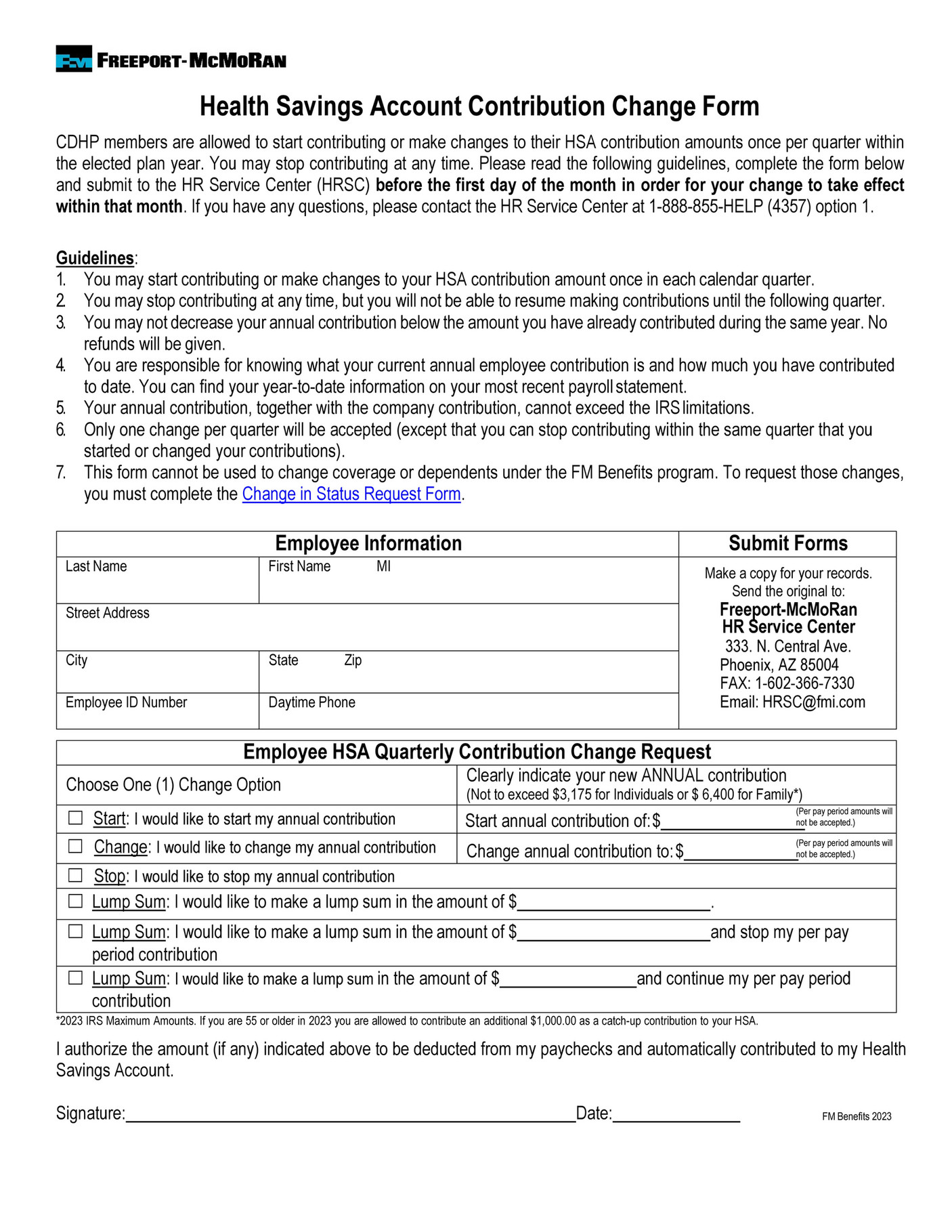

Hsa Contribution Form 2023

Hsa Contribution Form 2023 - Learn how to file irs form 8889 for your hsa contributions and distributions in 2023. Determining that i am eligible for an hsa each year i make a contribution. Find out the hsa contribution limits, tax. Ensuring that all contributions i make are within the limits set. You (or someone on your behalf, including your employer) made contributions for 2023 to. You must file form 8889 if any of the following applies. If you have previously contributed to your hsa via payroll deduction or directly to your account during the current plan year, you need to track. Hsa contributions you made for 2023 (or those made on your behalf), including those made by the unextended due date of your tax return that.

Ensuring that all contributions i make are within the limits set. You must file form 8889 if any of the following applies. Determining that i am eligible for an hsa each year i make a contribution. You (or someone on your behalf, including your employer) made contributions for 2023 to. Learn how to file irs form 8889 for your hsa contributions and distributions in 2023. Find out the hsa contribution limits, tax. If you have previously contributed to your hsa via payroll deduction or directly to your account during the current plan year, you need to track. Hsa contributions you made for 2023 (or those made on your behalf), including those made by the unextended due date of your tax return that.

Find out the hsa contribution limits, tax. Learn how to file irs form 8889 for your hsa contributions and distributions in 2023. Ensuring that all contributions i make are within the limits set. You (or someone on your behalf, including your employer) made contributions for 2023 to. You must file form 8889 if any of the following applies. Determining that i am eligible for an hsa each year i make a contribution. Hsa contributions you made for 2023 (or those made on your behalf), including those made by the unextended due date of your tax return that. If you have previously contributed to your hsa via payroll deduction or directly to your account during the current plan year, you need to track.

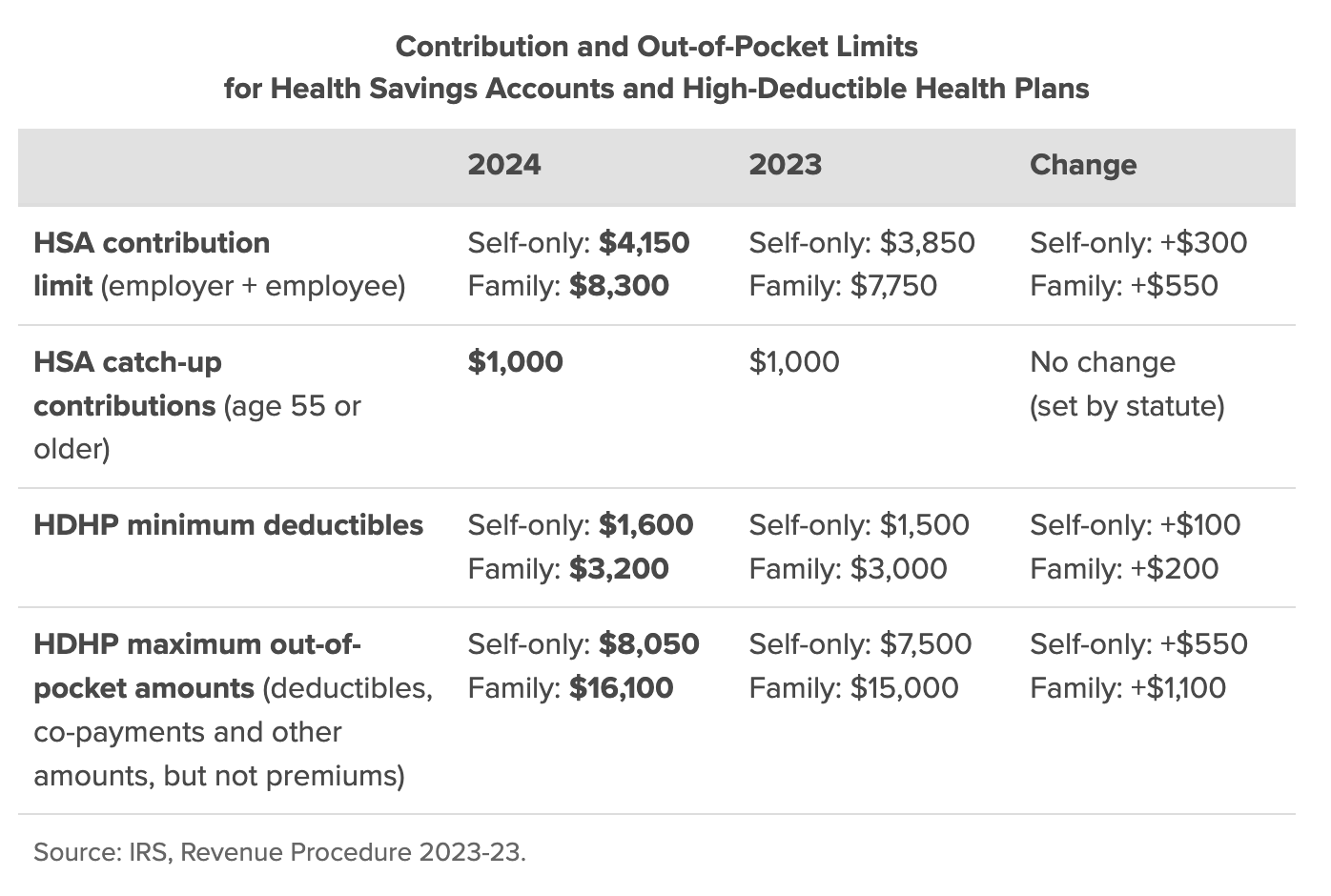

2024 HSA Contribution Limits Claremont Insurance Services

Ensuring that all contributions i make are within the limits set. You must file form 8889 if any of the following applies. Find out the hsa contribution limits, tax. If you have previously contributed to your hsa via payroll deduction or directly to your account during the current plan year, you need to track. Determining that i am eligible for.

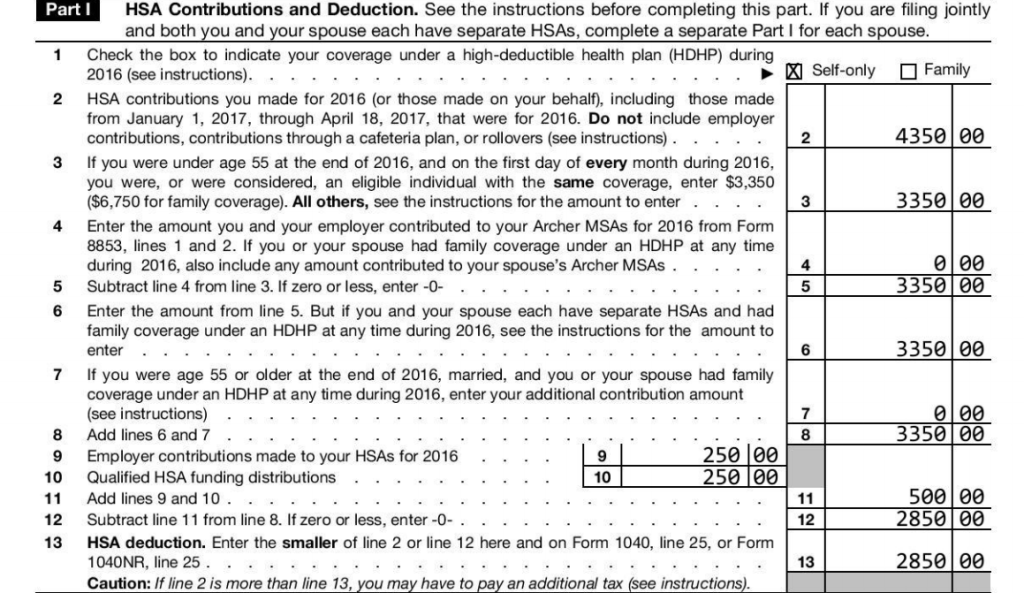

2024 Hsa Contribution Limits Pdf Form Aarika Stephannie

Learn how to file irs form 8889 for your hsa contributions and distributions in 2023. You (or someone on your behalf, including your employer) made contributions for 2023 to. Find out the hsa contribution limits, tax. You must file form 8889 if any of the following applies. Hsa contributions you made for 2023 (or those made on your behalf), including.

Hsa Max Contribution 2024 Irs Viki Melanie

You (or someone on your behalf, including your employer) made contributions for 2023 to. Determining that i am eligible for an hsa each year i make a contribution. You must file form 8889 if any of the following applies. Learn how to file irs form 8889 for your hsa contributions and distributions in 2023. Hsa contributions you made for 2023.

How to Handle Excess Contributions on Form 8889 HSA Edge

You (or someone on your behalf, including your employer) made contributions for 2023 to. Hsa contributions you made for 2023 (or those made on your behalf), including those made by the unextended due date of your tax return that. If you have previously contributed to your hsa via payroll deduction or directly to your account during the current plan year,.

2024 HSA Contribution Limits Claremont Insurance Services

Ensuring that all contributions i make are within the limits set. Determining that i am eligible for an hsa each year i make a contribution. You must file form 8889 if any of the following applies. Find out the hsa contribution limits, tax. If you have previously contributed to your hsa via payroll deduction or directly to your account during.

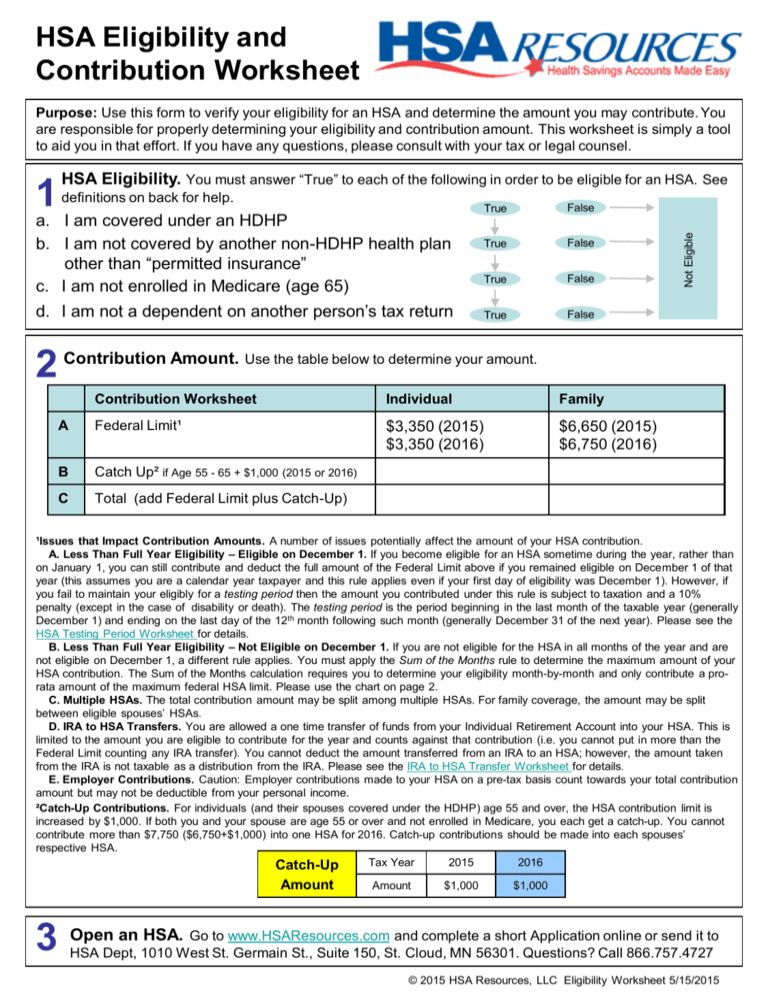

HSA Eligibility and Contribution Worksheet

Hsa contributions you made for 2023 (or those made on your behalf), including those made by the unextended due date of your tax return that. Determining that i am eligible for an hsa each year i make a contribution. Find out the hsa contribution limits, tax. You must file form 8889 if any of the following applies. You (or someone.

How HSA Distributions and Contributions Affect Your Tax Return

Ensuring that all contributions i make are within the limits set. Hsa contributions you made for 2023 (or those made on your behalf), including those made by the unextended due date of your tax return that. Determining that i am eligible for an hsa each year i make a contribution. Learn how to file irs form 8889 for your hsa.

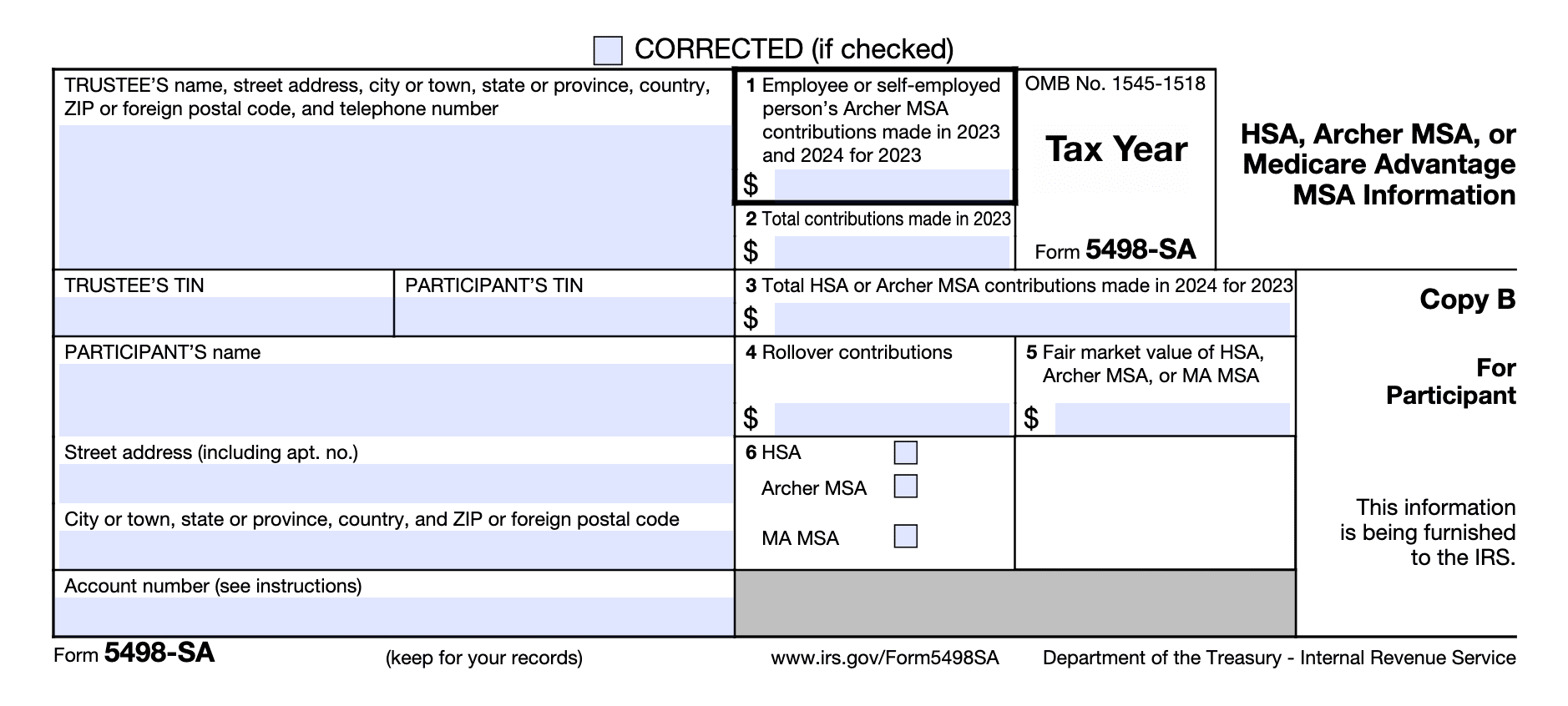

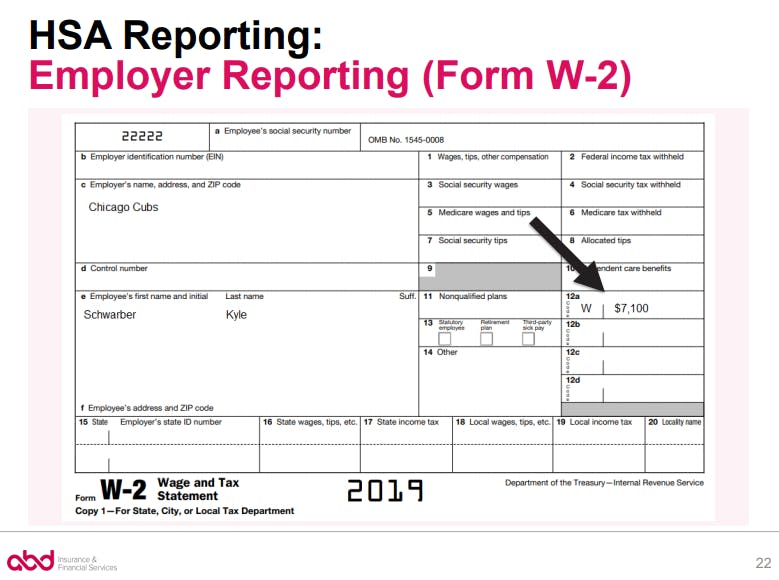

HSA Form W2 Reporting

Ensuring that all contributions i make are within the limits set. You (or someone on your behalf, including your employer) made contributions for 2023 to. Determining that i am eligible for an hsa each year i make a contribution. Hsa contributions you made for 2023 (or those made on your behalf), including those made by the unextended due date of.

IRS Announces 2023 HSA Contribution Limits

Find out the hsa contribution limits, tax. You must file form 8889 if any of the following applies. Determining that i am eligible for an hsa each year i make a contribution. Ensuring that all contributions i make are within the limits set. Hsa contributions you made for 2023 (or those made on your behalf), including those made by the.

2023 Hsa Form Printable Forms Free Online

Hsa contributions you made for 2023 (or those made on your behalf), including those made by the unextended due date of your tax return that. Find out the hsa contribution limits, tax. You (or someone on your behalf, including your employer) made contributions for 2023 to. If you have previously contributed to your hsa via payroll deduction or directly to.

Hsa Contributions You Made For 2023 (Or Those Made On Your Behalf), Including Those Made By The Unextended Due Date Of Your Tax Return That.

You (or someone on your behalf, including your employer) made contributions for 2023 to. If you have previously contributed to your hsa via payroll deduction or directly to your account during the current plan year, you need to track. Determining that i am eligible for an hsa each year i make a contribution. Find out the hsa contribution limits, tax.

Learn How To File Irs Form 8889 For Your Hsa Contributions And Distributions In 2023.

Ensuring that all contributions i make are within the limits set. You must file form 8889 if any of the following applies.