Ga Tax Liens

Ga Tax Liens - And will remain on record. Search for liens filed on real and personal property in georgia by name, county, book and page. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. Find pending liens issued by the georgia department. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. Search the georgia consolidated lien indexes alphabetically by name. A lien is a claim or hold on a taxpayer's property until overdue taxes have been payed. Liens may be also known as a fi.fa.

Find pending liens issued by the georgia department. Search for liens filed on real and personal property in georgia by name, county, book and page. A lien is a claim or hold on a taxpayer's property until overdue taxes have been payed. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. Search the georgia consolidated lien indexes alphabetically by name. Liens may be also known as a fi.fa. And will remain on record.

Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. Liens may be also known as a fi.fa. Search for liens filed on real and personal property in georgia by name, county, book and page. A lien is a claim or hold on a taxpayer's property until overdue taxes have been payed. Search the georgia consolidated lien indexes alphabetically by name. Find pending liens issued by the georgia department. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. And will remain on record.

Investing In Tax Liens Alts.co

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. And will remain on record. A lien is a claim or hold on a taxpayer's property until overdue taxes have been payed. Search for liens filed on real and personal property in.

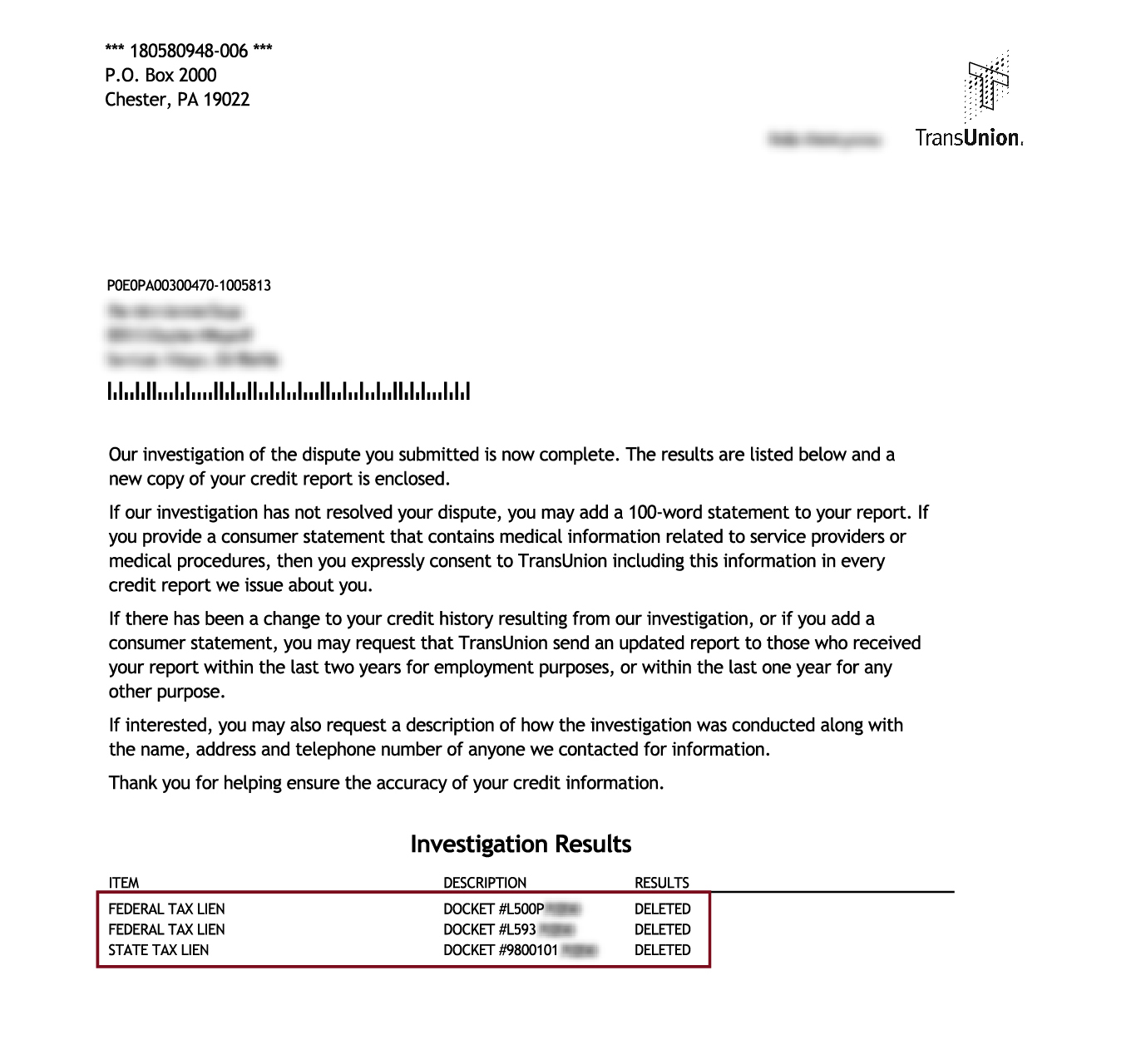

How to Remove an IRS Tax Lien from Your Credit Report

A lien is a claim or hold on a taxpayer's property until overdue taxes have been payed. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. And will remain on record. Liens may be also known as a fi.fa. Search the.

Entrepreneur's Tax Guide

And will remain on record. Search for liens filed on real and personal property in georgia by name, county, book and page. Find pending liens issued by the georgia department. Liens may be also known as a fi.fa. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases,.

Tax Liens An Overview CheckBook IRA LLC

A lien is a claim or hold on a taxpayer's property until overdue taxes have been payed. Search the georgia consolidated lien indexes alphabetically by name. And will remain on record. Find pending liens issued by the georgia department. Search for liens filed on real and personal property in georgia by name, county, book and page.

Fillable Online

A lien is a claim or hold on a taxpayer's property until overdue taxes have been payed. Search for liens filed on real and personal property in georgia by name, county, book and page. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. In georgia, tax liens.

TAX Consultancy Firm Gurugram

And will remain on record. Search the georgia consolidated lien indexes alphabetically by name. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a.

Is There a Statute of Limitations on IRS Tax Liens? SH Block Tax Services

Search the georgia consolidated lien indexes alphabetically by name. A lien is a claim or hold on a taxpayer's property until overdue taxes have been payed. And will remain on record. Liens may be also known as a fi.fa. Search for liens filed on real and personal property in georgia by name, county, book and page.

Tax Preparation Business Startup

And will remain on record. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. Search the georgia consolidated lien indexes alphabetically by name. A lien is a claim or hold on a taxpayer's property until overdue taxes have been payed. Liens may be also known as a.

Fulton County Ga Property Tax Sales Tax Preparation Classes

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. A lien is a claim or hold on a taxpayer's.

Tax Solution Point Purnia

Search for liens filed on real and personal property in georgia by name, county, book and page. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. Liens may be also known as a fi.fa. Find state tax liens and related documents.

In Georgia, Tax Liens Stay In Place Until They Expire, Or You Pay Your Tax Debt In Full, But In Some Cases, You Can Convince The Dor To.

Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. Search the georgia consolidated lien indexes alphabetically by name. Liens may be also known as a fi.fa. And will remain on record.

Find Pending Liens Issued By The Georgia Department.

Search for liens filed on real and personal property in georgia by name, county, book and page. A lien is a claim or hold on a taxpayer's property until overdue taxes have been payed.