How To Record Depreciation In Quickbooks

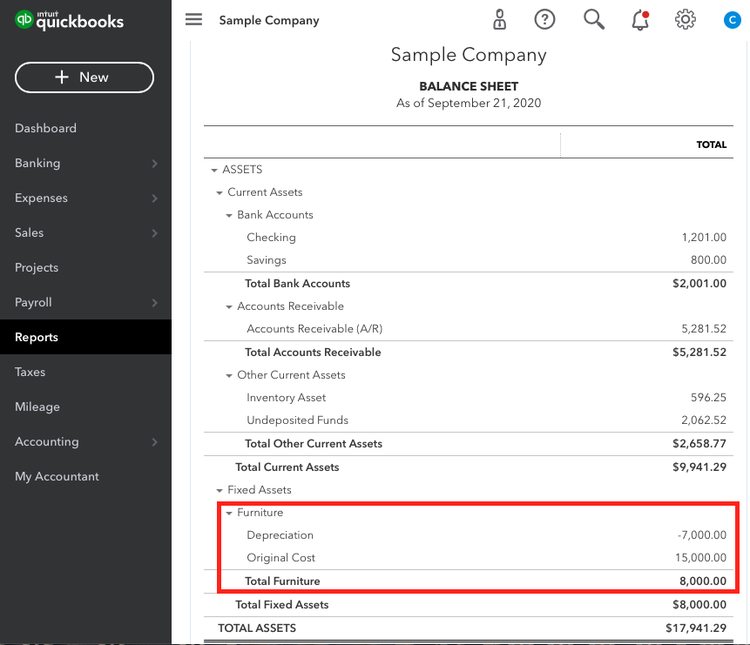

How To Record Depreciation In Quickbooks - When i used tt business, i set this up ($3400) as a section 179 deduction. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. Entering depreciation in quickbooks involves recording the calculated depreciation expense for specific assets, ensuring accurate financial.

Entering depreciation in quickbooks involves recording the calculated depreciation expense for specific assets, ensuring accurate financial. When i used tt business, i set this up ($3400) as a section 179 deduction. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

When i used tt business, i set this up ($3400) as a section 179 deduction. Entering depreciation in quickbooks involves recording the calculated depreciation expense for specific assets, ensuring accurate financial. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

How to record Depreciation Expenses in QuickBooks Online YouTube

When i used tt business, i set this up ($3400) as a section 179 deduction. Entering depreciation in quickbooks involves recording the calculated depreciation expense for specific assets, ensuring accurate financial. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

A Beginner's Guide to Accumulated Depreciation

Entering depreciation in quickbooks involves recording the calculated depreciation expense for specific assets, ensuring accurate financial. When i used tt business, i set this up ($3400) as a section 179 deduction. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

How to Use QuickBooks to Calculate Depreciation?

Entering depreciation in quickbooks involves recording the calculated depreciation expense for specific assets, ensuring accurate financial. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. When i used tt business, i set this up ($3400) as a section 179 deduction.

What account do you credit for depreciation? Leia aqui What is journal

Entering depreciation in quickbooks involves recording the calculated depreciation expense for specific assets, ensuring accurate financial. When i used tt business, i set this up ($3400) as a section 179 deduction. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

How to Record Depreciation in QuickBooks Online South Africa YouTube

Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. When i used tt business, i set this up ($3400) as a section 179 deduction. Entering depreciation in quickbooks involves recording the calculated depreciation expense for specific assets, ensuring accurate financial.

How to record Depreciation and Accumulated Depreciation in QuickBooks

Entering depreciation in quickbooks involves recording the calculated depreciation expense for specific assets, ensuring accurate financial. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. When i used tt business, i set this up ($3400) as a section 179 deduction.

Solved Record a computer purchase fixed asset

When i used tt business, i set this up ($3400) as a section 179 deduction. Entering depreciation in quickbooks involves recording the calculated depreciation expense for specific assets, ensuring accurate financial. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

Fillable Online How do I record the depreciation of an asset

Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. Entering depreciation in quickbooks involves recording the calculated depreciation expense for specific assets, ensuring accurate financial. When i used tt business, i set this up ($3400) as a section 179 deduction.

How is depreciation recorded? Leia aqui How do you record depreciation

Entering depreciation in quickbooks involves recording the calculated depreciation expense for specific assets, ensuring accurate financial. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and. When i used tt business, i set this up ($3400) as a section 179 deduction.

Depreciation Inside QuickBooks Desktop Candus Kampfer

Entering depreciation in quickbooks involves recording the calculated depreciation expense for specific assets, ensuring accurate financial. When i used tt business, i set this up ($3400) as a section 179 deduction. Quickbooks online advanced automates how you manage and track your fixed assets, calculate book depreciation, and.

Quickbooks Online Advanced Automates How You Manage And Track Your Fixed Assets, Calculate Book Depreciation, And.

When i used tt business, i set this up ($3400) as a section 179 deduction. Entering depreciation in quickbooks involves recording the calculated depreciation expense for specific assets, ensuring accurate financial.