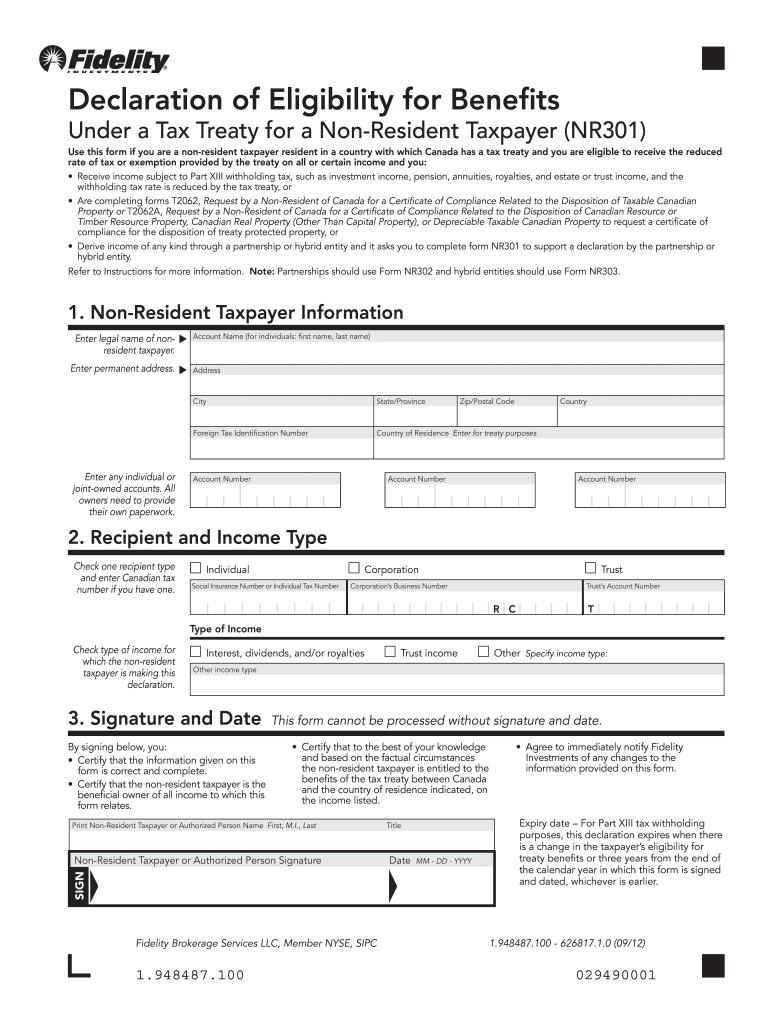

Form Nr 301

Form Nr 301 - Payers should get written confirmation of beneficial ownership and residency and eligibility for treaty benefits under the treaty between. Request a completed form nr301 or equivalent information before applying a reduced rate of withholding tax. Collect additional documentation or form nr301 if the treaty benefit applies only under certain conditions (such as when the amounts must be.

Collect additional documentation or form nr301 if the treaty benefit applies only under certain conditions (such as when the amounts must be. Payers should get written confirmation of beneficial ownership and residency and eligibility for treaty benefits under the treaty between. Request a completed form nr301 or equivalent information before applying a reduced rate of withholding tax.

Payers should get written confirmation of beneficial ownership and residency and eligibility for treaty benefits under the treaty between. Collect additional documentation or form nr301 if the treaty benefit applies only under certain conditions (such as when the amounts must be. Request a completed form nr301 or equivalent information before applying a reduced rate of withholding tax.

GT FORM HF2.1 HYBRID BRUSHED TITANIUM 20X10.5 5X114.3 WHEEL ONLY

Collect additional documentation or form nr301 if the treaty benefit applies only under certain conditions (such as when the amounts must be. Payers should get written confirmation of beneficial ownership and residency and eligibility for treaty benefits under the treaty between. Request a completed form nr301 or equivalent information before applying a reduced rate of withholding tax.

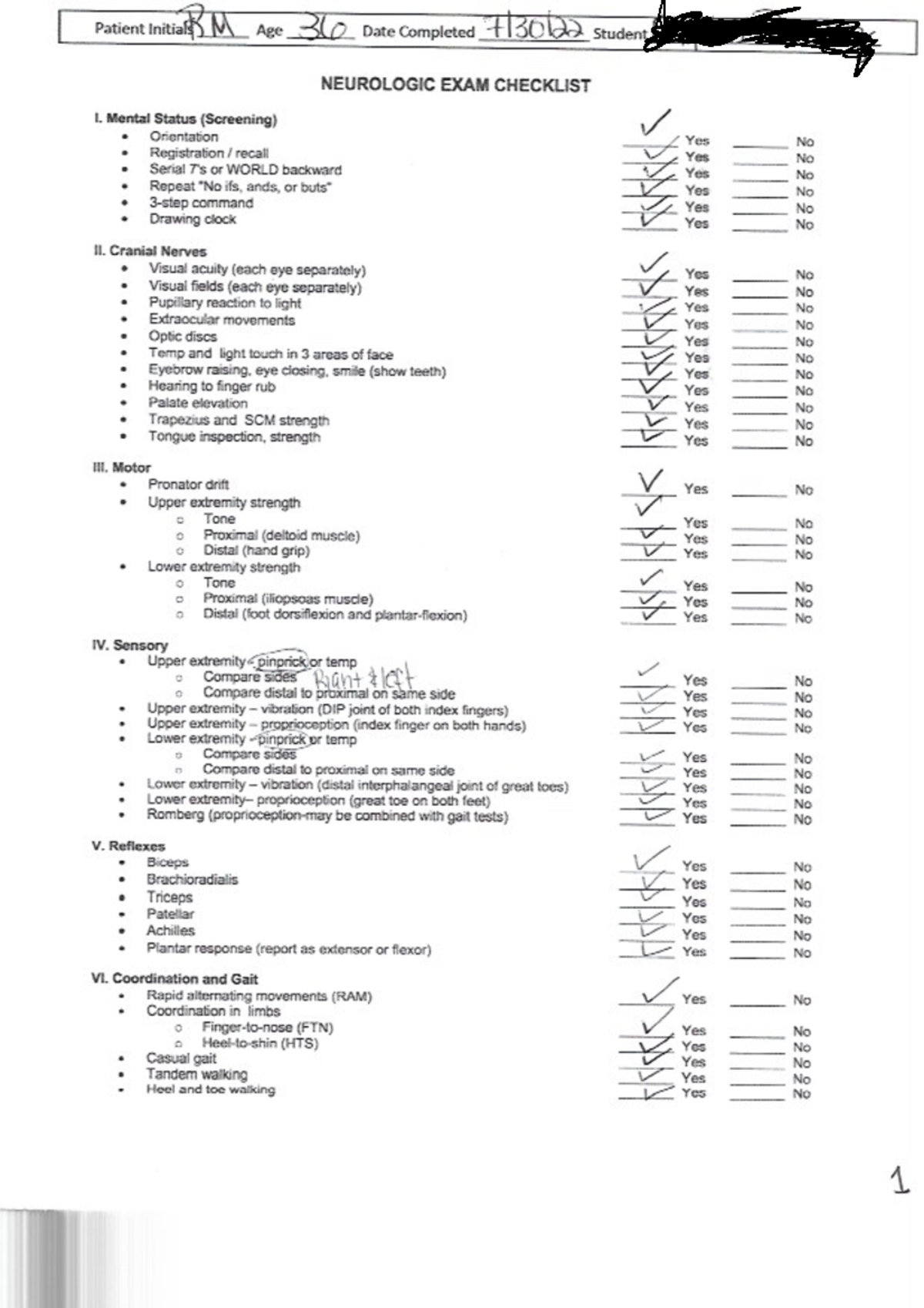

Week 4 Neurological Assessment Form NR304 Studocu

Collect additional documentation or form nr301 if the treaty benefit applies only under certain conditions (such as when the amounts must be. Request a completed form nr301 or equivalent information before applying a reduced rate of withholding tax. Payers should get written confirmation of beneficial ownership and residency and eligibility for treaty benefits under the treaty between.

Dop (nr. 301) Geertsema Staal

Request a completed form nr301 or equivalent information before applying a reduced rate of withholding tax. Collect additional documentation or form nr301 if the treaty benefit applies only under certain conditions (such as when the amounts must be. Payers should get written confirmation of beneficial ownership and residency and eligibility for treaty benefits under the treaty between.

Nr301 20122024 Form Fill Out and Sign Printable PDF Template

Request a completed form nr301 or equivalent information before applying a reduced rate of withholding tax. Payers should get written confirmation of beneficial ownership and residency and eligibility for treaty benefits under the treaty between. Collect additional documentation or form nr301 if the treaty benefit applies only under certain conditions (such as when the amounts must be.

スナックみほ ️ 1948416 301 1

Payers should get written confirmation of beneficial ownership and residency and eligibility for treaty benefits under the treaty between. Request a completed form nr301 or equivalent information before applying a reduced rate of withholding tax. Collect additional documentation or form nr301 if the treaty benefit applies only under certain conditions (such as when the amounts must be.

Fillable Online form 1nr/py Fax Email Print pdfFiller

Collect additional documentation or form nr301 if the treaty benefit applies only under certain conditions (such as when the amounts must be. Request a completed form nr301 or equivalent information before applying a reduced rate of withholding tax. Payers should get written confirmation of beneficial ownership and residency and eligibility for treaty benefits under the treaty between.

Air Max Waffle 'Action Green and Altitude Green' (FV6946301) release

Payers should get written confirmation of beneficial ownership and residency and eligibility for treaty benefits under the treaty between. Collect additional documentation or form nr301 if the treaty benefit applies only under certain conditions (such as when the amounts must be. Request a completed form nr301 or equivalent information before applying a reduced rate of withholding tax.

OSHA Form 301 Requirements learn what your obligations are

Collect additional documentation or form nr301 if the treaty benefit applies only under certain conditions (such as when the amounts must be. Request a completed form nr301 or equivalent information before applying a reduced rate of withholding tax. Payers should get written confirmation of beneficial ownership and residency and eligibility for treaty benefits under the treaty between.

form NR Gov.uk

Collect additional documentation or form nr301 if the treaty benefit applies only under certain conditions (such as when the amounts must be. Payers should get written confirmation of beneficial ownership and residency and eligibility for treaty benefits under the treaty between. Request a completed form nr301 or equivalent information before applying a reduced rate of withholding tax.

Form Nr303 Fill Out and Sign Printable PDF Template airSlate SignNow

Request a completed form nr301 or equivalent information before applying a reduced rate of withholding tax. Payers should get written confirmation of beneficial ownership and residency and eligibility for treaty benefits under the treaty between. Collect additional documentation or form nr301 if the treaty benefit applies only under certain conditions (such as when the amounts must be.

Payers Should Get Written Confirmation Of Beneficial Ownership And Residency And Eligibility For Treaty Benefits Under The Treaty Between.

Collect additional documentation or form nr301 if the treaty benefit applies only under certain conditions (such as when the amounts must be. Request a completed form nr301 or equivalent information before applying a reduced rate of withholding tax.