Florida State Tax Lien Search

Florida State Tax Lien Search - You can search our database by: You can search for liens on our website. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. To resolve your tax liability, you must do one of the following: If the debtor is a business entity, the debtor’s assigned department of state document number is. For copies of your own tax records , send a written. Search records corporations, limited liability companies, limited partnerships, and trademarks. Enter a stipulated payment agreement. Pay the amount in full.

You can search our database by: You can search for liens on our website. To resolve your tax liability, you must do one of the following: Enter a stipulated payment agreement. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. If the debtor is a business entity, the debtor’s assigned department of state document number is. Search records corporations, limited liability companies, limited partnerships, and trademarks. Pay the amount in full. For copies of your own tax records , send a written.

Search records corporations, limited liability companies, limited partnerships, and trademarks. Enter a stipulated payment agreement. Pay the amount in full. You can search for liens on our website. If the debtor is a business entity, the debtor’s assigned department of state document number is. You can search our database by: The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. For copies of your own tax records , send a written. To resolve your tax liability, you must do one of the following:

Tax Lien Certificate Investment Basics

Enter a stipulated payment agreement. Pay the amount in full. You can search our database by: If the debtor is a business entity, the debtor’s assigned department of state document number is. Search records corporations, limited liability companies, limited partnerships, and trademarks.

What Is a Tax Lien? Definition & Impact on Credit TheStreet

Search records corporations, limited liability companies, limited partnerships, and trademarks. You can search for liens on our website. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. For copies of your own tax records , send a written. You can search our database by:

Property Tax Lien Search Nationwide Title Insurance

If the debtor is a business entity, the debtor’s assigned department of state document number is. Search records corporations, limited liability companies, limited partnerships, and trademarks. To resolve your tax liability, you must do one of the following: Pay the amount in full. Enter a stipulated payment agreement.

Tax Lien California State Tax Lien

The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. Pay the amount in full. You can search our database by: Enter a stipulated payment agreement. You can search for liens on our website.

Tax Lien Texas State Tax Lien

The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. You can search for liens on our website. To resolve your tax liability, you must do one of the following: For copies of your own tax records , send a written. You can search our database.

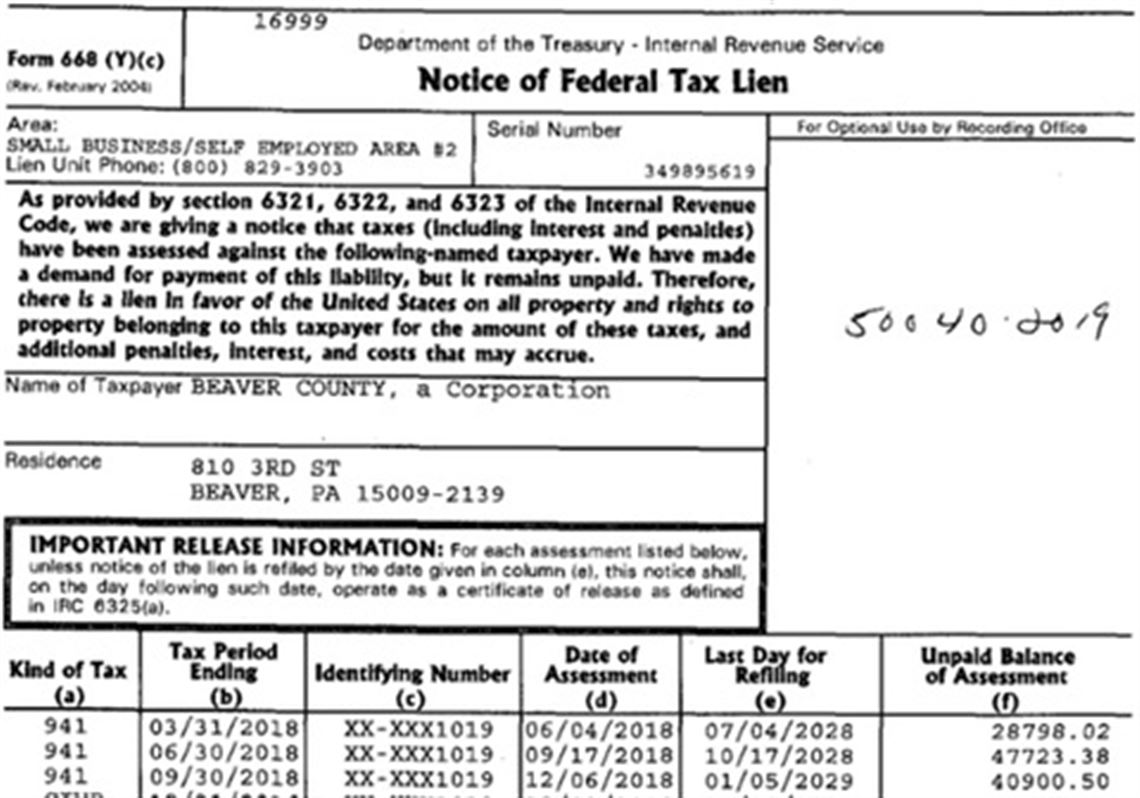

Certificate Of Release Of Federal Tax Lien Get What You Need For Free

The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. You can search for liens on our website. To resolve your tax liability, you must do one of the following: For copies of your own tax records , send a written. You can search our database.

Pennsylvania state tax liability and lien

To resolve your tax liability, you must do one of the following: You can search our database by: For copies of your own tax records , send a written. You can search for liens on our website. If the debtor is a business entity, the debtor’s assigned department of state document number is.

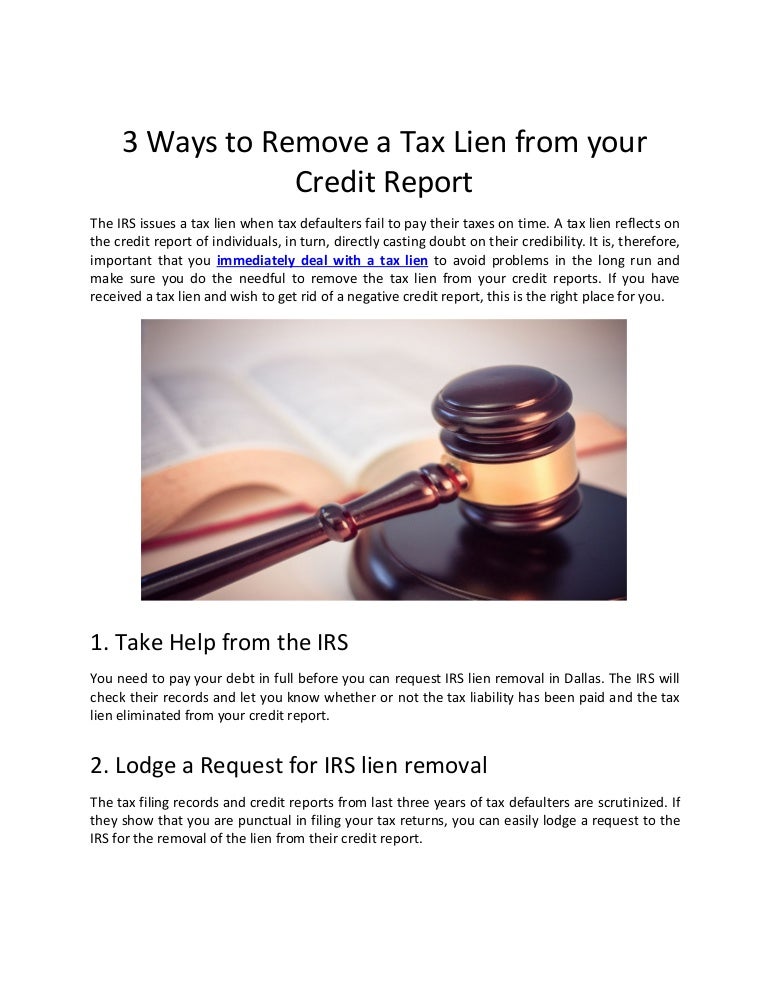

3 Ways to Remove a Tax Lien from your Credit Report

The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. If the debtor is a business entity, the debtor’s assigned department of state document number is. Pay the amount in full. You can search our database by: For copies of your own tax records , send.

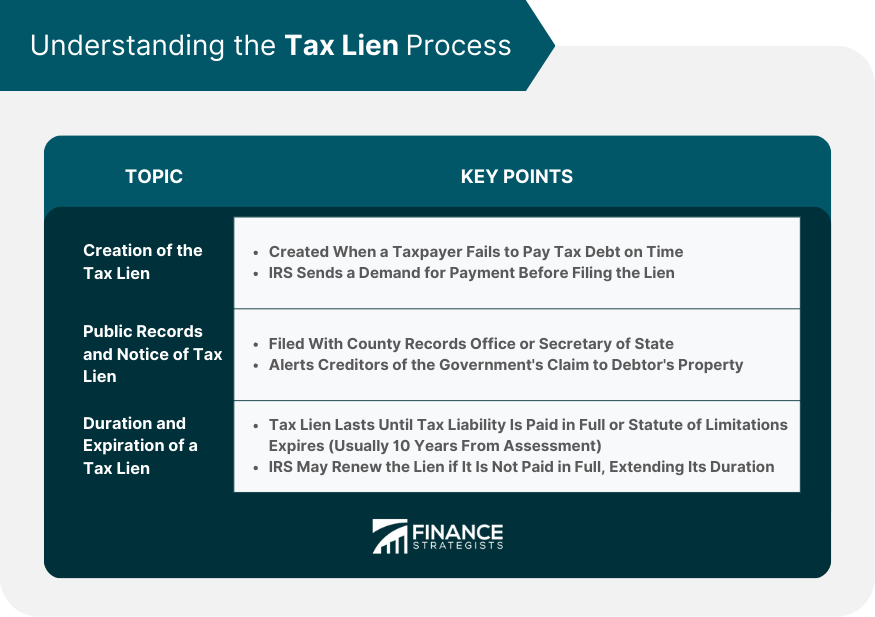

Tax Lien Definition, Process, Consequences, How to Handle

Enter a stipulated payment agreement. Search records corporations, limited liability companies, limited partnerships, and trademarks. If the debtor is a business entity, the debtor’s assigned department of state document number is. You can search for liens on our website. To resolve your tax liability, you must do one of the following:

Tips On Dealing With A State Tax Lien Legal News Letter

Enter a stipulated payment agreement. Pay the amount in full. For copies of your own tax records , send a written. If the debtor is a business entity, the debtor’s assigned department of state document number is. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays.

The Florida Department Of Revenue Begins The Collection Process When A Taxpayer Fails To File A Return, Fails To Make A Payment, Underpays The.

For copies of your own tax records , send a written. To resolve your tax liability, you must do one of the following: Pay the amount in full. If the debtor is a business entity, the debtor’s assigned department of state document number is.

Enter A Stipulated Payment Agreement.

You can search our database by: Search records corporations, limited liability companies, limited partnerships, and trademarks. You can search for liens on our website.