Form 1310 Turbotax

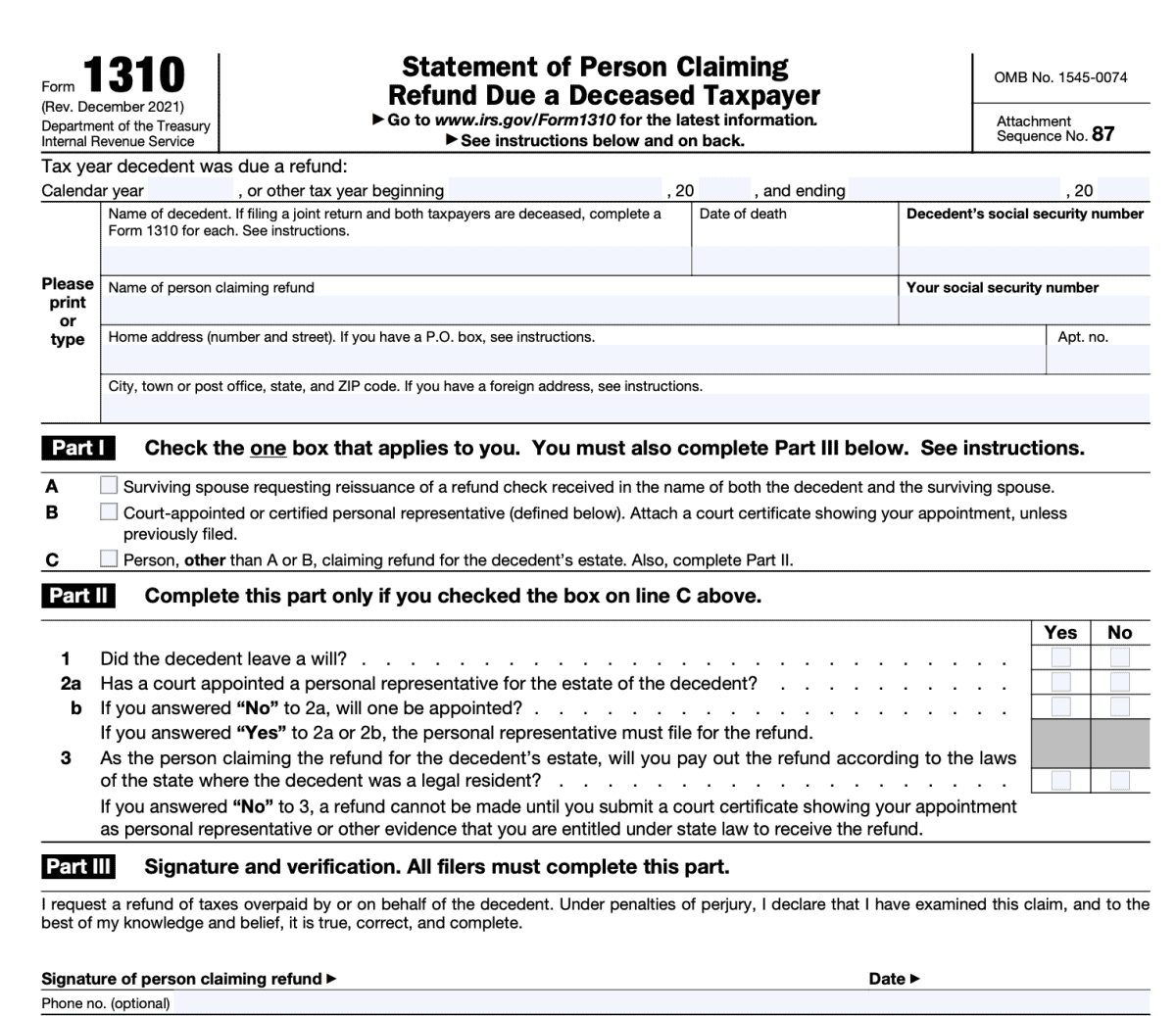

Form 1310 Turbotax - Click on c in part i of form 1310 where it asks person, other than a or b, claiming a refund for the decedent’s estate. After you've filled out the return, search for form 1310 inside turbotax and select the jump to link. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). You'll come to the let's see if. The following articles are the top questions referring form 1310. You must file form 1310 if the description in line a, line b, or line c on the form. How to resolve form 1310 critical. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,.

You must file form 1310 if the description in line a, line b, or line c on the form. The following articles are the top questions referring form 1310. Yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). You'll come to the let's see if. After you've filled out the return, search for form 1310 inside turbotax and select the jump to link. Click on c in part i of form 1310 where it asks person, other than a or b, claiming a refund for the decedent’s estate. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Use form 1310 to claim a refund on behalf of a deceased taxpayer. How to resolve form 1310 critical.

You'll come to the let's see if. The following articles are the top questions referring form 1310. After you've filled out the return, search for form 1310 inside turbotax and select the jump to link. Yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). How to resolve form 1310 critical. Click on c in part i of form 1310 where it asks person, other than a or b, claiming a refund for the decedent’s estate. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. You must file form 1310 if the description in line a, line b, or line c on the form. Use form 1310 to claim a refund on behalf of a deceased taxpayer.

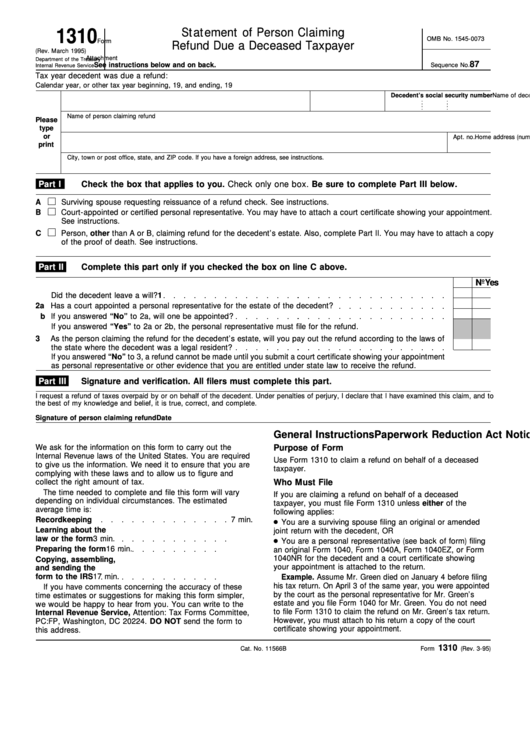

Form 1310 (Rev. March 1995) printable pdf download

How to resolve form 1310 critical. You'll come to the let's see if. Click on c in part i of form 1310 where it asks person, other than a or b, claiming a refund for the decedent’s estate. After you've filled out the return, search for form 1310 inside turbotax and select the jump to link. The following articles are.

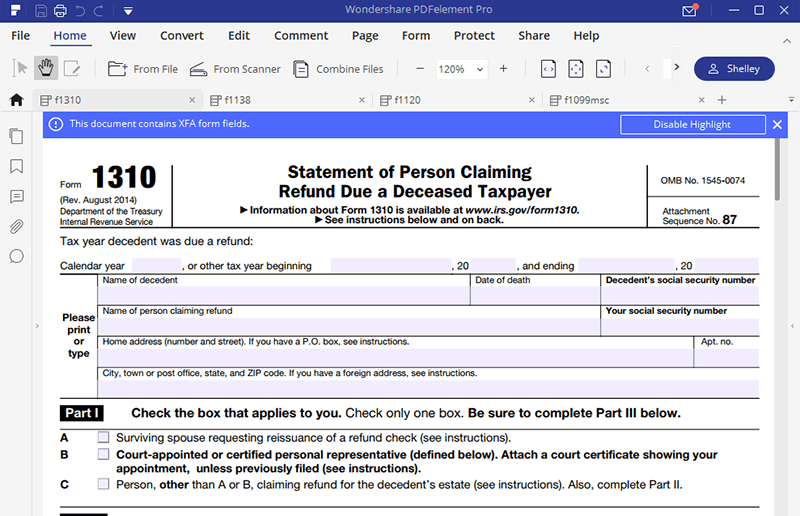

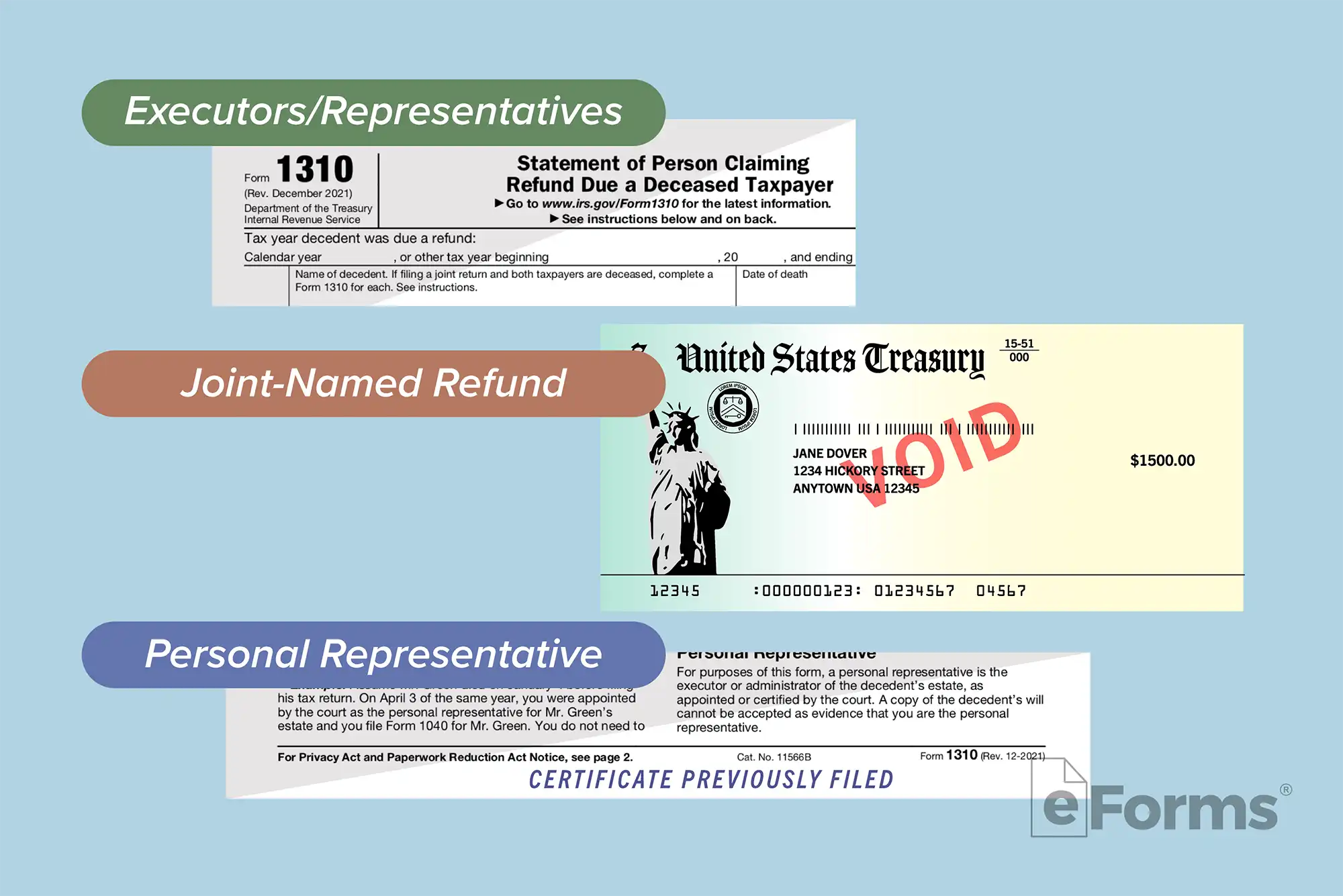

IRS Form 1310 How to Fill it Right

After you've filled out the return, search for form 1310 inside turbotax and select the jump to link. How to resolve form 1310 critical. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. You must file form 1310 if the description in line a, line b, or line c on the form. Use.

How to File IRS Form 1310 Refund Due a Deceased Taxpayer

The following articles are the top questions referring form 1310. You must file form 1310 if the description in line a, line b, or line c on the form. You'll come to the let's see if. Yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf.

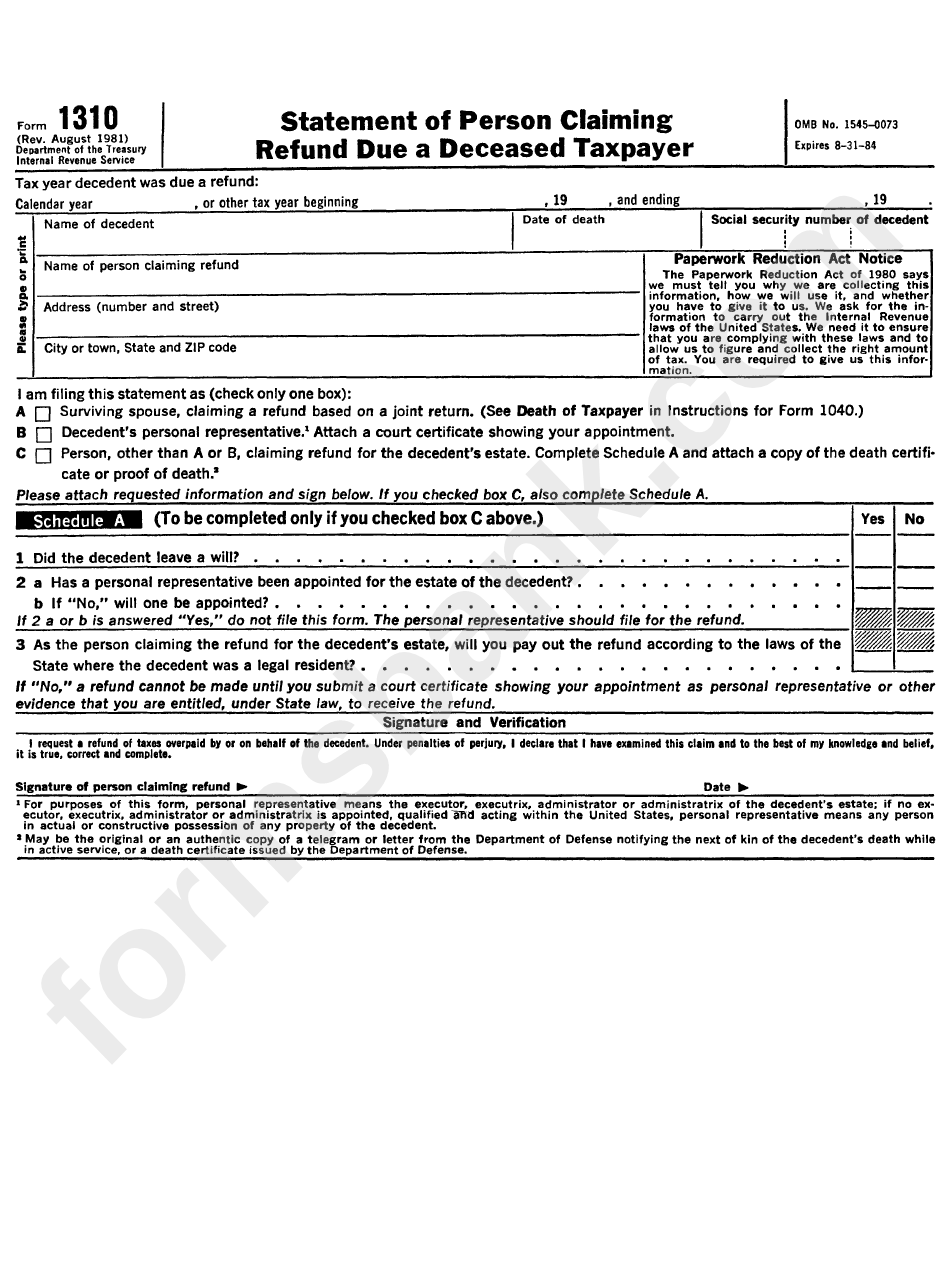

Irs Form 1310 Instructions 2023 Printable Forms Free Online

You'll come to the let's see if. Click on c in part i of form 1310 where it asks person, other than a or b, claiming a refund for the decedent’s estate. After you've filled out the return, search for form 1310 inside turbotax and select the jump to link. The following articles are the top questions referring form 1310..

Irs Form 1310 Printable Printable Forms Free Online

You must file form 1310 if the description in line a, line b, or line c on the form. You'll come to the let's see if. Use form 1310 to claim a refund on behalf of a deceased taxpayer. How to resolve form 1310 critical. The following articles are the top questions referring form 1310.

Free IRS Form 1310 PDF eForms

The following articles are the top questions referring form 1310. Yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. You must file form 1310 if.

Turbotax products momssilope

After you've filled out the return, search for form 1310 inside turbotax and select the jump to link. You must file form 1310 if the description in line a, line b, or line c on the form. You'll come to the let's see if. Yes, you can file irs form 1310 in turbotax to claim the tax refund for a.

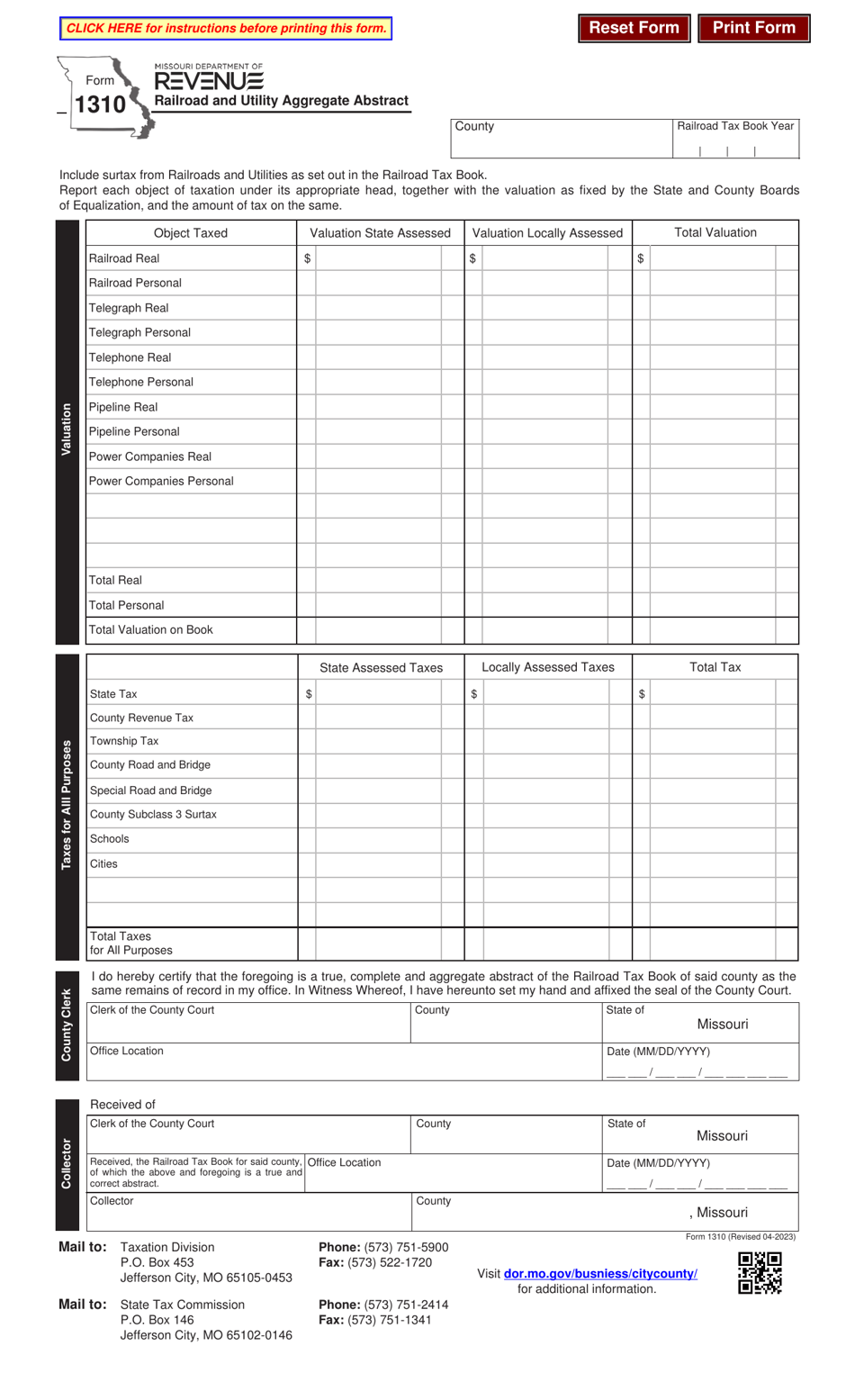

Form 1310 Fill Out, Sign Online and Download Fillable PDF, Missouri

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. How to resolve form 1310 critical. The following articles are the top questions referring form 1310. After you've filled out the return, search for form 1310 inside turbotax and select the jump to link. Yes, you can file irs form 1310 in turbotax to.

Irs Form 1310 Printable

Use form 1310 to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. How to resolve form 1310 critical. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. The following articles are the top.

Turbotax service codes angnom

Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. Click on c in part i of form 1310 where it asks person, other than a or b, claiming a refund for the decedent’s estate. The following articles are the top questions referring form 1310. You must file form 1310 if the description in.

How To Resolve Form 1310 Critical.

The following articles are the top questions referring form 1310. You must file form 1310 if the description in line a, line b, or line c on the form. Information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates,. You'll come to the let's see if.

Use Form 1310 To Claim A Refund On Behalf Of A Deceased Taxpayer.

After you've filled out the return, search for form 1310 inside turbotax and select the jump to link. Yes, you can file irs form 1310 in turbotax to claim the tax refund for a decedent return (a return filed on the behalf of a deceased taxpayer). Click on c in part i of form 1310 where it asks person, other than a or b, claiming a refund for the decedent’s estate.