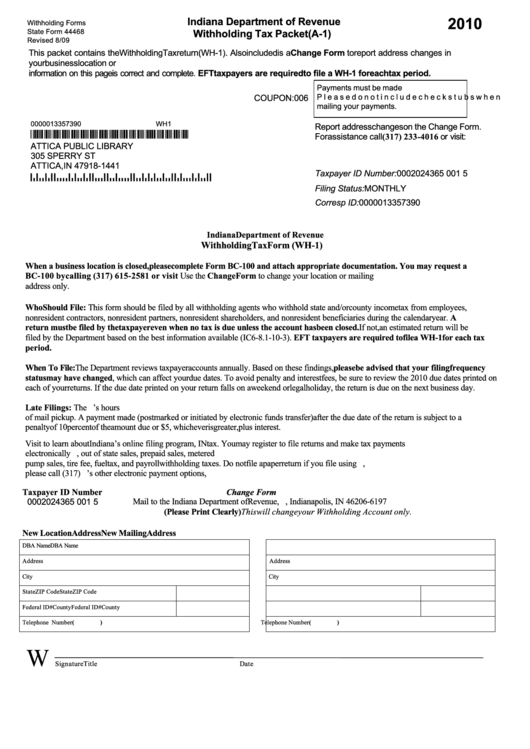

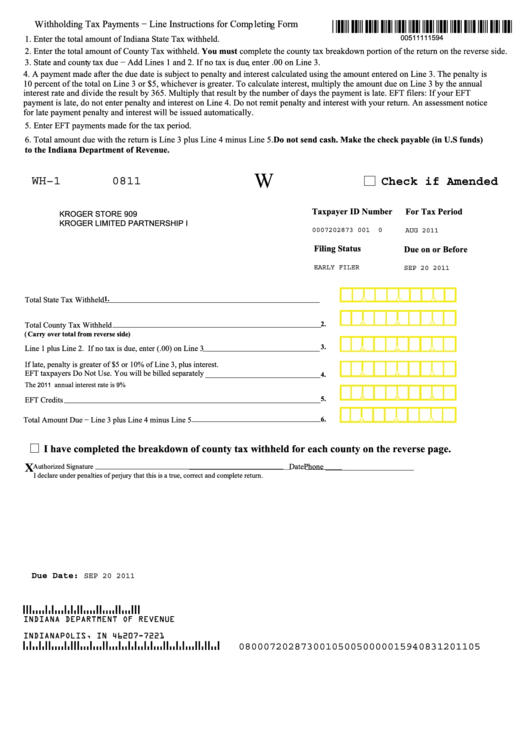

Indiana Withholding Form Wh 1

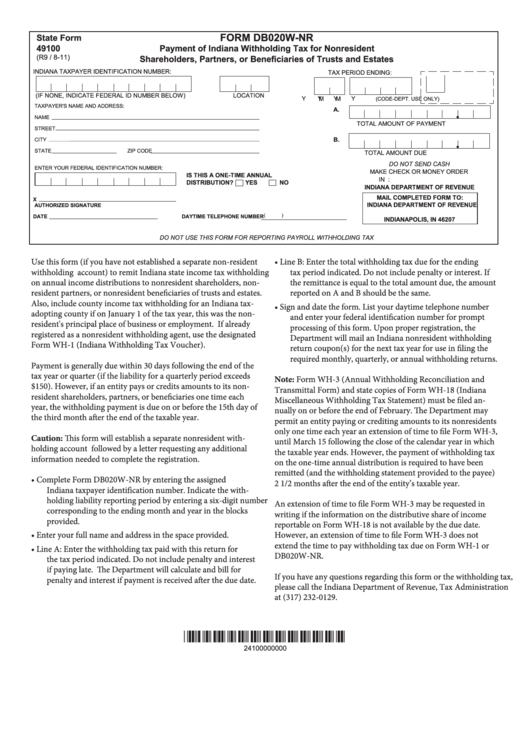

Indiana Withholding Form Wh 1 - You'll receive your account number and tax rate instantly once you have completed the online registration. Discover essential forms for withholding tax. When completed correctly, this form ensures that a business’s withholding taxes. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county taxes, and who are required by the internal revenue code to. Annual withholding tax reconciliation forms (form. Find important information regarding withholding tax forms from the indiana department of revenue (dor). Register online with the indiana department of workforce development.

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county taxes, and who are required by the internal revenue code to. Discover essential forms for withholding tax. Register online with the indiana department of workforce development. Annual withholding tax reconciliation forms (form. When completed correctly, this form ensures that a business’s withholding taxes. You'll receive your account number and tax rate instantly once you have completed the online registration. Find important information regarding withholding tax forms from the indiana department of revenue (dor).

When completed correctly, this form ensures that a business’s withholding taxes. Annual withholding tax reconciliation forms (form. Discover essential forms for withholding tax. Register online with the indiana department of workforce development. You'll receive your account number and tax rate instantly once you have completed the online registration. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county taxes, and who are required by the internal revenue code to. Find important information regarding withholding tax forms from the indiana department of revenue (dor).

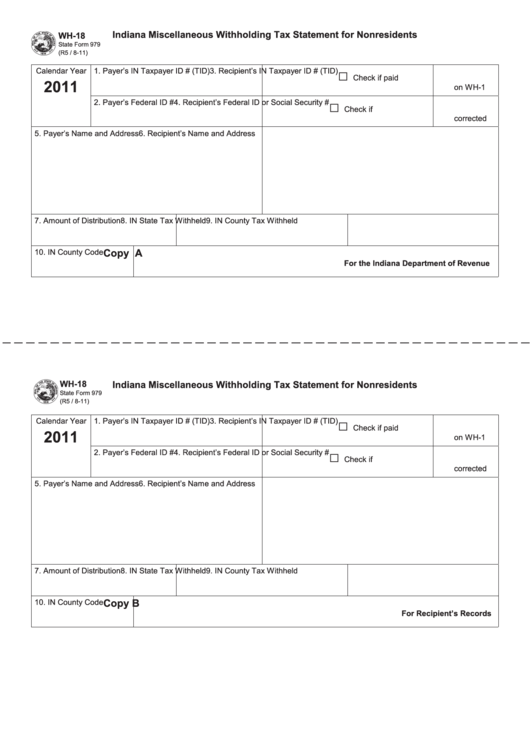

Indiana Local Tax Withholding Form

Find important information regarding withholding tax forms from the indiana department of revenue (dor). When completed correctly, this form ensures that a business’s withholding taxes. Annual withholding tax reconciliation forms (form. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county taxes, and who are required by the internal.

Top 13 Indiana Withholding Form Templates free to download in PDF format

When completed correctly, this form ensures that a business’s withholding taxes. Find important information regarding withholding tax forms from the indiana department of revenue (dor). Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county taxes, and who are required by the internal revenue code to. Annual withholding tax.

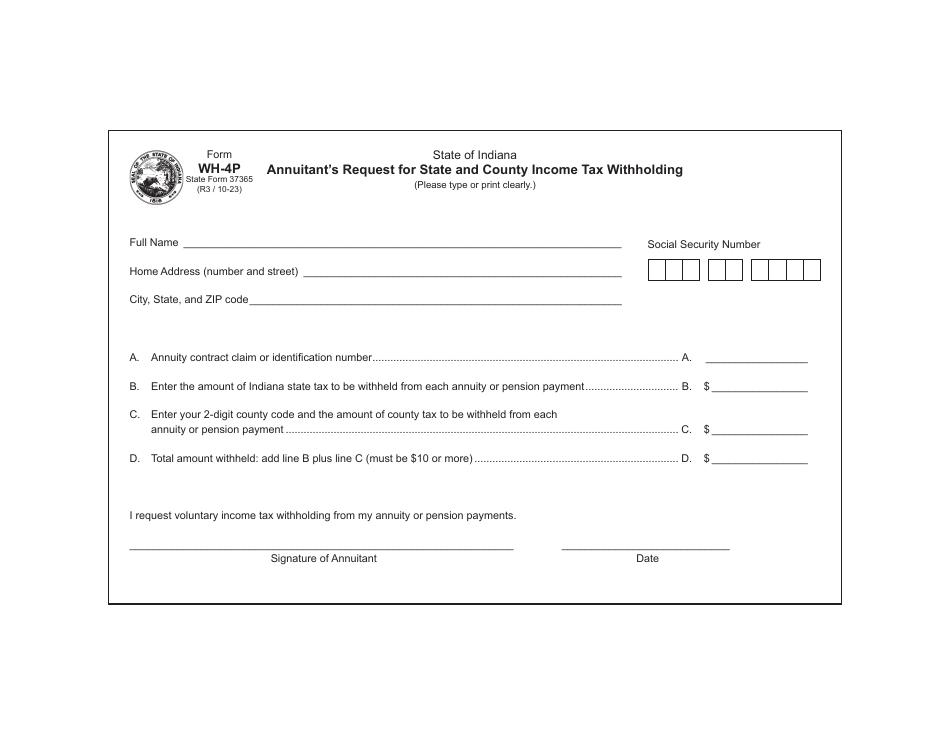

Indiana Tax Withholding Form 2022

Discover essential forms for withholding tax. Register online with the indiana department of workforce development. Find important information regarding withholding tax forms from the indiana department of revenue (dor). Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county taxes, and who are required by the internal revenue code.

Fillable Online Indiana's WH4 Form State Tax Withholding Fax Email

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county taxes, and who are required by the internal revenue code to. When completed correctly, this form ensures that a business’s withholding taxes. Discover essential forms for withholding tax. Find important information regarding withholding tax forms from the indiana department.

Form WH4P (State Form 37365) Fill Out, Sign Online and Download

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county taxes, and who are required by the internal revenue code to. Discover essential forms for withholding tax. Annual withholding tax reconciliation forms (form. You'll receive your account number and tax rate instantly once you have completed the online registration..

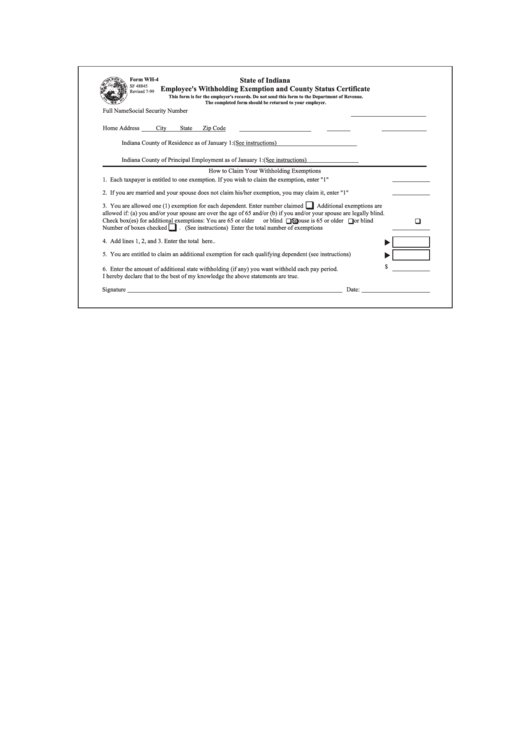

Indiana County Withholding Tax Form

Find important information regarding withholding tax forms from the indiana department of revenue (dor). Discover essential forms for withholding tax. You'll receive your account number and tax rate instantly once you have completed the online registration. Register online with the indiana department of workforce development. Annual withholding tax reconciliation forms (form.

State Of Indiana Employee'S Withholding Exemption And County Status

When completed correctly, this form ensures that a business’s withholding taxes. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county taxes, and who are required by the internal revenue code to. Register online with the indiana department of workforce development. Annual withholding tax reconciliation forms (form. You'll receive.

Top 13 Indiana Withholding Form Templates free to download in PDF format

Annual withholding tax reconciliation forms (form. Find important information regarding withholding tax forms from the indiana department of revenue (dor). Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county taxes, and who are required by the internal revenue code to. You'll receive your account number and tax rate.

Mo State Tax Withholding Form

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county taxes, and who are required by the internal revenue code to. When completed correctly, this form ensures that a business’s withholding taxes. Discover essential forms for withholding tax. Annual withholding tax reconciliation forms (form. You'll receive your account number.

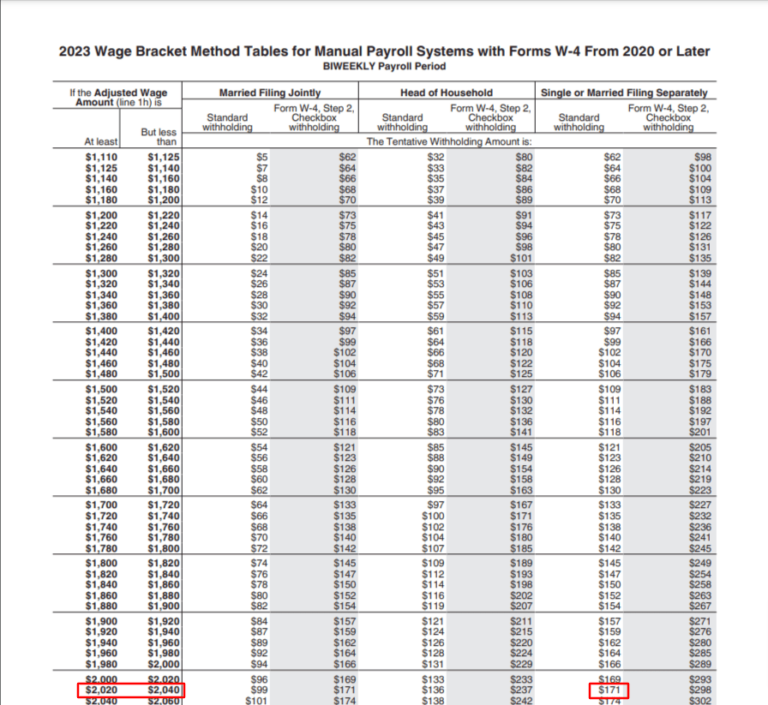

Fica And Medicare Withholding Rates For 2024 Withholding Juli Valentina

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county taxes, and who are required by the internal revenue code to. You'll receive your account number and tax rate instantly once you have completed the online registration. Annual withholding tax reconciliation forms (form. When completed correctly, this form ensures.

Discover Essential Forms For Withholding Tax.

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county taxes, and who are required by the internal revenue code to. You'll receive your account number and tax rate instantly once you have completed the online registration. When completed correctly, this form ensures that a business’s withholding taxes. Register online with the indiana department of workforce development.

Find Important Information Regarding Withholding Tax Forms From The Indiana Department Of Revenue (Dor).

Annual withholding tax reconciliation forms (form.