How Do You Write Off Bad Debt In Quickbooks

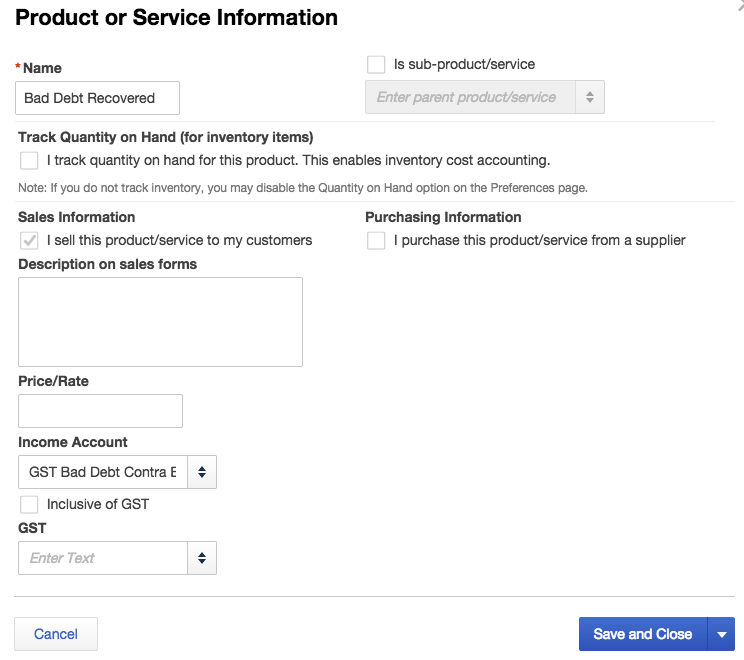

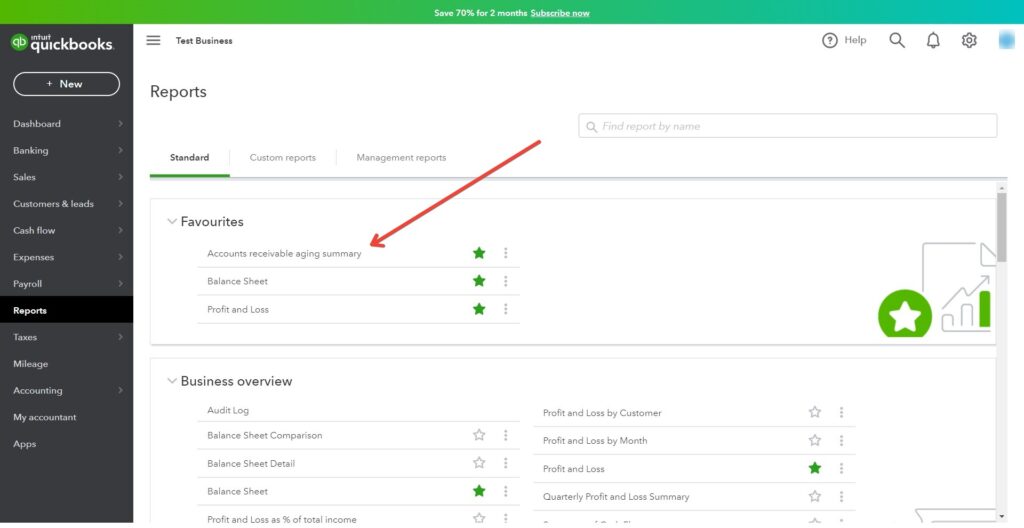

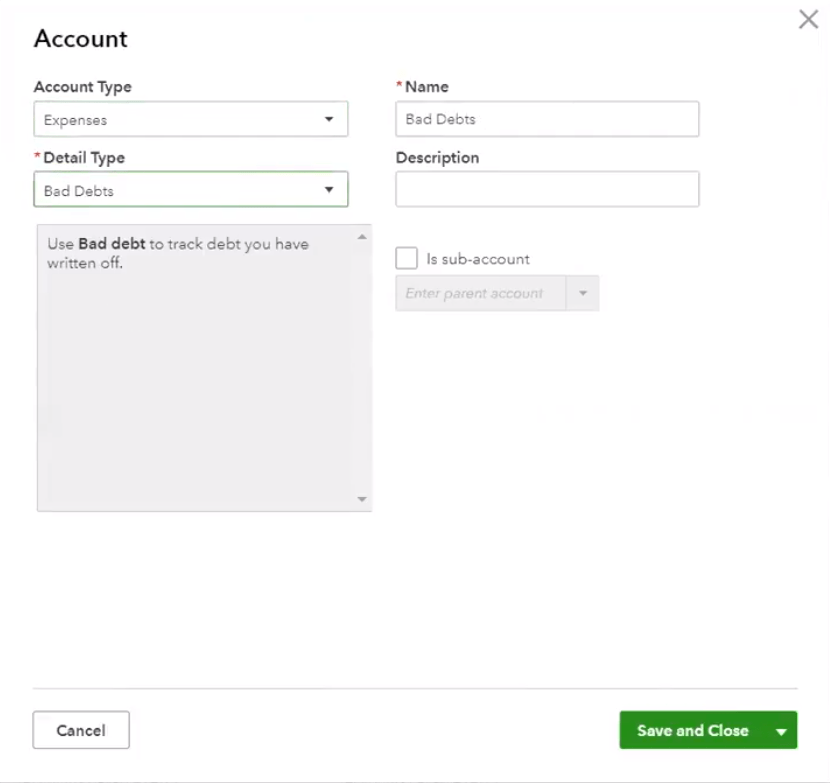

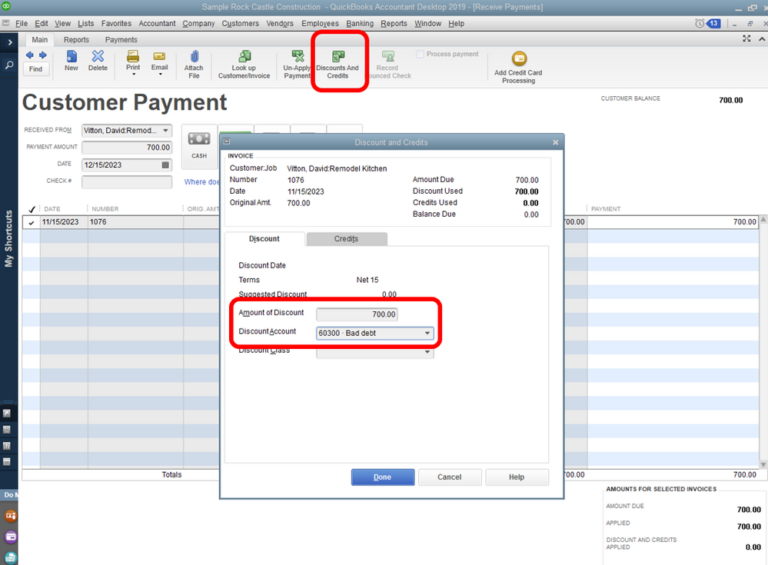

How Do You Write Off Bad Debt In Quickbooks - Learn how to efficiently write off bad debt in quickbooks, understand tax implications, and manage reversals with this comprehensive. When invoices you send in quickbooks become uncollectible, you need to record them as a bad debt and write them off. How to write off bad debt in quickbooks in 5 steps. When invoices you send in quickbooks desktop become uncollectible, you need to record them as a bad debt and write. If you’ve decided it’s time to write off bad debt, there’s an easy and straightforward.

Learn how to efficiently write off bad debt in quickbooks, understand tax implications, and manage reversals with this comprehensive. When invoices you send in quickbooks desktop become uncollectible, you need to record them as a bad debt and write. If you’ve decided it’s time to write off bad debt, there’s an easy and straightforward. How to write off bad debt in quickbooks in 5 steps. When invoices you send in quickbooks become uncollectible, you need to record them as a bad debt and write them off.

When invoices you send in quickbooks become uncollectible, you need to record them as a bad debt and write them off. When invoices you send in quickbooks desktop become uncollectible, you need to record them as a bad debt and write. How to write off bad debt in quickbooks in 5 steps. If you’ve decided it’s time to write off bad debt, there’s an easy and straightforward. Learn how to efficiently write off bad debt in quickbooks, understand tax implications, and manage reversals with this comprehensive.

How to Write Off Bad Debt in QuickBooks Desktop & Online?

When invoices you send in quickbooks desktop become uncollectible, you need to record them as a bad debt and write. When invoices you send in quickbooks become uncollectible, you need to record them as a bad debt and write them off. If you’ve decided it’s time to write off bad debt, there’s an easy and straightforward. How to write off.

bad debt quickbooks

When invoices you send in quickbooks become uncollectible, you need to record them as a bad debt and write them off. Learn how to efficiently write off bad debt in quickbooks, understand tax implications, and manage reversals with this comprehensive. How to write off bad debt in quickbooks in 5 steps. If you’ve decided it’s time to write off bad.

Clearing the Books How to Write Off Bad Debt in QuickBooks by jeaf

If you’ve decided it’s time to write off bad debt, there’s an easy and straightforward. How to write off bad debt in quickbooks in 5 steps. When invoices you send in quickbooks desktop become uncollectible, you need to record them as a bad debt and write. When invoices you send in quickbooks become uncollectible, you need to record them as.

How Do You Write Off Bad Debt In Quickbooks

When invoices you send in quickbooks become uncollectible, you need to record them as a bad debt and write them off. Learn how to efficiently write off bad debt in quickbooks, understand tax implications, and manage reversals with this comprehensive. If you’ve decided it’s time to write off bad debt, there’s an easy and straightforward. When invoices you send in.

How to Write Off Bad Debt in Quickbooks The Digital Merchant

Learn how to efficiently write off bad debt in quickbooks, understand tax implications, and manage reversals with this comprehensive. When invoices you send in quickbooks desktop become uncollectible, you need to record them as a bad debt and write. If you’ve decided it’s time to write off bad debt, there’s an easy and straightforward. When invoices you send in quickbooks.

How to Write off Bad Debts in QuickBooks Desktop and Online

How to write off bad debt in quickbooks in 5 steps. When invoices you send in quickbooks desktop become uncollectible, you need to record them as a bad debt and write. Learn how to efficiently write off bad debt in quickbooks, understand tax implications, and manage reversals with this comprehensive. When invoices you send in quickbooks become uncollectible, you need.

How to write off bad debt in QuickBooks LiveFlow

If you’ve decided it’s time to write off bad debt, there’s an easy and straightforward. When invoices you send in quickbooks become uncollectible, you need to record them as a bad debt and write them off. When invoices you send in quickbooks desktop become uncollectible, you need to record them as a bad debt and write. Learn how to efficiently.

How to Write off Bad Debts in QuickBooks Desktop and Online

How to write off bad debt in quickbooks in 5 steps. If you’ve decided it’s time to write off bad debt, there’s an easy and straightforward. Learn how to efficiently write off bad debt in quickbooks, understand tax implications, and manage reversals with this comprehensive. When invoices you send in quickbooks desktop become uncollectible, you need to record them as.

Can You Write Off Tools at Noel Cormier blog

When invoices you send in quickbooks become uncollectible, you need to record them as a bad debt and write them off. Learn how to efficiently write off bad debt in quickbooks, understand tax implications, and manage reversals with this comprehensive. How to write off bad debt in quickbooks in 5 steps. If you’ve decided it’s time to write off bad.

How Do You Write Off Bad Debt In Quickbooks

When invoices you send in quickbooks become uncollectible, you need to record them as a bad debt and write them off. How to write off bad debt in quickbooks in 5 steps. Learn how to efficiently write off bad debt in quickbooks, understand tax implications, and manage reversals with this comprehensive. If you’ve decided it’s time to write off bad.

When Invoices You Send In Quickbooks Desktop Become Uncollectible, You Need To Record Them As A Bad Debt And Write.

How to write off bad debt in quickbooks in 5 steps. When invoices you send in quickbooks become uncollectible, you need to record them as a bad debt and write them off. Learn how to efficiently write off bad debt in quickbooks, understand tax implications, and manage reversals with this comprehensive. If you’ve decided it’s time to write off bad debt, there’s an easy and straightforward.