy

It's not going to be hard for a court to figure that out. You'll have a quicker recovery that way. You could get in serious. Imho, it's probably better to file bankruptcy while your credit is still good than to just let it all go. Cut up the cards (you already did one consolidation loan, that didn't take), do a.

Credit Cards After Bankruptcy 7 Steps to Rebuilding Your Credit

Charging irs debt to credit cards and then filing for bankruptcy is clear fraud. You'll have a quicker recovery that way. You could get in serious. Imho, it's probably better to file bankruptcy while your credit is still good than to just let it all go. It's not going to be hard for a court to figure that out.

Credit cards During Bankruptcy and After Bankruptcy Credit Cards & BK

Charging irs debt to credit cards and then filing for bankruptcy is clear fraud. You could get in serious. Cut up the cards (you already did one consolidation loan, that didn't take), do a second job for a few months to get out from under the 5k credit card. Imho, it's probably better to file bankruptcy while your credit is.

Cries in bankruptcy applies to credit cards but not student loans r

You could get in serious. It's not going to be hard for a court to figure that out. You'll have a quicker recovery that way. Charging irs debt to credit cards and then filing for bankruptcy is clear fraud. Cut up the cards (you already did one consolidation loan, that didn't take), do a second job for a few months.

7 Best Credit Cards Reddit Users (Dec. 2024)

Cut up the cards (you already did one consolidation loan, that didn't take), do a second job for a few months to get out from under the 5k credit card. Imho, it's probably better to file bankruptcy while your credit is still good than to just let it all go. Charging irs debt to credit cards and then filing for.

Credit Cards After Bankruptcy Solved

Charging irs debt to credit cards and then filing for bankruptcy is clear fraud. It's not going to be hard for a court to figure that out. You'll have a quicker recovery that way. You could get in serious. Cut up the cards (you already did one consolidation loan, that didn't take), do a second job for a few months.

Maxing Out Credit Cards and Later Filing Bankruptcy Louisville

You'll have a quicker recovery that way. You could get in serious. Cut up the cards (you already did one consolidation loan, that didn't take), do a second job for a few months to get out from under the 5k credit card. Charging irs debt to credit cards and then filing for bankruptcy is clear fraud. Imho, it's probably better.

You Could Get In Serious.

Charging irs debt to credit cards and then filing for bankruptcy is clear fraud. Imho, it's probably better to file bankruptcy while your credit is still good than to just let it all go. Cut up the cards (you already did one consolidation loan, that didn't take), do a second job for a few months to get out from under the 5k credit card. You'll have a quicker recovery that way.