How Do I Know If I Have A Tax Lien

How Do I Know If I Have A Tax Lien - If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a federal tax lien on your assets: What do i need to know? Get information about a federal tax lien, including how to get rid of a lien, how a lien affects you and how to avoid a lien. Alternatively, you can visit the local. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. To get the total amount due on a tax debt,. Depending on the state, you’ll have to use ucc or tax lien search option and verify your identity when checking if the irs has a lien on your property. The irs centralized lien unit is a. The government also may file a notice of federal tax lien (nftl). Notices of federal tax lien.

If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a federal tax lien on your assets: The irs centralized lien unit is a. Depending on the state, you’ll have to use ucc or tax lien search option and verify your identity when checking if the irs has a lien on your property. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. Alternatively, you can visit the local. To get the total amount due on a tax debt,. Notices of federal tax lien. The government also may file a notice of federal tax lien (nftl). Get information about a federal tax lien, including how to get rid of a lien, how a lien affects you and how to avoid a lien. What do i need to know?

If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a federal tax lien on your assets: What do i need to know? The irs centralized lien unit is a. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. Get information about a federal tax lien, including how to get rid of a lien, how a lien affects you and how to avoid a lien. To get the total amount due on a tax debt,. The government also may file a notice of federal tax lien (nftl). Alternatively, you can visit the local. Depending on the state, you’ll have to use ucc or tax lien search option and verify your identity when checking if the irs has a lien on your property.

Tax Lien Lists Leads

If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a federal tax lien on your assets: What do i need to know? Notices of federal tax lien. The government also may file a notice of federal tax lien (nftl). For general lien information, taxpayers.

Tax Lien Investing Tips Which States have tax sales in the next 30

A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. The government also may file a notice of federal tax lien (nftl). Alternatively, you can visit the local. If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to.

Federal tax lien on foreclosed property laderdriver

What do i need to know? For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. Alternatively, you can visit the local. Get information about a federal tax lien, including how to get rid of a lien, how a lien affects you and how to avoid a lien. A federal tax lien arises.

Tax Lien Investing What to Know CheckBook IRA LLC

To get the total amount due on a tax debt,. What do i need to know? The irs centralized lien unit is a. Alternatively, you can visit the local. Get information about a federal tax lien, including how to get rid of a lien, how a lien affects you and how to avoid a lien.

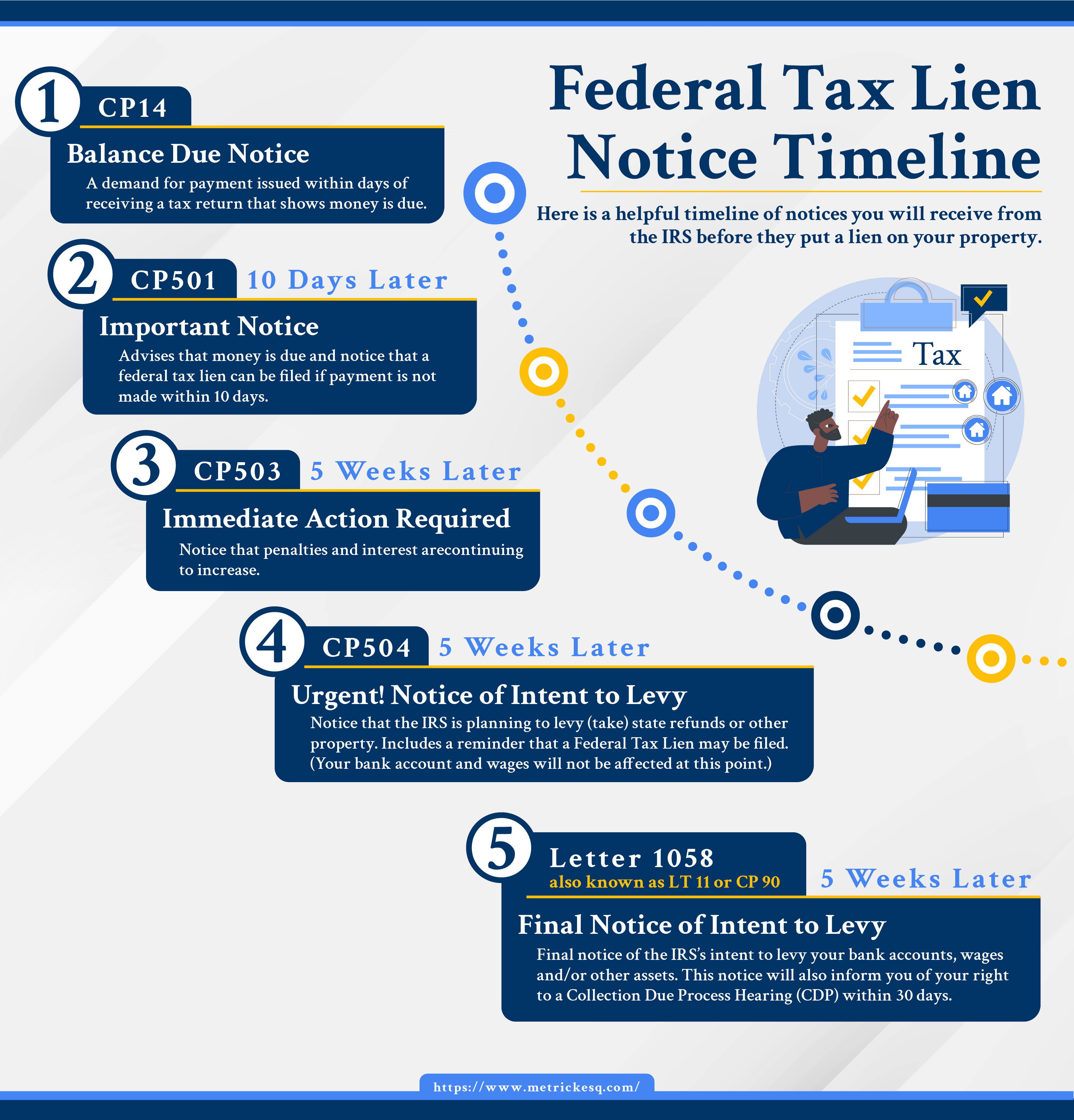

Federal Tax Lien Resolution Services Ira J. Metrick, Esq.

If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a federal tax lien on your assets: Depending on the state, you’ll have to use ucc or tax lien search option and verify your identity when checking if the irs has a lien on your.

Things to know before investing in tax lien Latest Infographics

The government also may file a notice of federal tax lien (nftl). Notices of federal tax lien. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. Alternatively, you can visit the local.

Things to Know About Tax Lien Certificate and Its Investment Method

For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. Alternatively, you can visit the local. Notices of federal tax lien. If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a federal tax lien on your assets:.

TAX LIEN CODE by Tax Lien Code Issuu

For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a federal tax lien on your assets: Notices of federal tax lien. Alternatively, you can visit the local..

What Causes a Tax Lien? Clean Slate Tax

For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. Get information about a federal tax lien, including how to get rid of a lien, how a lien affects you and how to avoid a lien. What do i need to know? A federal tax lien arises automatically if you don’t pay the.

Four things to know about tax lien investing Latest Infographics

A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. The irs centralized lien unit is a. To get the total amount due on a tax debt,. Get information about a federal tax lien, including how to get rid of a lien, how a lien affects you and how to avoid a.

A Federal Tax Lien Arises Automatically If You Don’t Pay The Amount Due After Receiving Your First Bill.

Depending on the state, you’ll have to use ucc or tax lien search option and verify your identity when checking if the irs has a lien on your property. Get information about a federal tax lien, including how to get rid of a lien, how a lien affects you and how to avoid a lien. The government also may file a notice of federal tax lien (nftl). For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov.

What Do I Need To Know?

If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a federal tax lien on your assets: Alternatively, you can visit the local. The irs centralized lien unit is a. Notices of federal tax lien.