How To Record A Returned Payment In Quickbooks Online

How To Record A Returned Payment In Quickbooks Online - Or follow these steps if you need to. Want to know how to record a customer’s returned payment or contribution that you previously recorded using a sales receipt in. When you enter a returned payment for a business expense or canceled project, you can record the fund by linking a bank deposit to. In quickbooks online, users can record a bounced check by accessing the banking section and creating a new transaction to reflect the. Learn how to use an expense to record a customer's bounced check in quickbooks online.

Learn how to use an expense to record a customer's bounced check in quickbooks online. Want to know how to record a customer’s returned payment or contribution that you previously recorded using a sales receipt in. When you enter a returned payment for a business expense or canceled project, you can record the fund by linking a bank deposit to. Or follow these steps if you need to. In quickbooks online, users can record a bounced check by accessing the banking section and creating a new transaction to reflect the.

Want to know how to record a customer’s returned payment or contribution that you previously recorded using a sales receipt in. Learn how to use an expense to record a customer's bounced check in quickbooks online. Or follow these steps if you need to. When you enter a returned payment for a business expense or canceled project, you can record the fund by linking a bank deposit to. In quickbooks online, users can record a bounced check by accessing the banking section and creating a new transaction to reflect the.

Solved TRANSACTION DETAIL BY ACCOUNT REPORT

Or follow these steps if you need to. Learn how to use an expense to record a customer's bounced check in quickbooks online. When you enter a returned payment for a business expense or canceled project, you can record the fund by linking a bank deposit to. Want to know how to record a customer’s returned payment or contribution that.

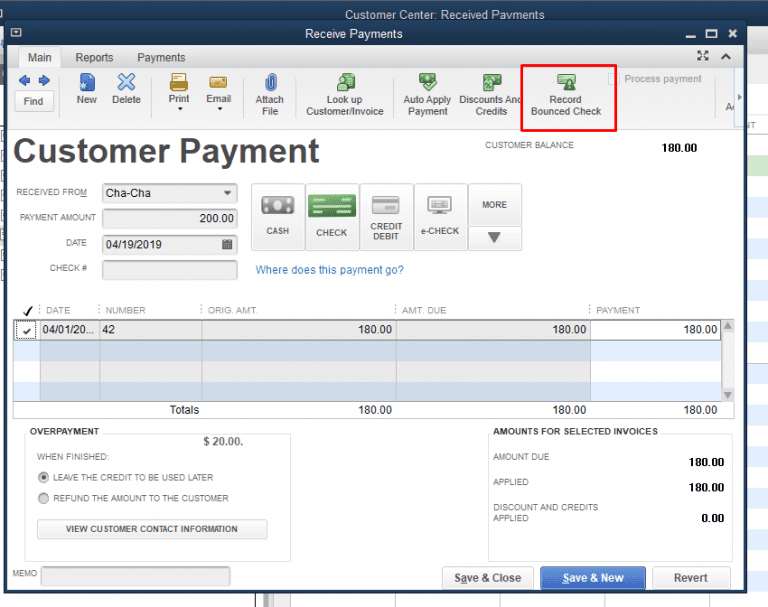

How to Record a Returned or Bounced Check in QuickBooks?

When you enter a returned payment for a business expense or canceled project, you can record the fund by linking a bank deposit to. Learn how to use an expense to record a customer's bounced check in quickbooks online. Want to know how to record a customer’s returned payment or contribution that you previously recorded using a sales receipt in..

How To Record Returned Checks in QuickBooks LiveFlow

When you enter a returned payment for a business expense or canceled project, you can record the fund by linking a bank deposit to. In quickbooks online, users can record a bounced check by accessing the banking section and creating a new transaction to reflect the. Want to know how to record a customer’s returned payment or contribution that you.

How to Record A Customer Returned Payment in QuickBooks Online (NSF

Or follow these steps if you need to. Want to know how to record a customer’s returned payment or contribution that you previously recorded using a sales receipt in. In quickbooks online, users can record a bounced check by accessing the banking section and creating a new transaction to reflect the. When you enter a returned payment for a business.

How To Record A Credit Card Payment In Quickbooks Online LiveWell

When you enter a returned payment for a business expense or canceled project, you can record the fund by linking a bank deposit to. Or follow these steps if you need to. In quickbooks online, users can record a bounced check by accessing the banking section and creating a new transaction to reflect the. Learn how to use an expense.

Record a returned payment or bounced check in QuickBooks Online

Learn how to use an expense to record a customer's bounced check in quickbooks online. Want to know how to record a customer’s returned payment or contribution that you previously recorded using a sales receipt in. In quickbooks online, users can record a bounced check by accessing the banking section and creating a new transaction to reflect the. Or follow.

Record a Returned Customer's Sales Receipt Payment in QuickBooks Online

In quickbooks online, users can record a bounced check by accessing the banking section and creating a new transaction to reflect the. Learn how to use an expense to record a customer's bounced check in quickbooks online. Or follow these steps if you need to. When you enter a returned payment for a business expense or canceled project, you can.

Record a Returned Customer's Sales Receipt Payment in QuickBooks Online

When you enter a returned payment for a business expense or canceled project, you can record the fund by linking a bank deposit to. Want to know how to record a customer’s returned payment or contribution that you previously recorded using a sales receipt in. Or follow these steps if you need to. In quickbooks online, users can record a.

Quickbooks Journal Entry Template

Or follow these steps if you need to. When you enter a returned payment for a business expense or canceled project, you can record the fund by linking a bank deposit to. In quickbooks online, users can record a bounced check by accessing the banking section and creating a new transaction to reflect the. Learn how to use an expense.

How to Record Returned or Bounced Check in QuickBooks

Or follow these steps if you need to. When you enter a returned payment for a business expense or canceled project, you can record the fund by linking a bank deposit to. Learn how to use an expense to record a customer's bounced check in quickbooks online. In quickbooks online, users can record a bounced check by accessing the banking.

Learn How To Use An Expense To Record A Customer's Bounced Check In Quickbooks Online.

In quickbooks online, users can record a bounced check by accessing the banking section and creating a new transaction to reflect the. Want to know how to record a customer’s returned payment or contribution that you previously recorded using a sales receipt in. When you enter a returned payment for a business expense or canceled project, you can record the fund by linking a bank deposit to. Or follow these steps if you need to.