Foreclosure Tax

Foreclosure Tax - Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property.

But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's.

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's.

Avoid Tax Foreclosure Jay Buys Detroit Jay Buys Detroit

But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or.

Investing in a Tax Foreclosure Abernathy Law

But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or.

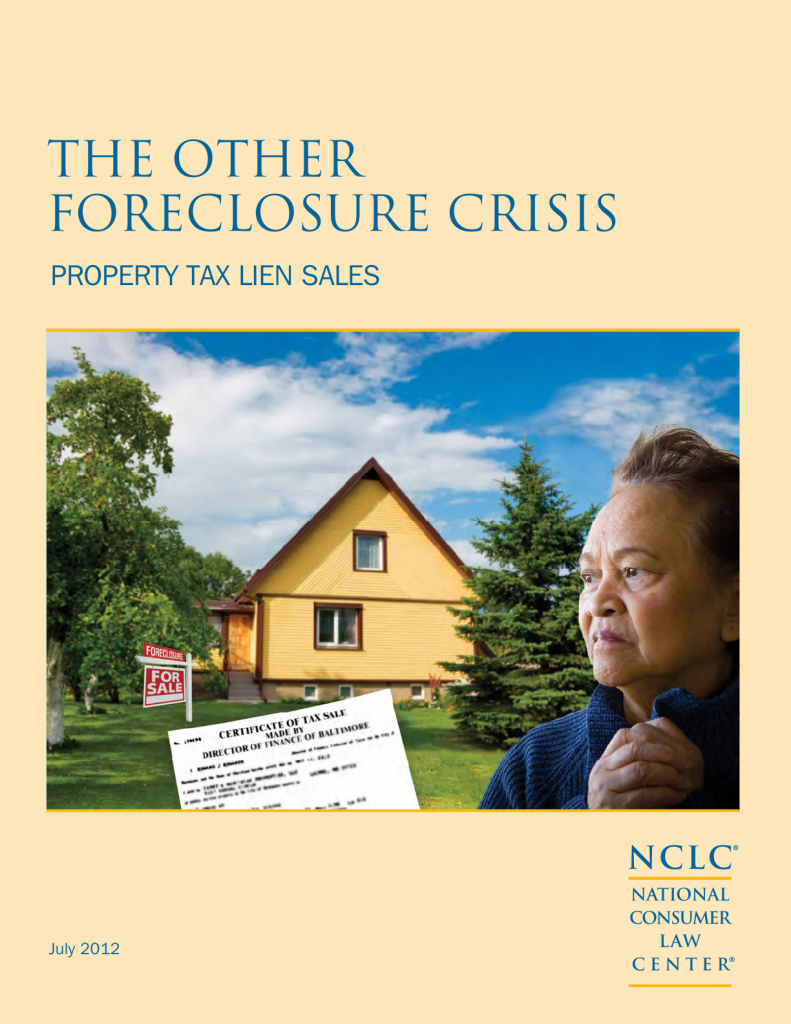

The Other Foreclosure Crisis Property Tax Lien Sales FORECLOSURE FRAUD

Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or.

SampleForeclosureAnswer PDF Foreclosure Complaint

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a.

Illegal Foreclosure Tax Lien Scam by Guy Neighbors

But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse.

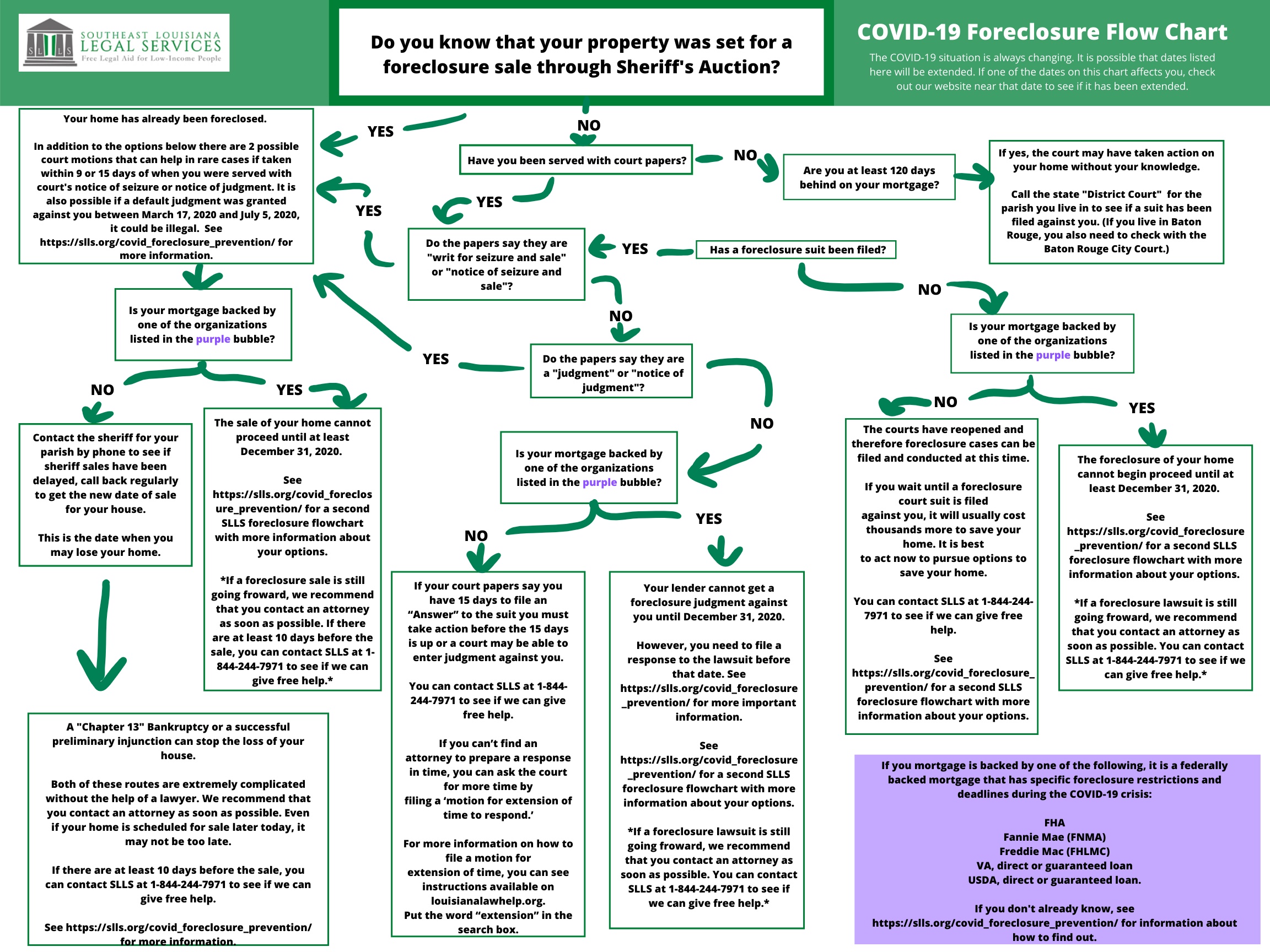

Updated Foreclosure Flow Chart SLLS

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse.

Tax Lien Foreclosure Attorney In Ohio?

But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or.

Erie County Tax Foreclosure Auction 2024 Schedule Mona Sylvia

But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse.

stop property tax foreclosure

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a lien on the property. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse.

Foreclosure Defense

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's. But if the homeowner doesn't pay these taxes, the delinquent amount becomes a.

But If The Homeowner Doesn't Pay These Taxes, The Delinquent Amount Becomes A Lien On The Property.

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific steps to. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the taxpayer's.