How To Categorize Payroll In Quickbooks Online

How To Categorize Payroll In Quickbooks Online - Categorizing payroll in quickbooks online is crucial for efficient payroll management, accurate tax reporting, comprehensive expense tracking,. In this article, we'll take a look at how to create pay categories and employee liability categories in quickbooks online advanced payroll. In quickbooks online payroll premium. Matching payroll transactions in quickbooks online involves a systematic process to reconcile employee wages, tax deductions, and related. Learn how to categorize your payroll expenses into different classes and projects when you run payroll.

Learn how to categorize your payroll expenses into different classes and projects when you run payroll. In quickbooks online payroll premium. Matching payroll transactions in quickbooks online involves a systematic process to reconcile employee wages, tax deductions, and related. In this article, we'll take a look at how to create pay categories and employee liability categories in quickbooks online advanced payroll. Categorizing payroll in quickbooks online is crucial for efficient payroll management, accurate tax reporting, comprehensive expense tracking,.

In this article, we'll take a look at how to create pay categories and employee liability categories in quickbooks online advanced payroll. Matching payroll transactions in quickbooks online involves a systematic process to reconcile employee wages, tax deductions, and related. Learn how to categorize your payroll expenses into different classes and projects when you run payroll. In quickbooks online payroll premium. Categorizing payroll in quickbooks online is crucial for efficient payroll management, accurate tax reporting, comprehensive expense tracking,.

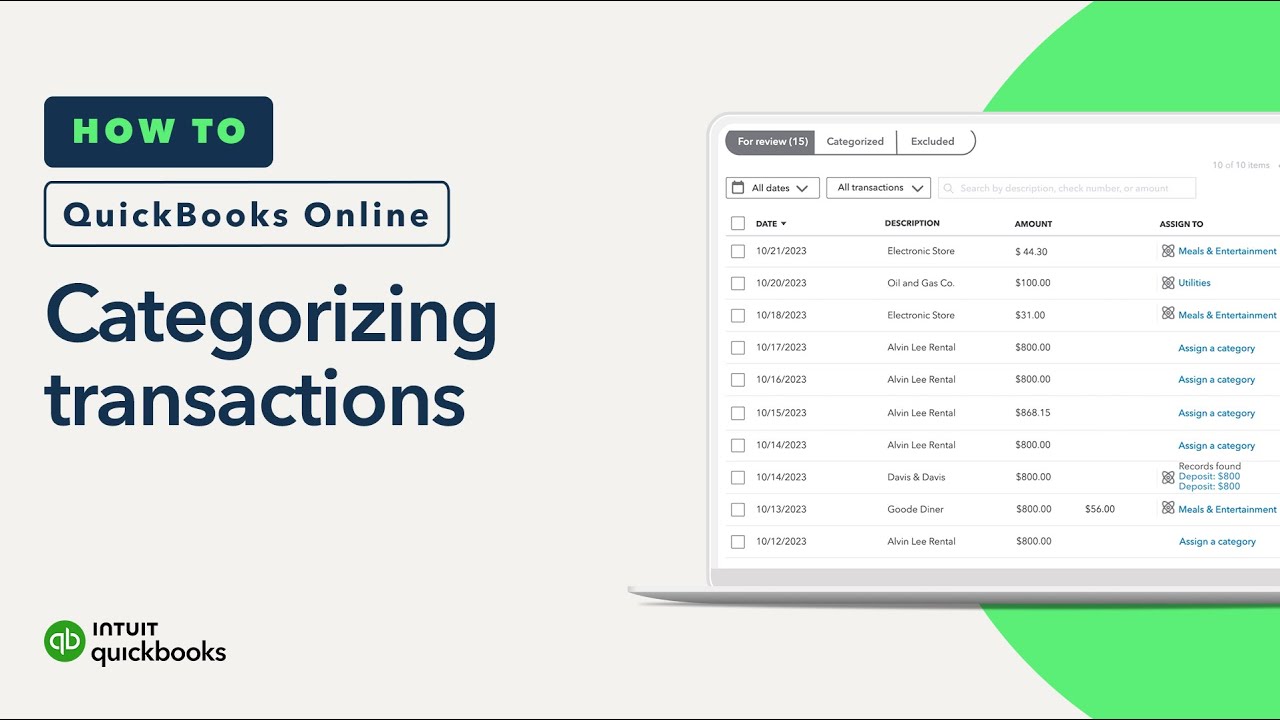

How to categorize transactions in QuickBooks Online YouTube

In this article, we'll take a look at how to create pay categories and employee liability categories in quickbooks online advanced payroll. In quickbooks online payroll premium. Matching payroll transactions in quickbooks online involves a systematic process to reconcile employee wages, tax deductions, and related. Learn how to categorize your payroll expenses into different classes and projects when you run.

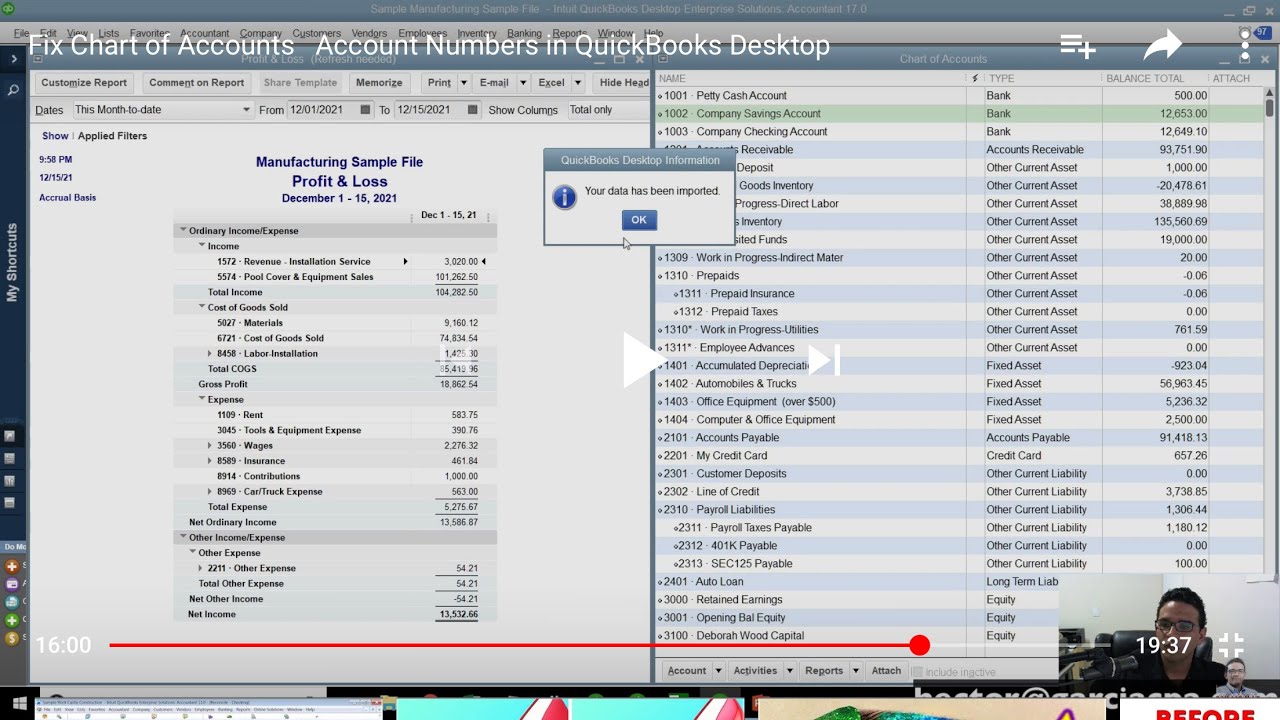

Quickbooks Desktop

Learn how to categorize your payroll expenses into different classes and projects when you run payroll. In quickbooks online payroll premium. Matching payroll transactions in quickbooks online involves a systematic process to reconcile employee wages, tax deductions, and related. In this article, we'll take a look at how to create pay categories and employee liability categories in quickbooks online advanced.

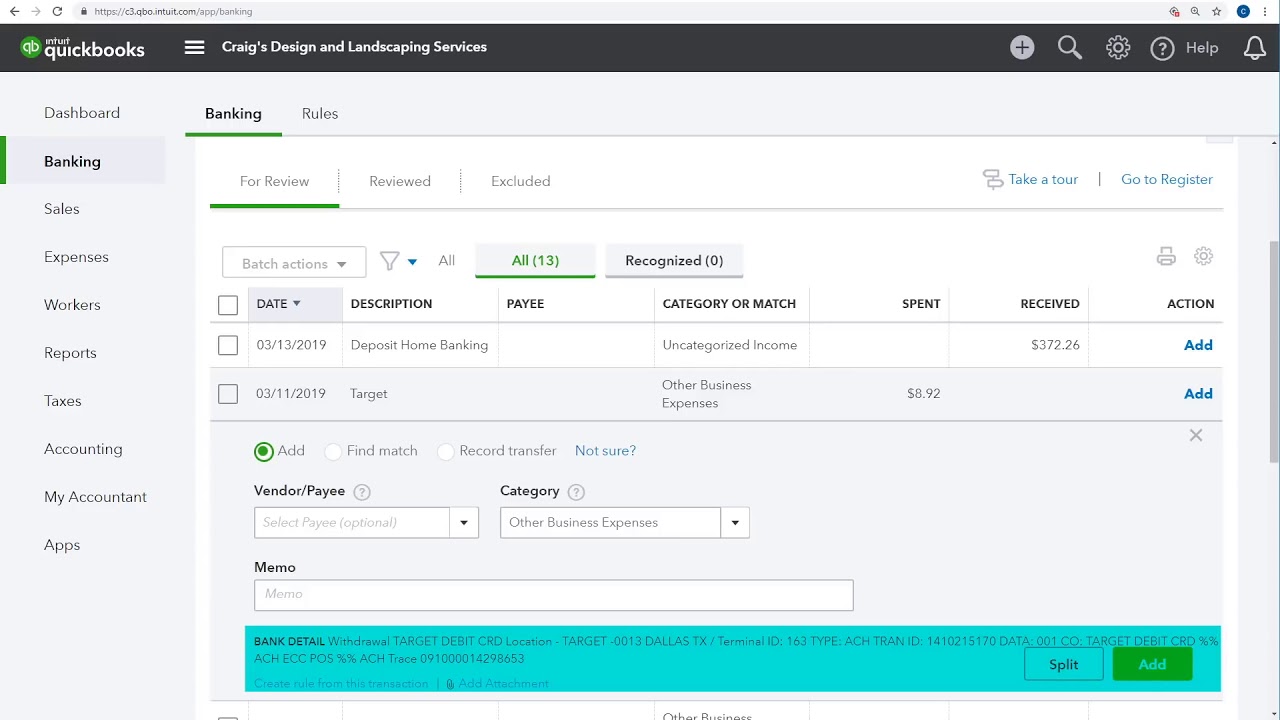

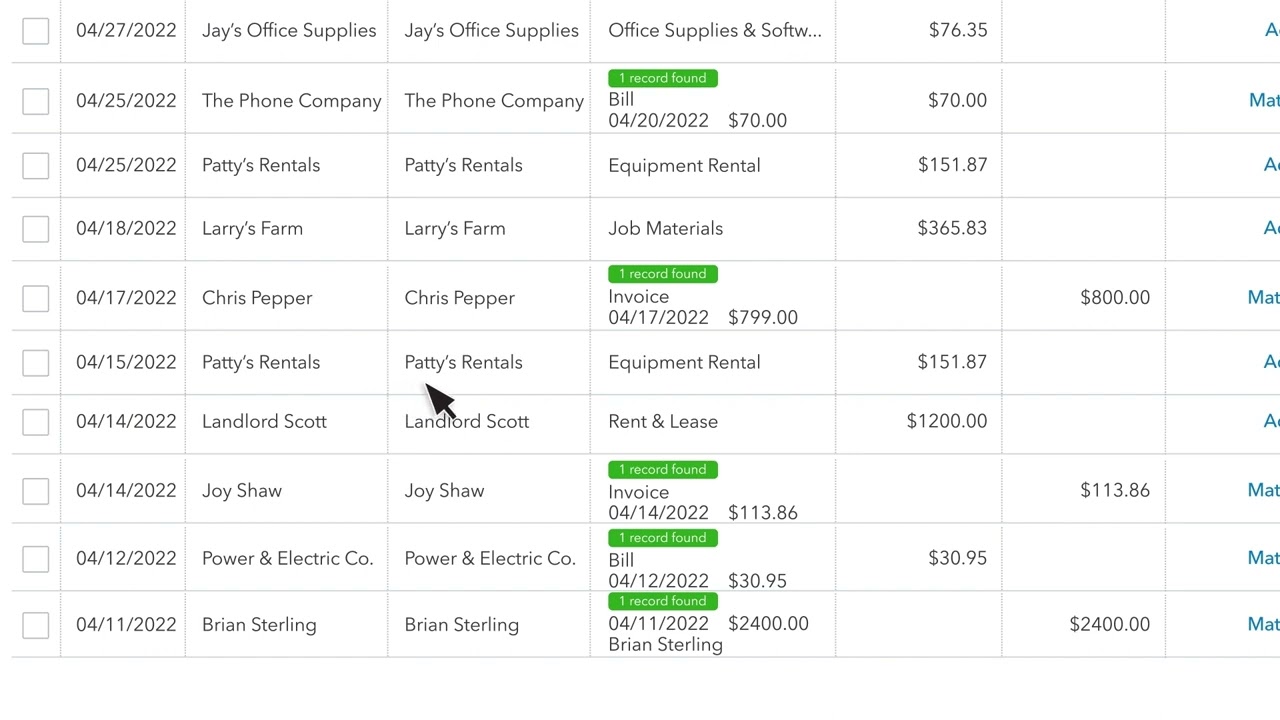

How to Categorize Transactions in QuickBooks

In this article, we'll take a look at how to create pay categories and employee liability categories in quickbooks online advanced payroll. Matching payroll transactions in quickbooks online involves a systematic process to reconcile employee wages, tax deductions, and related. Learn how to categorize your payroll expenses into different classes and projects when you run payroll. In quickbooks online payroll.

Chart Of Accounts Template Quickbooks Master of Documents

In this article, we'll take a look at how to create pay categories and employee liability categories in quickbooks online advanced payroll. Categorizing payroll in quickbooks online is crucial for efficient payroll management, accurate tax reporting, comprehensive expense tracking,. In quickbooks online payroll premium. Matching payroll transactions in quickbooks online involves a systematic process to reconcile employee wages, tax deductions,.

How to Categorize Transactions From Your Bank & Credit Card QuickBooks

Matching payroll transactions in quickbooks online involves a systematic process to reconcile employee wages, tax deductions, and related. In this article, we'll take a look at how to create pay categories and employee liability categories in quickbooks online advanced payroll. Categorizing payroll in quickbooks online is crucial for efficient payroll management, accurate tax reporting, comprehensive expense tracking,. In quickbooks online.

How To Categorize Non Business Expenses In Quickbooks at Armandina

Matching payroll transactions in quickbooks online involves a systematic process to reconcile employee wages, tax deductions, and related. In quickbooks online payroll premium. Categorizing payroll in quickbooks online is crucial for efficient payroll management, accurate tax reporting, comprehensive expense tracking,. Learn how to categorize your payroll expenses into different classes and projects when you run payroll. In this article, we'll.

How to categorize transactions in QuickBooks Online Booke AI

In quickbooks online payroll premium. Matching payroll transactions in quickbooks online involves a systematic process to reconcile employee wages, tax deductions, and related. Categorizing payroll in quickbooks online is crucial for efficient payroll management, accurate tax reporting, comprehensive expense tracking,. In this article, we'll take a look at how to create pay categories and employee liability categories in quickbooks online.

Solved Employer Payroll Tax Expense Account

In this article, we'll take a look at how to create pay categories and employee liability categories in quickbooks online advanced payroll. Learn how to categorize your payroll expenses into different classes and projects when you run payroll. Matching payroll transactions in quickbooks online involves a systematic process to reconcile employee wages, tax deductions, and related. Categorizing payroll in quickbooks.

How to Categorise Transactions in QuickBooks Online Introduction to

Learn how to categorize your payroll expenses into different classes and projects when you run payroll. Categorizing payroll in quickbooks online is crucial for efficient payroll management, accurate tax reporting, comprehensive expense tracking,. In quickbooks online payroll premium. In this article, we'll take a look at how to create pay categories and employee liability categories in quickbooks online advanced payroll..

Solved How to categorize payroll in checking account transactions

Learn how to categorize your payroll expenses into different classes and projects when you run payroll. Matching payroll transactions in quickbooks online involves a systematic process to reconcile employee wages, tax deductions, and related. In quickbooks online payroll premium. Categorizing payroll in quickbooks online is crucial for efficient payroll management, accurate tax reporting, comprehensive expense tracking,. In this article, we'll.

In This Article, We'll Take A Look At How To Create Pay Categories And Employee Liability Categories In Quickbooks Online Advanced Payroll.

Matching payroll transactions in quickbooks online involves a systematic process to reconcile employee wages, tax deductions, and related. Learn how to categorize your payroll expenses into different classes and projects when you run payroll. Categorizing payroll in quickbooks online is crucial for efficient payroll management, accurate tax reporting, comprehensive expense tracking,. In quickbooks online payroll premium.