How To Record Donations Received In Quickbooks Online

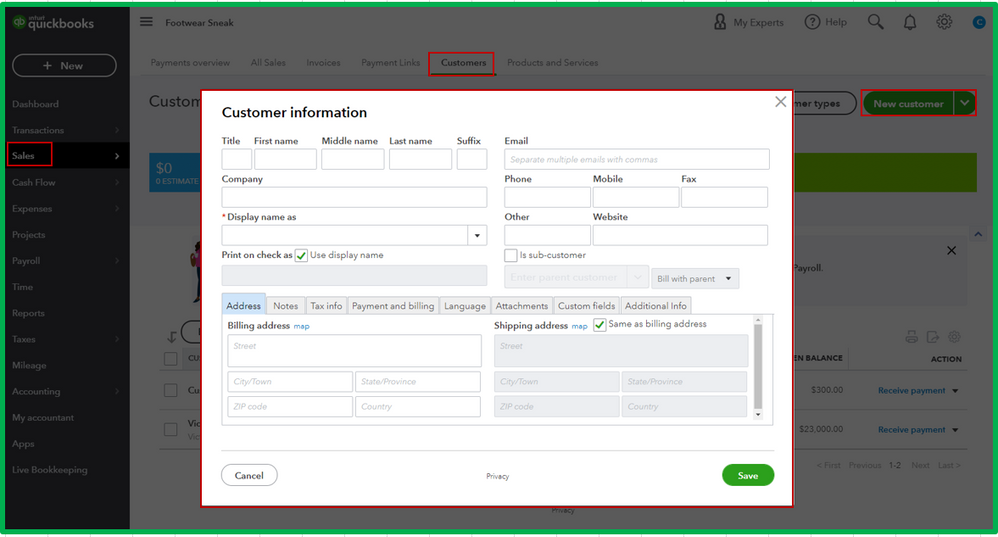

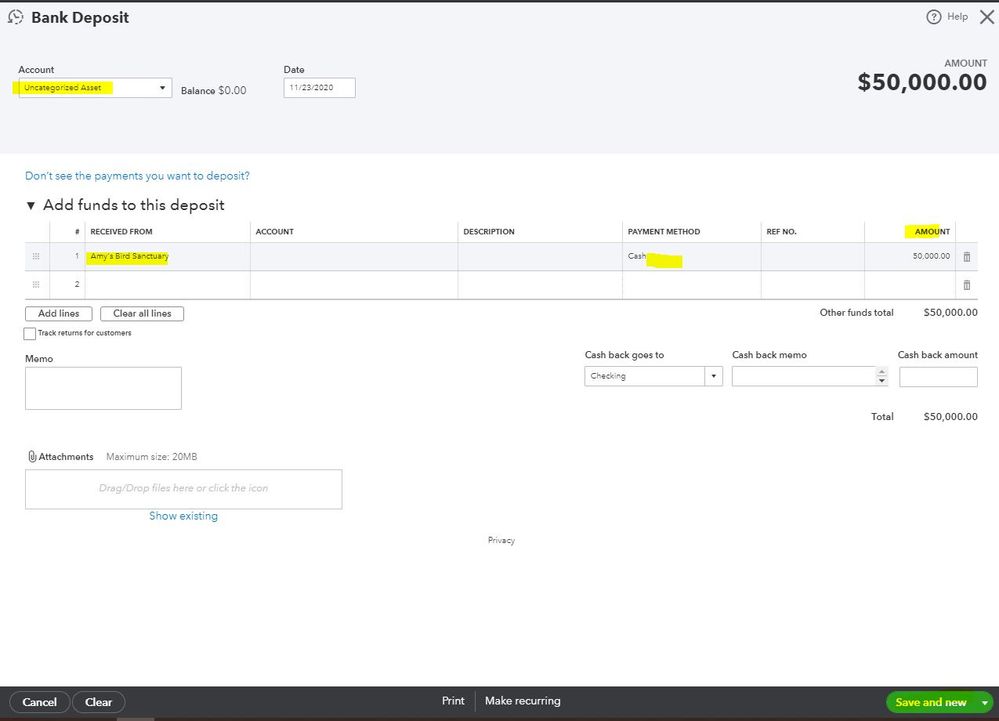

How To Record Donations Received In Quickbooks Online - There are two ways in tracking the fund donation in quickbooks online. These revenues should be entered as donations to. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. Quickbooks provides the ability to track donations in the form of cash, check and credit cards. For the donation you've received right away, you can.

There are two ways in tracking the fund donation in quickbooks online. For the donation you've received right away, you can. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. These revenues should be entered as donations to. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. Quickbooks provides the ability to track donations in the form of cash, check and credit cards.

To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. There are two ways in tracking the fund donation in quickbooks online. Quickbooks provides the ability to track donations in the form of cash, check and credit cards. For the donation you've received right away, you can. These revenues should be entered as donations to. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:.

payment received How to record donations received Treezsoft Blog

These revenues should be entered as donations to. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. Quickbooks provides the ability to track donations in the form of cash, check and credit cards. For the donation you've received right away, you can. There are two ways in.

Donation Log Book Track Your Donations, Perfect for Churches and Other

For the donation you've received right away, you can. There are two ways in tracking the fund donation in quickbooks online. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. Quickbooks provides the ability to track donations in the form of cash, check and credit cards. To.

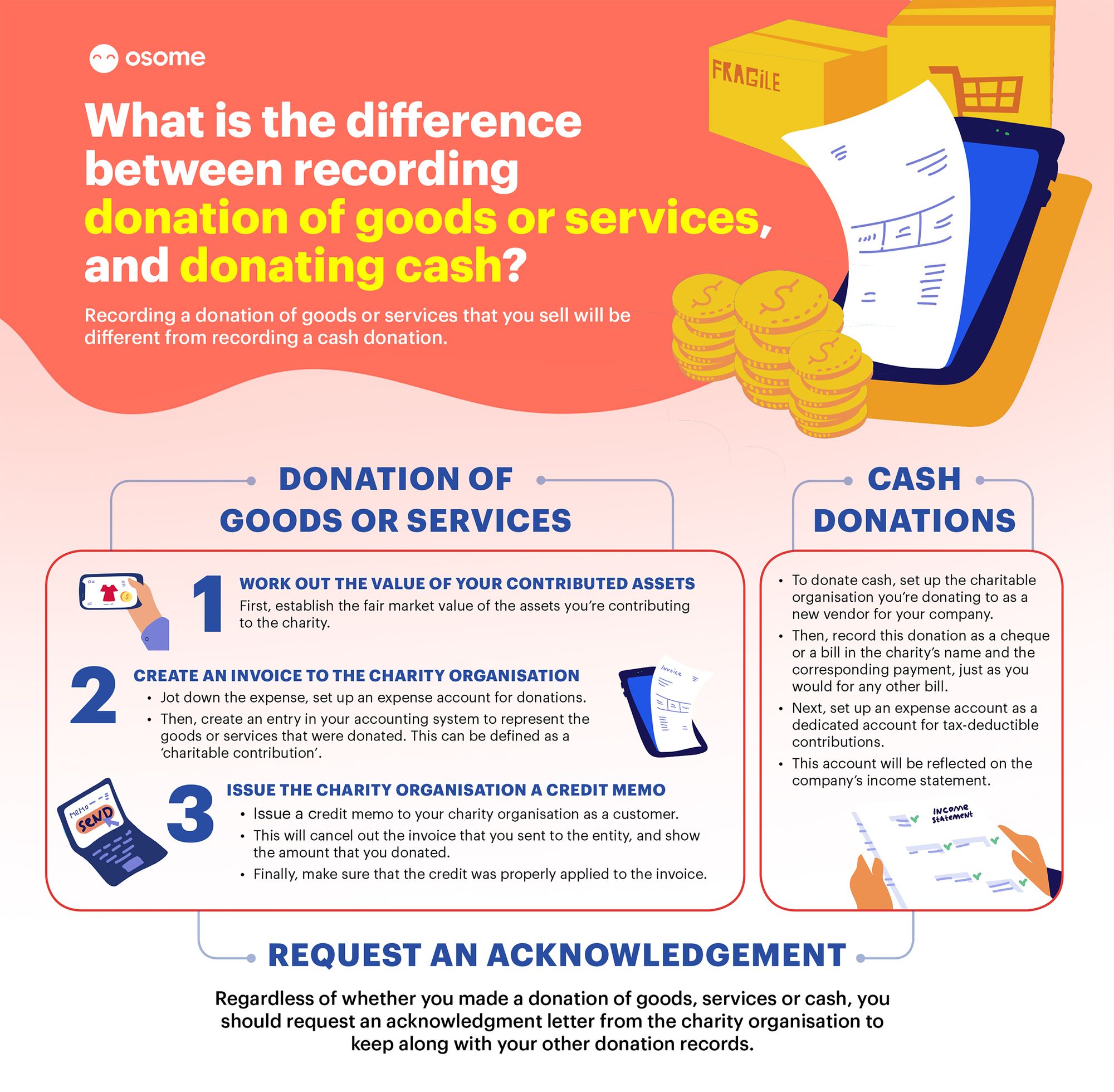

How To Record Donations in Bookkeeping for UK Companies

To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. These revenues should be entered as donations to. Quickbooks provides the ability to track donations in.

How to Record Online Donations from PayPal or Stripe in QuickBooks

For the donation you've received right away, you can. Quickbooks provides the ability to track donations in the form of cash, check and credit cards. There are two ways in tracking the fund donation in quickbooks online. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. To.

How do you record cash donations received for a nonprofit to the

Quickbooks provides the ability to track donations in the form of cash, check and credit cards. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. These revenues should be entered as donations to. There are two ways in tracking the fund donation in quickbooks online. For the.

payment received How to record donations received Treezsoft Blog

For the donation you've received right away, you can. These revenues should be entered as donations to. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. Quickbooks provides the ability to track donations in the form of cash, check and credit cards. There are two ways in.

How do you record cash donations received for a nonprofit to the

For the donation you've received right away, you can. These revenues should be entered as donations to. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. Quickbooks provides the ability to track donations in the form of cash, check and credit cards. There are two ways in.

Solved How do I record donations to our small charity on

There are two ways in tracking the fund donation in quickbooks online. These revenues should be entered as donations to. Quickbooks provides the ability to track donations in the form of cash, check and credit cards. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. To record.

payment received How to record donations received Treezsoft Blog

These revenues should be entered as donations to. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. Quickbooks provides the ability to track donations in.

How to Record Online Donations from PayPal or Stripe in QuickBooks

Quickbooks provides the ability to track donations in the form of cash, check and credit cards. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. These revenues should be entered as donations to. There are two ways in tracking the fund donation in quickbooks online. To record.

There Are Two Ways In Tracking The Fund Donation In Quickbooks Online.

To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:. Quickbooks provides the ability to track donations in the form of cash, check and credit cards. These revenues should be entered as donations to. To record a product and services donation, you'll need to follow these steps in this order, which we'll walk you through below:.