How To Record Erc Refund In Quickbooks

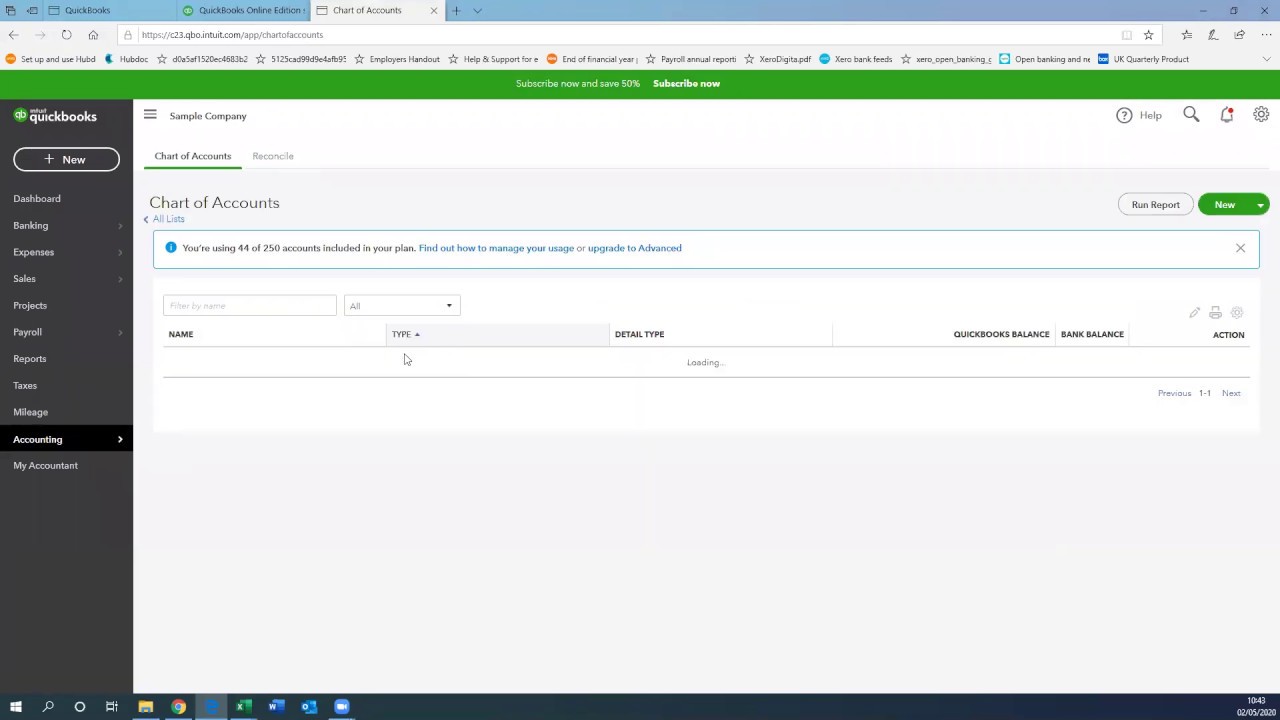

How To Record Erc Refund In Quickbooks - To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): You can create a deposit to record your erc credit. If you received a refund check for the employee retention credit (erc), record it by creating a bank deposit in quickbooks for 2022. It is possible to make a deposit to record your particular erc credit. Here are the steps to record employee retention credit in. First off, we'll have to create a new account to hold and house this credit.

Here are the steps to record employee retention credit in. You can create a deposit to record your erc credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): It is possible to make a deposit to record your particular erc credit. If you received a refund check for the employee retention credit (erc), record it by creating a bank deposit in quickbooks for 2022. First off, we'll have to create a new account to hold and house this credit.

It is possible to make a deposit to record your particular erc credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): First off, we'll have to create a new account to hold and house this credit. If you received a refund check for the employee retention credit (erc), record it by creating a bank deposit in quickbooks for 2022. You can create a deposit to record your erc credit. Here are the steps to record employee retention credit in.

How To Record A Refund In Quickbooks

Here are the steps to record employee retention credit in. You can create a deposit to record your erc credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): If you received a refund check for the employee retention credit (erc), record it by creating a bank.

How To Record A Refund In Quickbooks

If you received a refund check for the employee retention credit (erc), record it by creating a bank deposit in quickbooks for 2022. Here are the steps to record employee retention credit in. You can create a deposit to record your erc credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your.

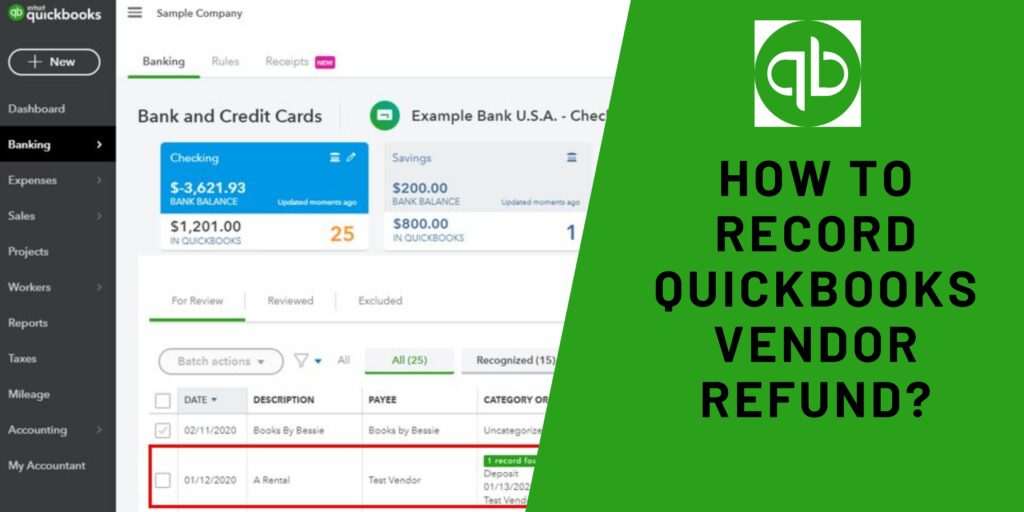

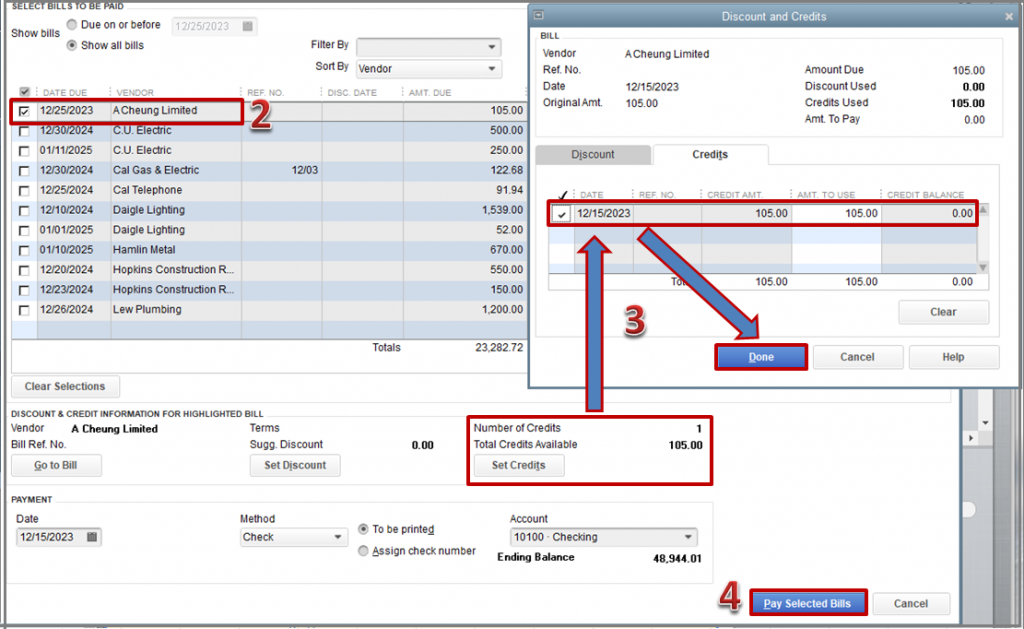

Record QuickBooks Vendor Refund Complete StepbyStep Guide

First off, we'll have to create a new account to hold and house this credit. Here are the steps to record employee retention credit in. You can create a deposit to record your erc credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): It is possible.

How to Record ERC in QuickBooks?

Here are the steps to record employee retention credit in. You can create a deposit to record your erc credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): It is possible to make a deposit to record your particular erc credit. First off, we'll have to.

How To Record A Refund In Quickbooks

You can create a deposit to record your erc credit. It is possible to make a deposit to record your particular erc credit. If you received a refund check for the employee retention credit (erc), record it by creating a bank deposit in quickbooks for 2022. First off, we'll have to create a new account to hold and house this.

Record Quickbooks Vendor Refund 1 Select the Received fr… Flickr

Here are the steps to record employee retention credit in. It is possible to make a deposit to record your particular erc credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): If you received a refund check for the employee retention credit (erc), record it by.

Record a Refund from a Vendor in QuickBooks Online Accounting Guide

You can create a deposit to record your erc credit. If you received a refund check for the employee retention credit (erc), record it by creating a bank deposit in quickbooks for 2022. Here are the steps to record employee retention credit in. It is possible to make a deposit to record your particular erc credit. To record a deposit.

How to Record ERC in QuickBooks?

To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): You can create a deposit to record your erc credit. First off, we'll have to create a new account to hold and house this credit. Here are the steps to record employee retention credit in. If you received.

How To Record Employee Retention Credit In Quickbooks Desktop LiveWell

You can create a deposit to record your erc credit. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): If you received a refund check for the employee retention credit (erc), record it by creating a bank deposit in quickbooks for 2022. Here are the steps to.

How To Record ERC Refund In Quickbooks

To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): Here are the steps to record employee retention credit in. First off, we'll have to create a new account to hold and house this credit. It is possible to make a deposit to record your particular erc credit..

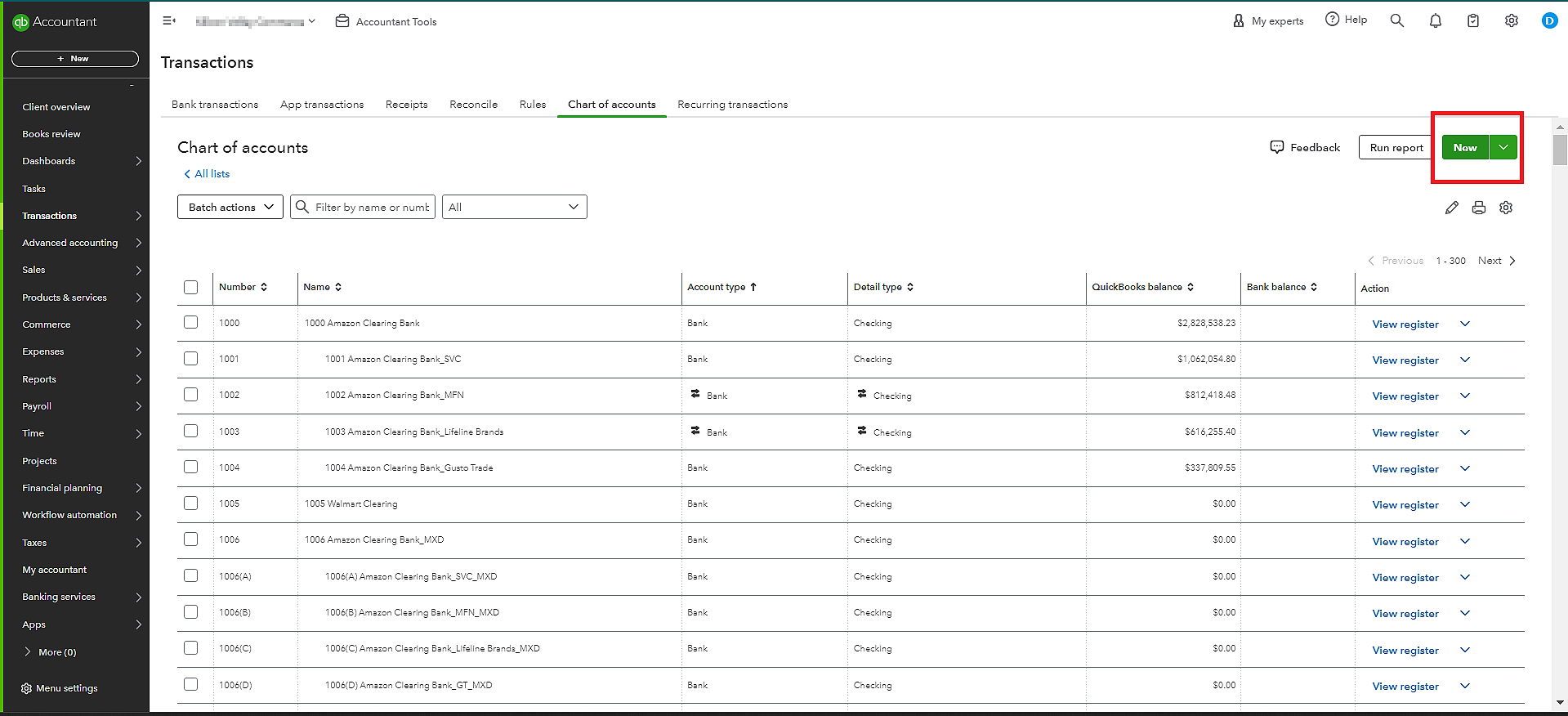

First Off, We'll Have To Create A New Account To Hold And House This Credit.

You can create a deposit to record your erc credit. If you received a refund check for the employee retention credit (erc), record it by creating a bank deposit in quickbooks for 2022. To record a deposit for the refund of liabilities (which are, as you say, sitting on your balance sheet as an overpayment): It is possible to make a deposit to record your particular erc credit.