How Do You Change The Sales Tax Rate In Quickbooks

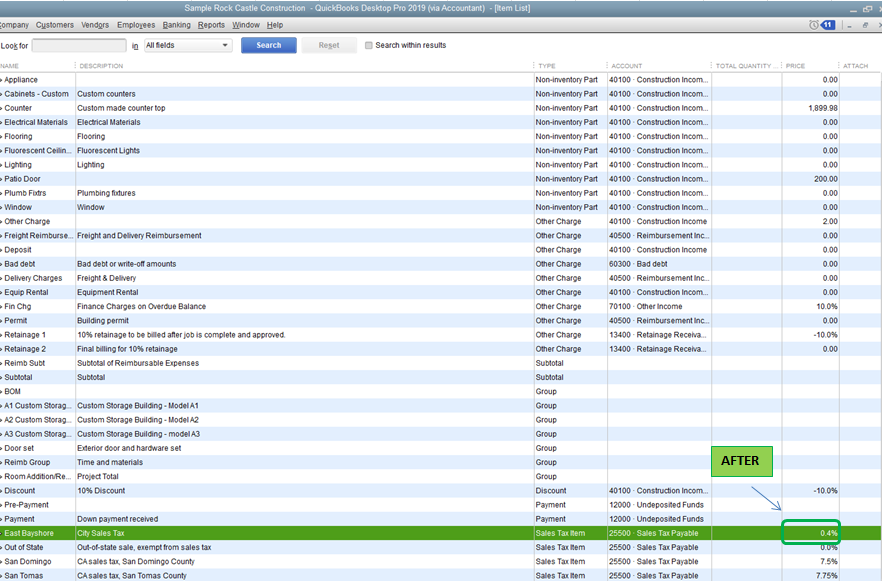

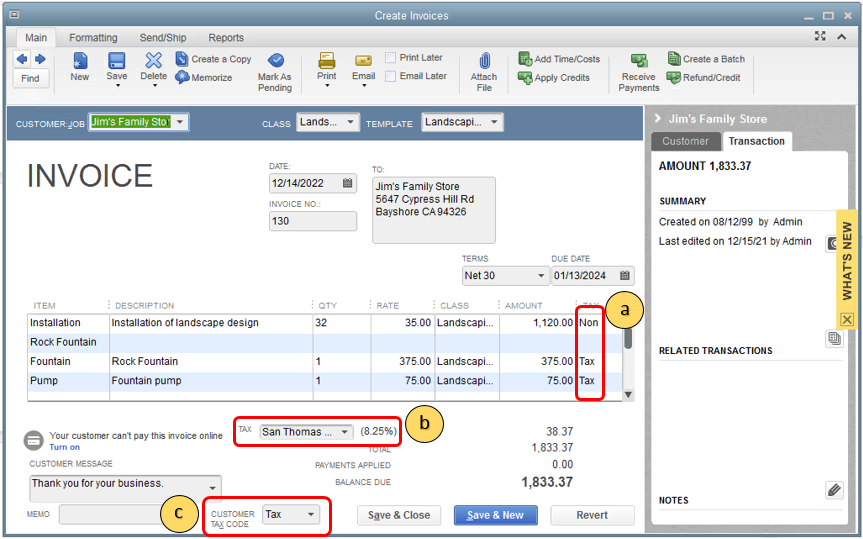

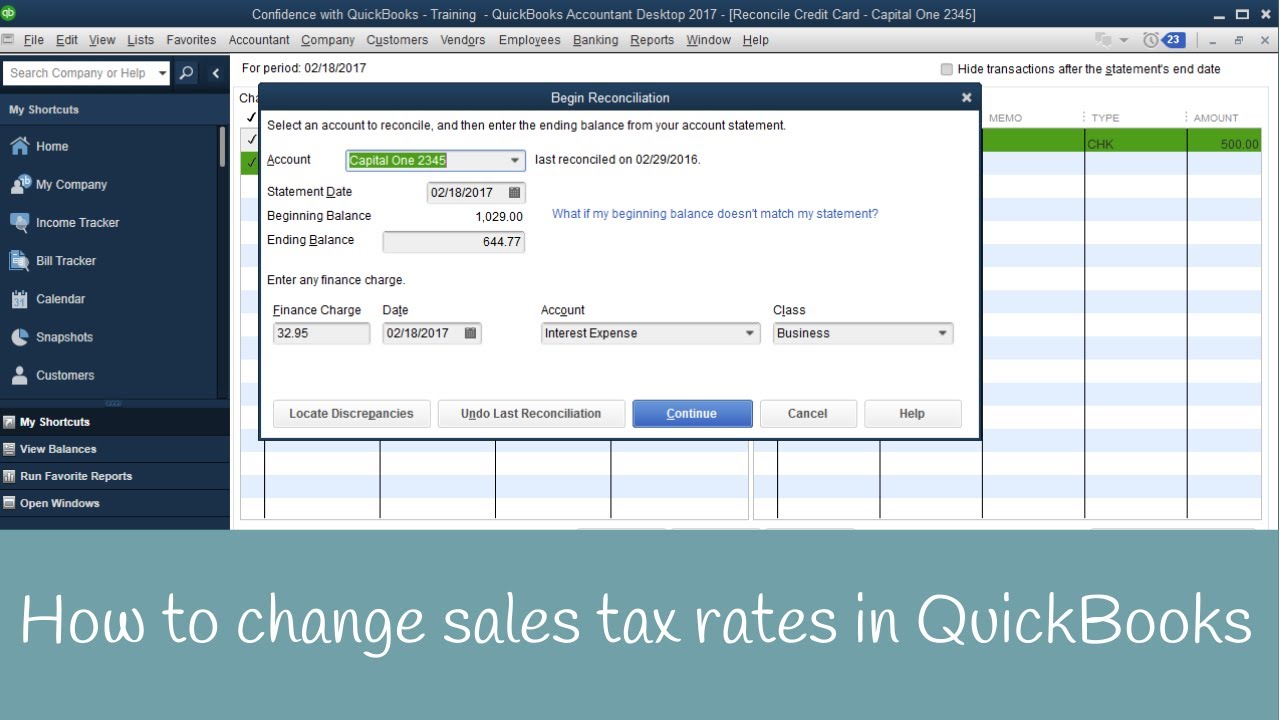

How Do You Change The Sales Tax Rate In Quickbooks - Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. You can only edit component rates. You can edit a sales tax rate if you need to make changes to it. When you use the automated sales tax feature, quickbooks automatically generates the tax agencies and sales tax rates you need. To change the sales tax rate in quickbooks, you need to access the sales tax settings. To edit a combined rate,.

To edit a combined rate,. When you use the automated sales tax feature, quickbooks automatically generates the tax agencies and sales tax rates you need. To change the sales tax rate in quickbooks, you need to access the sales tax settings. You can edit a sales tax rate if you need to make changes to it. You can only edit component rates. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the.

To change the sales tax rate in quickbooks, you need to access the sales tax settings. You can only edit component rates. You can edit a sales tax rate if you need to make changes to it. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. When you use the automated sales tax feature, quickbooks automatically generates the tax agencies and sales tax rates you need. To edit a combined rate,.

How to Setup Sales Tax in Quickbooks YouTube

You can only edit component rates. You can edit a sales tax rate if you need to make changes to it. To edit a combined rate,. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. To change the sales tax rate in quickbooks, you need to access the.

Solved Change the sales tax rate for all customers

Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. To edit a combined rate,. When you use the automated sales tax feature, quickbooks automatically generates the tax agencies and sales tax rates you need. You can edit a sales tax rate if you need to make changes to.

How To Change Sales Tax Rate In Quickbooks

You can only edit component rates. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. You can edit a sales tax rate if you need to make changes to it. To edit a combined rate,. When you use the automated sales tax feature, quickbooks automatically generates the tax.

How Do You Add Sales Tax In Quickbooks Tax Walls

When you use the automated sales tax feature, quickbooks automatically generates the tax agencies and sales tax rates you need. To edit a combined rate,. To change the sales tax rate in quickbooks, you need to access the sales tax settings. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments.

How To Change Sales Tax Rate In Quickbooks

To change the sales tax rate in quickbooks, you need to access the sales tax settings. To edit a combined rate,. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. You can only edit component rates. You can edit a sales tax rate if you need to make.

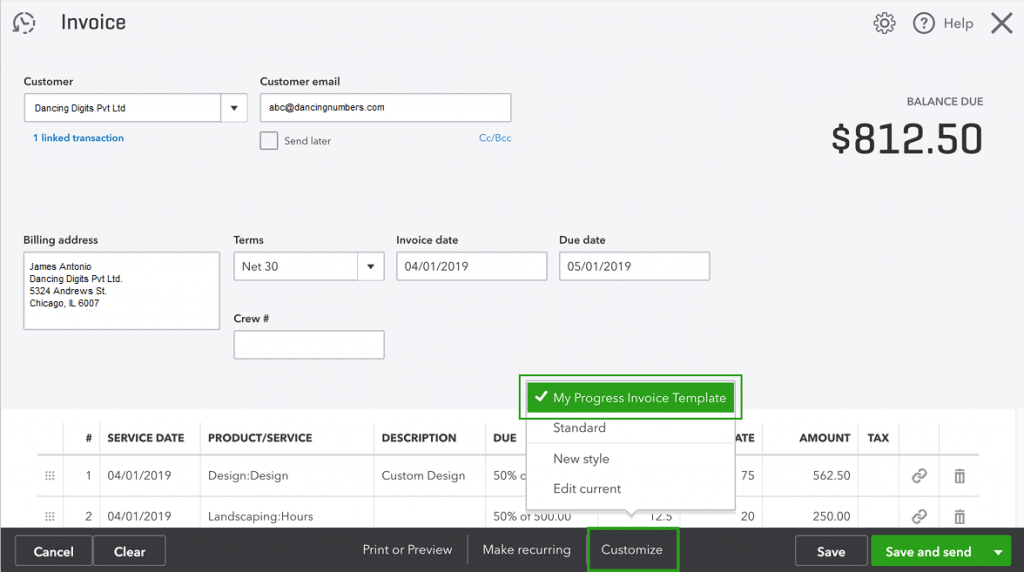

How to Set up and Send Progress Invoices in QuickBooks Online

When you use the automated sales tax feature, quickbooks automatically generates the tax agencies and sales tax rates you need. To change the sales tax rate in quickbooks, you need to access the sales tax settings. You can only edit component rates. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary.

How to collect and pay sales tax in QuickBooks Desktop YouTube

Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. You can only edit component rates. To edit a combined rate,. When you use the automated sales tax feature, quickbooks automatically generates the tax agencies and sales tax rates you need. You can edit a sales tax rate if.

Sales Tax Rates Effective October 1, 2022 News Post Varney & Associates

You can only edit component rates. You can edit a sales tax rate if you need to make changes to it. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. When you use the automated sales tax feature, quickbooks automatically generates the tax agencies and sales tax rates.

How to update or change sales tax rates in QuickBooks YouTube

To change the sales tax rate in quickbooks, you need to access the sales tax settings. When you use the automated sales tax feature, quickbooks automatically generates the tax agencies and sales tax rates you need. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. To edit a.

How to Change Tax Rates in Quickbooks Guide) LiveFlow

When you use the automated sales tax feature, quickbooks automatically generates the tax agencies and sales tax rates you need. To edit a combined rate,. To change the sales tax rate in quickbooks, you need to access the sales tax settings. You can only edit component rates. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax.

To Edit A Combined Rate,.

To change the sales tax rate in quickbooks, you need to access the sales tax settings. You can edit a sales tax rate if you need to make changes to it. When you use the automated sales tax feature, quickbooks automatically generates the tax agencies and sales tax rates you need. You can only edit component rates.