How Does A Negative Equity Account Affect The Balance Sheet

How Does A Negative Equity Account Affect The Balance Sheet - Explore the implications of negative equity on a balance sheet and learn effective strategies to manage and mitigate its impact. A highly leveraged company can represent negative equity on its balance sheet as equity is valued at book values. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. It occurs when a company’s. While positive equity reflects a healthy financial position, a negative equity account can have significant consequences.

Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. It occurs when a company’s. While positive equity reflects a healthy financial position, a negative equity account can have significant consequences. Explore the implications of negative equity on a balance sheet and learn effective strategies to manage and mitigate its impact. A highly leveraged company can represent negative equity on its balance sheet as equity is valued at book values.

While positive equity reflects a healthy financial position, a negative equity account can have significant consequences. Explore the implications of negative equity on a balance sheet and learn effective strategies to manage and mitigate its impact. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. It occurs when a company’s. A highly leveraged company can represent negative equity on its balance sheet as equity is valued at book values.

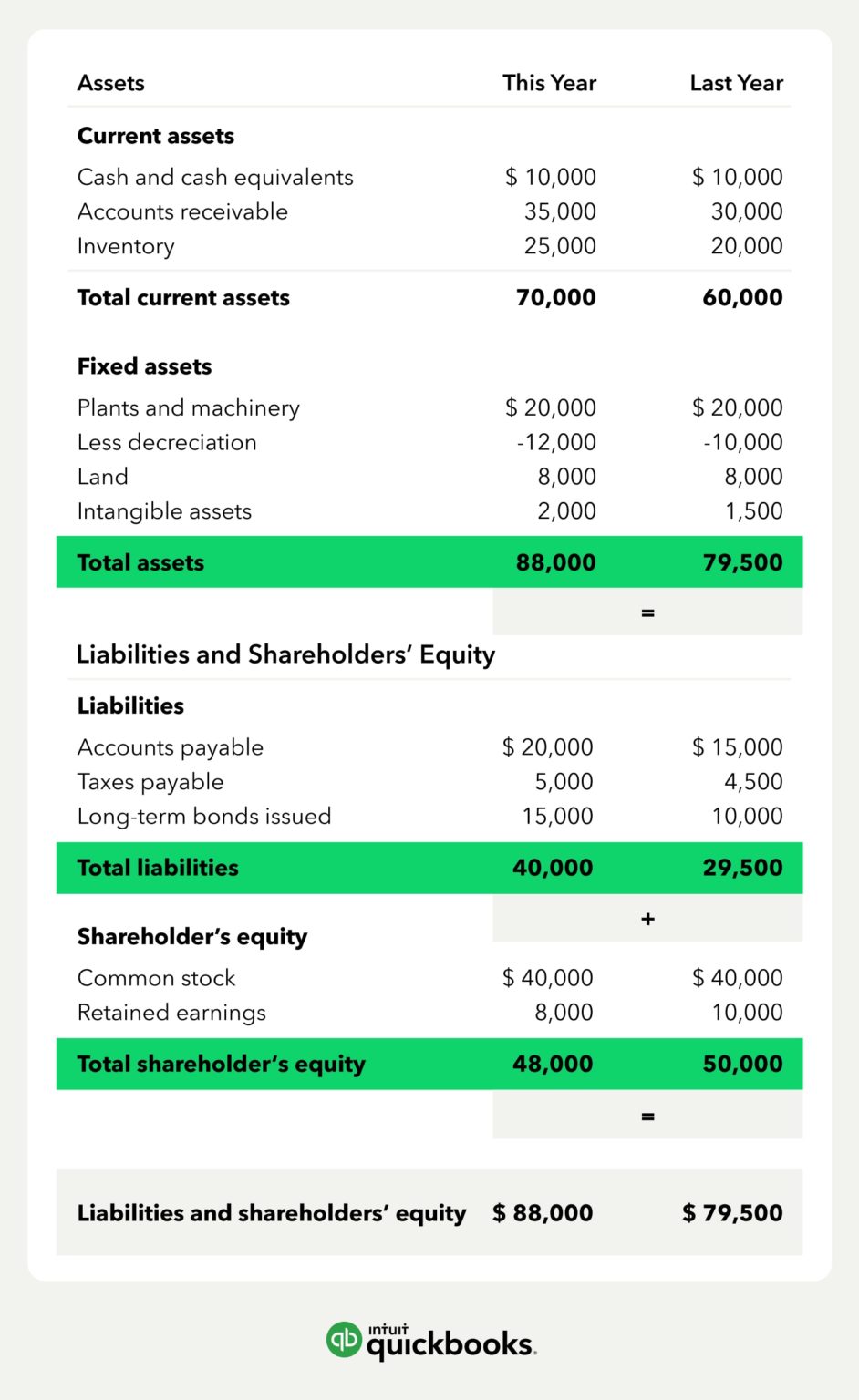

How Do You Calculate a Company's Equity?

Explore the implications of negative equity on a balance sheet and learn effective strategies to manage and mitigate its impact. It occurs when a company’s. While positive equity reflects a healthy financial position, a negative equity account can have significant consequences. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. A highly leveraged.

הון עצמי לבעלי מניות איך זה עובד ואיך לחשב את זה מילון מושגים

A highly leveraged company can represent negative equity on its balance sheet as equity is valued at book values. Explore the implications of negative equity on a balance sheet and learn effective strategies to manage and mitigate its impact. It occurs when a company’s. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company..

Understanding Negative Balances in Your Financial Statements Fortiviti

Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. It occurs when a company’s. A highly leveraged company can represent negative equity on its balance sheet as equity is valued at book values. Explore the implications of negative equity on a balance sheet and learn effective strategies to manage and mitigate its impact..

How Does A Negative Equity Account Affect The Balance Sheet? LiveWell

While positive equity reflects a healthy financial position, a negative equity account can have significant consequences. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. A highly leveraged company can represent negative equity on its balance sheet as equity is valued at book values. Explore the implications of negative equity on a balance.

Liabilities How to classify, Track and calculate liabilities?

It occurs when a company’s. While positive equity reflects a healthy financial position, a negative equity account can have significant consequences. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. Explore the implications of negative equity on a balance sheet and learn effective strategies to manage and mitigate its impact. A highly leveraged.

Owners’ Equity, Stockholders' Equity, Shareholders' Equity Business

While positive equity reflects a healthy financial position, a negative equity account can have significant consequences. It occurs when a company’s. A highly leveraged company can represent negative equity on its balance sheet as equity is valued at book values. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. Explore the implications of.

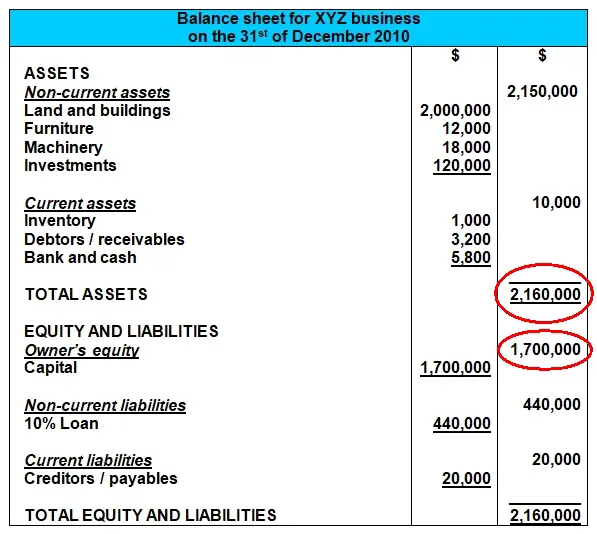

Negative Balance sheet

Explore the implications of negative equity on a balance sheet and learn effective strategies to manage and mitigate its impact. A highly leveraged company can represent negative equity on its balance sheet as equity is valued at book values. It occurs when a company’s. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company..

How to read and understand financial statements

Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. It occurs when a company’s. Explore the implications of negative equity on a balance sheet and learn effective strategies to manage and mitigate its impact. While positive equity reflects a healthy financial position, a negative equity account can have significant consequences. A highly leveraged.

Balance Sheet Key Indicators of Business Success

It occurs when a company’s. Explore the implications of negative equity on a balance sheet and learn effective strategies to manage and mitigate its impact. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. While positive equity reflects a healthy financial position, a negative equity account can have significant consequences. A highly leveraged.

What Is A Negative Equity Car Lease & How Does It Affect You?

Explore the implications of negative equity on a balance sheet and learn effective strategies to manage and mitigate its impact. Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. A highly leveraged company can represent negative equity on its balance sheet as equity is valued at book values. While positive equity reflects a.

A Highly Leveraged Company Can Represent Negative Equity On Its Balance Sheet As Equity Is Valued At Book Values.

Negative shareholders’ equity is a financial red flag that can signal deeper issues within a company. While positive equity reflects a healthy financial position, a negative equity account can have significant consequences. It occurs when a company’s. Explore the implications of negative equity on a balance sheet and learn effective strategies to manage and mitigate its impact.

:max_bytes(150000):strip_icc()/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)