Invoice Factoring Small Business

Invoice Factoring Small Business - Businesses can sell their outstanding invoices to an invoice factoring. Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. Invoice factoring enables you to convert unpaid invoices into cash for your business. If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. This type of funding allows b2b. A basic introduction to invoice factoring for businesses.

If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. A basic introduction to invoice factoring for businesses. Invoice factoring enables you to convert unpaid invoices into cash for your business. Businesses can sell their outstanding invoices to an invoice factoring. Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. This type of funding allows b2b.

Invoice factoring enables you to convert unpaid invoices into cash for your business. This type of funding allows b2b. Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. Businesses can sell their outstanding invoices to an invoice factoring. Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. A basic introduction to invoice factoring for businesses.

Invoice factoring is defined as an alternative method to the

Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. Invoice factoring enables you to convert unpaid invoices into cash for your business. If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. Invoice factoring.

Invoice Factoring altLINE by The Southern Bank

Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. Invoice factoring enables you to convert unpaid invoices into cash for your business. Use.

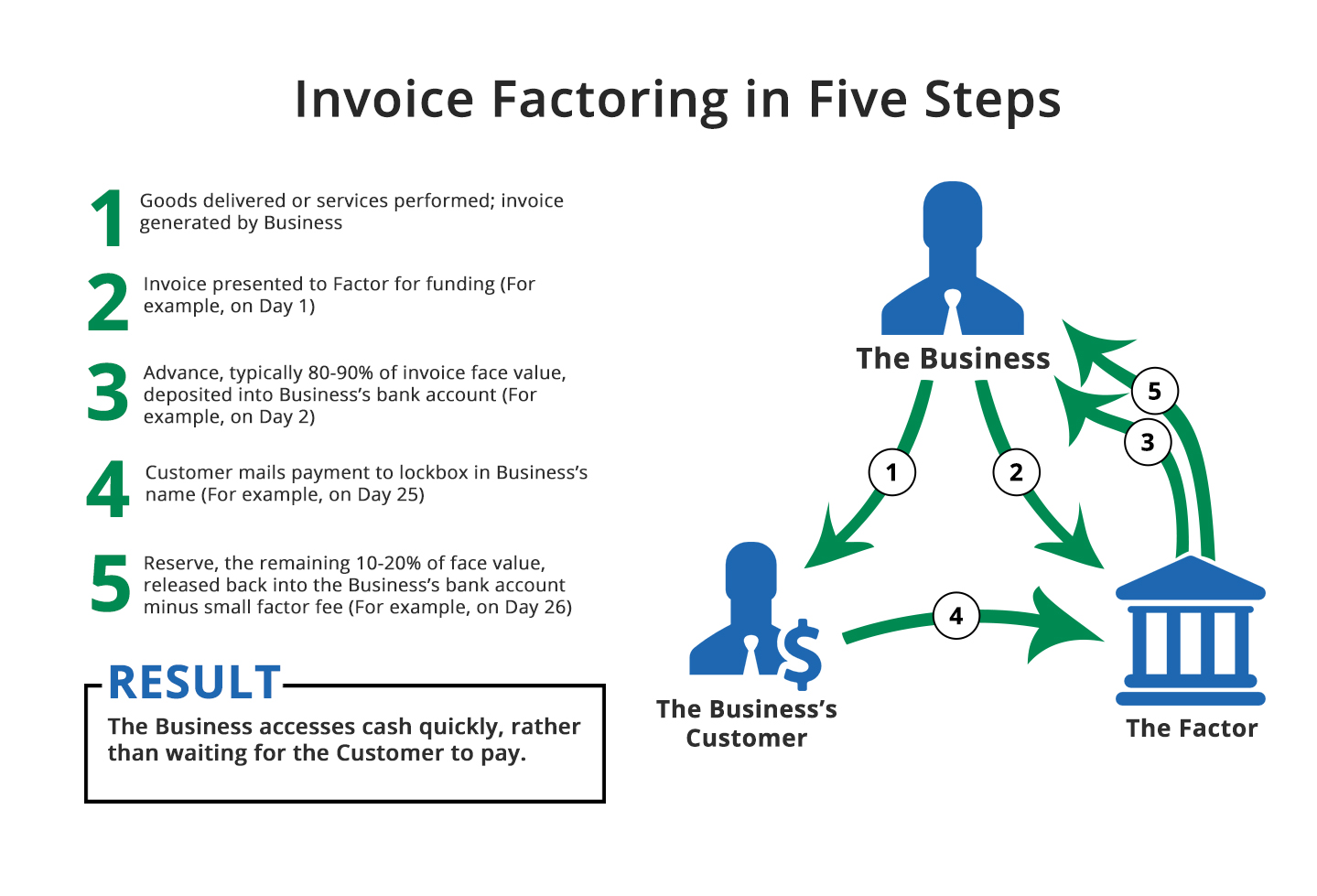

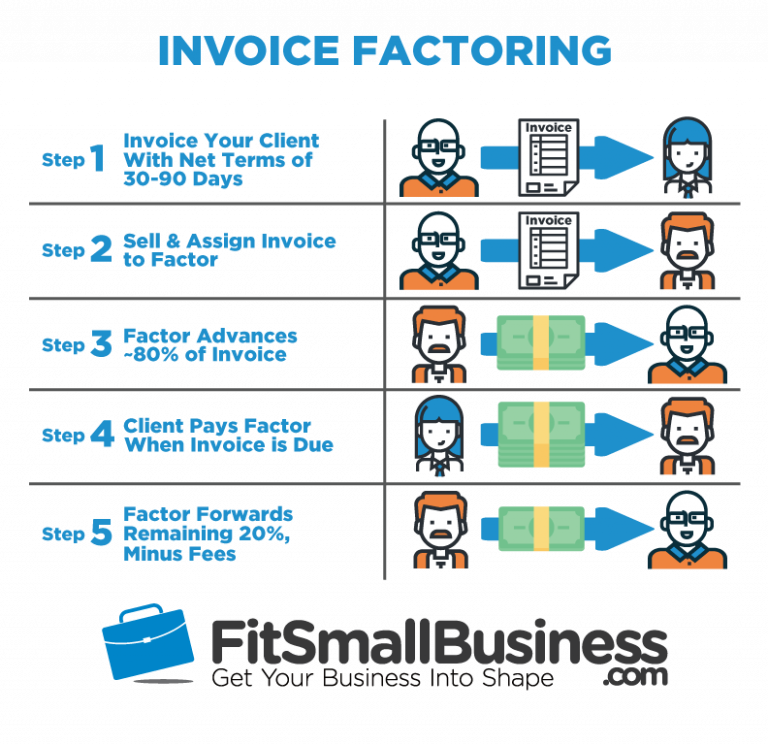

How Invoice Factoring Works

Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. Invoice factoring enables you to.

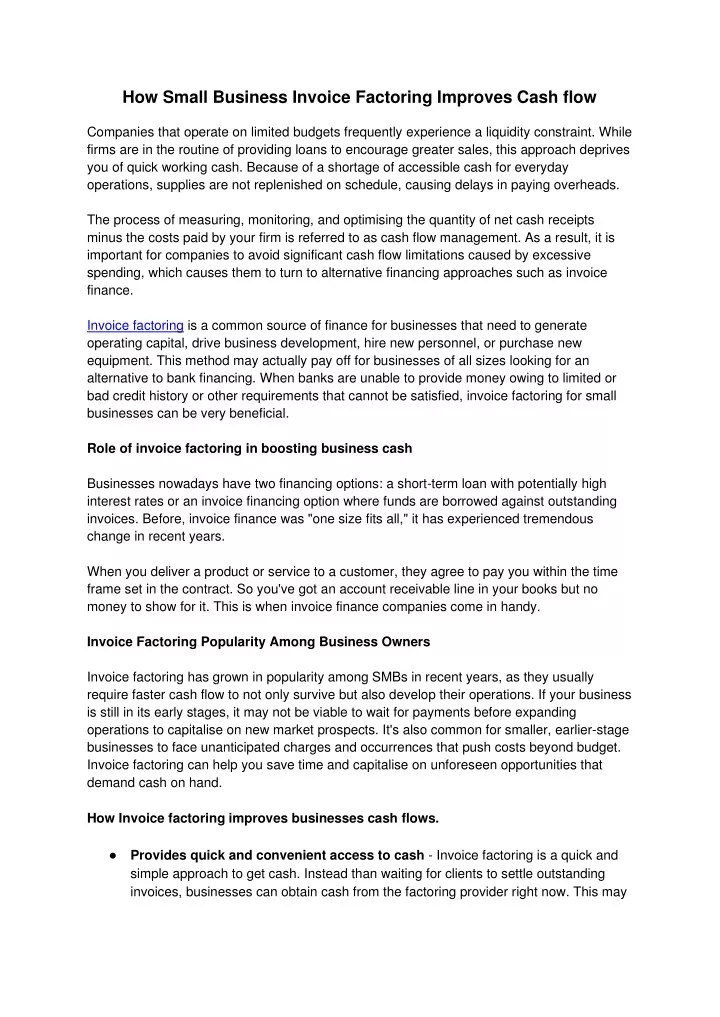

PPT How Small Business Invoice Factoring Improves Cash flow

A basic introduction to invoice factoring for businesses. Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. This type of funding allows b2b. If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track..

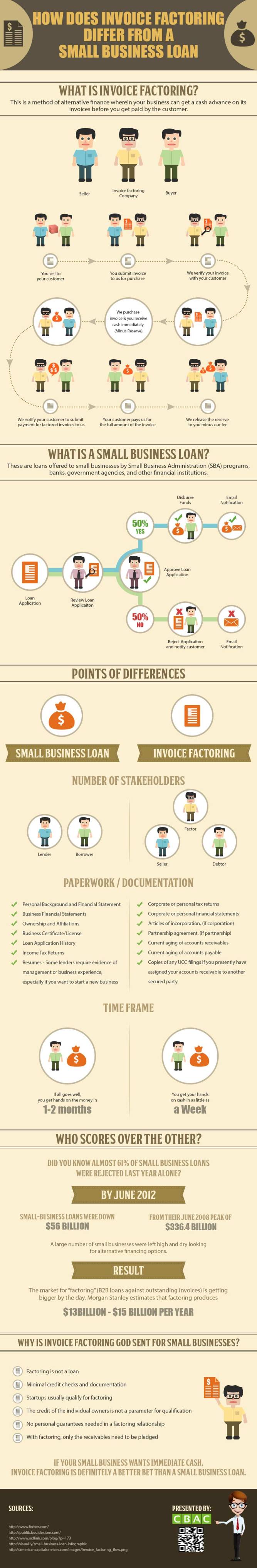

Invoice Factoring and Small Business Loans Know the Basic Difference

This type of funding allows b2b. Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. Invoice factoring enables you to convert unpaid invoices into cash for your business. If unpaid invoices are affecting your cash flow, invoice factoring may help get your.

Understanding Invoice Factoring A Guide for Small Business Owners

This type of funding allows b2b. Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. Use our guide to learn about how invoice.

Invoice Factoring How Factor Finance Works, Including Pros & Cons

This type of funding allows b2b. Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. Use our guide to learn about how invoice.

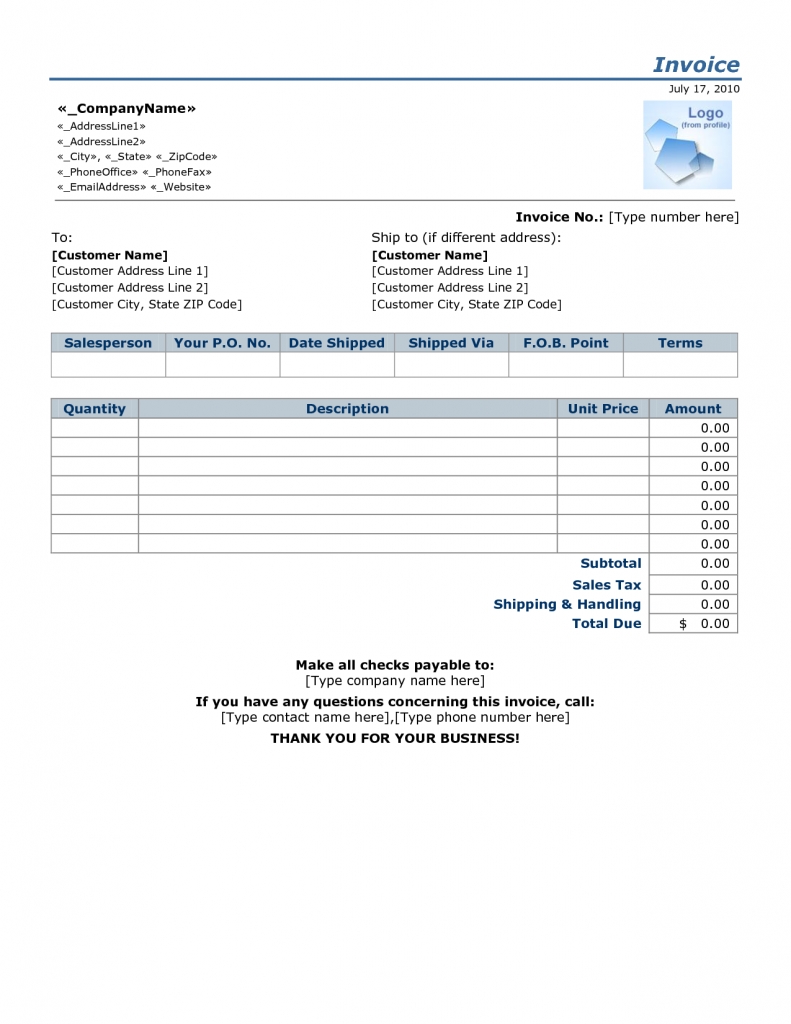

Invoice Factoring Agreement Template

If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. A basic introduction to invoice factoring for businesses. Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. This type of funding allows b2b..

Invoice Factoring Guide for Small Business ReliaBills

Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. Invoice factoring enables you to convert unpaid invoices into cash for your business. This type of funding allows b2b. Businesses can sell their outstanding invoices to an invoice factoring. A basic introduction.

How to Use Invoice Factoring for Small Business

Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. A basic introduction to invoice factoring for businesses. If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. Businesses can sell their outstanding invoices to.

If Unpaid Invoices Are Affecting Your Cash Flow, Invoice Factoring May Help Get Your Finances Back On Track.

Businesses can sell their outstanding invoices to an invoice factoring. Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. This type of funding allows b2b.

A Basic Introduction To Invoice Factoring For Businesses.

Invoice factoring enables you to convert unpaid invoices into cash for your business.