How To Check Transaction History In Quickbooks Desktop

How To Check Transaction History In Quickbooks Desktop - Checking the transaction history in quickbooks desktop allows users to review a comprehensive log of all financial activities and. With the quickbooks audit log report, you can keep track of added, deleted, and modified transactions, as well as user entries. Understand, view, and use the transaction journal report for calculations, insights, and auditing. In the audit log, use the filter. To track recent changes to quickbooks: Use it as a tool to.

With the quickbooks audit log report, you can keep track of added, deleted, and modified transactions, as well as user entries. In the audit log, use the filter. Use it as a tool to. Understand, view, and use the transaction journal report for calculations, insights, and auditing. Checking the transaction history in quickbooks desktop allows users to review a comprehensive log of all financial activities and. To track recent changes to quickbooks:

In the audit log, use the filter. With the quickbooks audit log report, you can keep track of added, deleted, and modified transactions, as well as user entries. Understand, view, and use the transaction journal report for calculations, insights, and auditing. Checking the transaction history in quickbooks desktop allows users to review a comprehensive log of all financial activities and. To track recent changes to quickbooks: Use it as a tool to.

How To Check Yono Transaction History How To Check Transaction

Checking the transaction history in quickbooks desktop allows users to review a comprehensive log of all financial activities and. Understand, view, and use the transaction journal report for calculations, insights, and auditing. With the quickbooks audit log report, you can keep track of added, deleted, and modified transactions, as well as user entries. Use it as a tool to. To.

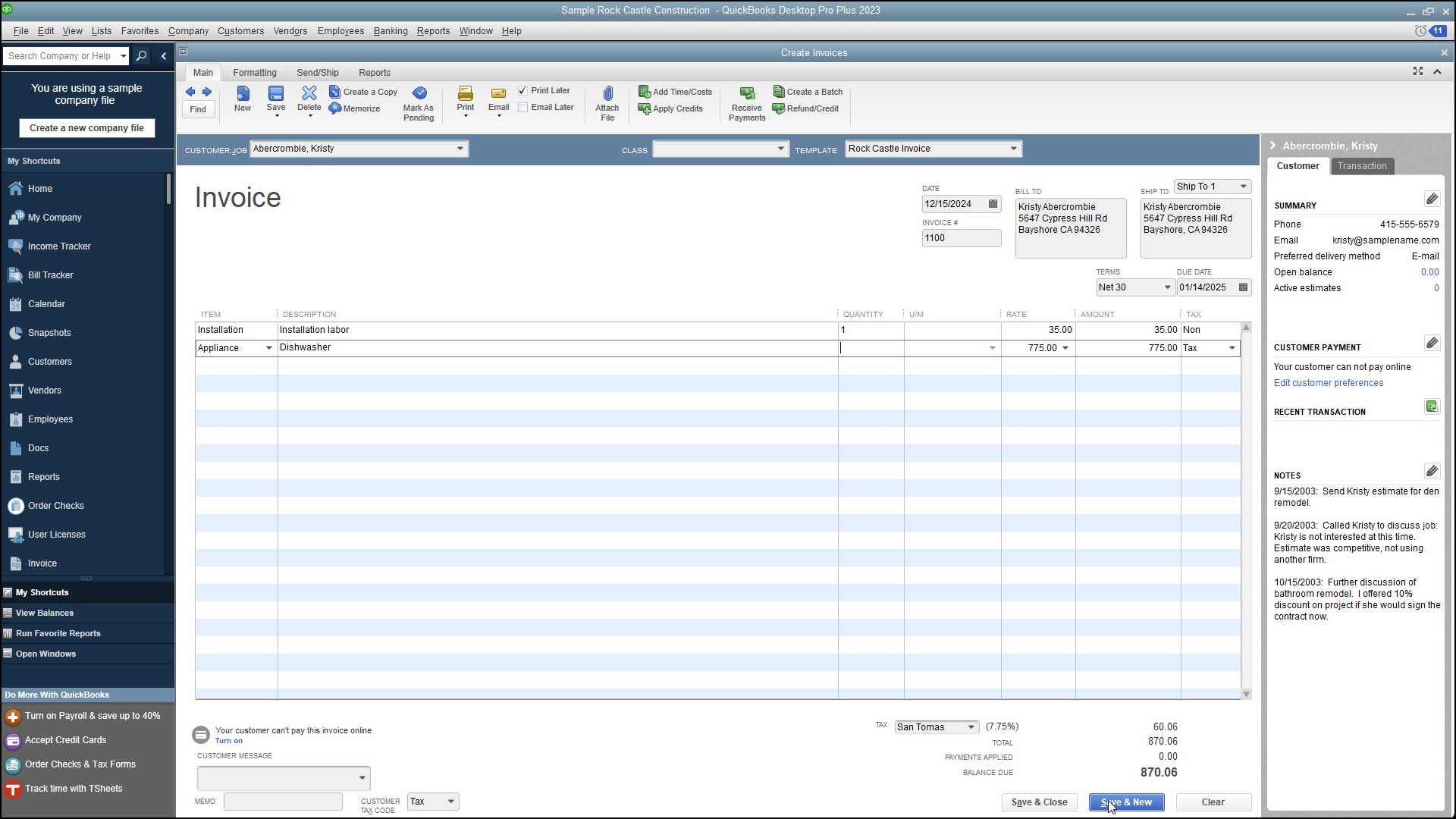

How To Change Invoice Template In Quickbooks Desktop

With the quickbooks audit log report, you can keep track of added, deleted, and modified transactions, as well as user entries. Understand, view, and use the transaction journal report for calculations, insights, and auditing. Use it as a tool to. To track recent changes to quickbooks: Checking the transaction history in quickbooks desktop allows users to review a comprehensive log.

Paytm Transaction History Track Your Payments & Transfers in December 2024

With the quickbooks audit log report, you can keep track of added, deleted, and modified transactions, as well as user entries. To track recent changes to quickbooks: Checking the transaction history in quickbooks desktop allows users to review a comprehensive log of all financial activities and. Use it as a tool to. In the audit log, use the filter.

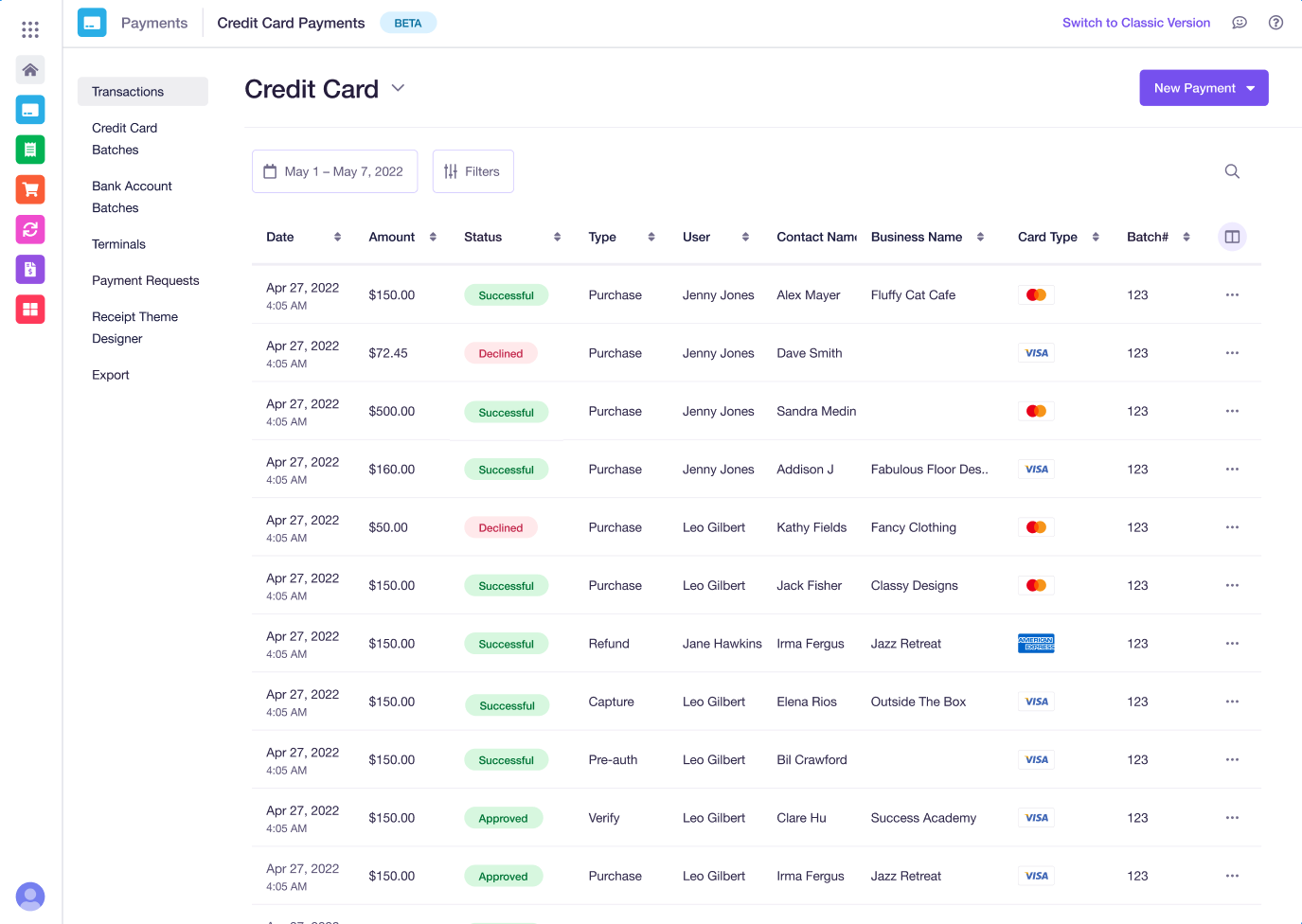

Viewing and Searching Transaction History BETA

Use it as a tool to. Understand, view, and use the transaction journal report for calculations, insights, and auditing. Checking the transaction history in quickbooks desktop allows users to review a comprehensive log of all financial activities and. To track recent changes to quickbooks: With the quickbooks audit log report, you can keep track of added, deleted, and modified transactions,.

QuickBooks Audit Trail, Log, and Transaction History — Method

In the audit log, use the filter. Use it as a tool to. Understand, view, and use the transaction journal report for calculations, insights, and auditing. To track recent changes to quickbooks: Checking the transaction history in quickbooks desktop allows users to review a comprehensive log of all financial activities and.

How to check Transaction History?

With the quickbooks audit log report, you can keep track of added, deleted, and modified transactions, as well as user entries. Use it as a tool to. To track recent changes to quickbooks: Understand, view, and use the transaction journal report for calculations, insights, and auditing. Checking the transaction history in quickbooks desktop allows users to review a comprehensive log.

Quickbooks A follow along guide on how to use it TechStory

With the quickbooks audit log report, you can keep track of added, deleted, and modified transactions, as well as user entries. Use it as a tool to. Understand, view, and use the transaction journal report for calculations, insights, and auditing. Checking the transaction history in quickbooks desktop allows users to review a comprehensive log of all financial activities and. In.

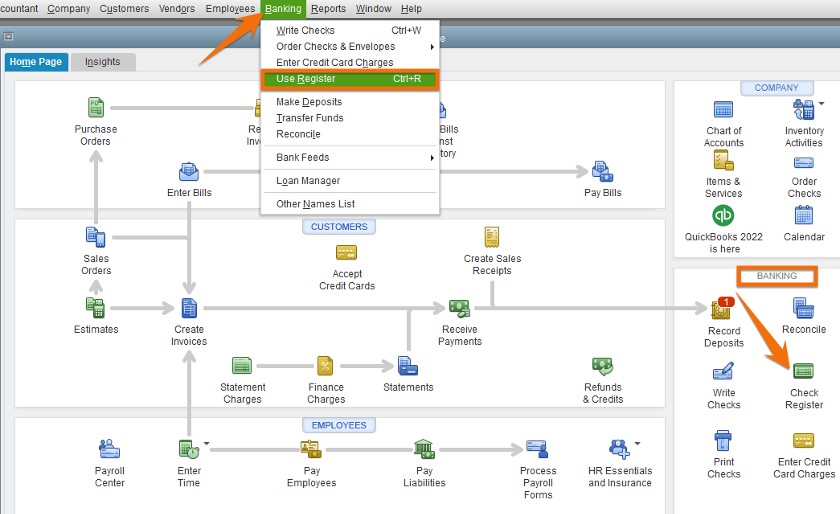

How To Void a Check in QuickBooks Desktop

To track recent changes to quickbooks: In the audit log, use the filter. With the quickbooks audit log report, you can keep track of added, deleted, and modified transactions, as well as user entries. Understand, view, and use the transaction journal report for calculations, insights, and auditing. Checking the transaction history in quickbooks desktop allows users to review a comprehensive.

Solved Transaction Journal & Transaction History

Understand, view, and use the transaction journal report for calculations, insights, and auditing. Use it as a tool to. Checking the transaction history in quickbooks desktop allows users to review a comprehensive log of all financial activities and. With the quickbooks audit log report, you can keep track of added, deleted, and modified transactions, as well as user entries. In.

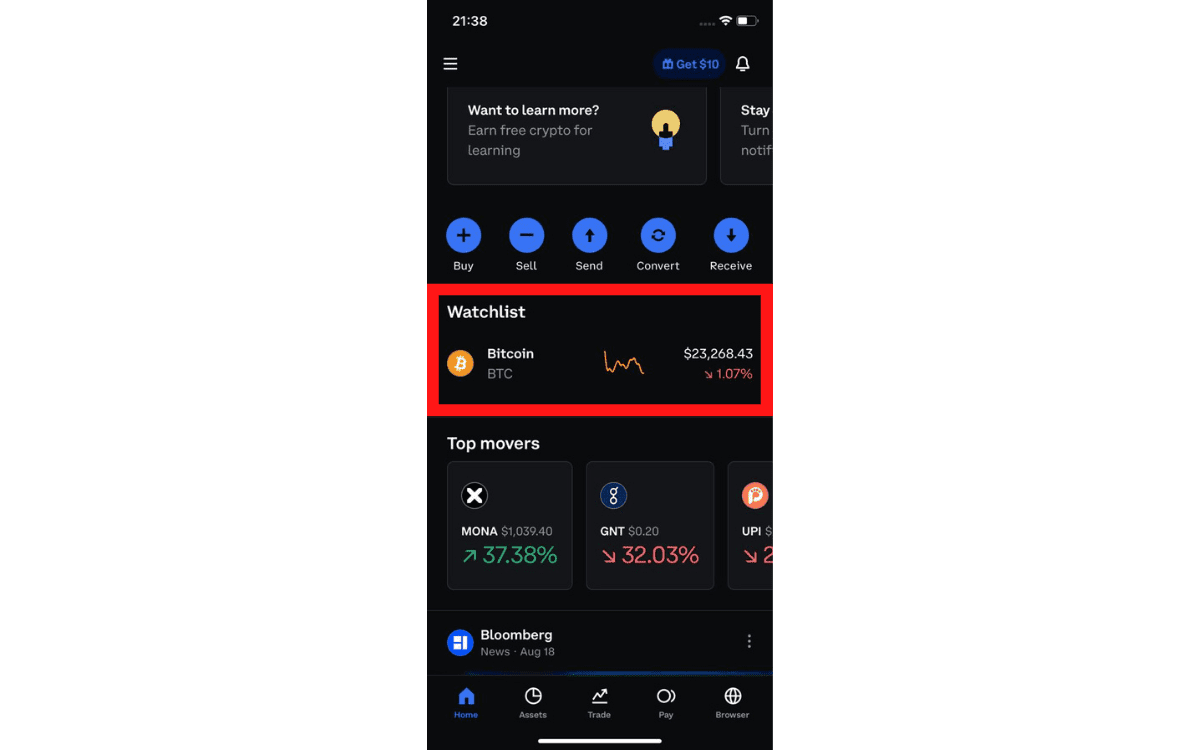

How to Check Coinbase Transaction History

Understand, view, and use the transaction journal report for calculations, insights, and auditing. Use it as a tool to. With the quickbooks audit log report, you can keep track of added, deleted, and modified transactions, as well as user entries. Checking the transaction history in quickbooks desktop allows users to review a comprehensive log of all financial activities and. In.

To Track Recent Changes To Quickbooks:

In the audit log, use the filter. Checking the transaction history in quickbooks desktop allows users to review a comprehensive log of all financial activities and. With the quickbooks audit log report, you can keep track of added, deleted, and modified transactions, as well as user entries. Understand, view, and use the transaction journal report for calculations, insights, and auditing.