Irs Form 4797 Instructions

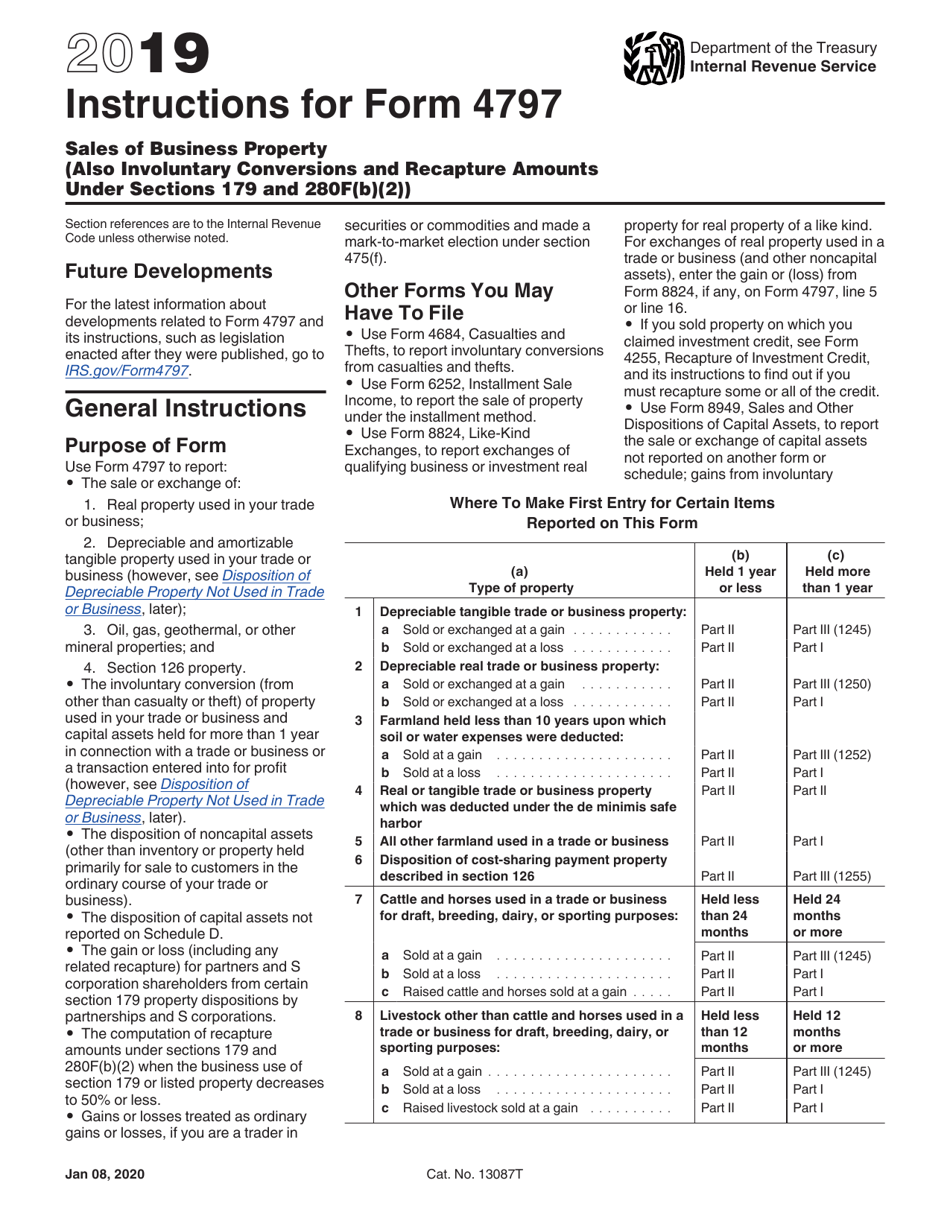

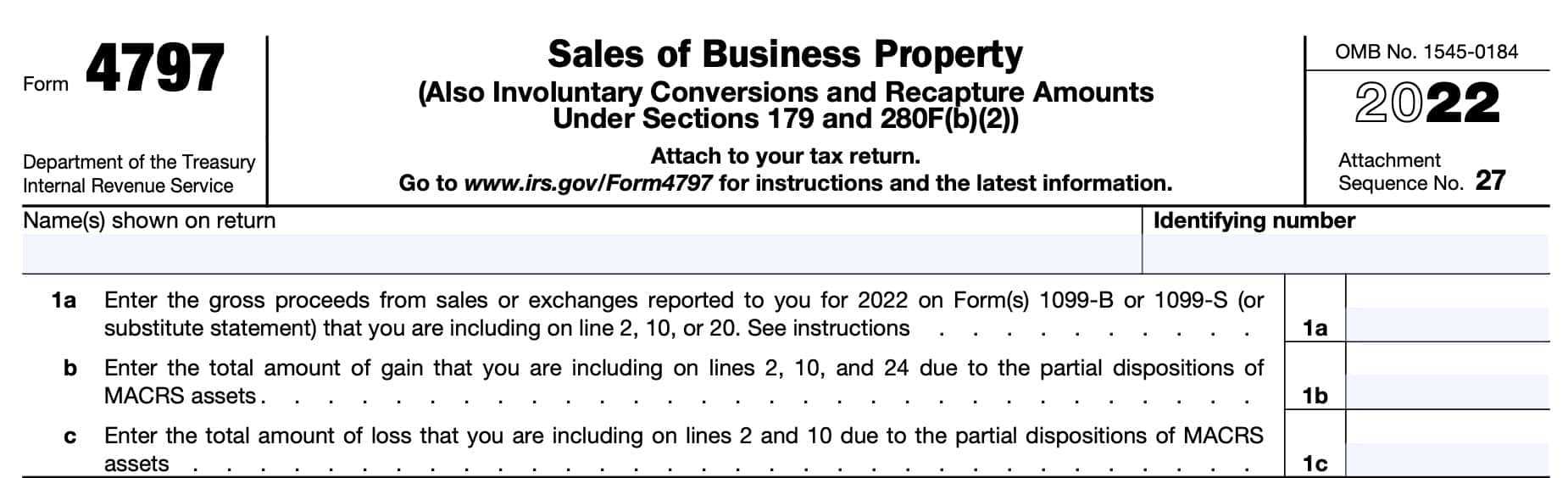

Irs Form 4797 Instructions - Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Form 4797 is used to report gains made from the sale or exchange of business property, including property used to. Form 4797 is a tax form distributed by the internal revenue service (irs). Form 4797 is a crucial document for anyone involved in selling or exchanging business property, as it helps determine the gains and losses that must be reported to the irs. According to the internal revenue service, taxpayers must use irs form 4797 to calculate and report the sale of certain types of property used for business. For the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797.

Form 4797 is a tax form distributed by the internal revenue service (irs). Form 4797 is used to report gains made from the sale or exchange of business property, including property used to. According to the internal revenue service, taxpayers must use irs form 4797 to calculate and report the sale of certain types of property used for business. Form 4797 is a crucial document for anyone involved in selling or exchanging business property, as it helps determine the gains and losses that must be reported to the irs. For the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets.

For the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. Form 4797 is a tax form distributed by the internal revenue service (irs). Form 4797 is used to report gains made from the sale or exchange of business property, including property used to. According to the internal revenue service, taxpayers must use irs form 4797 to calculate and report the sale of certain types of property used for business. Form 4797 is a crucial document for anyone involved in selling or exchanging business property, as it helps determine the gains and losses that must be reported to the irs. Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets.

IRS Form 4797 Instructions Sales of Business Property

Form 4797 is a crucial document for anyone involved in selling or exchanging business property, as it helps determine the gains and losses that must be reported to the irs. Form 4797 is used to report gains made from the sale or exchange of business property, including property used to. Form 4797 is used to report the details of gains.

IRS Form 4797 Instructions Sales of Business Property

For the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. According to the internal revenue service, taxpayers must use irs form 4797 to calculate and report the sale of certain types of property used for business. Form 4797 is a crucial document for anyone involved in.

Download Instructions for IRS Form 4797 Sales of Business Property

Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. For the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. Form 4797 is used to report gains made from the.

Irs Form 4797 Instructions 2022 Fill online, Printable, Fillable Blank

Form 4797 is a crucial document for anyone involved in selling or exchanging business property, as it helps determine the gains and losses that must be reported to the irs. Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. For the latest information.

4797 instructions Fill out & sign online DocHub

Form 4797 is a crucial document for anyone involved in selling or exchanging business property, as it helps determine the gains and losses that must be reported to the irs. Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. For the latest information.

IRS Form 4797 Instructions Sales of Business Property

Form 4797 is used to report gains made from the sale or exchange of business property, including property used to. Form 4797 is a crucial document for anyone involved in selling or exchanging business property, as it helps determine the gains and losses that must be reported to the irs. Form 4797 is a tax form distributed by the internal.

2019 Form IRS 4797 Fill Online, Printable, Fillable, Blank pdfFiller

Form 4797 is a crucial document for anyone involved in selling or exchanging business property, as it helps determine the gains and losses that must be reported to the irs. Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. For the latest information.

IRS Form 4797 Instructions Sales of Business Property

Form 4797 is a tax form distributed by the internal revenue service (irs). Form 4797 is used to report gains made from the sale or exchange of business property, including property used to. According to the internal revenue service, taxpayers must use irs form 4797 to calculate and report the sale of certain types of property used for business. Form.

IRS Form 8846 Instructions Credit for Employer Taxes Paid on Tips

According to the internal revenue service, taxpayers must use irs form 4797 to calculate and report the sale of certain types of property used for business. Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Form 4797 is used to report gains made.

IRS Form 4797 Instructions Sales of Business Property

For the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. Form 4797 is used to report gains made from the sale or exchange of business property, including property used to. Form 4797 is a crucial document for anyone involved in selling or exchanging business property, as.

For The Latest Information About Developments Related To Form 4797 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To Irs.gov/Form4797.

Form 4797 is a crucial document for anyone involved in selling or exchanging business property, as it helps determine the gains and losses that must be reported to the irs. According to the internal revenue service, taxpayers must use irs form 4797 to calculate and report the sale of certain types of property used for business. Form 4797 is a tax form distributed by the internal revenue service (irs). Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets.