How To Categorize Personal Expenses In Quickbooks

How To Categorize Personal Expenses In Quickbooks - How do i categorize personal expenses in quickbooks? The personal option can be. When business funds are used to cover personal expenses, it’s essential to properly record these transactions in quickbooks to. To categorize personal expenses in quickbooks, create a separate category, such. Efficiently categorizing expenses in quickbooks involves utilizing subcategories, setting up rules for recurring expenses, and regularly reviewing. The initial step in categorizing personal expenses in quickbooks online involves creating distinct categories specifically tailored to personal. Categorizing paying yourself in quickbooks is essential for accurate tracking and reporting of personal withdrawals or owner’s equity.

Categorizing paying yourself in quickbooks is essential for accurate tracking and reporting of personal withdrawals or owner’s equity. Efficiently categorizing expenses in quickbooks involves utilizing subcategories, setting up rules for recurring expenses, and regularly reviewing. How do i categorize personal expenses in quickbooks? To categorize personal expenses in quickbooks, create a separate category, such. The personal option can be. When business funds are used to cover personal expenses, it’s essential to properly record these transactions in quickbooks to. The initial step in categorizing personal expenses in quickbooks online involves creating distinct categories specifically tailored to personal.

The initial step in categorizing personal expenses in quickbooks online involves creating distinct categories specifically tailored to personal. To categorize personal expenses in quickbooks, create a separate category, such. The personal option can be. Categorizing paying yourself in quickbooks is essential for accurate tracking and reporting of personal withdrawals or owner’s equity. Efficiently categorizing expenses in quickbooks involves utilizing subcategories, setting up rules for recurring expenses, and regularly reviewing. When business funds are used to cover personal expenses, it’s essential to properly record these transactions in quickbooks to. How do i categorize personal expenses in quickbooks?

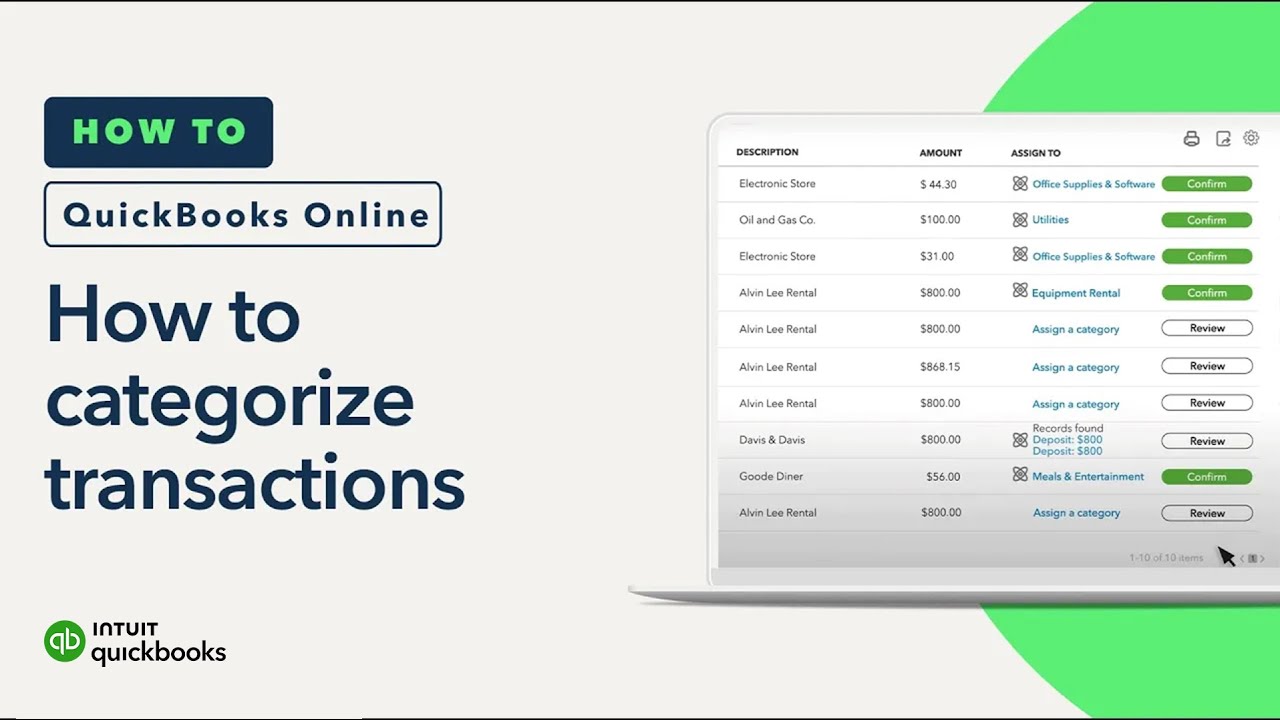

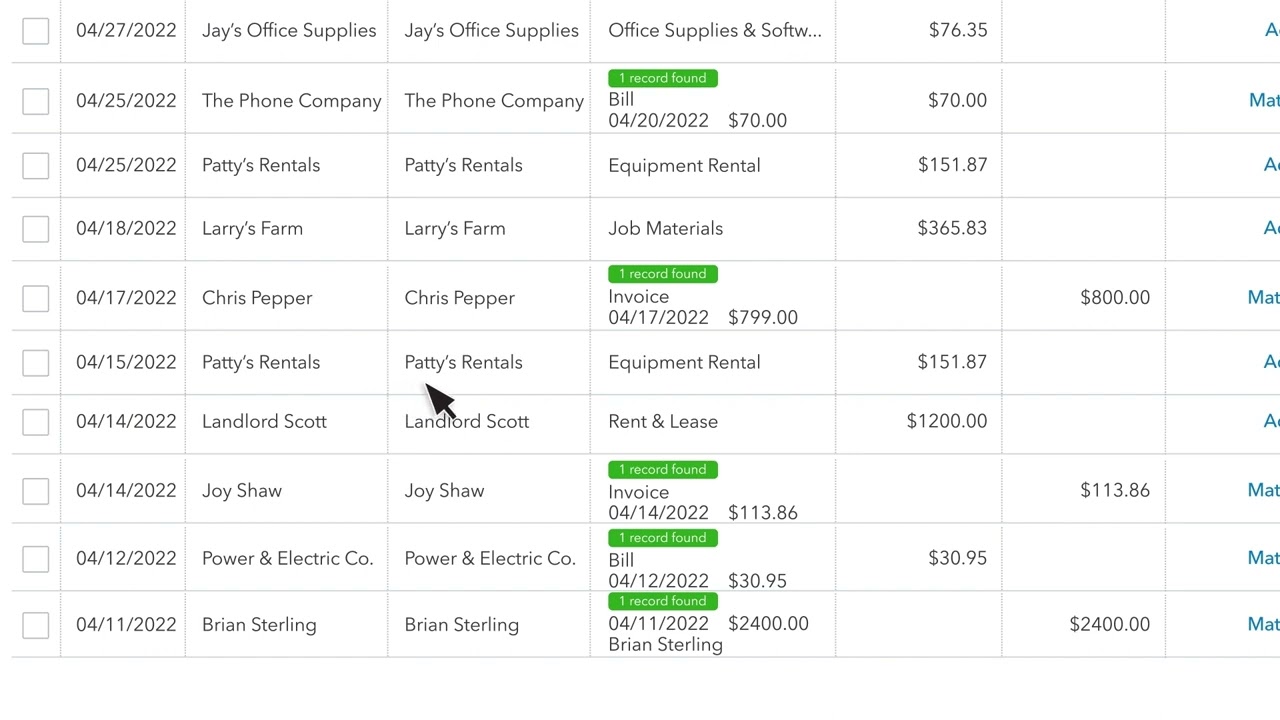

How to Categorize Expenses in QuickBooks Online Categorizing Expenses

How do i categorize personal expenses in quickbooks? To categorize personal expenses in quickbooks, create a separate category, such. The personal option can be. Efficiently categorizing expenses in quickbooks involves utilizing subcategories, setting up rules for recurring expenses, and regularly reviewing. Categorizing paying yourself in quickbooks is essential for accurate tracking and reporting of personal withdrawals or owner’s equity.

How To Categorize Expenses in QuickBooks (FAQs Guide) LiveFlow

The initial step in categorizing personal expenses in quickbooks online involves creating distinct categories specifically tailored to personal. Categorizing paying yourself in quickbooks is essential for accurate tracking and reporting of personal withdrawals or owner’s equity. When business funds are used to cover personal expenses, it’s essential to properly record these transactions in quickbooks to. How do i categorize personal.

Categorize Personal Expense Paid with Business Card In QuickBooks

Efficiently categorizing expenses in quickbooks involves utilizing subcategories, setting up rules for recurring expenses, and regularly reviewing. How do i categorize personal expenses in quickbooks? The personal option can be. To categorize personal expenses in quickbooks, create a separate category, such. When business funds are used to cover personal expenses, it’s essential to properly record these transactions in quickbooks to.

How To Categorize Transactions In QuickBooks Online QBO Tutorial

Categorizing paying yourself in quickbooks is essential for accurate tracking and reporting of personal withdrawals or owner’s equity. To categorize personal expenses in quickbooks, create a separate category, such. The initial step in categorizing personal expenses in quickbooks online involves creating distinct categories specifically tailored to personal. Efficiently categorizing expenses in quickbooks involves utilizing subcategories, setting up rules for recurring.

Can you track personal expenses in quickbooks summerlokasin

When business funds are used to cover personal expenses, it’s essential to properly record these transactions in quickbooks to. The initial step in categorizing personal expenses in quickbooks online involves creating distinct categories specifically tailored to personal. Efficiently categorizing expenses in quickbooks involves utilizing subcategories, setting up rules for recurring expenses, and regularly reviewing. To categorize personal expenses in quickbooks,.

QUICKBOOKS (QBO) HOW TO Categorize transactions in Bank Feeds YouTube

To categorize personal expenses in quickbooks, create a separate category, such. How do i categorize personal expenses in quickbooks? Efficiently categorizing expenses in quickbooks involves utilizing subcategories, setting up rules for recurring expenses, and regularly reviewing. When business funds are used to cover personal expenses, it’s essential to properly record these transactions in quickbooks to. Categorizing paying yourself in quickbooks.

How To Categorize Non Business Expenses In Quickbooks at Armandina

When business funds are used to cover personal expenses, it’s essential to properly record these transactions in quickbooks to. Efficiently categorizing expenses in quickbooks involves utilizing subcategories, setting up rules for recurring expenses, and regularly reviewing. The personal option can be. Categorizing paying yourself in quickbooks is essential for accurate tracking and reporting of personal withdrawals or owner’s equity. To.

Budget Categories 60+ Simple Categories You Need in Your Budget

The personal option can be. How do i categorize personal expenses in quickbooks? When business funds are used to cover personal expenses, it’s essential to properly record these transactions in quickbooks to. Categorizing paying yourself in quickbooks is essential for accurate tracking and reporting of personal withdrawals or owner’s equity. Efficiently categorizing expenses in quickbooks involves utilizing subcategories, setting up.

How to categorize transactions in QuickBooks Online (Business View

Categorizing paying yourself in quickbooks is essential for accurate tracking and reporting of personal withdrawals or owner’s equity. To categorize personal expenses in quickbooks, create a separate category, such. The personal option can be. How do i categorize personal expenses in quickbooks? Efficiently categorizing expenses in quickbooks involves utilizing subcategories, setting up rules for recurring expenses, and regularly reviewing.

How to Categorise Transactions in QuickBooks Online Introduction to

How do i categorize personal expenses in quickbooks? The initial step in categorizing personal expenses in quickbooks online involves creating distinct categories specifically tailored to personal. To categorize personal expenses in quickbooks, create a separate category, such. When business funds are used to cover personal expenses, it’s essential to properly record these transactions in quickbooks to. Efficiently categorizing expenses in.

The Personal Option Can Be.

When business funds are used to cover personal expenses, it’s essential to properly record these transactions in quickbooks to. How do i categorize personal expenses in quickbooks? To categorize personal expenses in quickbooks, create a separate category, such. The initial step in categorizing personal expenses in quickbooks online involves creating distinct categories specifically tailored to personal.

Efficiently Categorizing Expenses In Quickbooks Involves Utilizing Subcategories, Setting Up Rules For Recurring Expenses, And Regularly Reviewing.

Categorizing paying yourself in quickbooks is essential for accurate tracking and reporting of personal withdrawals or owner’s equity.