How To Adjust Sales Tax Rate In Quickbooks

How To Adjust Sales Tax Rate In Quickbooks - In this comprehensive guide, we will walk you through the process of adjusting sales tax payable in quickbooks desktop and online, as well as. Learn how to edit sales tax rates in quickbooks online. The amount of sales tax you collect may increase or decrease depending on. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. Learn how to set up, edit, and deactivate your sales tax rate and settings. In the sales tax center, you can add and edit tax.

The amount of sales tax you collect may increase or decrease depending on. Learn how to set up, edit, and deactivate your sales tax rate and settings. In the sales tax center, you can add and edit tax. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. In this comprehensive guide, we will walk you through the process of adjusting sales tax payable in quickbooks desktop and online, as well as. Learn how to edit sales tax rates in quickbooks online.

In this comprehensive guide, we will walk you through the process of adjusting sales tax payable in quickbooks desktop and online, as well as. Learn how to edit sales tax rates in quickbooks online. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. Learn how to set up, edit, and deactivate your sales tax rate and settings. In the sales tax center, you can add and edit tax. The amount of sales tax you collect may increase or decrease depending on.

How to Adjust Sales Tax in QuickBooks

Learn how to edit sales tax rates in quickbooks online. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. Learn how to set up, edit, and deactivate your sales tax rate and settings. In the sales tax center, you can add and edit tax. The amount of sales.

How Do I Adjust Sales Tax Allocation on a Vendor Invoice? Discovery

Learn how to edit sales tax rates in quickbooks online. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. Learn how to set up, edit, and deactivate your sales tax rate and settings. In this comprehensive guide, we will walk you through the process of adjusting sales tax.

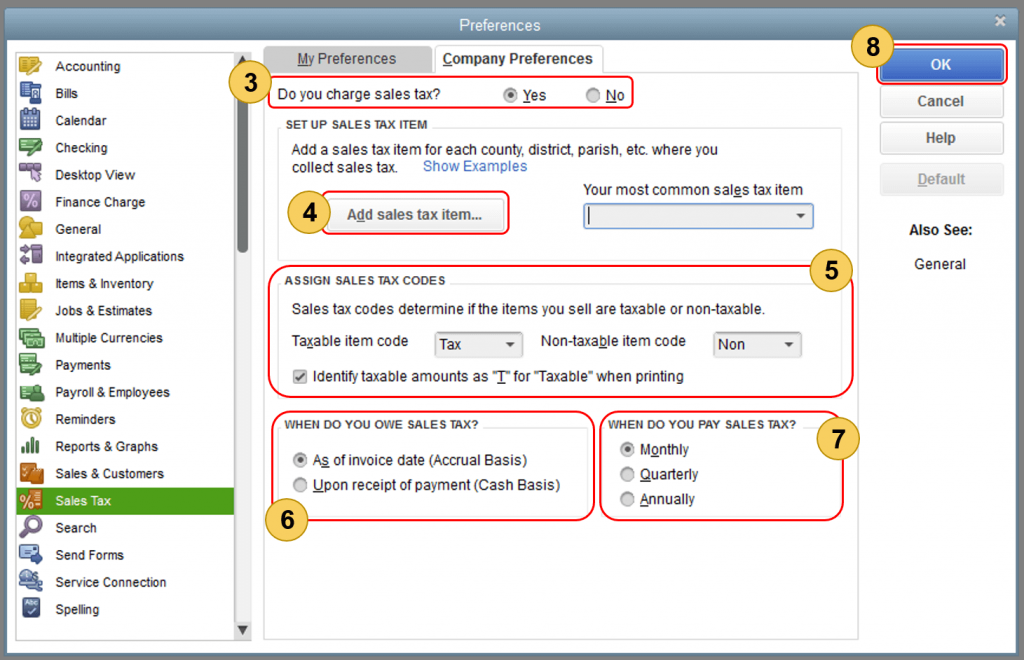

How to Set Up Sales Tax in QuickBooks Desktop?

In the sales tax center, you can add and edit tax. In this comprehensive guide, we will walk you through the process of adjusting sales tax payable in quickbooks desktop and online, as well as. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. The amount of sales.

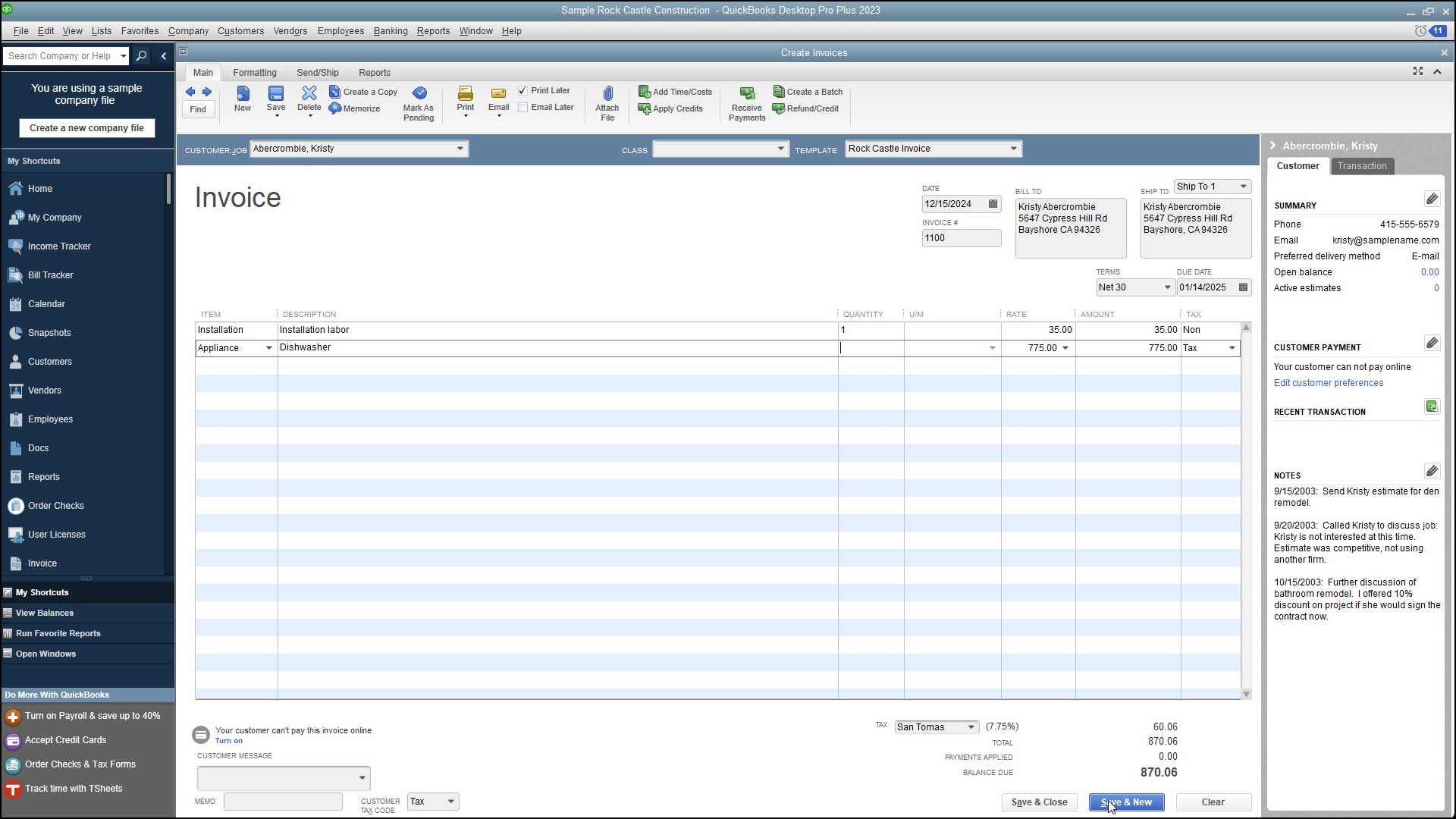

Create an Invoice in QuickBooks Desktop Pro Instructions

In the sales tax center, you can add and edit tax. Learn how to edit sales tax rates in quickbooks online. In this comprehensive guide, we will walk you through the process of adjusting sales tax payable in quickbooks desktop and online, as well as. The amount of sales tax you collect may increase or decrease depending on. Learn how.

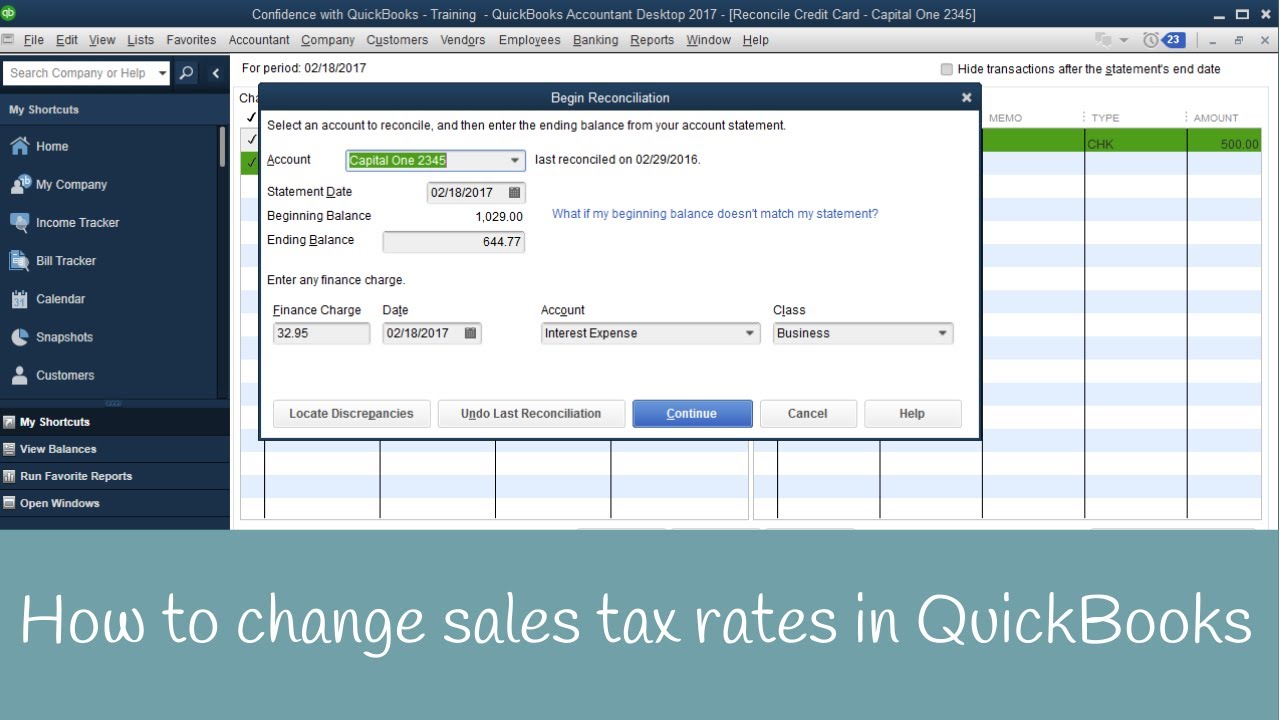

How to update or change sales tax rates in QuickBooks YouTube

In this comprehensive guide, we will walk you through the process of adjusting sales tax payable in quickbooks desktop and online, as well as. Learn how to set up, edit, and deactivate your sales tax rate and settings. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. The.

HOW TO ADJUST SALES TAXES IN QUICKBOOKS ONLINE YouTube

In the sales tax center, you can add and edit tax. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. Learn how to set up, edit, and deactivate your sales tax rate and settings. Learn how to edit sales tax rates in quickbooks online. The amount of sales.

What are 2 reasons you might need to adjust sales tax on the return? in

Learn how to set up, edit, and deactivate your sales tax rate and settings. In the sales tax center, you can add and edit tax. Learn how to edit sales tax rates in quickbooks online. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. The amount of sales.

How to Setup Sales Tax in Quickbooks YouTube

In the sales tax center, you can add and edit tax. Learn how to edit sales tax rates in quickbooks online. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. The amount of sales tax you collect may increase or decrease depending on. In this comprehensive guide, we.

Adjust sales tax amount per vendor charged sales tax Dynamics.FO F

In this comprehensive guide, we will walk you through the process of adjusting sales tax payable in quickbooks desktop and online, as well as. The amount of sales tax you collect may increase or decrease depending on. Learn how to set up, edit, and deactivate your sales tax rate and settings. In the sales tax center, you can add and.

How To Change Sales Tax Rate In Quickbooks

Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the. Learn how to edit sales tax rates in quickbooks online. The amount of sales tax you collect may increase or decrease depending on. In this comprehensive guide, we will walk you through the process of adjusting sales tax payable.

Learn How To Edit Sales Tax Rates In Quickbooks Online.

In this comprehensive guide, we will walk you through the process of adjusting sales tax payable in quickbooks desktop and online, as well as. Learn how to set up, edit, and deactivate your sales tax rate and settings. The amount of sales tax you collect may increase or decrease depending on. Modifying the sales tax rate in quickbooks desktop entails accessing the sales tax center and making the necessary adjustments to the.