Form 990 Late Filing Penalty

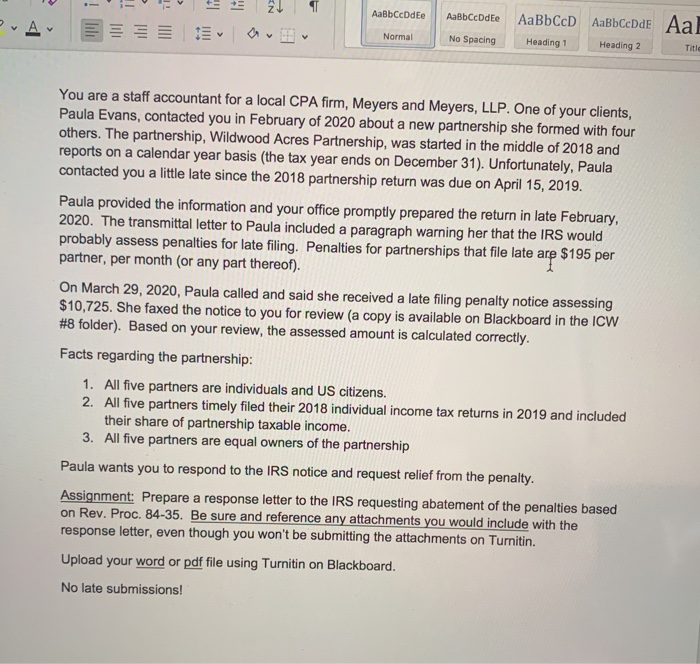

Form 990 Late Filing Penalty - Can penalties for filing form 990 late be abated? Did your nonprofit organization file a form 990 after the due date? Are you faced with paying a penalty to the irs? “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under. If so, you may have heard. If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty.

If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day. Did your nonprofit organization file a form 990 after the due date? Can penalties for filing form 990 late be abated? Are you faced with paying a penalty to the irs? If so, you may have heard. “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty.

Did your nonprofit organization file a form 990 after the due date? If so, you may have heard. If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day. “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under. Can penalties for filing form 990 late be abated? Failure to timely file the information return, absent reasonable cause, can give rise to a penalty. Are you faced with paying a penalty to the irs?

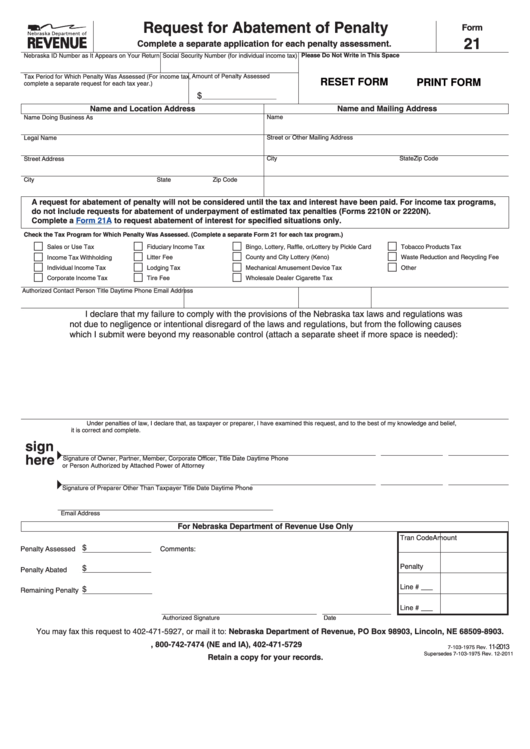

Abatement Of Irs Penalties Sample Letter

Did your nonprofit organization file a form 990 after the due date? Failure to timely file the information return, absent reasonable cause, can give rise to a penalty. If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day. “an affirmative.

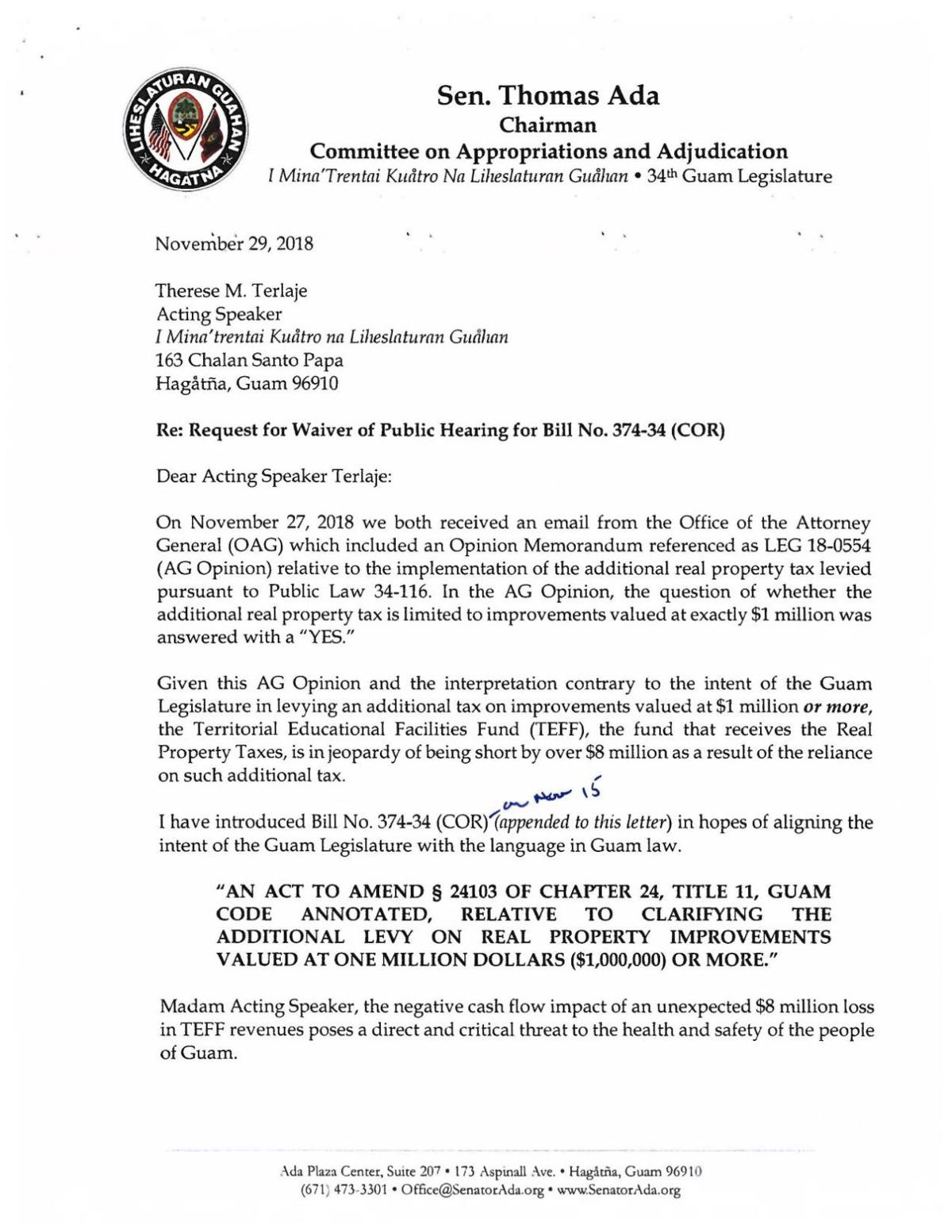

Form 990 LateFiling Penalty Abatement Manual, Example Letters and

Are you faced with paying a penalty to the irs? If so, you may have heard. Did your nonprofit organization file a form 990 after the due date? Can penalties for filing form 990 late be abated? “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made.

Sample Irs Letter To Request First Time Penalty Abatement

Can penalties for filing form 990 late be abated? Are you faced with paying a penalty to the irs? If so, you may have heard. “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under. Did your nonprofit organization file a form 990 after the due.

Penalty Abatement Letter Sample

Failure to timely file the information return, absent reasonable cause, can give rise to a penalty. “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under. Can penalties for filing form 990 late be abated? Did your nonprofit organization file a form 990 after the due.

Penalty Relief Due To Reasonable Cause Sample Letter

Did your nonprofit organization file a form 990 after the due date? Failure to timely file the information return, absent reasonable cause, can give rise to a penalty. If so, you may have heard. Are you faced with paying a penalty to the irs? Can penalties for filing form 990 late be abated?

Form 990 Penalty Abatement Letter

Are you faced with paying a penalty to the irs? “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under. If so, you may have heard. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty. Did your nonprofit organization.

How to Write a Form 990 Late Filing Penalty Abatement Letter

If so, you may have heard. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty. Did your nonprofit organization file a form 990 after the due date? “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under. Can penalties.

990 late filing penalty Form 990 penalties for nonprofits

If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day. Are you faced with paying a penalty to the irs? If so, you may have heard. Did your nonprofit organization file a form 990 after the due date? Failure to.

Irs Penalty Abatement Templates prntbl.concejomunicipaldechinu.gov.co

Did your nonprofit organization file a form 990 after the due date? “an affirmative showing of reasonable cause must be made in the form of a written statement, containing a declaration that it is made under. Are you faced with paying a penalty to the irs? If an organization fails to file a required return by the due date (including.

S Corp Late Filing Penalty Abatement Letter Sample

If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty. Did your nonprofit organization file a form 990 after the due date? If so,.

“An Affirmative Showing Of Reasonable Cause Must Be Made In The Form Of A Written Statement, Containing A Declaration That It Is Made Under.

If an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day. Can penalties for filing form 990 late be abated? Failure to timely file the information return, absent reasonable cause, can give rise to a penalty. If so, you may have heard.

Are You Faced With Paying A Penalty To The Irs?

Did your nonprofit organization file a form 990 after the due date?

/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)