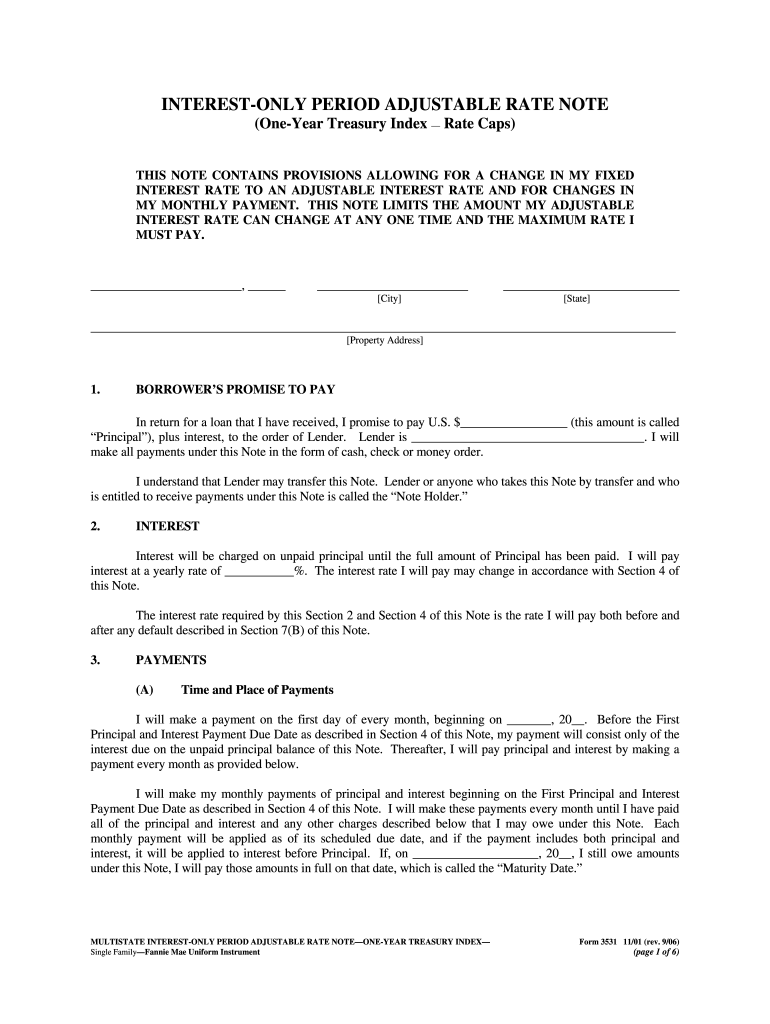

Irs Form 3531 Missing Signature

Irs Form 3531 Missing Signature - I filed electronically for 2019 and no. If the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. The irs sends form 3531 which informs you that your tax return was sent without the signature or because the irs questions the validity of your. You have to mail the form with the ink signature directly to the irs. Note that form 3531 says a photocopied signature is not a. May 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. Together with the 3531 form, all the original. My wife received the 3531 form saying that no signature in the original 1040 form. It sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box 7). Form 3531, page 2this represents page 2 of form 3531, request for signature or missing information to complete return, with an example of how to.

My wife received the 3531 form saying that no signature in the original 1040 form. You have to mail the form with the ink signature directly to the irs. I filed electronically for 2019 and no. Together with the 3531 form, all the original. Note that form 3531 says a photocopied signature is not a. Form 3531, page 2this represents page 2 of form 3531, request for signature or missing information to complete return, with an example of how to. If the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. The irs sends form 3531 which informs you that your tax return was sent without the signature or because the irs questions the validity of your. It sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box 7). May 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing.

It sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box 7). My wife received the 3531 form saying that no signature in the original 1040 form. If the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. I filed electronically for 2019 and no. Together with the 3531 form, all the original. You have to mail the form with the ink signature directly to the irs. Note that form 3531 says a photocopied signature is not a. Form 3531, page 2this represents page 2 of form 3531, request for signature or missing information to complete return, with an example of how to. May 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. The irs sends form 3531 which informs you that your tax return was sent without the signature or because the irs questions the validity of your.

Printable Irs Form 3531 Printable Forms Free Online

The irs sends form 3531 which informs you that your tax return was sent without the signature or because the irs questions the validity of your. May 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. It sounds like your signature is missing or improperly signed (box 1) but that your return.

Irs Form 3531 Pdf Fill Online, Printable, Fillable, Blank pdfFiller

Form 3531, page 2this represents page 2 of form 3531, request for signature or missing information to complete return, with an example of how to. I filed electronically for 2019 and no. The irs sends form 3531 which informs you that your tax return was sent without the signature or because the irs questions the validity of your. Together with.

Printable Irs Form 3531 Printable Forms Free Online

It sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box 7). My wife received the 3531 form saying that no signature in the original 1040 form. Together with the 3531 form, all the original. I filed electronically for 2019 and no. Form 3531, page 2this represents page 2 of form 3531,.

Irs Revenue Ruling 202414 Phaedra

May 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. Together with the 3531 form, all the original. If the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. My wife received the 3531 form saying that no signature.

3.11.3 Individual Tax Returns Internal Revenue Service

Note that form 3531 says a photocopied signature is not a. You have to mail the form with the ink signature directly to the irs. If the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. My wife received the 3531 form saying that no signature in.

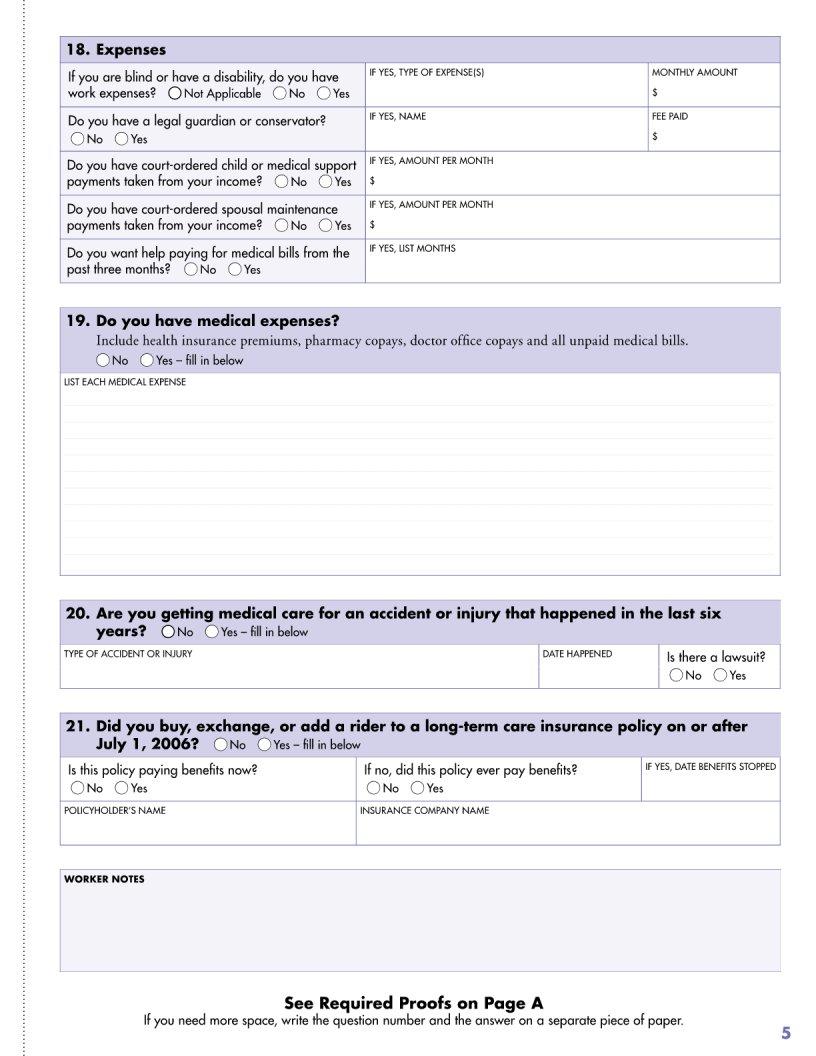

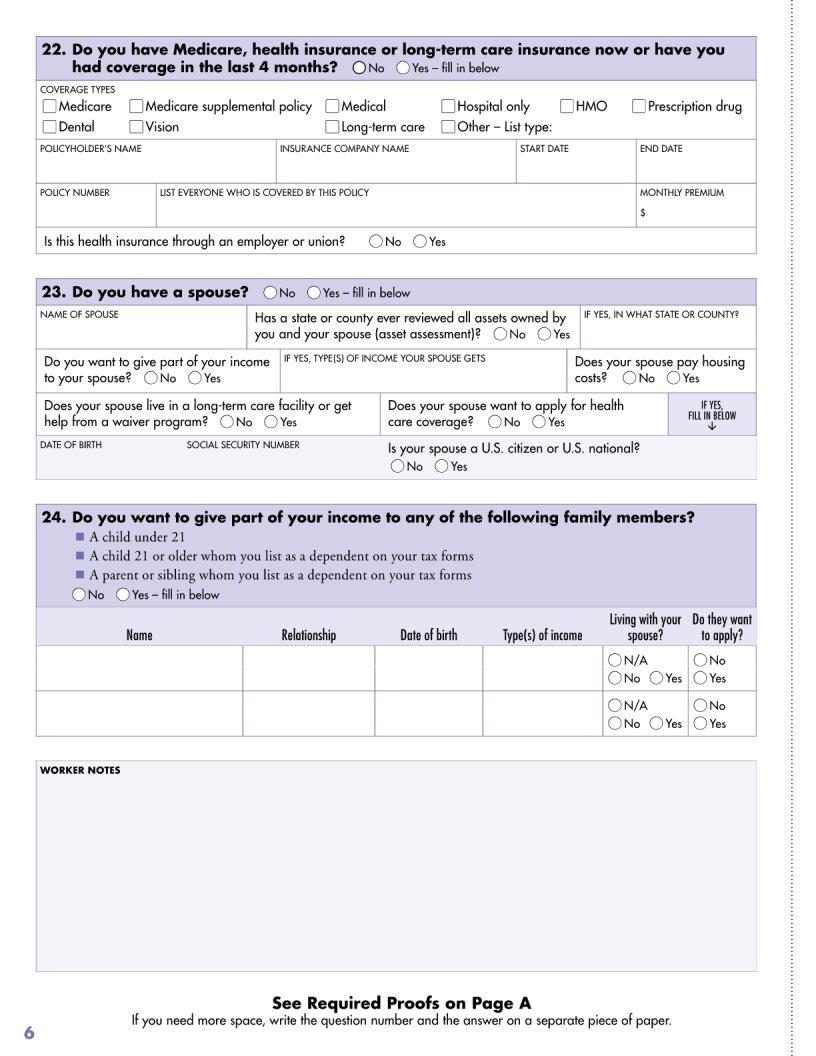

Dhs 3531 Form ≡ Fill Out Printable PDF Forms Online

Form 3531, page 2this represents page 2 of form 3531, request for signature or missing information to complete return, with an example of how to. Together with the 3531 form, all the original. The irs sends form 3531 which informs you that your tax return was sent without the signature or because the irs questions the validity of your. May.

Printable Irs Form 3531 Printable Forms Free Online

Together with the 3531 form, all the original. You have to mail the form with the ink signature directly to the irs. Form 3531, page 2this represents page 2 of form 3531, request for signature or missing information to complete return, with an example of how to. My wife received the 3531 form saying that no signature in the original.

Missing signature? r/FAFSA

Together with the 3531 form, all the original. It sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box 7). My wife received the 3531 form saying that no signature in the original 1040 form. Note that form 3531 says a photocopied signature is not a. I filed electronically for 2019 and.

IRS Audit Letter 3531 Sample 1

If the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. It sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box 7). I filed electronically for 2019 and no. Form 3531, page 2this represents page 2 of form.

Fillable Online Solved I received form 3531 from the IRS. ( top right

Note that form 3531 says a photocopied signature is not a. You have to mail the form with the ink signature directly to the irs. Together with the 3531 form, all the original. I filed electronically for 2019 and no. The irs sends form 3531 which informs you that your tax return was sent without the signature or because the.

The Irs Sends Form 3531 Which Informs You That Your Tax Return Was Sent Without The Signature Or Because The Irs Questions The Validity Of Your.

Form 3531, page 2this represents page 2 of form 3531, request for signature or missing information to complete return, with an example of how to. It sounds like your signature is missing or improperly signed (box 1) but that your return is missing (box 7). Together with the 3531 form, all the original. May 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing.

I Filed Electronically For 2019 And No.

If the required valid legal signature is missing or not below the jurat statement, send the return back to the taxpayer using form 3531. My wife received the 3531 form saying that no signature in the original 1040 form. Note that form 3531 says a photocopied signature is not a. You have to mail the form with the ink signature directly to the irs.