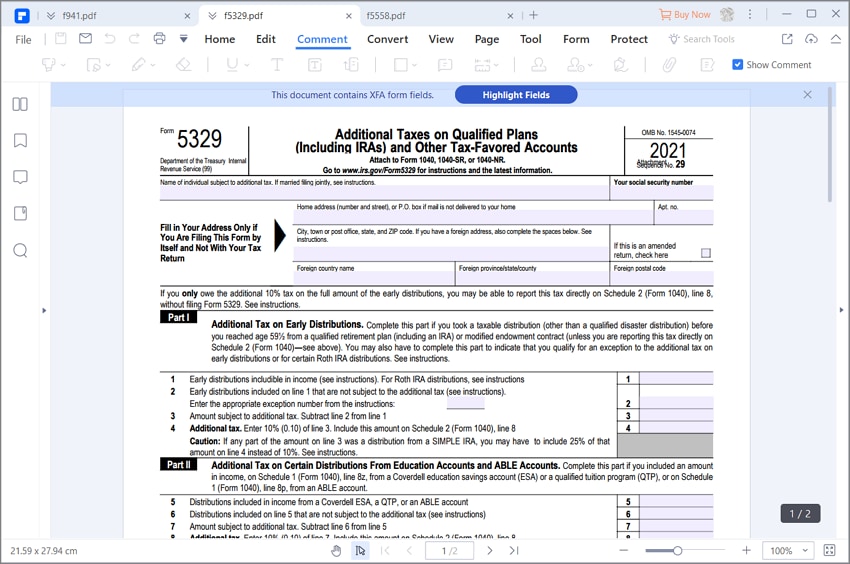

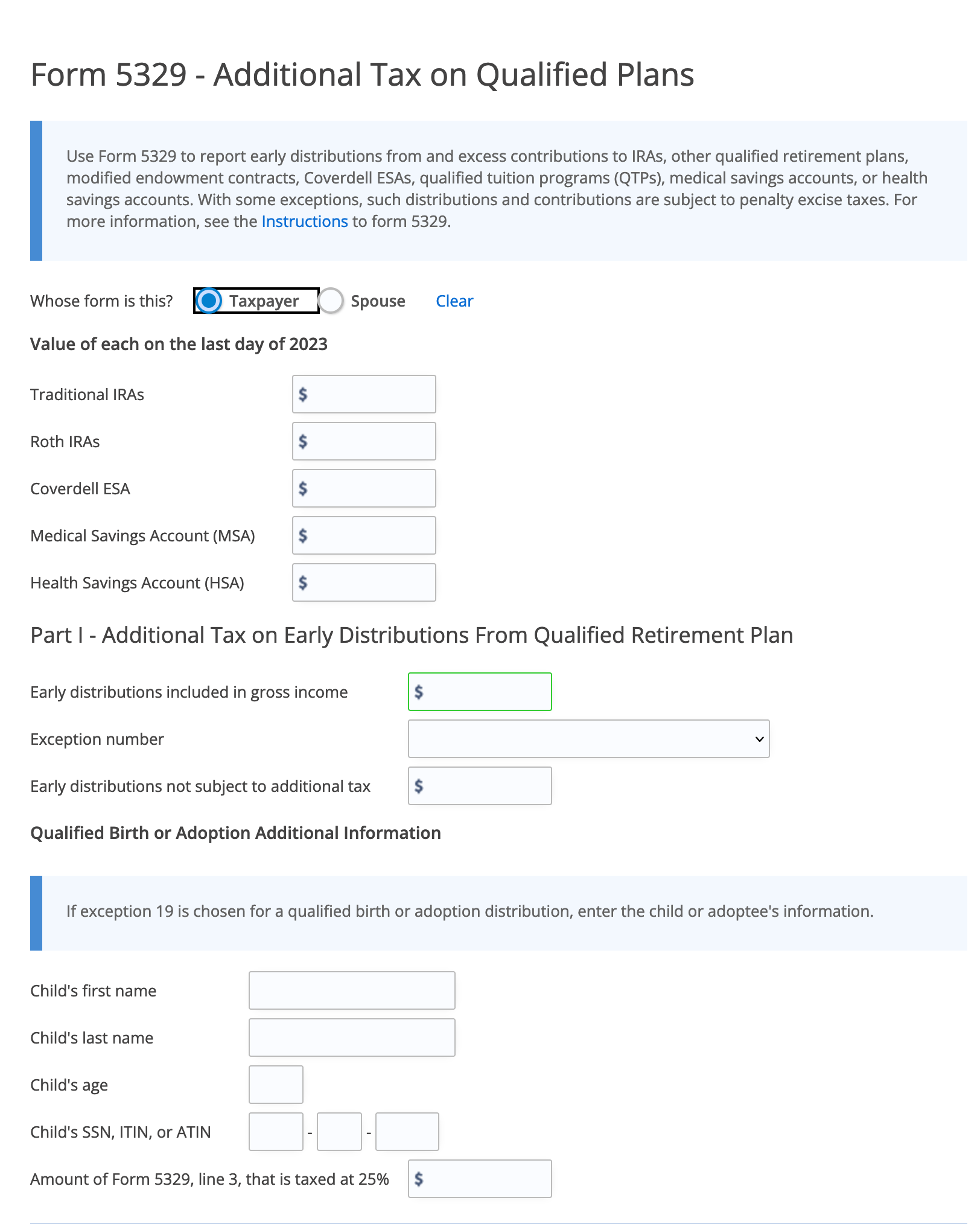

Form 5329 Turbotax

Form 5329 Turbotax - Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. You will get a 2022.

You will get a 2022. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from.

Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. You will get a 2022. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from.

IRS Form 5329 walkthrough (Additional Taxes on Qualified Plans and

Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. You will get a 2022. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return.

How to Fill in IRS Form 5329

You will get a 2022. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from.

W9 Form 2024 Irs.Gov Dorie Geralda

Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. You will get a 2022. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from.

IRS Tax Form 5329 Explained Lively

Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. You will get a 2022.

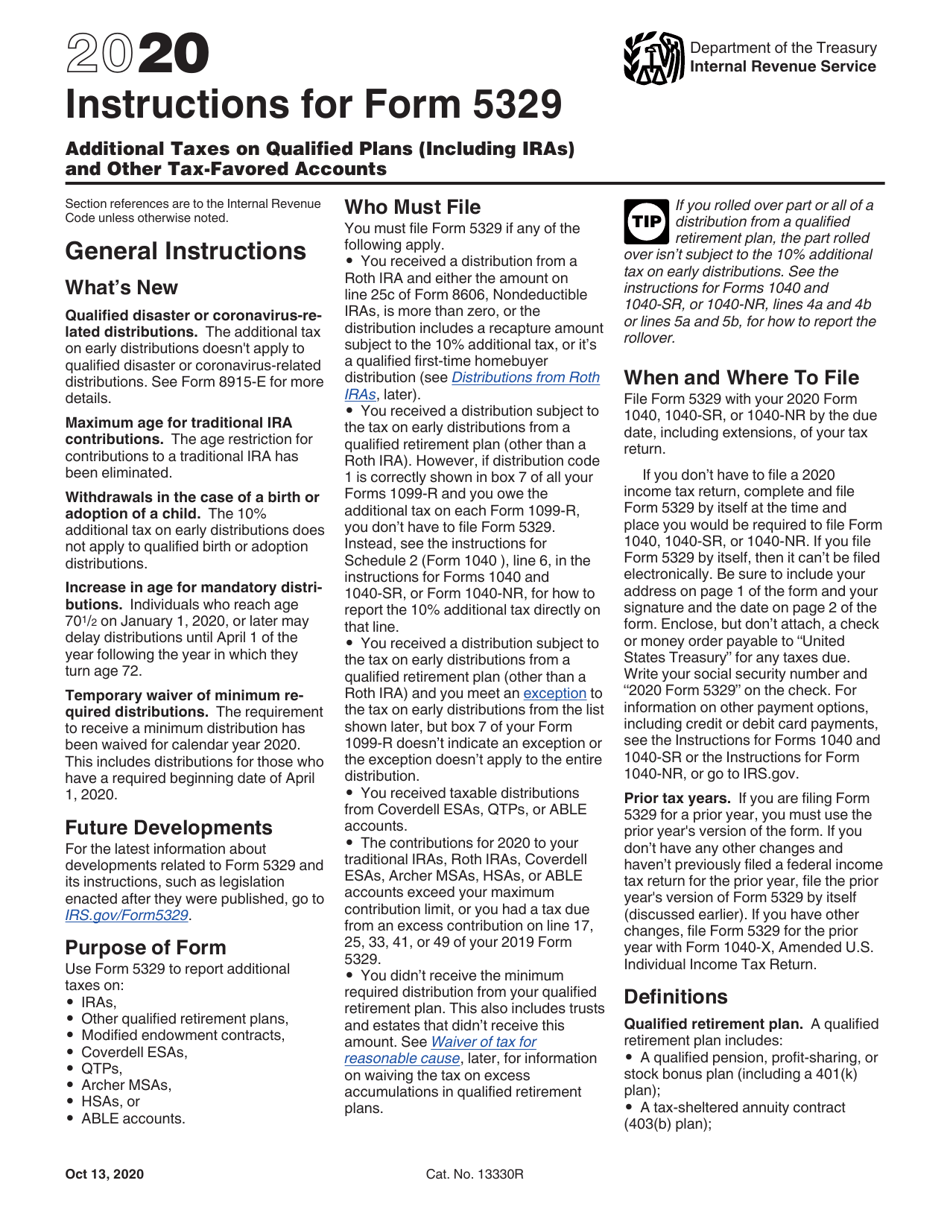

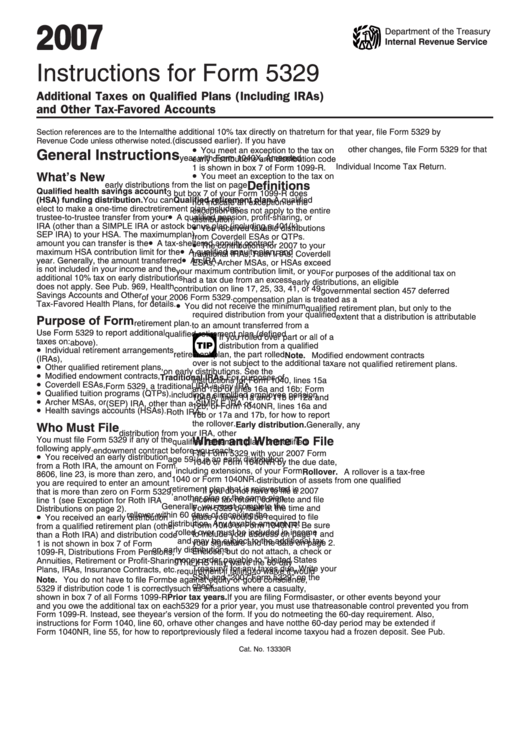

Download Instructions for IRS Form 5329 Additional Taxes on Qualified

You will get a 2022. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return.

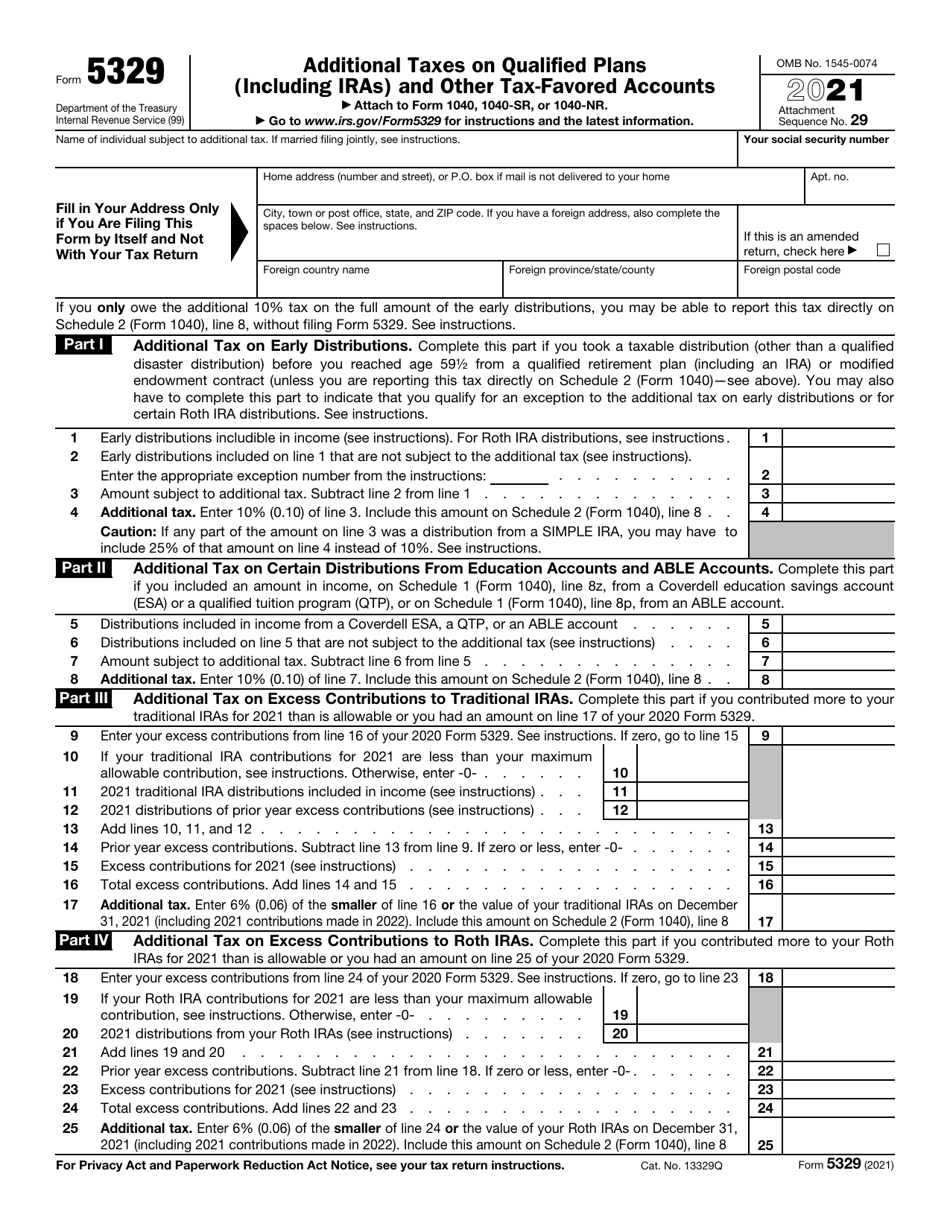

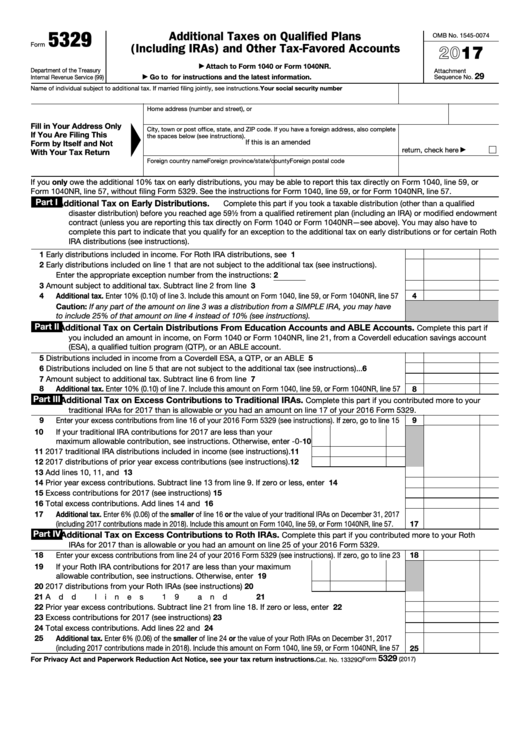

IRS Form 5329 Download Fillable PDF or Fill Online Additional Taxes on

Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. You will get a 2022.

Form 5329 Additional Taxes on Qualified Plans and Other TaxFavored

Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. You will get a 2022. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return.

When to file form 5329. Taxes on Qualified Plans

Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. You will get a 2022. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from.

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. You will get a 2022.

Fillable Form 5329 Additional Taxes On Qualified Plans (Including

Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. Irs form 5329 can be reported for both the taxpayer and the spouse in a married filing jointly tax return. You will get a 2022.

Irs Form 5329 Can Be Reported For Both The Taxpayer And The Spouse In A Married Filing Jointly Tax Return.

Complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from. You will get a 2022.