Irs Business Name Change Form

Irs Business Name Change Form - Learn how to change your business name with the irs. This guide covers the steps, including a sample business name change letter to the irs, and more. For corporations, you need to report the name change on your current annual tax return using form 1120 (u.s. Business owners and other authorized individuals can submit a name change for their business. The irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the appropriate. The specific action required may vary depending on the type of business.

Business owners and other authorized individuals can submit a name change for their business. For corporations, you need to report the name change on your current annual tax return using form 1120 (u.s. The irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the appropriate. The specific action required may vary depending on the type of business. Learn how to change your business name with the irs. This guide covers the steps, including a sample business name change letter to the irs, and more.

The specific action required may vary depending on the type of business. Learn how to change your business name with the irs. The irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the appropriate. Business owners and other authorized individuals can submit a name change for their business. This guide covers the steps, including a sample business name change letter to the irs, and more. For corporations, you need to report the name change on your current annual tax return using form 1120 (u.s.

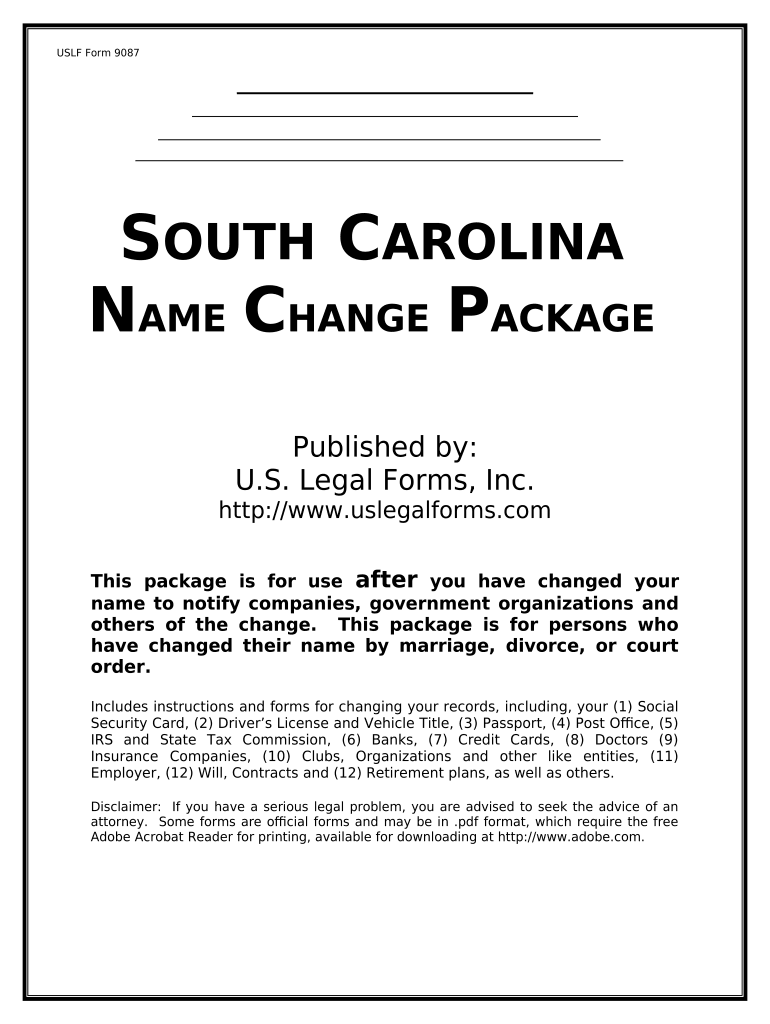

Sc Name Change Complete with ease airSlate SignNow

Business owners and other authorized individuals can submit a name change for their business. For corporations, you need to report the name change on your current annual tax return using form 1120 (u.s. The specific action required may vary depending on the type of business. The irs will automatically update the business name associated with your current ein after you.

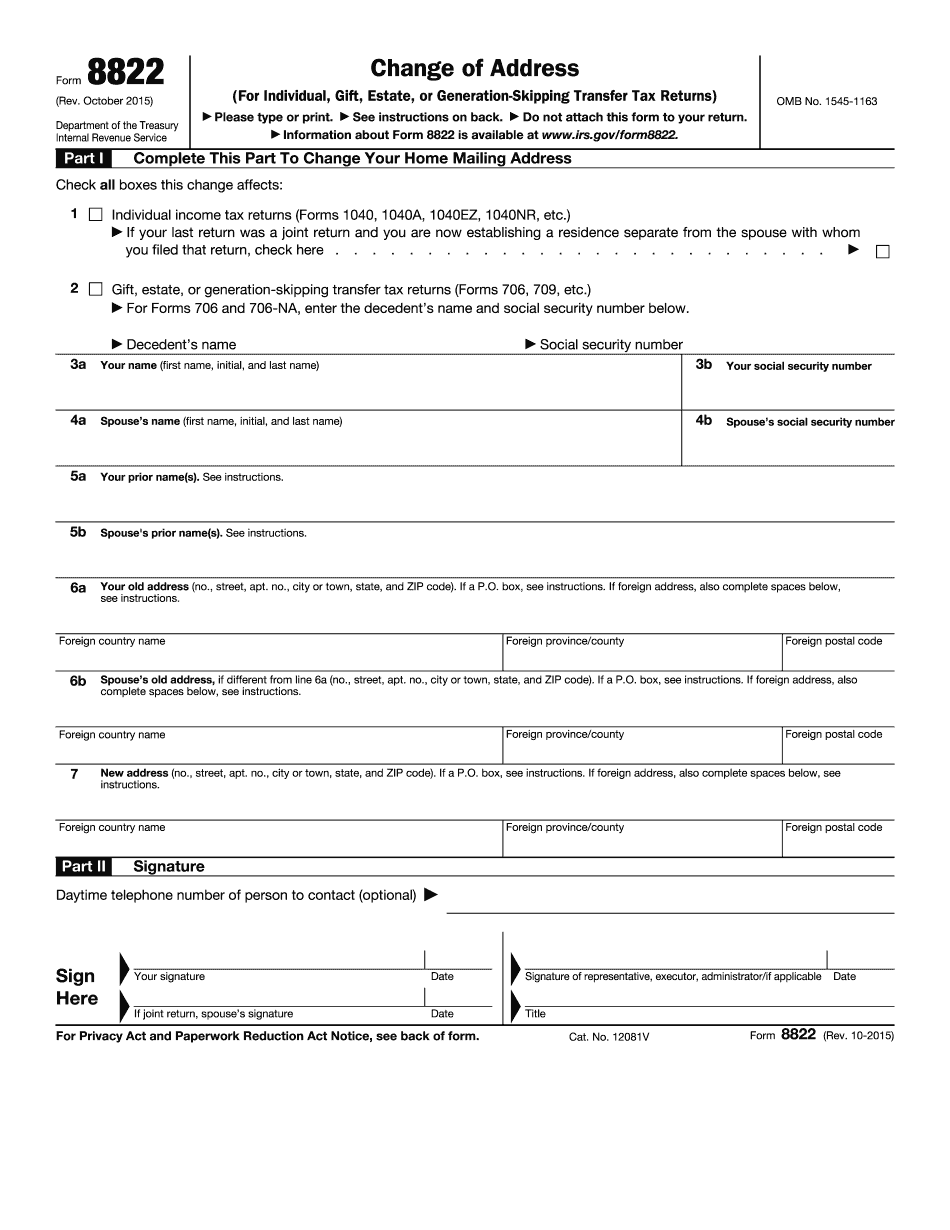

irs name change form Fill Online, Printable, Fillable Blank form

For corporations, you need to report the name change on your current annual tax return using form 1120 (u.s. The irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the appropriate. Business owners and other authorized individuals can submit a name change for their business..

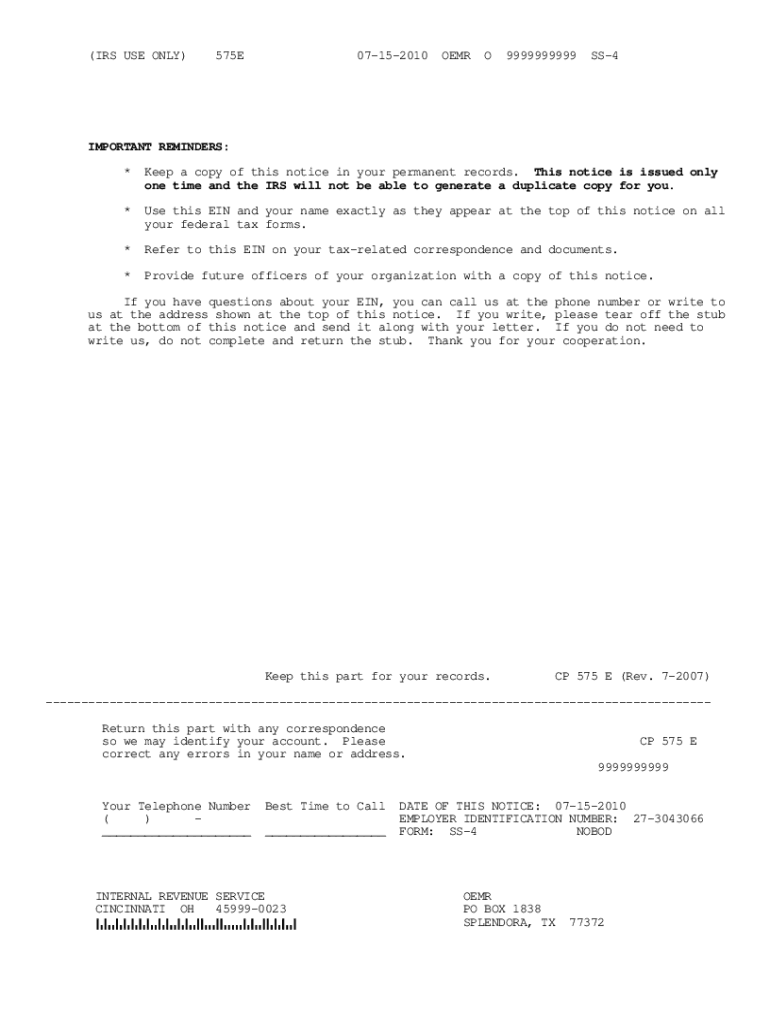

IRS Business Name Change

The specific action required may vary depending on the type of business. Business owners and other authorized individuals can submit a name change for their business. Learn how to change your business name with the irs. For corporations, you need to report the name change on your current annual tax return using form 1120 (u.s. The irs will automatically update.

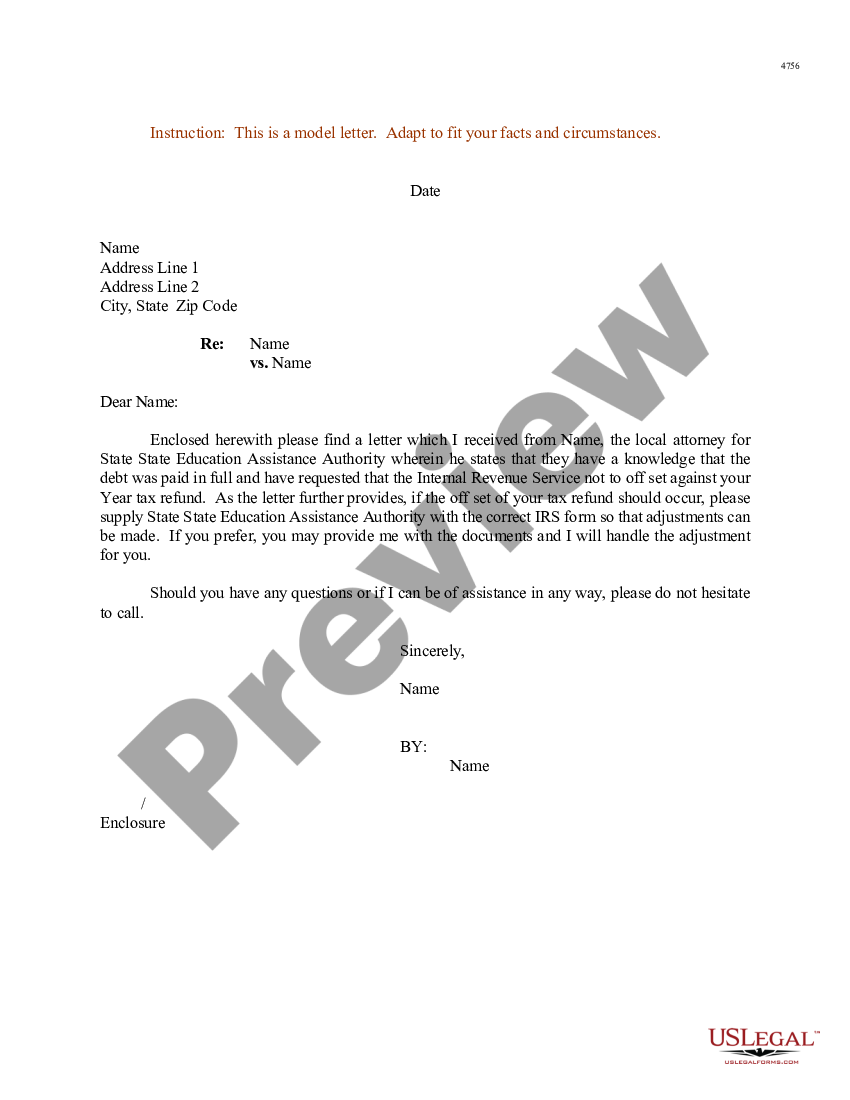

Sample Letter To Irs For Business Name Change US Legal Forms

The irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the appropriate. Learn how to change your business name with the irs. Business owners and other authorized individuals can submit a name change for their business. The specific action required may vary depending on the.

Irs Business Name Change Letter Template

For corporations, you need to report the name change on your current annual tax return using form 1120 (u.s. Learn how to change your business name with the irs. The irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the appropriate. Business owners and other.

Business Name Change Irs Sample Letter / Lovely Irs Ein Name Change

This guide covers the steps, including a sample business name change letter to the irs, and more. The irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the appropriate. The specific action required may vary depending on the type of business. Learn how to change.

Pin on Letter Template

Learn how to change your business name with the irs. This guide covers the steps, including a sample business name change letter to the irs, and more. The irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the appropriate. The specific action required may vary.

Business Name Change Letter Template To Irs

Learn how to change your business name with the irs. This guide covers the steps, including a sample business name change letter to the irs, and more. Business owners and other authorized individuals can submit a name change for their business. The specific action required may vary depending on the type of business. The irs will automatically update the business.

Irs Business Name Change Form 8822b Armando Friend's Template

Business owners and other authorized individuals can submit a name change for their business. The irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the appropriate. For corporations, you need to report the name change on your current annual tax return using form 1120 (u.s..

How to Change Business Name with IRS? Live Business Blog

Learn how to change your business name with the irs. The specific action required may vary depending on the type of business. This guide covers the steps, including a sample business name change letter to the irs, and more. The irs will automatically update the business name associated with your current ein after you send the name change letter and.

The Specific Action Required May Vary Depending On The Type Of Business.

Learn how to change your business name with the irs. For corporations, you need to report the name change on your current annual tax return using form 1120 (u.s. Business owners and other authorized individuals can submit a name change for their business. The irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the appropriate.