Illinois Tax Lien

Illinois Tax Lien - To search for a certificate of tax lien, you may search by case number or debtor name. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. The registry will be an online, statewide system for maintaining notices of tax liens filed or. The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. Iltaxsale.com advertises tax deed auctions for joseph e. With the case number search, you may use either the. Meyer & associates collects unwanted tax liens for 80. What is the state tax lien registry?

The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. The registry will be an online, statewide system for maintaining notices of tax liens filed or. Iltaxsale.com advertises tax deed auctions for joseph e. Meyer & associates collects unwanted tax liens for 80. To search for a certificate of tax lien, you may search by case number or debtor name. With the case number search, you may use either the. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. What is the state tax lien registry? Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all.

What is the state tax lien registry? The registry will be an online, statewide system for maintaining notices of tax liens filed or. Iltaxsale.com advertises tax deed auctions for joseph e. To search for a certificate of tax lien, you may search by case number or debtor name. The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Meyer & associates collects unwanted tax liens for 80. With the case number search, you may use either the.

Investing in Tax Lien Seminars and Courses

Iltaxsale.com advertises tax deed auctions for joseph e. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. Meyer & associates collects unwanted tax liens for 80. To search for a certificate of tax lien, you may search by case number or debtor name. The state tax lien.

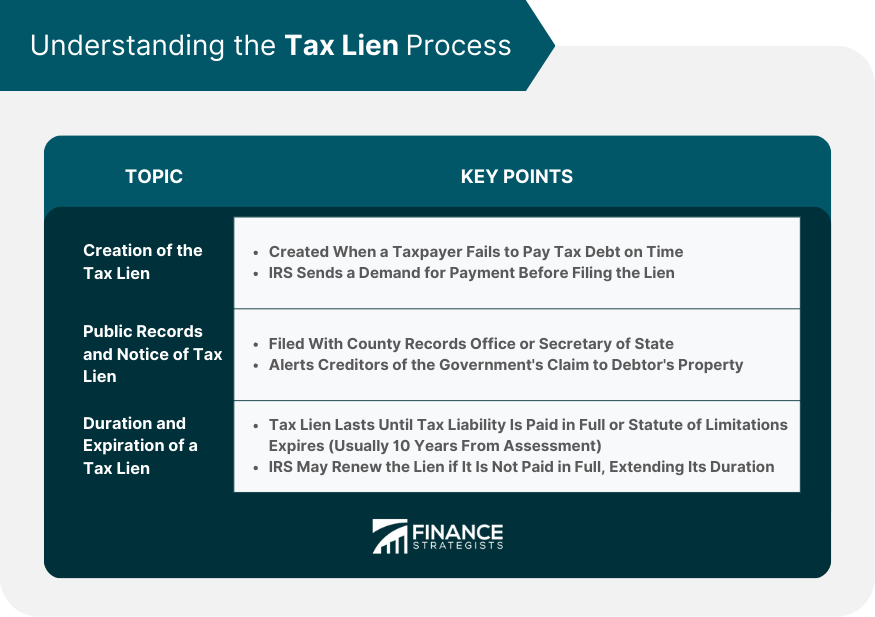

Tax Lien Definition, Process, Consequences, How to Handle

Iltaxsale.com advertises tax deed auctions for joseph e. The registry will be an online, statewide system for maintaining notices of tax liens filed or. With the case number search, you may use either the. Meyer & associates collects unwanted tax liens for 80. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect.

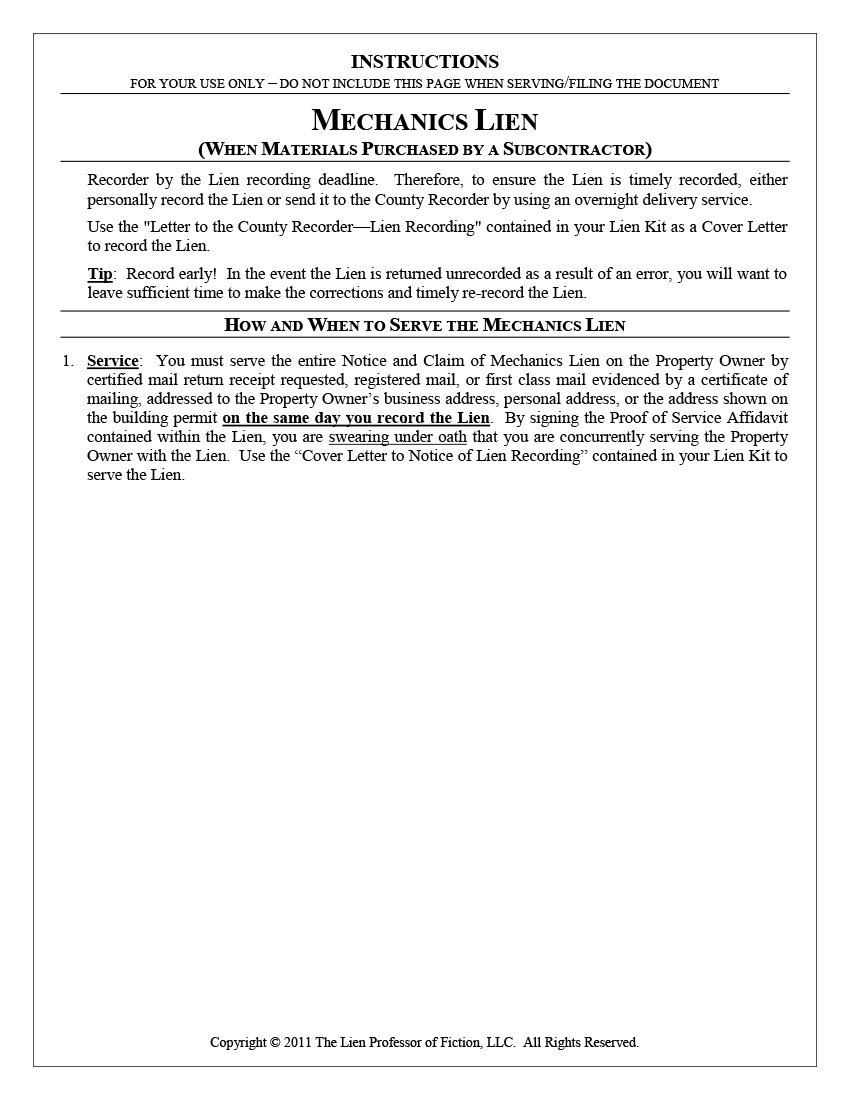

How to file a mechanics lien in Illinois and get paid National Lien

Meyer & associates collects unwanted tax liens for 80. The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. The registry will be an online, statewide system for maintaining notices of tax liens filed or. To search for a certificate of tax lien, you may search by case.

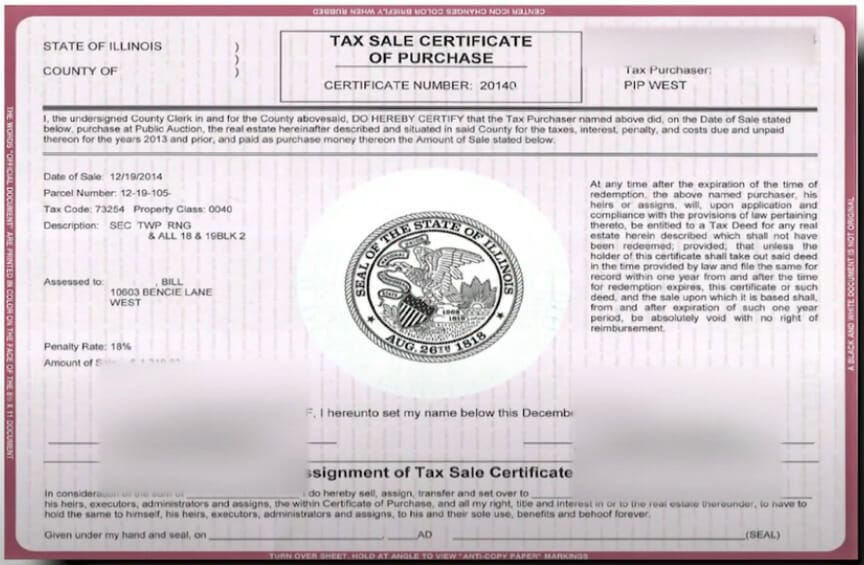

EasytoUnderstand Tax Lien Code Certificates Posteezy

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Meyer & associates collects unwanted tax liens for 80. What is the state tax lien registry? The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally.

Is Illinois a Tax Lien or Tax Deed State, and Why Is It a 1 Choice

The registry will be an online, statewide system for maintaining notices of tax liens filed or. What is the state tax lien registry? The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. With the case number search, you may use either the. Each year,.

Tax Lien Sale Download Free PDF Tax Lien Taxes

Meyer & associates collects unwanted tax liens for 80. Iltaxsale.com advertises tax deed auctions for joseph e. With the case number search, you may use either the. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. The state tax lien registry is an online, statewide system for.

Residential Subcontractor Illinois Mechanic Lien Documents and Packages

The registry will be an online, statewide system for maintaining notices of tax liens filed or. Meyer & associates collects unwanted tax liens for 80. Iltaxsale.com advertises tax deed auctions for joseph e. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. With the case number search,.

Illinois’ New State Tax Lien Registry Gensburg Calandriello & Kanter

Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. With the case number search, you may use either the. The state tax lien registry is.

tax lien PDF Free Download

Meyer & associates collects unwanted tax liens for 80. To search for a certificate of tax lien, you may search by case number or debtor name. The registry will be an online, statewide system for maintaining notices of tax liens filed or. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or.

Tax Lien Properties In Montana Brightside Tax Relief

Meyer & associates collects unwanted tax liens for 80. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. With the case number search, you may use either the. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released.

Meyer & Associates Collects Unwanted Tax Liens For 80.

What is the state tax lien registry? Iltaxsale.com advertises tax deed auctions for joseph e. With the case number search, you may use either the. To search for a certificate of tax lien, you may search by case number or debtor name.

The Lien Remains Until The Debt Is Fully Satisfied Or Becomes Unenforceable Due To The Statute Of Limitations, Generally 20 Years From.

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. The registry will be an online, statewide system for maintaining notices of tax liens filed or. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all.